Search

Recent comments

- peer pressure....

1 hour 25 min ago - strike back....

1 hour 31 min ago - israel paid....

2 hours 33 min ago - on earth....

7 hours 3 min ago - distraction....

8 hours 14 min ago - on the brink....

8 hours 23 min ago - witkoff BS....

9 hours 37 min ago - new dump....

21 hours 30 min ago - incoming disaster....

21 hours 37 min ago - olympolitics.....

21 hours 42 min ago

Democracy Links

Member's Off-site Blogs

the burden of proof

U.S. Said to Open Criminal Inquiry Into Goldman

By LOUISE STORY and MICHAEL J. de la MERCED

Federal prosecutors have opened an investigation into trading at Goldman Sachs, raising the possibility of criminal charges against the Wall Street giant, according to people familiar with the matter.

While the investigation is still in a preliminary stage, the move could escalate the legal troubles swirling around Goldman.

The Securities and Exchange Commission, which two weeks ago filed a civil fraud suit against Goldman, referred its investigation to prosecutors for the Southern District of New York, which has now opened its own inquiry.

Goldman has vigorously denied the accusations by the S.E.C., which accused Goldman of defrauding investors involved a complex mortgage deal known as Abacus 2007-AC1.

Federal prosecutors would face a higher bar in bringing a criminal case against Goldman, whose role in the mortgage market came under sharp scrutiny this week during a marathon hearing in the Senate. In contrast to civil cases, the burden of proof is higher in criminal ones, where prosecutors must prove their case beyond a reasonable doubt.

The stakes are high for Goldman, but they are also high for the United States attorney’s office. Prosecutors from the Eastern District of New York lost a case last year filed against two hedge fund managers at Bear Stearns, whose collapse presaged the turmoil on Wall Street.

Prosecutors built much of that case around internal e-mail messages at Bear Stearns, much the way the S.E.C. and senators have pointed to e-mail at Goldman in which employees had disparaged investments that they were selling to their customers.

- By Gus Leonisky at 30 Apr 2010 - 6:40pm

- Gus Leonisky's blog

- Login or register to post comments

bringing accountability to Wall Street

The Senate has begun debating proposals for the most significant reforms to financial regulations since the 1930s.

After days of deadlock, Republicans and Democrats began arguing over a bill aimed at bringing accountability to Wall Street and avoiding another financial meltdown.

Republicans had blocked debate on the bill for three consecutive days, but eventually relented on Wednesday.

But they also promised a hard fight to make changes to the reform bill.

The key battlegrounds of the debates will be measures to restrict trades in complex financial instruments, called derivatives, and the powers proposed for a new agency to protect consumers.

and the natives are getting restless too ....

After a year of what seemed like nonstop Tea Party coverage, it's easy to forget that Americans ever protested in anything but solid ethnic blocs, or that angry Americans ever gathered to express coherent grievances grounded in reality.

Yesterday's AFL-CIO-led protest on Wall Street was an overdue reminder.

More than 5,000 union members and others delivered a crisp message with their march from City Hall to the Bowling Green Bull. In contrast to recent protests on the right, the event was noticeably lacking in loaded but a historical symbols like Gadsen flags, and refrained from vilifying individuals in favor of calling out institutions. Of hundreds of signs hoisted, only one was branded with the Obama logo.

The signs were non-partisan and dealt with real problems - namely, this country's rogue, unregulated finance sector. There was only one puppet, a fanged vampire squid meant to symbolize Goldman Sachs. The banners declared "Wall Street: Never Again" and "Less Audis, More Audits." To a one, they echoed the clear policy demands of the day: regulatory reform, new taxes on banks and speculators, and a jobs bill.

Thousands Rally In New York For Showdown With Wall St.?

moral bankruptcy .....

It was the Perry Mason moment in the unravelling of what was left of Goldman Sachs' reputation. Only in this case, it involved a grizzled former prosecutor, Sen. Carl Levin, rather than a genial defense attorney. The case was broken and the truth about the depth of Goldman's corruption revealed in his startling cross-examination of Goldman Chief Financial Officer David Viniar.

The Michigan Democrat, citing the language of the internal e-mails of Goldman traders concerning the deceptive products they were selling, asked: "And when you heard that your own employees in these e-mails are looking at these deals said 'God what a shitty deal. God, what a piece of crap,' when you hear your own employees and read about those e-mails, do you feel anything?"

Viniar's answer told us all we need to know about the banal but profound immorality of Goldman's business culture: "I think that's very unfortunate to have on e-mail."

A flabbergasted Levin cut in with "On e-mail? How about feeling that way?" and Viniar, apparently moved by jeers of ridicule from the audience, conceded "I think it is very unfortunate for anyone to have said that in any form." Pressed further by Levin asking, "How about to believe that and sell them?" the CFO finally conceded, "I think that's unfortunate as well." To which Levin responded, "That's what you should have started with."

'God, What a Piece of Crap'

no bankruptcy for some...

yes John....

a bet each way...

The world's third richest man, Warren Buffett, today declared that he saw nothing wrong in an allegedly fraudulent $1bn mortgage deal by Goldman Sachs and suggested that losers in the transaction, including Royal Bank of Scotland, had only themselves to blame for exercising "dumb" judgment.

After weeks of silence on the subject, Buffett delivered a valuable endorsement to the embattled Wall Street bank at Saturday's annual meeting of his Berkshire Hathaway business empire in Nebraska. The 79-year-old billionaire said he "loved" his own $5bn investment in Goldman and offered "100%" support to the bank's chief executive, Lloyd Blankfein.

"I do not hold against Goldman at all the fact that an allegation has been made by the Securities and Exchange Commission," Buffett told a gathering of 40,000 of his followers at Omaha's cavernous QWest sports stadium. But if fraud charges were proven, he added, "it's something more serious and we'd look at that at the time".

-----------------------

Meanwhile from the observer in fair street...

---------------------

Don't mention the crunch!" hissed the manic hotelier behind the backs of the party of diners from Goldman Sachs. "I mentioned it just now but I think I got away with it!" That's the sort of thing senior bank employees might have to endure in the coming decades. Top bankers are the new Germans. And the sooner we get to the point where we're making jokes about the outrages committed in their name, the better. We haven't got there yet.

I listened to a fascinating podcast from the US public radio show This American Life, about the causes of the credit crunch. It points out that what everyone in the banking sector always says about the financial crisis is that no one saw it coming. As Ira Glass, the host of the programme, puts it: "The recent collapse of the financial system has been described as a 100-year flood, a perfect storm, a force of nature. And it is so frustrating to hear it described that way – as something that happened to Wall Street instead of something that Wall Street brought on itself."

The show then tells the story of a hedge fund called Magnetar whose business plan is as villainous as its name. The people who ran it realised that the US property bubble was going to burst and found a way both of inflating it further and betting that it would pop. Consequently, they made a fortune when it did. They were aided and abetted by various bankers who, while nominally employed to represent the best interests of customers and shareholders, were actually rewarded for the number of deals they struck rather than their ultimate soundness.

It's a lamentable tale of the sort that the US Senate has been grilling Goldman Sachs executives about. I think most of us suspected that this kind of thing was going on, but hearing the details is riveting and maddening. Whether or not these business practices were strictly legal, wrong has been done here. Bankers personally took home vast sums of money – sums they still have – exacerbating a problem that has cost the world's taxpayers trillions to try to fix.

--------------------------

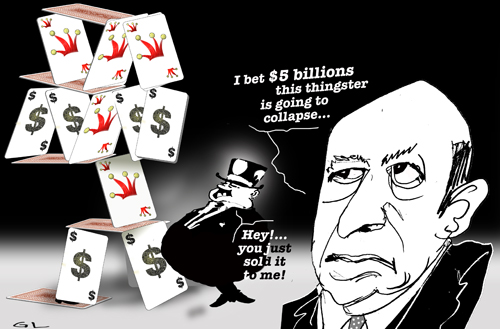

see toon at top...

dueling with oneself...

By GRETCHEN MORGENSON and LOUISE STORY

“Questions have been raised that go to the heart of this institution’s most fundamental value: how we treat our clients.”

— Lloyd C. Blankfein, Goldman Sachs’s C.E.O., at the firm’s annual meeting in May

As the housing crisis mounted in early 2007, Goldman Sachs was busy selling risky, mortgage-related securities issued by its longtime client, Washington Mutual, a major bank based in Seattle.

Although Goldman had decided months earlier that the mortgage market was headed for a fall, it continued to sell the WaMu securities to investors. While Goldman put its imprimatur on that offering, traders in the same Goldman unit were not so sanguine about WaMu’s prospects: they were betting that the value of WaMu’s stock and other securities would decline.

Goldman’s wager against its customer’s stock — a position known as a “short” — was large enough that it would have generated at least $10 million in profits if WaMu collapsed, according to documents recently released by Congress. And by mid-May, Goldman’s bet against other WaMu securities had made Goldman $2.5 million, the documents show.

WaMu eventually did collapse under the weight of souring mortgage loans; federal regulators seized it in September 2008, making it the biggest bank failure in American history.

Goldman’s bets against WaMu, wagers that took place even as it helped WaMu feed a housing frenzy that Goldman had already lost faith in, are examples of conflicting roles that trouble its critics and some former clients. While Goldman has legions of satisfied customers and maintains that it puts its clients first, it also sometimes appears to work against the interests of those same clients when opportunities to make trading profits off their financial troubles arise.

Goldman’s access to client information can also give its traders an advantage that many of the firm’s competitors lack. And because betting against a company’s shares or its debt can create an atmosphere of doubt about a company’s financial standing, Goldman because of its size and its position in the market can help make the success of some of its wagers faits accomplis.

Lucas van Praag, a Goldman spokesman, declined to say how much the firm earned on its bets against WaMu’s stock. He said his firm lost money on its bets against the other WaMu securities. In an e-mail reply to questions for this article, he said there was nothing improper about Goldman’s wagers against any of its clients. “Shorting stock or buying credit protection in order to manage exposures are typical tools to help a firm reduce its risk.”

eat my shorts...

from the BBC

Germany is to ban so-called "naked short-selling" at its 10 most important financial institutions.

Short-sellers usually borrow shares, sell them, then buy them back when the stock falls and return them to the lender keeping the difference in price.

"Naked" short selling occurs when a trader sells a financial instrument he has not yet borrowed.

The German ban will run from 19 May to 31 March 2011, also applying to naked credit default swaps.

Credit default swaps are financial derivatives that provide insurance for losses if a borrower goes bankrupt, and have become a lucrative trading market.

--------------------

meanwhile at robbing the masses industries...

The euro has plummeted against the US dollar, falling below $1.22 for the first time since April 2006.

The eurozone's single currency fell more than 1.7% in afternoon trading in New York, to $1.216, before rallying.

The decline came after Germany announced plans to ban naked short-selling of shares from midnight local time (2200 GMT).

The single currency dropped by more than 2% against the yen.

Traders fear that the austerity measures being put in place in many eurozone countries will hit growth.

Despite the huge sums of money pledged in support for eurozone countries, severe measures are needed to cut budget deficits and debt.

http://news.bbc.co.uk/2/hi/business/10124179.stm

selling someone else's grandmother...

from the BBC

Germany is considering widening a ban on "naked" short-selling on some financial stocks to cover all German-listed stocks, proposals have shown.

Short-sellers usually borrow shares, sell them, then buy them back when the stock falls.

"Naked" short-selling is when a trader sells financial instruments he has not yet borrowed.

Last week Germany banned naked short-selling at its 10 most important financial institutions.

But the draft proposal from the Finance Ministry now suggests the ban will be extended to shares and derivatives in all companies.

According to the Wall Street Journal, the proposal states: "Naked short-selling of stocks and the debt of eurozone states that are listed on a domestic exchange in a regulated marketplace will be forbidden."

-------------------------

Gus: at last, one country (soon to be followed by all European countries hopefully) has recognised that one cannot leave its economy open to sharks and robbers who don't care less about your health, as long as they have a piece of your cash, till they bleed you to death.

All these financial trickeries are not designed to support or foster business — apart from that of the mobsters who move money around and collect dues every time the token pass the GO corner. The technique of selling stuff that one does not own and buying it back at bargain price at the flee market is akin to someone stealing your valuables and selling them at the pawn-shop for cash. It's high-handed robbery. And you end up with such a short fall since the only insurance you have is derivatives — or bets on the value of your stolen goods on flea market at the time of day — you are skinned twice and pushed to enter that merry-go-round of sanctioned "stealing".

The sooner this short-selling is stamped out, the better the world economies will stabilise, but the US still maintains that fast robbery as a part of "free-enterprise" and "free markets" as long as it benefits the US... The US still play Monopoly on the world stage — that game designed to show that one can bankrupt everone else and amass the loot, while borrowing money that does not exists...

hubris and avarice

By MAUREEN DOWD

WASHINGTON

It’s unnerving, disorienting. A particularly noxious blend of helplessness, fear and fury that washes over you when you realize the country has again been dragged into a costly and scary maelstrom revolving around acronyms you’ve never heard of.

Our economy went in the ditch while traders got rich peddling C.D.O.’s and C.D.S.’s. Even many bankers — much less average Americans who lost their shirts — were gobsmacked by the acronyms, and scrambled to figure out how collateralized debt obligations and credit default swaps worked.

And now a gazillion gallons of oil have poisoned the Gulf of Mexico, thanks in part to unethical employees at a once-obscure agency known as M.M.S. — the Interior Department’s Minerals Management Service. M.M.S. is charged with collecting royalties from Big Oil even as it regulates it — an absurd conflict right there. So M.M.S. has had the same sort of conflicts of interest as ratings agencies like Moody’s and Standard & Poor’s had with Wall Street.

Consorting with the industry intensified once two oilmen took over the White House. Dick Cheney, Duke of Halliburton — responsible for the cementing of the calamitous well, now under investigation — had his aides conspire with BP America and other oil companies to draw up an energy policy.

As when derivatives experts had to help unravel the derivatives debacle, now the White House is dependent on BP to find a solution to the horror it created. The financial crisis and the oil spill are both man-made disasters brought on by hubris and avarice.

------------------------

see toon at top...

collateral bummer...

Lehman Brothers Holdings is suing JP Morgan Chase to recover tens of billions of dollars in "lost value".

Lehman claims JP Morgan "siphoned off" billions of dollars of assets in the days leading up to its bankruptcy.

JP Morgan was Lehman's main short-term lender before its September 2008 collapse. It is accused of contributing to the failure by demanding $8.6bn of collateral as credit markets tightened.

JP Morgan has called the lawsuit "ill-conceived".

'Gun to head'

The lawsuit, filed in Manhattan, New York, accuses JP Morgan of using its "unparalleled access" to inside details of Lehman's distress to demand the cash in the four business days ahead of Lehman's collapse.

The complaint claims that JP Morgan knew Lehman's viability was weakening, and threatened to deprive Lehman of critical clearing services unless it posted a large amount of collateral.

"On the brink of LBHI's bankruptcy, JP Morgan leveraged its life and death power as the brokerage firm's primary clearing bank to force LBHI into a series of one-sided agreements and to siphon billions of dollars in critically needed assets," Lehman said in the complaint.

------------------

See toon at top

JPMorgan omelet...

The FSA said the "oversight" at the futures and options business of JPMorgan Securities (JPMS) meant that funds which should have been held in trust for corporate clients ended up mixed in with the bank's own cash. That could have presented those clients with a huge problem had JPMorgan run into difficulties and been declared insolvent. Instead of being able to recover their funds they would have become unsecured creditors.

Regulators around the world were shocked at the effect on the markets of the failure of Lehman Brothers, where it subsequently emerged that clients' money was not kept properly separate. That amplified the effect of the insolvency and helped to spread financial contagion around the world.

Margaret Cole, the FSA's director of enforcement and financial crime, said: "JPMS committed a serious breach of our client money rules by failing to segregate billions of dollars of its clients' money for nearly seven years. The penalty reflects the amount of client money involved in this breach. The FSA has repeatedly emphasised the importance of ensuring that client money is adequately protected.

see toon at top

we buy and sell as long as you loose...

A billion-dollar lawsuit launched by an Australian hedge fund against Goldman Sachs has been labelled a "misguided attempt" to shift losses on to the investment bank.

Basis Yield Alpha Fund (Master) (BYAFM) says it was forced into insolvency by margin calls from Goldman Sachs related to financial instruments sold to it by the investment bank.

The product in question was the Timberwolf collateralised debt obligation (CDO) which, it was revealed in recent US Senate hearings, was described as "one shitty deal" in internal Goldman emails.

BYAFM invested about $US78 million in two tranches of the Timberwolf CDO in June 2007, one rated with the highest AAA rating and the other rated AA.

It claims Goldman made false representations in the sale of the security which had been assembled because and in order to fail.

But Goldman Sachs says the lawsuit is "without merit" and based on "false allegations".

"The lawsuit is a misguided attempt by Basis, a hedge fund that was one of the world's most experienced CDO investors, to shift its investment losses to Goldman Sachs," the company said in a statement.

"At the time of the Timberwolf transaction, Basis specifically stated it would not place any reliance on Goldman Sachs, and this decision formed part of the agreement Basis signed.

"Basis made its investment at market levels - levels it deemed attractive.

"These levels were substantially below the face value of the securities and consistent with where other investors were purchasing the same Timberwolf securities during the same time period.

"Basis is now trying to recoup its losses based on false allegations that it was misled about aspects of the transaction and market conditions.

"A material fact worth noting is that Goldman Sachs also had substantial exposure to Timberwolf securities and lost several hundred million dollars as a result."

------------------

Gus: As I have mentioned before on this site, the way a sting is usually set up is for the people who set up the sting to appear to "lose" some of their cash on the sting itself while collecting all the loot in the back rooms where the betting is fast and furious on an obscure specific part of the sting... Thus having lost money on one's own sting, collusion becomes a "diluted" argument at the frontshop...

goldman sucks .....

timber wolf .....

paid too little for too much...

Mr Diamond spent four hours on the stand yesterday as the court heard an application to reopen the approval of the deal, in which Barclays acquired the bulk of Lehman's business in 2008, days after the firm collapsed at the height of the credit crisis. The bankruptcy trustee and the Lehman Brothers estate, representing creditors, is trying to wrest more money from Barclays.

At issue is whether the court was told all the details of the deal when it approved the transaction. Barclays booked a $2.3bn profit on the acquisition within months, and attorneys said it had only been possible because Barclays had insisted on a discount for certain assets or because it had inappropriately taken possession of cash that should have stayed with the Lehman estate.

---------------

see toon at top...

fined but no wrongdoing record...

Goldman Sachs has agreed to pay $550 million to the Securities and Exchange Commission, one of the largest penalties ever paid by a Wall Street firm, to settle charges of securities fraud linked to mortgage investments.

The S.E.C. filed a lawsuit against Goldman in April, accusing the bank of securities fraud. The settlement came just days before Goldman is scheduled to report its second-quarter earnings.

Under the terms of the deal, Goldman will pay $300 million in fines to the Treasury Department, with the rest serving as restitution to investors in the mortgage-linked security. Goldman will not admit wrongdoing, though it will admit that its marketing materials for the investment “contained incomplete information.”

-----------------

See toon at top... The deal reminds me of... oh heck, you know...

four per cent...

The US insurance giant AIG has agreed to pay $725m (£474m) to settle a long-running fraud case against it.

The settlement is likely to be one of the biggest in US history, following a class action lawsuit led by three Ohio pension funds.

They alleged that AIG had engaged in stock price manipulation, anti-competitive behaviour and accounting fraud between 1999 and 2005.

That, they say, resulted in shareholders losing millions.

The court now needs to give its approval before payments can be made.

A first payment of $175m is scheduled within days of the court's approval, however, while AIG is expected to raise the further $550m though the issuing of new shares.

AIG is now 80% owned by the US government following a massive bailout of the company at the height of the financial crisis.

Ohio Attorney General Richard Cordray, who represented the Ohio funds, said total payouts from AIG to shareholders would now total $1bn, including previous settlements.

AIG said it was "pleased to have resolved this matter", adding that it could now focus on paying back taxpayers the $182bn used to rescue it.

-----------------------------

Gus: the fine is about 4 per cent of the rescue package... Is there a lesson or a sign in that? see toon at top.

democracy on the brooklyn bridge...

Police reopened the Brooklyn Bridge on Saturday evening after more than 700 anti-Wall Street protesters were arrested for blocking traffic lanes and attempting an unauthorised march across the span.

The arrests took place when a large group of marchers, participating in a second week of protests by the Occupy Wall Street movement, broke off from others on the bridge's pedestrian walkway and headed across the Brooklyn-bound lanes.

"Over 700 summonses and desk appearance tickets have been issued in connection with a demonstration on the Brooklyn Bridge late this afternoon after multiple warnings by police were given to protesters to stay on the pedestrian walkway, and that if they took roadway they would be arrested," a police spokesman said.

"Some complied and took the walkway without being arrested. Others proceeded on the Brooklyn-bound vehicular roadway and were. The bridge was re-opened to traffic at 8:05 pm (local time Sunday)."

Most of those who were arrested were taken into custody off the bridge, issued summonses and released.

Witnesses described a chaotic scene on the famous suspension bridge as a sea of police officers surrounded the protesters using orange mesh netting.

Some protesters tried to get away as officers started handcuffing members of the group. Dozens of protesters were seen handcuffed and sitting on the span as three buses were called in to take them away, witnesses and organisers said.

The march started about 3:30 pm (local time) from the protesters' camp in Zuccotti Park in downtown Manhattan near the former World Trade Center. Members of the group have vowed to stay at the park through the winter.

http://www.abc.net.au/news/2011-10-02/hundreds-arrested-in-wall-street-protest/3205566

see toon at top...

loosing more than predicted...

By SUSANNE CRAIGGoldman Sachs, weighed down by problems in its private equity portfolio and the broader global economic woes, reported a loss of $428 million, compared with a $1.7 billion profit a year ago.

It’s only the second quarterly loss for Goldman since the investment bank went public in 1999.

The company reported a loss of 84 cents a share, worse than analysts’ predictions of a loss of 16 cents, according to Thomson Reuters.

http://dealbook.nytimes.com/2011/10/18/goldman-sachs-reports-428-million-loss/?hp

betting against oneself...

By EDWARD WYATTWASHINGTON — Citigroup has agreed to pay $285 million to settle a civil fraud complaint that it misled investors in a $1 billion derivatives deal tied to the United States housing market, then bet against the investors as the housing market began to show signs of distress, the Securities and Exchange Commission said Wednesday.

The S.E.C. also brought a civil action against a Citigroup employee who was responsible for structuring the transaction, and brought and settled another against the asset management unit of Credit Suisse and a Credit Suisse employee who also had responsibility for the derivative security.

The securities fraud complaint was similar to one the S.E.C. brought against Goldman Sachs last year, with one significant difference. Goldman Sachs was accused of misleading investors about who was picking the investments in a mortgage-related derivative.

It told investors that the bonds would be chosen by an independent manager, when in fact many of them were chosen by John A. Paulson, a hedge fund manager who chose assets that he believed were most likely to lose value, according to the S.E.C.’s complaint in that case. Goldman later settled the case by paying $550 million.

In the Citigroup case, however, it was the bank itself that chose assets for the portfolio that it then bet against. Investors were not told of its role or that Citigroup had an interest that was adverse to the interests of investors.

“The securities laws demand that investors receive more care and candor than Citigroup provided to these C.D.O. investors,” said Robert Khuzami, director of the S.E.C.’s division of enforcement. “Investors were not informed that Citigroup had decided to bet against them and had helped choose the assets that would determine who won or lost.”

The S.E.C. said the $285 million would be returned to investors in the deal, a collateralized debt obligation known as Class V Funding III. The commission said Citigroup exercised significant influence over the selection of $500 million of assets in the deal’s portfolio.

http://www.nytimes.com/2011/10/20/business/citigroup-to-pay-285-million-to-settle-sec-charges.html?_r=1&hp=&pagewanted=print

politically infectious toxic banks....

The ascension of Mario Monti to the Italian prime ministership is remarkable for more reasons than it is possible to count. By replacing the scandal-surfing Silvio Berlusconi, Italy has dislodged the undislodgeable. By imposing rule by unelected technocrats, it has suspended the normal rules of democracy, and maybe democracy itself. And by putting a senior adviser at Goldman Sachs in charge of a Western nation, it has taken to new heights the political power of an investment bank that you might have thought was prohibitively politically toxic.

http://www.independent.co.uk/news/business/analysis-and-features/what-price-the-new-democracy-goldman-sachs-conquers-europe-6264091.html

The world is being driven towards the "unthinkable scenario of untreatable infections", experts are warning, because of the growth of superbugs resistant to all antibiotics and the dwindling interest in developing new drugs to combat them.

Reports are increasing across Europe of patients with infections that are nearly impossible to treat. The European Centre for Disease Control and Prevention (ECDC) said yesterday that in some countries up to 50 per cent of cases of blood poisoning caused by one bug – K. pneumoniae, a common cause of urinary and respiratory conditions – were resistant to carbapenems, the most powerful class of antibiotics.

http://www.independent.co.uk/life-style/health-and-families/health-news/antibioticresistant-infections-spread-through-europe-6264079.html