Search

Recent comments

- making sense....

13 min 15 sec ago - balls....

16 min 28 sec ago - university semites....

1 hour 4 min ago - by the balls....

1 hour 18 min ago - furphy....

6 hours 33 min ago - nothing new....

7 hours 5 min ago - blood brothers....

8 hours 3 min ago - germanic merde....

8 hours 7 min ago - englishit....

9 hours 50 min ago - kurdylord....

10 hours 1 min ago

Democracy Links

Member's Off-site Blogs

when crime pays .....

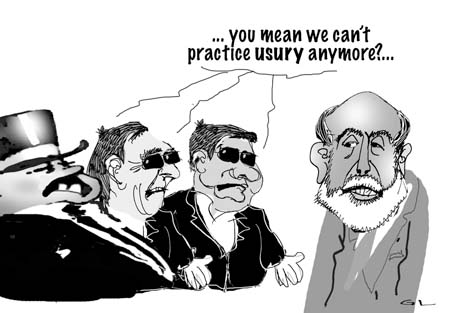

The mortgage industry, facing the prospect of tougher regulations for its central role in the housing crisis, has begun an intensive campaign to fight back.

As the Federal Reserve completes work on rules to root out abuses by lenders, its plan has run into a buzz saw of criticism from bankers, mortgage brokers and other parts of the housing industry. One common industry criticism is that at a time of tight credit, tighter rules could make many mortgages more expensive by creating more paperwork and potentially exposing lenders to more lawsuits.

To the chagrin of consumer groups that have complained that the proposed rules are not strong enough, the industry’s criticism has already prompted the Fed to consider narrowing the scope of the plan so it applies to fewer loans.

The debate over new mortgage standards comes in response to a severe crisis in the housing and financial markets that many economists trace back to overly loose credit and abusive loans. Those practices, combined with low interest rates, led to inflated market values that have declined rapidly in recent months as investors have begun to lose confidence in the financial instruments tied to those loans.- By Gus Leonisky at 28 Apr 2008 - 9:33pm

- Gus Leonisky's blog

- Login or register to post comments

huge interest on interest free stamp

The Allure of the Forever Stamp

By Mike Nizza

INSERT DESCRIPTION

Risky investments and rising prices seem to be everywhere these days — except for one unique deal at your local post office.

For the past year, branches have been selling “The Forever Stamp” for 41 cents each. Unlike the 401(k)’s and social security accounts that keep many of us up at night, these have a guarantee from the most trusted government agency for the past four years: the United States Postal Service.

“The stamp will be good for mailing one-ounce First-Class letters anytime in the future — regardless of price changes,” the agency promises.

As the penny increase of May 12 nears, the forever deal is proving irresistible to millions of Americans, according to today’s news release:

In the past several weeks, Postal Service customers have been buying Forever Stamps at a rate of about 30 million per day, bringing the amount sold to more than 6 billion since they were first offered.

The Associated Press further detailed the climb, reporting forever stamp sales of $267,696,023 in March, $207,900,132 in February and $115,303,031 in January.

Not only is the forever stamp a bright light in a tough economy, it is also providing a whole lot of pleasure for the postal service. Last year, the agency’s chief seemed to relish his chance to introduce it, saying “Who said nothing lasts forever?”

-------------------

Gus: should this service pledge be extended to other industry and providers, this would send shivers down the spine of the money grubbers. Imagine placing all your bets on a one to one basis forever, no speculation allowed (at this stage)... They'd cry in their soup, at the local charity kitchen.

Possibly some people are buying the stamp in drove in the hope that should the price of postage go up, they could sell the "forever" stamp on the black market with a profit, below the increase... But inflation and all things variable would make it an intensive low return racket for losers...

Could this be a protection against privatisation of the US postal service?

Interest free loans?... There are some organisations and cooperative that supply interest free loans, using members contribution and ballots for allocation... but they are rare and loans rarely go above S100,000... and members have to wait for their luck...

innovation of greed?...

April 29, 2008

Op-Ed Contributors

Muzzling the Watchdog

By WILLIAM DONALDSON, ARTHUR LEVITT Jr. and DAVID RUDER

THE downfall of Bear Stearns, the release of Treasury Secretary Henry Paulson’s sweeping blueprint for the overhaul of our financial regulatory structure, and the worsening health of the stock market and our economy has raised serious questions for the future of the Securities and Exchange Commission. As the capital-markets regulator and investor’s advocate, the S.E.C. is a natural recipient of finger-pointing during a market crisis.

Each of us led the S.E.C. during challenging times — the stock market crash of 1987, the price-fixing scandal at Nasdaq in the 1990s, and the accounting and governance failures and mutual fund scandals of this decade. We are in agreement with Secretary Paulson that the world of finance is changing rapidly, having eclipsed in many areas the regulatory structure put in place, piece by piece, over the past century. Yet we fear that the current conversation about the future of the S.E.C. is getting ahead of itself. Secretary Paulson’s proposals to change the structure and function of the S.E.C., if adopted, risk inflicting serious damage to investors and our capital markets.

The current housing and credit troubles do not present a sufficient basis for reforming the entire financial regulatory system. Instead of moving hastily, policymakers need to examine what went wrong, why it went wrong and what the best approaches are for re-establishing the unequaled reputation and performance of the American capital markets.

There is precedent for such an exercise. In 1987, a presidential task force was established to investigate the Black Monday crash. Today, we need a similar exhaustive, bipartisan and impartial examination to explore a series of possible business and regulatory failures.

This investigation should include apparent conflicts of interest on the part of the credit ratings agencies; the failure of banks and other lenders to adopt sound lending practices; the failure of investment banks to disclose that they had significant portfolios of securities backed by subprime mortgages; the sale of high-risk securities to investors for whom they were unsuited; the breakdown (or absence) of adequate risk management systems among the top financial services firms; and the failure of regulators to recognize and take early action to deal with the problems that have grown to today’s magnitude.

...

We are not advocating a preservation of the status quo. The only thing constant in our global economy is change, and to keep pace with the capital markets and needs of investors, our regulators too must change. But before we embark on a radical restructuring of the financial regulatory system, we must understand clearly where the current problems lie, what was and was not done by regulators leading up to the current crisis, and whether new powers are needed to keep pace with financial innovation.

--------------

Gus: we all know why the system went butt-up...: financial innovation, otherwise known as GREED. Yes new powers are needed to keep the "innovation" — a euphemism for a process to suck the system without any ethical value other than line the pocket of a few privileged people — where it belongs.