Search

Recent comments

- making sense....

31 min 25 sec ago - balls....

34 min 38 sec ago - university semites....

1 hour 22 min ago - by the balls....

1 hour 36 min ago - furphy....

6 hours 51 min ago - nothing new....

7 hours 24 min ago - blood brothers....

8 hours 21 min ago - germanic merde....

8 hours 25 min ago - englishit....

10 hours 8 min ago - kurdylord....

10 hours 19 min ago

Democracy Links

Member's Off-site Blogs

the amerikan way .....

from Crikey …..

Bear Stearns and the decline of American prestige

Stephen Mayne writes:

George W Bush will go down as arguably the worst US President in history and it will come back to two points: Iraq and the housing-induced credit crash.

Alan Kohler had a fascinating column in Business Spectator on February 29 reviewing a new book by Joseph Stiglitz, the former chief economist of the World Bank, which blamed the credit crisis on the $3 trillion Iraq war.

The $3 trillion was all borrowed and, as Kohler summed up Stiglitz, this became “the hidden cause of the credit crisis because the Alan Greenspan Federal Reserve colluded with the Bush Administration by flooding the US with cheap credit to keep interest rates down.”

Throw in the various frauds which put loans into the hands of 10% of Americans who couldn’t afford them and then flogged them off to the rest of the world and you have today’s global credit crisis.

The collapse of Bear Stearns is certainly the biggest disaster for Wall Street in a generation. Long Term Capital Management got a Fed-induced $US3.6 billion bailout from its peers, whereas Bear Stearns got $US30 billion of liquidity from the Fed.

Whilst the British Government effectively funded the $150 billion run on Northern Rock, the Federal Reserve has funded the sale to stop the run.

Stand by for a huge backlash against the US investment banks, starting with new US legislation which will make Enron’s Sarbanes-Oxley look like a picnic.

Everyone from gangsters to US Presidents knows that you need a combination of brains and muscle to prosper. American multinationals have long surfed on the coat-tails of US military power and trade negotiations.

Unfortunately, the Yanks went brain-dead over Iraq – producing more expensive rather than cheaper oil – and now can’t afford to maintain their huge military spending, let alone bail out investment banks or guarantee housing for Americans.

When saddled with $US7 trillion in government debt, a banking and credit crisis is disastrous for America. You just can’t keep borrowing $US2 billion a day from the rest of the world to fund huge budget and current account deficits. No wonder the US dollar is free-falling when people start talking about the Fed printing money.

It was largely foreign governments which pumped more than $40 billion into Wall Street banks last year because the US government simply didn’t have the cash.

These foreign governments are collectively more than $10 billion underwater and so this time the Fed had to borrow even more money to facilitate a sale to the only American bank left with a strong balance sheet, JP Morgan.London has already replaced New York as the world financial capital and what we are seeing here is the rapid decline of American power and prestige.

- By Gus Leonisky at 18 Mar 2008 - 9:24pm

- Gus Leonisky's blog

- Login or register to post comments

life has hazards...

'Moral Hazard': Why Risk Is Good

By Frank Ahrens

Washington Post Staff Writer

Golf has water hazards. Your car has flashing hazards. A bachelor party in Vegas has a host of potential hazards.

The phrase "moral hazard" has been percolating on Wall Street and in Washington in the past few days in the wake of the $30 billion federal bailout of the Bear Stearns investment bank, essentially driven out of business by the subprime mortgage crisis.

Moral hazard describes a situation in which a party is insulated from the consequences of its actions. Thus protected, it has no incentive to behave differently. Insurance companies coined the term to describe someone who, for instance, takes out a big auto policy, then leaves his car unlocked. If the car is stolen, the insurance company -- and its other customers -- pay the price for the reckless behavior.

In the case of Bear Stearns, critics have said that such highflying investment houses will continue to engage in risky activities with investors' money, knowing that if they blow it, the federal government -- read: taxpayers -- will bail them out.

During a House Budget Committee meeting in January, Rep. Scott Garrett (R-N.J.) cautioned: "It's very plausible to suggest that if government bails everyone out of this mess that we will continue to bail out bad actors in the future, and the market discipline that currently remains will further erode."

But after the Bear Stearns rescue, Treasury Secretary Henry M. Paulson Jr. said the bank got away with nothing. Trading for as much as $172 per share last year, Bear Stearns was snapped up by J.P. Morgan Chase for $2 per share.

"And when we talk about moral hazard," Paulson said on Monday, "I would say, 'Look at the Bear Stearns shareholder.' "

And that could be the moral to this hazardous story.

-------------------

Gus: and all those who got conned by cheap loan they could not repay when the bank interest went up, also know that living in the street is not a crash hot hazard. And the poor buggers can't even afford to play golf. And they would not know which end of the stick to hit their local spruiker-shonky/banker with, anyway. And the local spruiker-shonky/banker may be playing golf in the Bahamas, anyway...

"offer that couldn't be refused"?...

The management team at Bear Stearns faces a backlash over the bank's capitulation to JP Morgan's $280m (£140m) rescue takeover bid, with lawyers and stock market speculators hoping to upset the deal.

Bear's shares were changing hands today for $5.53 - twice the level of JP Morgan's all-stock offer, presently worth about $2.45 a share - in a sign that investors are clinging to the belief that an alternative to the bid may materialise.

Part of the rise has been attributed to "shell shocked" employees who own 30% of the stock and are unwilling to accept that the bank, valued at $7bn a week ago, is worth such a paltry sum. The Bahamas-based billionaire Joe Lewis, who owns a 9.4% stake, has fuelled discontent by describing the offer as "derisory".

In contrast, Bear Stearns bondholders have been buying shares in the hope of pushing the deal through because they want their bonds converted into less risky JP Morgan ones.

A vote by shareholders is likely to take place in two months' time. But, faced with the bank's desperate situation, JP Morgan was able to attach unusual conditions making its offer difficult to block.

privatise the profits, socialise the risks...

There should be financial accountability for the man who led Bear Stearns as it gorged on dubious subprime securities to boost its profits and share price, helping to set up one of the biggest financial collapses since the savings-and-loan crisis in the 1980s. Some might argue that he should have lost it all.

But that’s not how it works. The ongoing bailout of the financial system by the Federal Reserve underscores the extent to which financial barons socialize the costs of private bets gone bad. Not a week goes by that the Fed doesn’t inaugurate a new way to provide liquidity — meaning money — to the financial system. Bear Stearns isn’t enormous. It doesn’t take deposits from the public. Yet the Fed believed that letting it implode could unleash a domino effect among other banks, and the Fed provided a $30 billion guarantee for JPMorgan to snap it up.?

Compared to the cold shoulder given to struggling homeowners, the cash and attention lavished by the government on the nation’s financial titans provides telling insight into the priorities of the Bush administration. It’s not simply a matter of fairness, though. The Fed is probably right to be doing all it can think of to avoid worse damage than the economy is already suffering. But if the objective is to encourage prudent banking and keep Wall Street’s wizards from periodically driving financial markets over the cliff, it is imperative to devise a remuneration system for bankers that puts more of their skin in the game.

Financiers, of course, dispute that they are being insufficiently penalized. “I received no bonus for 2007, no severance pay, no golden parachute,” E. Stanley O’Neal, the former chief executive of Merrill Lynch, told a House committee recently. That doesn’t seem like much of a blow to Mr. O’Neal, who was removed earlier this year following gargantuan subprime-related losses.

Indeed, the pain that is being inflicted on financial-industry executives as a result of their own actions and decisions is not proving much of an encouragement. Rather, the knuckle-rapping seems only to encourage bankers to make up for any losses they may suffer by finding another way to navigate their companies, the financial system and the economy into the next maelstrom — from Internet stocks to what the industry calls zero-down, negative amortization, no-doc, adjustable-rate mortgages.

(Translation: derivatives based on incomprehensible mortgages with unpredictable interest rates given to people who have no reasonable chance of understanding them, let alone paying them back. )

------------------

Gus: privatise the profits, socialise the risks..., the system is crook. Charges should be laid. But the problem is like a terminal cancer: greed has tainted EVERY financial organisation beyond the "morally" acceptable. Fixing the problem properly would require total demolition and reconstruction of the system. But that would be too drastic for the profiteers in the system, thus they overfeed the system that does nothing more than keep the fat alive, while telling us it's better for the system to be bloated like geese for "foie gras" than dead...

And we the guilable public we get a few crumbs if we're lucky...

movement in the bowels of the US Banking system...

According to the New York Times, from the Fed Reserve:

Goldman Sachs and Morgan Stanley, the last two independent investment banks, will become bank holding companies, the Federal Reserve said Sunday night, fundamentally altering the landscape of Wall Street.

The move fundamentally changes one of the mainstay models of modern Wall Street, the independent investment bank, soon after the federal government unveiled the biggest market rescue since the Great Depression. It heralds new regulations and supervisions of previously lightly regulated investment banks. It is also the latest signal by the Federal Reserve that it will not let Goldman or Morgan fail.

-----------------

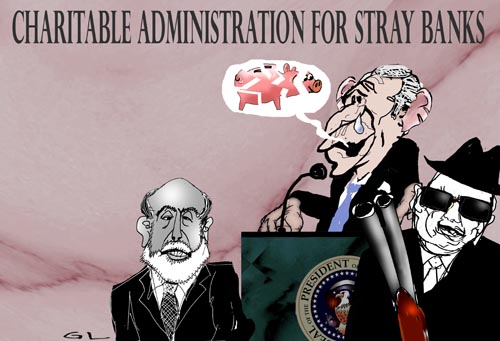

Gus: Let's hope the diarrhea is contained... see toon at top...