Search

Recent comments

- no shipping.....

3 hours 55 min ago - digging graves....

4 hours 7 min ago - BS draft...

4 hours 15 min ago - tankers ablaze....

5 hours 2 min ago - shoes....

7 hours 6 sec ago - new map....

7 hours 34 min ago - weapongeddon....

7 hours 51 min ago - squirming....

8 hours 7 min ago - UK kills russians...

12 hours 48 min ago - fury shit....

12 hours 58 min ago

Democracy Links

Member's Off-site Blogs

the great reflater .....

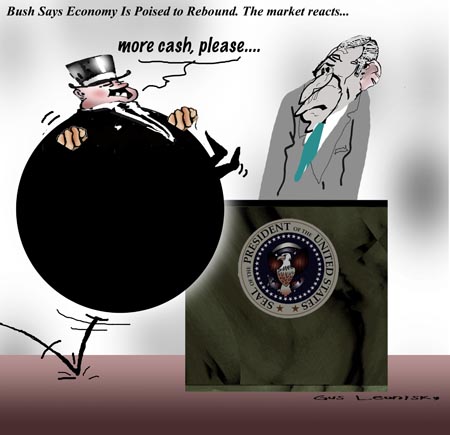

President Bush urged Congress on Monday to resist efforts by Democrats to pass a second economic stimulus package, saying that while the economy is “in a rough time right now,” he is confident it will begin to rebound by the end of the year.

On his first day back from a swing through Eastern Europe and Russia, Mr. Bush summoned small-business leaders to the White House to showcase the first stimulus package, signed into law in February. That package included rebates for taxpayers - the White House says the checks will start to go out next month - and tax incentives intended to encourage businesses to invest.

Mr. Bush urged lawmakers to give the law a chance to work before passing a new one. “Give this one a chance to kick in,” he said.

But in the wake of a bleak report on Friday that showed 80,000 jobs were lost in March, Democrats say there is no time to waste. The House speaker, Nancy Pelosi of California, has called on Mr. Bush to work with Congress in passing a new stimulus bill and has said she will raise the issue with Mr. Bush directly at a meeting scheduled for Wednesday at the White House.

Ms. Pelosi is proposing a package that would include an extension of unemployment benefits, a provision that the White House opposed in negotiations over the first stimulus package. At the same time, Senate Democrats and Republicans are working together on a housing bill to help struggling homeowners avert foreclosure; the White House says it has “deep concerns” about that legislation.- By Gus Leonisky at 8 Apr 2008 - 10:20pm

- Gus Leonisky's blog

- Login or register to post comments

villains of the markets...

Toxic shock: how the banking industry created a global crisis

The warnings began eight years ago, but even the most respected financiers did not understand all the risks

The banking industry is gripped by a credit crisis that has taken the US economy to the brink of recession. Two banks have, in effect, been nationalised, house prices are tumbling and it is harder to secure a home loan. In a major investigation, Jill Treanor looks at the flawed financial products at the heart of the credit crunch and explores how the banks brought the crisis on themselves and how it could mark a return to basics.

In a luxurious chateau in Alsace eight years ago, a top financier made a confession: some of the complex financial instruments being pumped out by the world's biggest investment banks were potentially "toxic". Top regulators were left in no doubt of the perils hiding in the financial system after the two-day summit aimed at finding and disarming the bombs waiting to explode.

The warning proved to be prescient. About a year ago one of these bombs exploded. The ensuing credit crunch could lead to a complete redrawing of the financial map and may even herald the end of globalisation.

The toxic instruments highlighted by the banker were collateralised debt obligations (CDOs). Little was known of them when this regulatory teach-in was taking place, but since then banks have embraced them as a way of shifting debt off their balance sheets, enabling them to lend more. They have been bought enthusiastically by many investors across the financial system. As they began to blow up last year, there was mayhem at banks and brokers on Wall Street, which, in turn, sent shock waves through the world's financial markets.

CDOs are the villains of the market turmoil but before they unravelled they fuelled easy credit and economic growth in many developed economies. Britons amassed a record £1.4tr of debts - more than the UK's gross domestic product - as banks loosened their lending criteria. Millions of Americans with poor credit histories who might not otherwise have bought their homes were granted sub-prime mortgages.

----------

Gus: since the early beginnings of this site, we've warned about the way these "villains" were being subtly used by governments to inflate their credentials as good "economic managers". In fact we've been going down the drain, despite the illusion of a "strong economy" as massaged by Costello...

War (killing people) has also been used as a prop for people's "prosperity", except for those being killed and most likely not for many who did or are doing the killings directly. Eventually, these people might come to confront their personal moral obligations, while a psychopathic war president sleeps well at night...

worry and thrift...

April 18, 2008

Workers Get Fewer Hours, Deepening the Downturn

By PETER S. GOODMAN

Not long ago, overtime was a regular feature at the Ludowici Roof Tile factory in eastern Ohio. Not anymore. With orders scarce and crates of unsold tiles piling up across the yard, the company has slowed production and cut working hours, sowing worry and thrift among its workers.

“We don’t just hop in the car and go shopping or get something to eat,” said Kim Baker, whose take-home pay at the plant has recently dropped to $450 a week, from more than $600. “You’ve got to watch everything. If we go to town now, it’s for a reason.”

Throughout the country, businesses grappling with declining fortunes are cutting hours for those on their payrolls. Self-employed people are suffering a drop in demand for their services, like music lessons, catering and management consulting. Growing numbers of people are settling for part-time work out of a failure to secure a full-time position.

The gradual erosion of the paycheck has become a stealth force driving the American economic downturn. Most of the attention has focused on the loss of jobs and the risk of layoffs. But the less-noticeable shrinking of hours and pay for millions of workers around the country appears to be a bigger contributor to the decline, which has already spread from housing and finance to other important areas of the economy.

While official unemployment has risen only modestly, to 5.1 percent, the reduction of wages and working hours for those still employed has become a primary cause of distress, pushing many more Americans into a downward spiral, economists say.

Moreover, this slippage is a critical indicator that the nation may well be on the verge of a recession, if not already in one.

Last month, the hours worked by those on American payrolls dropped, compared with six months earlier, according to an index maintained by the Labor Department. The last time the index moved into negative territory was February 2001, when the economy was on the doorstep of recession. A similar slide emerged in August 1990, one month into what proved an even more severe downturn.

From March 2007 to March of this year, the average workweek reported in the private sector slipped slightly to 33.8 hours, from 33.9 hours, while overtime for manufacturing workers fell by a larger margin.

---------------------

Gus: as mentioned Bushit has incompetently managed the US economy thus reducing US consumption without planning, leading to a local tiny "improvement" on the global warming front... But the US has exported a few of its previous emission problems to China in manufacture and to Iraq in war... Still not a pretty sight when one tallies it all up. But as usual, the people at the bottom of the food chain are the ones taking the brunt of it all...

lead from a looser...

Sticker Shock in the Organic Aisles

By ANDREW MARTIN and KIM SEVERSON

Published: April 18, 2008

Shoppers have long been willing to pay a premium for organic food. But how much is too much?

Prices are rising for organic food, which typically costs 20 percent to 100 percent more than a conventional counterpart.

Rising prices for organic groceries are prompting some consumers to question their devotion to food produced without pesticides, chemical fertilizers or antibiotics. In some parts of the country, a loaf of organic bread can cost $4.50, a pound of pasta has hit $3, and organic milk is closing in on $7 a gallon.

“The prices have gotten ridiculous,” said Brenda Czarnik, who was shopping recently at a food cooperative in St. Paul.

...

The United States had 4.1 million acres of organic farmland in 2005, triple the amount in 1997, according to the Department of Agriculture, which regulates the organic industry. But farmers and grain buyers say the growth of new organic acreage has slowed, falling short of rising demand and causing organic grain prices to soar.

That is partly because prices for conventional corn, soybeans and wheat are at or near records, so there is less incentive for farmers to switch to organic crops; making the switch requires a three-year transition and piles of paperwork.

“There has been no new surge of land going into organic,” said Lynn Clarkson, who buys organic grain as president of Clarkson Grain in central Illinois. “We are having to compete with this ethanol juggernaut,” he added, referring to the growing use of field corn for fuel.

Ken Cook, president of the Environmental Working Group, an environmental research organization, said conventional dairy and grain prices were so high that they were nearly rivaling prices that organic farmers receive. Organic farmers normally earn a hefty premium for raising livestock and crops without chemical fertilizer, pesticides or antibiotics.

--------------------

Gus: proper food (organic food, without chemical fertilizer, pesticides or antibiotics [and without herbicides?]) is being hammered by Bush's mismanagement of the entire US economy... Net wages going down, prices of everything going up, bio-fuel syndrome driving hunger, festering "little" wars, record deficit, subsidies to the rich, shrinking food stamps for the poor, endemic obesity due to bad food and bad diet, wasted energy, over-population, lax protection of the environment, semantic torture, real torture for some, reduction of freedoms, spying on millions of citizen, manipulation of the justice system, global warming inadequate policies, "carte blanche" to usurers and swindlers, increasing violence... etc, etc. etc...

rebounding like a lead balloon

Bush bails out US mortgage giants

By Stephen Foley in New York

Monday, 8 September 2008

The Bush administration ripped up years of laissez-faire economic policies last night and launched a government takeover of two of the most powerful mortgage companies in the US. The move is designed to forestall a collapse in house prices that could plunge America into a new Great Depression and trigger chaos on the world's financial markets.

The seizure of the two lenders, Fannie Mae and Freddie Mac, puts a federal guarantee behind an extraordinary $5trn of outstanding mortgage debt, and writes a blank cheque from the US taxpayer that could ultimately run into tens of billions of dollars of support for the country's ailing housing market.

The US Treasury Secretary, Henry Paulson, said that by bringing the companies under government control, the government could ensure they continued to do their vital work providing financing to the mortgage market. Without them, few Americans would be able to find loans to buy homes, consumer confidence could collapse and the already fragile global economy would contract dramatically.

read more at The Independent and see toon at top