Search

Recent comments

- furphy....

5 hours 4 min ago - nothing new....

5 hours 36 min ago - blood brothers....

6 hours 34 min ago - germanic merde....

6 hours 38 min ago - englishit....

8 hours 21 min ago - kurdylord....

8 hours 32 min ago - a win!....

8 hours 36 min ago - sad....

8 hours 43 min ago - closed....

20 hours 58 min ago - no excuses....

1 day 1 hour ago

Democracy Links

Member's Off-site Blogs

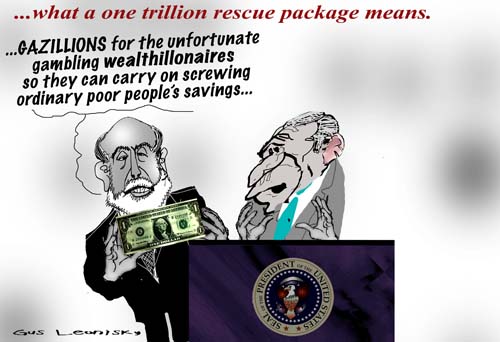

the bushit school of economics .....

The Treasury is proposing a fund worth up to $800bn to buy back a large proportion of the US mortgage market, media reports say.

Legislation for the plan will be pushed through as soon as possible, Treasury Secretary Henry Paulson said.

President Bush said swift, politically bipartisan action was needed to keep the US economy from grinding to a halt as problems sparked by the credit crisis had begun to spread through the entire financial system - leaving jobs, pensions and companies under threat.

"These are risks the US cannot afford to take. We must act now to protect economic health from serious risk," he added.

The US is facing "unprecedented challenges and we're responding with unprecedented action", he said.

A "bold" move was needed to restore the financial system's health, Mr Paulson insisted.

He added the Bush administration was stepping in with a plan to remove so-called "toxic debts" from US banks' balance sheets.

While he gave few details, he said federal lawmakers would meet over the weekend to thrash out legislation for the programme which must be "large enough to have maximum impact".- By Gus Leonisky at 21 Sep 2008 - 3:24pm

- Gus Leonisky's blog

- Login or register to post comments

conopoly .....

Yes Gus, we no sooner had absorbed the news about the act of mega-larceny through the Federal Reserve's $85 billion bailout of the American International Group & bushit doubles the stakes.

All this grandtheft through the FED – a nominally private entity that exercises immense political and economic power without constitutional standing or accountability of any kind.

Congress didn't appropriate the necessary funds for the AIG bailout. Nor was the money set aside through executive action, the entirely illegal method now commonly used to commit the US to immensely expensive undertakings such as wars of aggression against distant, helpless countries.

The FED's action amounts to the $85 billion purchase of a private company, on behalf of the federal government, using public funds – without political accountability of any kind. Outrageous as it is, this action may have the healthy, if thoroughly unintended, consequence of illustrating just who actually runs our political system and economy.

As the immensely perceptive economic analyst Michael Rozeff points out, on this Constitution Day we have witnessed an unprecedented arrogation of power by the unelected government that actually rules us. True power in our putative republic is actually exercised by the oligarchy that created, empowered, and controls the Federal Reserve.

Oh, sure, that oligarchy will allow elected officials to play-act the role of representatives or "Deciders," and every once in a while it will countenance a very limited form of political competition.

But the really serious business – such as the disposition of the lives of the subject population in wars, or the re-allocation of their wealth for the benefit of politically favoured constituencies – is simply too important to be left to the vagaries of representative politics. Thus we are routinely reminded that some issues are insulated from the public by being enshrined as part of the sacred "bipartisan consensus."

The nationalization of AIG is on that list, which explains why today we hear a palpably relieved silence from Capitol Hill, when the air should be shredded by expressions of bitter outrage over the FED's action.

"Until this week," notes the Financial Times, "it would have been unthinkable for the Federal Reserve to bail out an insurance company....”

So what’s the cost of this bushit game of conopoly so far …..

The US$85 billion “loan” to the American International Group brings the running total of bushit bailouts thus far to US$900 billion, plus the latest US800Billion ….. US$1.7trillion & still counting!!!

Following are details of actions and amounts:

- US$200 billion for Fannie Mae & Freddie Mac;

- US$4 billion in grants to local communities to help them buy & repair homes abandoned due to mortgage foreclosures;

- US$85 billion loan for AIG;

- At least US$87 billion in repayments to JPMorgan Chase for providing financing to underpin trades with units of bankrupt investment bank Lehman Brothers;

- US$29 billion in financing for JPMorgan Chase's government-brokered buyout of Bear Stearns in March; &

- At least US$200 billion of currently outstanding loans to banks issued through the Fed's Term Auction Facility, which was recently expanded to allow for longer loans of 84 days alongside the previous 28-day credits.

As Gusmeister reflected in his ‘toon rocks in the heads ….. surely bushitville is headed for bankruptcy …..

And so far, not one single financial swindler in handcuffs.

You wouldn’t trust these guys to manage a parking meter …..

expensive and now not so free enterpirse...

yes John

From the independent

This is what we might call the $1trillion question. That's $1,000,000,000,000, by the way. It is a little like surgery. The US government has amputated the gangrenous leg of the banking system to save the patient. But it is now preparing to graft the infected limb on to the body politic of America. The US taxpayers will be lucky if they do not feel distinctly unwell as a result of this little experiment.

The truth is that simply buying the banks' worthless securities has been an option, if an unpalatable one, for the authorities since the credit crunch began a year ago. All the plans to lend against these assets, such as the Bank of England's Special Liquidity Scheme, and other "injections of liquidity", were temporary solutions, born out of a hope, if not an expectation, that the crisis would not be prolonged.

We know better now. What the American authorities have done is the only sure way to protect the banking system against further destabilisation. Short-selling or not, left to their own devices, the markets would sooner or later force more banks into the arms of the taxpayer anyhow. It is a sad day when hard-pressed citizens find themselves subsidising private banks for their stupid mistakes. But that is what's happening in the US, and it will surely be done here. The Bank of England hates the notion; but Gordon Brown may well feel that he has no choice.

So for the banks and their shareholders and staff, the US rescue plan is already working, and it will save the wider economy from yet more damage. It is less clear whether it will end the credit crisis or preserve America's fast disappearing economic hegemony.

Even taking a trillion dollars of crud out of the equation can't save the financial system from damage already done. Despite the Fed's efforts, many banks in America and around the world have severely enfeebled balance sheets. They cannot lend, even if they wanted to. With the developed world in recession – Japan, Britain, Germany and Spain are leading the way – the banks will soon be losing money on their conventional lines of business, as mortgages suffer defaults and companies go out of business. We will then see a vicious cycle of bad debts leading to less lending, more job losses, more defaults and so on.

----------------------

Gus: The only thing the US government has done is avoid a massive revolution worldwide. But it's not yet out of jail. As mentioned earlier in January this year, by myself and my dog full of flees, it would have been better if when the trouble started late last year to stop the banks overcharging interest on subprime mortgages and help the mortgagees with a government loan that could be repaid over much longer time with benefits rather than penalties (as the US banks structure the loans) if repaid early... That would have save at least 80 per cent of the bad debts and we would not have had the ugly financial rigmarole that followed.

But of course this would have been against the "spirit of free enterprise" otherwise called USURY...

The house of card....

The Amerikan way...

from the subprime zone...

just gotta luve my stimulus...

head, tails; everyone looses...

that's all folks...

free market forces...

the great reflater...

and he encouraged Congress to help homeowners caught up in the mortgage crisis

when crime pays...

foxes and henhouses...

paying for the plumber's crapper job next door

Fair Game

Your Money at Work, Fixing Others’ Mistakes

By GRETCHEN MORGENSON

IT looks as if we may get through this weekend without another scramble to save a troubled financial firm with a trillion-dollar balance sheet.

But that doesn’t mean taxpayers are out of danger. No, sir. No, ma’am. Because lawmakers are at work on a bailout fund that would buy the kind of distressed assets (defaulted mortgages, for example) that have ignited this firestorm.

Treasury Secretary Henry M. Paulson Jr. has called the fund the “troubled asset relief program.” I’ll just call it TARP for short (you know, the kind of thing they spread over muddy fields so you don’t soil your Guccis).

And depending on how TARP is operated, and how the assets are valued before taxpayers are forced to buy them, it could bloat our final bill for this mess while benefiting the very institutions that got us into it.

Yes, we need a smart plan and a concerted effort to get the frozen credit markets up and running. But we also have to be certain that the types of conflicts of interest that riddle Wall Street aren’t visited upon TARP.

Consider: A bank wants to sell the TARPistas (also known as TAXPAYERS) a pile of stinky mortgage securities that it currently values at 60 cents on the dollar. Let’s assume that the most recent actual trade between market participants for similar assets was struck at 30 cents on the dollar.

So what’s a fair price that we TARPistas should pay for the assets?

If we bought at 60 cents, a price that the bank would argue is appropriate, we would most likely face a loss. The bank, however, would be much better off than if it had to dump at 30 cents.

read more at the NYT and peruse ever the toons...

over at book-keeping .....

The bushit administration will leave the next presidential pretender with a record-breaking US$482 billion annual deficit & that doesn't include either the US$200 billion used to rescue Fannie Mae & Freddie Mac, or the US$700 billion financial institution bailout.

The US$700 billion financial institution bailout will push the US national debt limit to US$11.3 trillion, resulting in an annual interest bill alone of US$400 billion …..

priviledged bailout

By DAVID M. HERSZENHORNWASHINGTON — The Bush administration and Congressional leaders moved closer to agreement on a historic $700 billion bailout for financial firms on Monday, including tight oversight of the program and new efforts to help homeowners at risk of foreclosure.

But lawmakers in both parties voiced anger over the steep cost and even skepticism about the plan’s chances of success.

As heated debate began on Capitol Hill, Congress and the administration remained at odds over the demands of some lawmakers, including limits on the pay of top executives whose firms seek help, and new authority to allow bankruptcy judges to reduce mortgage payments for borrowers facing foreclosure.

Congressional leaders and Treasury officials also said they were close to an agreement over a proposal by some Democrats in which taxpayers could receive an ownership stake, in the form of warrants to buy stock, from firms seeking to sell distressed debt.

Lawmakers want to require an equity stake, while the administration wants flexibility on that matter, a Treasury official said.

see toon at top...

easy street

By Dana Milbank

Wednesday, September 24, 2008; A03

"I don't like to be in this position, asking for things and, you know, answering to the American taxpayer," Treasury Secretary Hank Paulson informed the Senate banking committee yesterday.

His discomfiture was easily understood.

He left Goldman Sachs two years ago with hundreds of millions in his pocket and an invitation from President Bush to take over the U.S. Treasury. Now, after assuring lawmakers for the past two years that the markets would take care of themselves, he was asking Congress for perhaps $1 trillion in borrowed taxpayer money to bail out his former peers and colleagues on Wall Street. He wanted the money so desperately -- "quickly and cleanly . . . avoid slowing it down . . . immediate implementation . . . urgency . . . immediate need" -- that, if he had any hair, he probably would have set it on fire right there in the Dirksen Senate Office Building.

The senators were none too pleased to receive this panhandler. Though they've collectively accepted more than $33 million from Wall Street and related industries in this election cycle alone, the committee members took turns channeling their inner Huey Longs.

------------------------

Gus: time to pay their piper?... Is Wall Street to become "Easy Street"? Is this how prostitution works? Getting paid handsomely hush money for passing on the clap to the general public?

Is there too many people to be put in prison?...

the trillion bux is not needed

A Bailout We Don't Need

By James K. Galbraith

Thursday, September 25, 2008; A19

Now that all five big investment banks -- Bear Stearns, Merrill Lynch, Lehman Brothers, Goldman Sachs and Morgan Stanley -- have disappeared or morphed into regular banks, a question arises.

Is this bailout still necessary?

The point of the bailout is to buy assets that are illiquid but not worthless. But regular banks hold assets like that all the time. They're called "loans."

With banks, runs occur only when depositors panic, because they fear the loan book is bad. Deposit insurance takes care of that. So why not eliminate the pointless $100,000 cap on federal deposit insurance and go take inventory? If a bank is solvent, money market funds would flow in, eliminating the need to insure those separately. If it isn't, the FDIC has the bridge bank facility to take care of that.

Next, put half a trillion dollars into the Federal Deposit Insurance Corp. fund -- a cosmetic gesture -- and as much money into that agency and the FBI as is needed for examiners, auditors and investigators. Keep $200 billion or more in reserve, so the Treasury can recapitalize banks by buying preferred shares if necessary -- as Warren Buffett did this week with Goldman Sachs. Review the situation in three months, when Congress comes back. Hedge funds should be left on their own. You can't save everyone, and those investors aren't poor.

With this solution, the systemic financial threat should go away. Does that mean the economy would quickly recover? No. Sadly, it does not. Two vast economic problems will confront the next president immediately. First, the underlying housing crisis: There are too many houses out there, too many vacant or unsold, too many homeowners underwater. Credit will not start to flow, as some suggest, simply because the crisis is contained. There have to be borrowers, and there has to be collateral. There won't be enough.

----------------------

Some people are actually blaming the people who took sub-prime mortgage loans for the problem!!!! They say these people should have read the small print... Poor sods. Most of that small print was hidden in tons of legal jargon that the uneducated could not understand as even most of the sophisticated scholar could not understand either — unless they had a degree in cunning deviousness-class con-artist and a pair of magnifying glasses to read the small stuff...

oink oink... bonuses, oink...

Hank Paulson's $125 Billion Mistake

By Steven Pearlstein

Friday, October 31, 2008; D01

It was only a few weeks ago that most right-thinking economists and left-leaning bloggers were jumping on Treasury Secretary Hank Paulson for his plan to jump-start the markets in asset-backed securities by having the government buy them up at auction. Much better, they argued, to use the $700 billion to "recapitalize" the banking system, just as Gordon Brown was doing in Britain. Even the Federal Reserve thought that a better idea.

So Paulson changed course, called in the nine biggest banks and "forced" them as a group to accept $125 billon in new capital. The critics patted themselves on the back for having been right all along.

Now, many of the same people are shocked -- shocked! -- to discover that the banks aren't using the money to make new loans to households and businesses, as they had assumed, but are using it to maintain dividend payments to shareholders, pay this year's bonuses to executives and traders, or squirrel it away for future acquisitions.

I hate to say it, but I told you so. Sprinkling money around a highly fragmented banking system when markets were panicked and everyone was scrambling to reduce leverage was always akin to shoveling sand against the tide.

see toon at top... note the date....