Search

Recent comments

- escalationing....

8 hours 5 min ago - not happy, john....

12 hours 25 min ago - corrupt....

17 hours 46 min ago - laughing....

19 hours 40 min ago - meanwhile....

21 hours 9 min ago - a long day....

23 hours 3 min ago - pressure....

23 hours 51 min ago - peer pressure....

1 day 15 hours ago - strike back....

1 day 15 hours ago - israel paid....

1 day 16 hours ago

Democracy Links

Member's Off-site Blogs

from the outhouse .....

Derivatives traders were yesterday nervously picking their way through the wreckage of the Lehman Brothers bankruptcy in what was the biggest test to date of the unregulated $60 trillion (£35.4 trillion) credit default swaps market.

Investors who had placed bets on Lehman's creditworthiness held an auction aimed at clarifying who owes what to whom after the investment bank went bust four weeks ago, and analysts believe that several hundreds of billions of dollars will change hands.

Credit default swaps are a kind of insurance, which investors used to protect themselves in the event that Lehman defaulted on its bonds. Unlike traditional insurance, however, any financial firm could write a credit default swap contract so banks, insurance companies, hedge funds and traditional fund managers are among those now being required to make investors whole.

The auction set a price for Lehman bonds of 8.625 cents on the dollar. Financial firms that sold credit default swaps, therefore, owe 91.375 cents on the dollar – more than Wall Street had been factoring in. That figure increased nerves about whether everyone in the chain will actually be able to pay the amount that they owe, something that will become clear over the coming days. Participants said the auction went smoothly and efficiently.- By Gus Leonisky at 11 Oct 2008 - 11:37pm

- Gus Leonisky's blog

- Login or register to post comments

gone with the wind...

From the New York Times

A.I.G. Lists Firms It Paid With Taxpayer Money

By MARY WILLIAMS WALSH

Among the biggest recipients were Société Générale, Deutsche Bank and Goldman Sachs, all of which were owed money from credit default swaps.

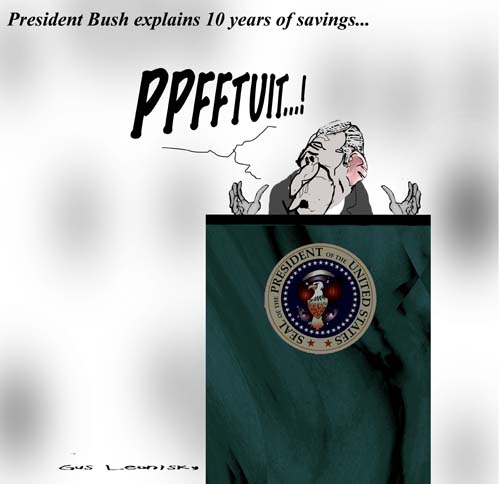

see toon at top...