Search

Recent comments

- chabad....

49 min 23 sec ago - back to the kitchen....

51 min 34 sec ago - loneliness....

3 hours 47 sec ago - insight....

3 hours 31 min ago - conspiracy....

23 hours 18 min ago - brutal USA....

1 day 1 hour ago - men....

1 day 1 hour ago - oil....

1 day 2 hours ago - system....

1 day 2 hours ago - not invited....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

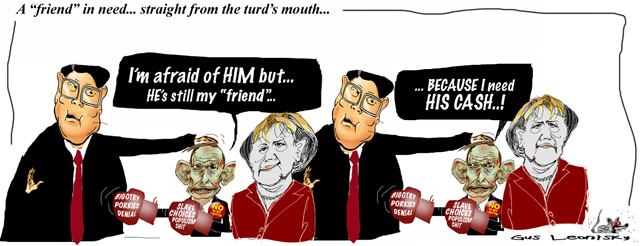

turdy blossoms on the international stage...

Tony Abbott has admitted at the highest international level that Australia's policies towards China are driven by two emotions: "fear and greed".

The Prime Minister's candid appraisal of Australia's primordial motivations, given with a grin in private conversation with Germany's Angela Merkel last November, is a long way from the prolix platitudes of official documents.

And it sits in awkward contrast with Mr Abbott's personal assertions of friendship, such as the one that he made to his Chinese counterpart the following day.

- By Gus Leonisky at 16 Apr 2015 - 5:24pm

- Gus Leonisky's blog

- Login or register to post comments

the chinese slide...

Weak Chinese growth figures and a further slide in consumer confidence locally helped drive the Australian share market to its third straight loss.

The All Ordinaries index closed 39 points lower at 5,877 and the ASX 200 fell 38 points to end the session at 5,908.

The market opened lower despite overnight gains on Wall Street, with the losses only intensifying as the poor economic data rolled in.

First came the Westpac - Melbourne Institute Index of Consumer Sentiment, showing a further fall in confidence.

Next was official data showing Chinese economic growth slowed to an annual rate of 7 per cent in the March quarter, the nation's slowest since 2009.

While the reading was in line with analyst predictions and the Chinese government's own growth target, investors reacted poorly, particularly to significantly weaker than expected industrial output.

On the local market, finance and retail stocks were the hardest hit, including the big four banks.

Westpac lost 1.6 per cent, the Commonwealth 1.5 per cent, ANZ 1.1 per cent and NAB 1 per cent

read more: http://www.abc.net.au/news/2015-04-15/chinese-growth-figures-consumer-confidence-local-market-loss/6395574