Search

Recent comments

- escalationing....

6 hours 3 min ago - not happy, john....

10 hours 22 min ago - corrupt....

15 hours 44 min ago - laughing....

17 hours 37 min ago - meanwhile....

19 hours 6 min ago - a long day....

21 hours 55 sec ago - pressure....

21 hours 48 min ago - peer pressure....

1 day 13 hours ago - strike back....

1 day 13 hours ago - israel paid....

1 day 14 hours ago

Democracy Links

Member's Off-site Blogs

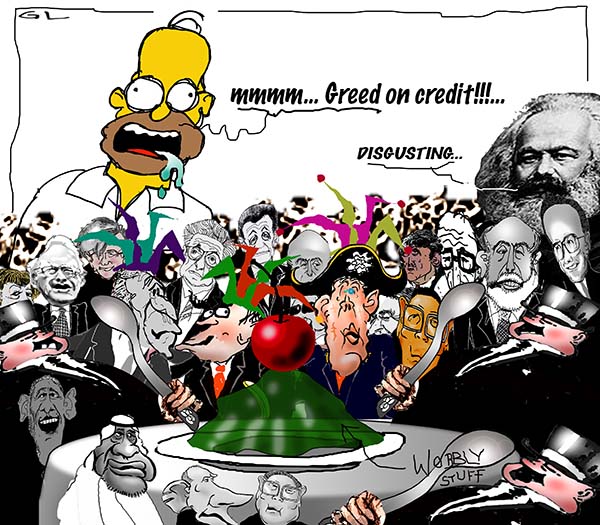

greed on credit .....

One could ask the question: how did the financial system got us into such a mess?

First one has to look at the value of anything and nothing…

On average:

* Real inflation has been around 8 per cent for the past ten years* Workers » remuneration has increased by around 4 per cent per year

* CEOs remuneration has increased by about 300 per cent (conservative figure).

After 5 years, workers are roughly 22 per cent behind in accepted value of fish things.CEOs are about 250 per cent in front. The poor are still behind the starting blocks.

Some things have fluctuated in price: oil by 700 per cent (500 % inflation adjusted) down to flat level (inflation adjusted). Other things have increased by calculated inflation value, plus increased costs of manufacturing and provision for a minimum 15 per cent increase per year profit for investors to be content with.

Most manufacturing was shifted to China to cut cost of production and increase profit margins by about 200 per cent.

Governments of the world have calculated fictitious « official » inflation between 3 and 4 per cent.GDP of the world was US$54.62 trillions in 2007.

World’s financial assets calculated at 140 trillions in the same period.

Value of Real Estate in 1999 around 110 per cent that of GDP in the US…

Value of Real Estate in 2007 around 140 per cent that of GDP in the US…

Increase of perceived value approx 30 per cent (discounting inflation).

Say similar figures for rest of world with small variations …Say that conservatively 50 per cent of the Real Estate value is on credit …

Say that credit repayments have become unmanageable versus income, as income diminish in real terms in some sectors.

Plus Sub-prime loans became a large hole in the credit fabric.There is a point a which, stitches in the jumper start to unravel.

One thread breaks and the whole thing falls apart, unless repaired quickly.We have not fixed the unravelling. We’re fixing a little thread: too late.

Stock prices have devalued by about 50 per cent in the last two years. Price of gold has gained about 20 per cent and climbing.

There is a fictitious accepted value of things that fluctuates with hope it will increase.There is a minimum accepted value of things at which we stop acquiring more stuff.

There is a minimum value of things at which people won’t accept devaluation below it and will revolt — as they cannot survive.

There is a perception that thrifty people have been screwed by "spendrifts" who bought things:

* they could not afford* on credit under encouragements of governments that wanted to maintain growth

The greatest threat to the financial system is itself, followed by an increasing urgent and increasingly important global warming factor encompassing population growth, asset growth, reduction of natural space, increase of climatic trauma.

Our financial system relies on an equation that leads to filling the jar without leaving space to move.Stylistic analysis of processes, in which we glorify our illusions versus our animal reality.

Glory takes many forms but mostly dismisses our animal reality to our detriment.

We need to become humanely intelligent again. Most Greek philosophers had more understanding of humanity than we have now at large, to the exception of a few thinkers whose mind are not cluttered by irrelevant entertaining that takes us away time from our own care and management.When looking at all the differentials, one can calculate the value of the black hole of illusion values. In my book, this comes down to about 15 trillion dollars and will stay yearly about the same till we’re able to rewrite by urgent choice the real value of global warming and environmental degradation into our economic equations. So far, the attempts by world leaders on this urgency have been pitiful and more or less useless.

Greed on credit has been the main culprit of the financial system crash. To repair this might be doomed to failure. A new system needs to be recast with the planet welfare in mind.

* Boom and bust versus steady growth analysis…

* The disappearance of savings …

* The value of the future not be left to speculation.

Unsustainability in our life by greed on credit… the price being highly beyond our comprehension.Increasing world population to increase the value of the pie is a nasty piece of work that leads to a greater problem.

- By Gus Leonisky at 17 Feb 2009 - 10:54pm

- Gus Leonisky's blog

- Login or register to post comments

the prometheus kids...

From Webdiary

Until recently, whenever climate research organizations reported increases in Arctic Sea ice melt rates [6], advocates of global “cooling” have been making references to the Antarctic continent as supposed counter argument [7]. Referring to small stable or slightly cooling parts of east Anarctica (Fig 2), a plethora of bogus climate websites claim Antarctic warming is not a part of global warming [8].

Presumably regarding Antarctica as part of another planet?

Nor do “climate skeptics” shed too many tears about Emperor penguins, the magnificent birds which have to migrate from their inland colonies across ice shelves and sea ice (Figs 8), where the females lay just one egg that is tended by the male. The ice plays a major role in their overall breeding success. Further, the extent of sea ice cover influences the abundance of krill and the fish species that eat them – both food sources for the penguins.

Misreadings of climate science by “climate skeptics” have delayed efforts at climate mitigation by at least 20 years. In the words of Clive Hamilton [9]: “If scientific advances cause scientists to reject the conclusions of past IPCC reports … not much harm will be done. … but if … fellow skeptics were successful in stopping policies to cut emissions and the IPCC projections turn out to be correct, then environmental catastrophe will follow and millions of people will die. Do they lose sleep over this? Do they worry about how their grandchildren will see them? Or are they so consumed by the crusade that they know they will never be proven wrong?”

------------------------

From the New York Times

Job Losses Pose a Threat to Stability Worldwide

By NELSON D. SCHWARTZPARIS — From lawyers in Paris to factory workers in China and bodyguards in Colombia, the ranks of the jobless are swelling rapidly across the globe.

Worldwide job losses from the recession that started in the United States in December 2007 could hit a staggering 50 million by the end of 2009, according to the International Labor Organization, a United Nations agency. The slowdown has already claimed 3.6 million American jobs.

High unemployment rates, especially among young workers, have led to protests in countries as varied as Latvia, Chile, Greece, Bulgaria and Iceland and contributed to strikes in Britain and France.-------------------------

From the Independent

The HBOS whistleblower whose revelations led to the resignation of one of the Government's top regulators is about to release a tranche of documents which he says point a direct and accusatory finger at Gordon Brown's responsibility for the banking crisis, and has called on the Prime Minister to resign. In a further blow to Labour, an Independent on Sunday poll showed voter support for the party evaporating, leaving it only a few points ahead of the Lib Dems.

Paul Moore, the former head of risk at HBOS, told the IoS that he has more than 30 potentially incendiary documents which he will send to MPs on the Treasury Select Committee. He says they disprove Mr Brown's claim about the reasons for HBOS's catastrophic losses – now estimated to be nearly £11bn – and show that it was the reckless lending culture, easy credit and failed regulation of the Brown years that led directly to the implosion of British banks.

--------------------

from the ABC

Personal borrowing at highest level in 6 months

Posted Mon Feb 16, 2009 4:41pm AEDT

Updated Mon Feb 16, 2009 4:40pm AEDT

Personal borrowing has posted its biggest rise in six months as consumers took advantage of lower interest rates to refinance existing loans.

Australian Bureau of Statistics (ABS) data shows personal borrowing rose 4.1 per cent in December compared to the month before.

It was the biggest monthly gain since June 2008, the first monthly increase in personal loans since September, and followed a 1.8 per cent fall in November.

CommSec's chief economist Craig James says it is a good sign households are still willing to spend.

------------------

[2007]

The linear growth started turning exponential in 1965 for GDP, and a year later in 1966 for Housing Valuation.

Such a close relationship between the two is not just a coincidence. Rising home values have made Americans feel wealthy. And tapping into the Home Equity has been the source of purchasing power. Fuelling consumption and GDP growth.

Since 1980 the Housing Valuation has exceeded GDP.

Since 2000, it also appears that The Housing Bubble has not been pushing up the GDP as much, and the Gap between the two has been rising.

May be the Housing Bubble is no longer effective in pushing up the GDP as much.

This may well be it's final sprint before busting after a 40 year expansion.

---------------------------------

Pakistan's president says his country is fighting for its survival against the Taleban, whose influence he said has spread deep into the country.

In an interview with US TV channel CBS, President Asif Zardari said the Taleban had established a presence across "huge parts" of Pakistan.

The country had failed to increase its forces in response, he said.

On Saturday, officials said at least 27 militants were killed in a suspected US missile strike on a Taleban hide-out.

The missile hit a house in north-west Pakistan, near the border with Afghanistan, where the US has carried out more than 20 air strikes from drones in recent months.

Islamabad has long argued that the strikes complicate its fight against insurgents, and violate its sovereignty.

---------------------------

BACK IN 1969 the International Monetary Fund (IMF) created a new kind of money – the ultimate form of international money, it believed – called the Special Drawing Right.

You can't shop with an SDR, nor trade it or even touch it. Unless you crunch numbers for an international organization like the IMF, Andes Reserve Fund, the Arab Monetary Fund, or the Bank for International Settlements (BIS) in Basel, the only time you're likely to come anywhere near an SDR is if an airline loses your luggage.

The Montreal Convention states that if your bags have not reached you within 21 days of expected arrival, you can claim 1,000 Special Drawing Rights as compensation from the airline.

At today's valuation, that would mean you receive around $1,500...or £770...or €955...or ¥159,000. Because you can't be paid in SDRs. In reality they don't exist. Only a government-issued paper money can bring the SDR's value into existence.

"Monetary Gold and SDRs issued by the IMF are financial assets for which there are no corresponding financial liabilities," explains the Monetary Fund. But while Gold holds value for people earning all kinds of currency across the world, the SDR is simply an intangible monetary unit. It exists as an accounting tool only, used by the world's central banks and cross-border monetary organizations.

--------------------------

In recent years, the World Bank like other international financial

institutions have been using GNI more frequently as a measure of national

income in international economic comparisons. Why ?

In order to understand this, we need to know first of all what GNI is. Well,

basically it is just a new acronym for the good old Gross National Product

we used to know, which in the 1970s was largely abandoned in favour of GDP.

The rationale given for the change in wording is that GNI is considered more

a concept of "income" rather than a "product measure" (sic.).

Officially, GNI equals GDP (the sum of value added by all resident

producers in the sphere of production) PLUS any product taxes

(less subsidies) not already included in the valuation of net output, PLUS

net receipts of primary income (compensation of employees and

profits) from abroad. (To smooth fluctuations in prices and exchange

rates, the "Atlas method of conversion" used by the World Bank then

applies a conversion factor, which averages the exchange rate for a

given year and the two preceding years, adjusted for differences in

rates of inflation between the country, and through 2000,

the G-5 countries (France, Germany, Japan, the United Kingdom,

and the United States). For 2001, these countries include the Euro Zone,

Japan, the United Kingdom, and the United States.)

The extra net income added to GDP thus refers specifically to the income

received from labour and capital owned overseas by residents of the domestic

economy, MINUS similar payments made from the domestic economy to

non-residents overseas. Conceptually, these incomes must be related to the

social accounting concept of "production". In other words, it has to be new

income generated by the application of factors of production overseas, which

are owned by domestic residents, income which represents a fraction of

new value added.

So far, so good, but now I want to know, just what difference does this

component make to the GNI and GDP totals ?

-------------------------------

[IMF 2000]

Prospects and Policy Challenges

How Much Longer Will the Expansion in North

America Continue?

Reenergizing the Japanese Recovery

Recovery and Divergence in Europe

Recovery in Latin America: Emerging But Still Vulnerable

Recovery in Asia-Pacific: The Momentum Increases

Russia and the Commonwealth of Independent States (CIS): Growth, But Uncertain Prospects for Sustained Recovery

Countries on the European Union Accession Track

Middle East and Africa: Stronger But Narrowly-Based Growth

Poverty and Globalization

The Ongoing Recovery in Emerging Market Economies

Financial Conditions Facing Emerging Market Economies

Commodity Market Developments

Policy Responses and Vulnerabilities in Latin America

Improved Outlook in East Asia, But Policy Challenges Remain

-----------------------

(Gus' note: some of the figure I quoted in the comment "greed on credit" were in the wrong year. By shifting back the values to the rightful year, the "economic trauma is thus emphasized [stressed] by an extra 13 per cent...")

28 January 2008

The total value of the world's financial assets grew faster in

2006 at 17 per cent to reach $167 trillion from $142 trillion in

2005, according to a McKinsey report titled, Mapping Global

Capital Markets, Fourth Annual Report, released this month.

At constant exchange rates, the growth in global financial

assets was 13 per cent.

The report, prepared by McKinsey Global Institute (MGI),

the economics research arm of McKinsey & Company, was

the latest year for which "comprehensive data was available".

---------------------------

"The world's financial system is overflowing with stocks, bonds and other financial assets -- $140 trillion worth, to be precise.

--------------------

Overflowing? Where did the overflow go and what created the overflow?

see toon above and others as indicated....

Do not sneeze...

"Raise you by another 2 bils*..."

or playing poker with the world economy... and the planet...

or a honest day's work for bugger-all slave-wage pay...

or two billions bet the house will burn down...

---------------

A lot has been said about many part of our financial system, but few parts of this wonky three-wheeler take the cake like CDS — or Credit Default Swaps for the initiated...

Few financial whizzes understand how derivatives really work and I don't blame them... Derivatives are hard yakka... And these CDS babies are derivatives of the smarter kind... Mathematically, they are a gem of simplicity, once past the fog of moralisationing and once we have mastered the ability to keep a straight face. I may be contested on my explanation here... go for it.

Some people dare describe CDS as "insurance" but it's actually a very cleverly disguised extortion — like a "protection racket" with a bet attached.

The Mafia would be proud!!

The scheme is ingenious. THE MAFIA GIVES YOU MONEY!!!

It gives you (the bank or busIness) money for someone else's (or your own, should you choose to as a business) windows NOT GETTING BROKEN... It seems like a win-win deal, doesn't it? But if the windows you have insured by BEING PAID MONEY FOR are broken, you pay the Mafia heaps (as an agreed amount) in return... Brilliant!!!!

And the broken windows are now irrelevantly kaput. That's only an aside to the transaction. Betting is the name of the game.

-------------

In other words:

in CDS, the banks will place a bet with "investors/insurers" that a business won't go up in flame. Meanwhile, the "investors/insurers" have to fork out regular payments to the banks should your business stay afloat for example. Of course your business relies substantially on the bank's largesse for loans to trade efficiently (or not).

You get your loans by waging your own assets as collateral. So far so good.

The banks hope they will beat the "investors/insurers"'s bet because it's in the bank's interest your business stay solvent, at least till the expiry date of the CDS contract, at which time the bank would have made heaps of cash for investing nothing.

Whether you business works well or not is not part of the deal. The deal is not an "investment". It's a bet on whether you stay afloat during the "contract" terms.

And this massive raining CDS cash meanwhile is accounted in the Banks annual returns and used for investing in other schemes, including supplying you with more loans so your business can "grow", faster and faster... The faster the better for the banks. They can't give you enough money... You want a million, here's two... The banks are laughing their heads off. They could and sometimes they do bet twice as much as before, against the "insurers/investors". The economy is booming... The "investors/insurers" fork out dough for nothing really — but for only betting your business is going to sink no matter what.

It does not take Einstein to work out what's going to happen next...

Our clever financial system relies on "boom and bust" cycles to create "greater" flow of money.

See, some universities (French UK and US) around the world put their brains together to snoop around this conundrum and have devised a strange but solid mathematical theory that says, in the long run, "economies" are gaining far more with boom and bust cycles that in a steady growth system. Weird but the figures don't lie... The maths do add up. In short with boon and bust practice — say slash, burn and rebuild — the economic advantages are about 300 to 500 per cent up per decade on just steady as she goes growth. And let's not talk of sustainability here... or any other planetary concerns either... And please do not mention that there are a few provisos... a small print clause in the equation so to speak, that bust the theory in specific cases — say advanced economies?.

Place your bets!

Thus in CDS the bets are placed on "when a bust is going to happen". The banks work their butt off to make sure there is always a boom or one at least till the contracts have expired...

One wonders if their brains are in their fundamental bums...

Imagine that there is a room on the backside of the banks where there is a big roller-poker circus going on. The bank know there will be a crash but they bet against the "investors/insurers" that the crash will come after the "investors/insurers" paid far more than the value of the windows that have been "insured".

As mentioned, these windows could be your own, but generally as a cautious "investor/insurer" they are someone else's that as an "investor/insurer" you keep a close eye upon. If they are your own, there is a chance you know your business is going arse-up, but the bank does not know that, despite all its effort to know the health of you trade...

Meanwhile, the "investor/insurer", is entitled to advertise to the whole wide world that the windows that are "insured" are very exposed and fragile, but they are "prepared to take the risk"...

What risk you may ask???...

the "insurers/investors" don't have to pay thugs to throw stones.

There are always some silly twits and graffiti artist ready to spray paint on the abode (say you're in business and your competition make deals with your customers, deals you can hardly match — i.e. manufactures in China, or so like) and, soon after, a few loose canons stop buying your products or make life difficult for your business. Meanwhile your windows are "insured" and, so far, on average, the odds are that they will be broken before they are "fully paid off" to the bank by the "investors/insurers". Thus the Bank has to give the "investors/insurers/Mafia") the full value of the windows or whatever sum "they were insured for" (which could be far more than your windows themselves)...

Easy pickings.

This amazing system was devised by a team of smart bankers working for JPMorgan/Chase... They wrote the rules of the games in 1997... And I believe they're still laughing their heads off... Sure the scheme has been publicly sold as an insurance against breakage but on that scale, breakage is inevitable and the scheme works... IN REVERSE!!!.

And since the premiums for this insurance are roughly based on a 15 year cycle, when the true boom and bust cycle is on average 7 years... or similar, and the contract are often written on a couple of years' basis, there is plenty of room for clever punters (not on the side of the banks of course) to make a killing. The presidential mug who signed off on the scheme was Bill Clinton — may be in a moment of libido weakness (possibly enamoured with Greenspan who was whispering sweet nothings of the financial markets in his ear).

Meanwhile the banks call the unfortunate payola to the "investors/insurers": bad debts... Same name as with other defaulting loans, such as in the sub-prime debacle. Extinction in species is that more than one bad factor is often necessary to become effective. In the case of banks, they had two major factors pushing their bum up. Sub-prime and I'd say CDS. These two factors would make the banks tighten their butts and credit would stop flowing to businesses, which in turn would go under, compounding the CDS bet debts at a rate of knots. Chugging along with me, folks?

Too many of these bad debts and the banks go under.

Despite their huge size, the banks may not have enough cash or borrowing power with other banks to pay the debt, because the bets are not done with potato chips — they are done with millions of dollars, adding to billions, bordering on trillion, etc.

Sometimes to save the furniture, the banks might do new deals with the "investors/insurers in broken windows" but it's a bit like double or nothing and the banks are likely to loose their pants and ours (we — the piddly-savers who are counting three bux fifty cents by candlelight) at the same time.

The banks become insolvent.

Some banks thus did crash, others got bought out with their massive bad debts, while GOVERNMENTS WORLDWIDE had to fork out rescue packages to salvage the bigger "banking system" including protecting savings by "garantee", otherwise, the entire house would go on fire.

And dry-cakes to the peasants would not be enough to stop a revolution. Thus governments have buttered the cakes as well... while making sacrifices to the god of money, Mercury, and by begging Pandora to open her box again, to let loose the last monster: hope...

I would guess there are some (many) nervous politicians in governments, in opposition and some (many) bankers with browning pants — although the latter's dry-cleaning bill is taken care of by their lavish bonuses...

So, no-one is prepared to put a figure on the bank and government losses yet.

The black hole is huge and still swallowing moneys. Unless one is prepared to rewrite the CDS contracts with a gun in hand (i.e. burn the paper they've been written on), nothing will save the system.

Meanwhile, businesses are begging for more cash but the banks having been cleaned up by the first CDS on the frontline are bare and only Governments can now print the maintenance money... Considering say for example the total value of financial assets worldwide being 140 trillions, the value of the Credit Default Swap is about two fifth of that — or 60 trillion bux. In my book, that is a mega lot of bet!!!.

Not that all assets will go on fire, but the "insurers/investors" are hoping so or at least wishing for a mega deconstruction (bust), so they can cash in. Sure the "Investors/investors" are also part of the system and smartly would have covered their tracks by having some other regular "investments" — investments that would burn in the collapse but, on balance the "insurers/investors" make mega bux on the difference. But did they expect such a large melt down? Growth was so spruiked up... I bet they did and did not... the market is bipolar (boom and bust) to progress...

Good luck to you anyway. As me mum used to say, "one does not take it away, once we've carked..."

And the fun of this scheme is that one does not have to be a bank to play this hot game. You and me, mere stingy mortals, could place a bet with an investor for example that the Euro won't be down against the dollar at the end of a fixed period. The investor will pay you regular cash against your bet (CDS) and you can enjoy the life of Midas — until you have to pay twice what you have in reserve (because you're a "spend-drift"), should the Euro take a nosedive at five minutes to midnight of the "contract". You sink. You're dead meat.

Unless you refuse to cough up.

Like the "investors/insurers" have protection, you have "thugs" working for you that will protect your assets against the "investors/insurers" you don't want to pay. They're called "lawyers" and private beefy blokes or "bodyguards", but their palms need to be well-oiled, so you need heaps of cash to afford this snubbing privilege.

It could turn ugly though, and the war in Iraq would be a side-show to your biffo with the "investors/insurers" demanding their cash...

They may have machine guns in their violin cases...

To avoid a massive bloodshed, the governments of the world had to basically pay the first part of the debt using FUTURE taxpayers money. And the poker-circus game is still on in the smoke-filled back rooms. No-one knows where the bluff will stop and more bets are waged.

The kitty is now more than 60 trillion bux, growing fast and on the table.

Do not sneeze.

*See toon above... I was going to do a toon with rotund bankers betting "bils" (billions) against the mafia with guns on the table while behind the scene, government leaders like Brown, Sarkozy, Obama, Rudd, etc would be sweating like pigs... But I got lazy and have work to do...

they shoot horses don't they .....

from Crikey …..

Irish bankers' luck runs outGlenn Dyer writes:

It is now apparent that the Irish financial system is a leaky, grubby, black hole. At one bank, Anglo Irish, mates and insiders, including the entire board, were loaned tens of millions of euros to do comfy deals that helped cause the bank's collapse and nationalisation.Two reports last week on Anglo Irish reveal it suffered a multi-billion euro run late last September to the point where it would have been insolvent but for the bodgied up deposits from Irish Life -- the bank financed the purchase of 10% of its shares from a group of rich Dublin business it refuses to name. Even though it has lost 300 million euros on the transactions, it lent a quarter of a billion euros to directors in 2008 and paid them over 5 million euros more.

In the words of an editorial in the Irish Times at the weekend:...the extent to which the directors and executives of the bank were also big customers is truly shocking. It confirms the picture that has emerged over the last few months of an organisation that was fundamentally flawed and morally bankrupt.

It's clear that Irish financial regulators either were asleep, incompetent or turned a blind eye to the apparent insolvency of this bank last September and the self dealing at the top. It should have been closed then and nationalised, yet the Irish Government still went ahead with the now absurd guarantee on bank deposits and assets.In the case of Anglo, it was guaranteeing a crock of rubbish: it was propped up by billion of euros of 'deposits' from Irish Life, which were reversed after balance date, while the board and management still got paid under false pretences, and the mates of the chairman and others had their share purchase loans written off.

The whole, horrible mess was detailed in part of a report from the Irish Government on the affairs of Anglo Irish from PricewaterhouseCoopers released on Friday night, two hours after the bank's 2008 annual report was released.The PwC report reveals that in the week before the government's bank guarantee scheme last September, there was a run on Anglo Irish Bank with 5.4 billion euros in corporate and retail deposits withdrawn.

"As of September 27th, Anglo was forecasting net negative cash of €12.0 billion by October 17th," it said.At the end of September, Anglo's balance sheet included 7.3 billion euros of deposits from Irish Life Assurance and 7.5 billion of short-term interbank placements from Irish Life and Permanent.

Its deposits stood at 51.5 billion euros at the end of the year.The report found the bank had 15 banking relationships in excess of €500 million. It concluded that the size of the exposures significantly increases the bank's risk profile. Most of these were property and housing developers. These loans could cost the bank 5 billion euros in losses over the next two years.

The bank said in its annual report that it lent 451 million euros to 10 clients to buy shares to support its share price last year:The amount loaned was 50% more than previously thought. They purchased up to 10% of the bank owned by businessman Sean Quinn. He had accumulated a 25% stake, more than revealed.

The shares are now worthless after the bank was nationalised. Only 83 million euros have been repaid from the 451 million lent, meaning 300 million will be written off.The bank also showed that 9.535 million euros was paid to the bank’s directors. Five executive directors, who managed the bank during the year, received a combined 8.13 million.

The Anglo report provides further details on the large loans drawn by the bank's directors.Some 255 million euros was advanced to 13 directors of the bank during its 2008 financial year to 30 September last, while 115 euros million was repaid. Including their board fees, that's 20 million euros in total for each of the 13 directors in 2008.

The loans advanced to directors equal almost a third of the pretax profits made by Anglo in the year.The outstanding amount owed by the directors at 30 September amounted to 179 million euros, of which 83.3 million was owed to the bank by the former chairman, Sean FitzPatrick. His loans were hidden by them being transferred to another Dublin bank at audit time with the connivance of Anglo's then CEO and other senior executives.

the 1.3 trillion pound heist...

As scapegoats go, Sir Fred Goodwin is straight out of Central Casting. He's a banker; he's mucked up big time, cost the taxpayer sums still too large to calculate properly, and he's walked away from the mess with riches beyond the avarice of a Premiership footballer. All he lacks, as a media villain, is a pair of staring eyes and record of cruelty to animals.

If Alastair Campbell were still around, Sir Fred might have been saddled with even that. But this week, as loomed the handing to banks of further barrels of public cash on what the furniture stores used to call easy terms, the Government had no need for nudge-nudge rumours of scuttlebutt to create a diversion. It had information even more incriminating and instantly unpopular: the size of Sir Fred's pension pot.

It was huge; it was blood-pressure raisingly indefensible; and, above all, it seemed politically useful. Ministers had known the scale of it for months; something pretty close to its size had been reported on City pages as far back as 14 October last year.

-------------------------

Gus: When one tallies all the rescue packages from Europe, the US and the rest of the world (including Russia and China), I would not be surprised if my "guesstimate" (actually a sharp calculation of bad debts differentials) of 15 trillions is accurate so far... see toon at top and read the blogs below it...

proud as a mafioso...

As Italy's Banks Tighten Lending, Desperate Firms Call on the Mafia

By Mary Jordan

Washington Post Foreign Service

Sunday, March 1, 2009; A01

ROME -- When the bills started piling up and the banks wouldn't lend, the white-haired art dealer in the elegant tweed jacket said he drove to the outskirts of Rome and knocked on the rusty steel door of a shipping container.

A beefy man named Mauro answered. He wore blue overalls with two big pockets, one stuffed with checks and the other with cash. The wad of bills he handed over, the art dealer recalled, reeked of the man's cologne and came at 120 percent annual interest.

As banks stop lending amid the global financial crisis, the likes of Mauro are increasingly becoming the face of Italian finance. The Mafia and its loan sharks, nearly everyone agrees, smell blood in the troubled waters.

"It's a fantastic time for the Mafia. They have the cash," said Antonio Roccuzzo, the author of several books on organized crime. "The Mafia has enormous liquidity. It may be the only Italian 'company' without any cash problem."

-------------------

in one of the comments above didn't I call "mafia/investor/insurer" those indulging in CDS (credit default swaps). Didn't I say the mafia would be proud? see toon at top...

neutering government watchdogs...

From Chris floyd...

Following the example of Arthur Silber, today we look to the work of Professor Michael Hudson to cut through the bewildering thicket of cant, con and deliberate deceit that surrounds the various "solutions" to the economic crisis. In his latest Counterpunch piece, Hudson addresses the seemingly counterintuitive spectacle of watching Alan Greenspan, the Arch-Druid of the "free market" cult, calling for nationalization of the nation's banks:

How is it that Alan Greenspan, free-market lobbyist for Wall Street, recently announced that he favored nationalization of America’s banks – and indeed, mainly the biggest and most powerful? Has the old disciple of Ayn Rand gone Red in the night? Surely not.

The answer is that the rhetoric of “free markets,” “nationalization” and even “socialism” (as in “socializing the losses”) has been turned into the language of deception to help the financial sector mobilize government power to support its own special privileges. Having undermined the economy at large, Wall Street’s public relations think tanks are now dismantling the language itself.

Exactly what does “a free market” mean? Is it what the classical economists advocated – a market free from monopoly power, business fraud, political insider dealing and special privileges for vested interests – a market protected by the rise in public regulation from the Sherman Anti-Trust law of 1890 to the Glass-Steagall Act and other New Deal legislation? Or is it a market free for predators to exploit victims without public regulation or economic policemen – the kind of free-for-all market that the Federal Reserve and Security and Exchange Commission (SEC) have created over the past decade or so? It seems incredible that people should accept today’s neoliberal idea of “market freedom” in the sense of neutering government watchdogs, Alan Greenspan-style, letting Angelo Mozilo at Countrywide, Hank Greenberg at AIG, Bernie Madoff, Citibank, Bear Stearns and Lehman Brothers loot without hindrance or sanction, plunge the economy into crisis and then use Treasury bailout money to pay the highest salaries and bonuses in U.S. history.

the pledge .....

In his speech on Iraq redeployment today, President Obama pledged to have all troops, including "residual forces," by the end of 2011. This is the pledge I have been waiting for:

Let me say this as plainly as I can: by August 31, 2010, our combat mission in Iraq will end.Through this period of transition, we will carry out further redeployments. And under the Status of Forces Agreement with the Iraqi government, I intend to remove all U.S. troops from Iraq by the end of 2011.

This is huge for no residual forces proponents. Now that President Obama has made this pledge, in public, it will be difficult for him to go back on it. This is especially the case since turning back on a promise with a deadline of December 31st, 2011, means violating a pledge during 2012 - the year President Obama will be running for re-election.

http://www.alternet.org/blogs/waroniraq/129283/Our social security cards

anti-laxative against derivatives

The US Treasury wants more regulation of derivatives - the complex financial instruments that brought down some of Wall Street's biggest names.

Proposals to be set out by Treasury Secretary Timothy Geithner will call for an electronic system to monitor buying and selling in the market.

Firms trading in derivatives will need enough capital in case they default and will face tough reporting requirements.

AIG and Lehman Brothers were among the firms ruined by dealing in derivatives.

Perhaps the most notorious form of derivative is the credit-default swap.

Insurance giant AIG sold these to investors as a form of insurance to protect against defaults on mortgage-backed securities.

But the firm had to accept a hefty federal bailout after it was unable to support the contracts.

"The days when a major insurance company could bet the house on credit default swaps with no one watching and no credible backing to protect the company or taxpayers from losses must end."

Timothy Geithner - Treasury Secretary

--------------------

See toon at top and read comments below it especially do not sneeze and see toon overthere...

betting against one's own product...

By GRETCHEN MORGENSON and LOUISE STORY

In late October 2007, as the financial markets were starting to come unglued, a Goldman Sachs trader, Jonathan M. Egol, received very good news. At 37, he was named a managing director at the firm.

Mr. Egol, a Princeton graduate, had risen to prominence inside the bank by creating mortgage-related securities, named Abacus, that were at first intended to protect Goldman from investment losses if the housing market collapsed. As the market soured, Goldman created even more of these securities, enabling it to pocket huge profits.

Goldman’s own clients who bought them, however, were less fortunate.

Pension funds and insurance companies lost billions of dollars on securities that they believed were solid investments, according to former Goldman employees with direct knowledge of the deals who asked not to be identified because they have confidentiality agreements with the firm.

Goldman was not the only firm that peddled these complex securities — known as synthetic collateralized debt obligations, or C.D.O.’s — and then made financial bets against them, called selling short in Wall Street parlance. Others that created similar securities and then bet they would fail, according to Wall Street traders, include Deutsche Bank and Morgan Stanley, as well as smaller firms like Tricadia Inc., an investment company whose parent firm was overseen by Lewis A. Sachs, who this year became a special counselor to Treasury Secretary Timothy F. Geithner.

How these disastrously performing securities were devised is now the subject of scrutiny by investigators in Congress, at the Securities and Exchange Commission and at the Financial Industry Regulatory Authority, Wall Street’s self-regulatory organization, according to people briefed on the investigations. Those involved with the inquiries declined to comment.

-------------------------

Here we can only move on to my explanation of CDS... see above "do not sneeze". See other financial comments above it as well (greed on credit) and other stuff on this site including yo yo yo hope...

perverse moneys...

I knew that...

From the NYT

Bets by some of the same banks that helped Greece shroud its mounting debts may actually now be pushing the nation closer to the brink of financial ruin.

Echoing the kind of trades that nearly toppled the American International Group, the increasingly popular insurance against the risk of a Greek default is making it harder for Athens to raise the money it needs to pay its bills, according to traders and money managers.

These contracts, known as credit-default swaps, effectively let banks and hedge funds wager on the financial equivalent of a four-alarm fire: a default by a company or, in the case of Greece, an entire country. If Greece reneges on its debts, traders who own these swaps stand to profit.

“It’s like buying fire insurance on your neighbor’s house — you create an incentive to burn down the house,” said Philip Gisdakis, head of credit strategy at UniCredit in Munich.

As Greece’s financial condition has worsened, undermining the euro, the role of Goldman Sachs and other major banks in masking the true extent of the country’s problems has drawn criticism from European leaders. But even before that issue became apparent, a little-known company backed by Goldman, JP Morgan Chase and about a dozen other banks had created an index that enabled market players to bet on whether Greece and other European nations would go bust.

Last September, the company, the Markit Group of London, introduced the iTraxx SovX Western Europe index, which is based on such swaps and let traders gamble on Greece shortly before the crisis. Such derivatives have assumed an outsize role in Europe’s debt crisis, as traders focus on their daily gyrations.

A result, some traders say, is a vicious circle. As banks and others rush into these swaps, the cost of insuring Greece’s debt rises. Alarmed by that bearish signal, bond investors then shun Greek bonds, making it harder for the country to borrow. That, in turn, adds to the anxiety — and the whole thing starts over again.

On trading desks, there is fierce debate over what exactly is behind Greece’s recent troubles. Some traders say swaps have made the problem worse, while others say Greece’s deteriorating finances are to blame.

-------------------

If one reads the do nott sneeze article above and the bet against one's own product above as well, one can see that this activity should be illegal and prosecuted forthwith retrospectively. Although it is hard to prove there is or was intent to precipitate the ruin of an "insured" in order to cash in, the simple fact of betting against one's own actions is too pervese for words... see also toon at top.

In another comment on this site, I exposed the hidden value of derivatives:

the world GDP is about 60 trillion US dollars.

The amount of money floating around worlswide is about 130 trillion US dollars.

The amount of derivatives (bets on the house), at last computation, is about 700 trillion US dollars...

Make the sums....

termites under the carpet...

By LOUISE STORY and ERIC DASH

It was like a hidden passage on Wall Street, a secret channel that enabled billions of dollars to flow through Lehman Brothers.

In the years before its collapse, Lehman used a small company — its “alter ego,” in the words of a former Lehman trader — to shift investments off its books.

The firm, called Hudson Castle, played a crucial, behind-the-scenes role at Lehman, according to an internal Lehman document and interviews with former employees. The relationship raises new questions about the extent to which Lehman obscured its financial condition before it plunged into bankruptcy.

While Hudson Castle appeared to be an independent business, it was deeply entwined with Lehman. For years, its board was controlled by Lehman, which owned a quarter of the firm. It was also stocked with former Lehman employees.

None of this was disclosed by Lehman, however.

Entities like Hudson Castle are part of a vast financial system that operates in the shadows of Wall Street, largely beyond the reach of banking regulators. These entities enable banks to exchange investments for cash to finance their operations and, at times, make their finances look stronger than they are.

Critics say that such deals helped Lehman and other banks temporarily transfer their exposure to the risky investments tied to subprime mortgages and commercial real estate. Even now, a year and a half after Lehman’s collapse, major banks still undertake such transactions with businesses whose names, like Hudson Castle’s, are rarely mentioned outside of footnotes in financial statements, if at all.

The Securities and Exchange Commission is examining various creative borrowing tactics used by some 20 financial companies. A Congressional panel investigating the financial crisis also plans to examine such deals at a hearing in May to focus on Lehman and Bear Stearns, according to two people knowledgeable about the panel’s plans.

------------------------

Gus: It's more burrowing tactics than borrowing whatever... We all know that if termites profit from hiding in your floor planks, eventually, the whole floor is going to collapse. The carpet might still be nice and clean till then but it can do nothing to support a couple of dancing economists...

secretly devised to fail

From the NYT

U.S. Accuses Goldman Sachs of Fraud in Mortgage DealBy LOUISE STORY and GRETCHEN MORGENSON

Goldman Sachs, which emerged relatively unscathed from the financial crisis, was accused of securities fraud in a civil suit filed Friday by the Securities and Exchange Commission, which claims the bank created and sold a mortgage investment that was secretly devised to fail.

...

But the deck was stacked against the Abacus investors, the complaint contends, because the investment was filled with bonds chosen by Mr. Paulson, who is not named in the suit, as likely to default. Goldman told investors in Abacus marketing materials reviewed by The Times that the bonds would be chosen by an independent manager.

“The product was new and complex, but the deception and conflicts are old and simple,” Robert Khuzami, the director of the S.E.C.’s division of enforcement, said in a statement. “Goldman wrongly permitted a client that was betting against the mortgage market to heavily influence which mortgage securities to include in an investment portfolio, while telling other investors that the securities were selected by an independent, objective third party.”

The complaint heralds the return of a more aggressive S.E.C. The case may help the agency recover from some initial mishaps, and signals that the agency is tracing the mortgage pipeline all the way from the companies like Countrywide that originated home loans to the raucous trading floors that dominate Wall Street’s profit machine.

-----------------

Gus: as you know, I am not an economist, nor a "financial wiz".... But I am an expert on "deception" (see the age of deceit [intro 1-2-3 and first chapter — in the same line of comments] and of spiders' webs. see also do not sneeze and also double cross and intelligence cock ups).

But despite not being an economist, nor a "financial wiz" let me say the construct of CDS and derivatives can be manipulated far beyond what they are ment to be "on the surface". Betting against the value of one's own product is perverse at least and criminal on average... As I wrote then:

Few financial whizzes understand how derivatives really work and I don't blame them... Derivatives are hard yakka... And these CDS babies are derivatives of the smarter kind... Mathematically, they are a gem of simplicity, once past the fog of moralisationing and once we have mastered the ability to keep a straight face. I may be contested on my explanation here... go for it. Some people dare describe CDS as "insurance" but it's actually a very cleverly disguised extortion — like a "protection racket" with a bet attached.

The Mafia would be proud!!

The scheme is ingenious. THE MAFIA GIVES YOU MONEY!!!

----------------

read the rest at "do not sneeze"... and read also the two blogs above this one. see toon at top.

betting for and against betting on betting...

A Wall Street Invention That Let the Crisis MutateBy JOE NOCERA

Can it get any worse?

Every time you pick up another rock along the winding path that led to the financial crisis, something else crawls out. Subprime mortgages were sold as a way to give low-income people a chance at homeownership and the American Dream. Instead, the mortgages turned out to be an excuse for predatory lending and fraud, enriching the lenders and Wall Street at the expense of subprime borrowers, many of whom ended up in foreclosure.

The ratings agencies, which rated the complex investments that were built with subprime mortgages, turned out to be only too happy to be gamed by firms that paid their fees — slapping AAA ratings on mortgage bonds doomed to fail. Lehman Brothers turned out to be disguising the full reality of its horrid balance sheet by playing accounting games. All over Wall Street, firms pushed mortgage originators to churn out more loans that were doomed the moment they were made.

In the immediate aftermath, the conventional wisdom was that Wall Street had simply lost its head. It was terrible, to be sure, but on some level understandable: Dutch tulips, the South Sea bubble, that sort of thing.

In recent months, though, something more troubling has begun to emerge. In December, Gretchen Morgenson and Louise Story of The New York Times exposed the role that some firms, including Goldman Sachs and Deutsche Bank, played in putting together investment structures — synthetic C.D.O.’s, they were called — that were primed to blow up. They did so, reportedly, because some savvy investors wanted to go short the subprime market.

On Friday, the Securities and Exchange Commission dropped the hammer, charging Goldman Sachs with securities fraud for its purported failure to disclose that the bonds that were the basis for one particular synthetic C.D.O. had been chosen by none other than John Paulson, the billionaire hedge fund investor, who was shorting them.

Oh, and one other thing is starting to become clear: synthetic C.D.O.’s made the crisis worse than it would otherwise have been.

•

Remember in the months leading up to the crisis, when the Federal Reserve chairman, Ben Bernanke, and Henry Paulson Jr., then the Treasury secretary, were assuring everyone that the “subprime problem” could be contained? In truth, if the only problem had been the actual mortgage bonds themselves, they might have been right. At the peak there were well over $1 trillion in subprime and Alt-A mortgages that were securitized on Wall Street. That’s a lot, to be sure — but it was a finite number. You could have only as much exposure as there were bonds in existence.

The introduction of synthetic C.D.O.’s changed all that. Unlike a “normal” collateralized debt obligation, which contained the bonds themselves, the synthetic version contained credit-default swaps — derivatives that “referenced” a particular group of mortgage bonds. Once synthetic C.D.O.’s became popular, Wall Street no longer needed to feed the beast with new subprime loans. It could make an infinite number of bets on the bonds that already existed.

---------------------

See toon at top and blog above this one. Er... why not indulge yourself and read the whole lot here from the top... and find how some (most) banks primed the pump to load their coffers at YOUR expense...

sucking on rotten fruit...

By LOUISE STORY and GRETCHEN MORGENSON

For Goldman Sachs, it was a relatively small transaction. But for the bank — and the rest of Wall Street — the stakes couldn’t be higher.

Accusations that Goldman defrauded customers who bought investments tied to risky subprime mortgages have only just begun to reverberate through the financial world.

The civil lawsuit that the Securities and Exchange Commission filed against Goldman on Friday seemed to confirm many Americans’ worst suspicions about Wall Street: that the game is rigged, the odds stacked in the banks’ favor. It is the first big case — but probably not the last, legal experts said — to delve into a Wall Street firm’s role in the mortgage fiasco.

It is a particularly sensitive time for Wall Street. Washington policy makers are hotly debating a sweeping overhaul of the nation’s financial regulations, and the news could embolden those seeking to rein in the banks. President Obama on Saturday stepped up pressure for financial reform by accusing Republicans of “cynical and deceptive” attacks on the measure.

The S.E.C.’s action could also hit Wall Street where it really hurts: the wallet. It could prompt dozens of investor claims against Goldman and other Wall Street titans that devised and sold toxic mortgage investments.

On Saturday, several European banks that lost money in the deal said they were reviewing the matter. They could try to recoup the money from Goldman.

And it raises new questions about Goldman, the bank at the center of more concentric circles of economic and political power than any other on Wall Street. Goldman — whose controversial success has leapt from the financial pages to the cover of Rolling Stone — has fiercely defended its actions before, during and after the financial crisis. On Friday, it called the S.E.C.’s accusations “unfounded.”

----------------------

Gus: Goldman Suschx says to the suckers:

Hey!!!... We sold you wrapped rotten fruit at a premium price and betted the fruit would rot before tomorrow... Nothing to do with us. Now our premium argument is how to define rotten: we've got lawyers-galore working on the semantics of the grade of rotten and on the premises that, first, it was your call to decide whether you wanted the fruit and, second, it's your court to find out whether the fruit was already rotten, on the way to rot or laced with fruit-flies before you bought — or that we knew the fruit was rotting or rotten... We always announce that whatever you buy from our golden fruiiiiiit shop, there is a "risk" factor... Now how can one say that a 99 per cent or a 10 per cent chance of rot is included in a sealed bundled package of rotten fruit? You mean you trust us at face value?!!??... And what or who can stop us for insuring the values of the goods for hundred (or a thousand) times the value we make you pay for? We live in a "free market", don't we? It's your call to inspect the goods and have your own insurance, No?... Now... prove that we deliberately loaded the fruit tray with more rotten peaches than your average risky tray of goodies... And remember, the bloke who did the packing — and/or advise on the packing — is now your principal advisor — good old Mr Paulson. He helped save your bacon by getting the taxpayers to fund your rescue from having bought our alleged rotten fruit. We're only the victims here... We sold the goods on good faith they would rot before tomorrow... We could have lost billions if they had not...

paying too much...

By LOUISE STORY

Joseph J. Cassano, the man who oversaw the unit that brought the American International Group to its knees, testified Wednesday that he could have saved taxpayers billions of dollars if he had stayed at the company to negotiate with banks that were demanding more collateral as the insurer hit trouble.

Speaking on the issue in public for the first time, Mr. Cassano appeared before the Financial Crisis Inquiry Commission, which is studying the causes of the financial crisis, in Washington.

A.I.G.’s derivative contracts are the subject of the commission’s latest hearing, scheduled to last for two days. The commission is interviewing experts, regulators and A.I.G. executives about the contracts, most of which were dismantled by the New York Federal Reserve during the bailout of 2008. The Fed retained the risk of the mortgage securities that A.I.G. insured.

Goldman was one of the largest banks on the other side of A.I.G.’s mortgage deals, and executives from that bank, including Gary D. Cohn, the president of Goldman, are also scheduled to testify. A little-known financial executive before A.I.G. hit trouble, Mr. Cassano spoke slowly and declined to read his testimony, which had already been posted on A.I.G.’s site. In his opening remarks, he simply noted that his perspective “diverges in important ways from the popular wisdom.”

To the commission’s chairman, he said, “you said this commission’s work will be tethered to the hard facts, I am grateful for that. I intend to give you my best recollection and candid perspectives.”

Mr. Cassano told commissioners that he wished he had stayed on beyond his retirement in March 2008, when A.I.G.’s then chief executive asked him to leave. He said if he had been A.I.G.’s “chief negotiator” when banks asked for more collateral, he would have extracted concessions from the banks and greatly reduced the amount of taxpayer money the insurer needed.

dry eyes, in the financial dust...

from the Washington Post

World economic recovery driven by global imbalances

By Neil Irwin

Washington Post Staff Writer

Friday, July 9, 2010; A01

The catastrophic economic downturn that began two years ago was supposed to shake up the global economy, ending an era in which Americans consumed too much and saved and exported too little.

But the recovery is being driven by a return to the very global imbalances that were a major cause of the crisis. Americans' savings rates have fallen over the past year, imports are rising faster than exports, and countries around the world are again turning to Americans to be the consumers of last resort.

"Despite all the good words and good intentions, I'm afraid we're going back to the same conditions that led us into this mess to begin with," said C. Fred Bergsten, director of the Peterson Institute for International Economics.

That's partly because countries around the world view those old ways, while dangerous over the long term, as the quickest option to power out of the deep economic decline. For China, Japan and Germany, that means exporting vast volumes of goods, saving too much and spending too little; for the United States, and to varying degrees Britain and other European nations, it is the reverse.

These trends are deeply ingrained in countries' policies and individual decisions by their citizens, such as the lack of a social safety net in China that causes people to save more and the mortgage-interest deductions in the United States that encourage people to take on more debt.

-----------------------

From the New York Times

Biggest Defaulters on Mortgages Are the RichBy DAVID STREITFELD

LOS ALTOS, Calif. — No need for tears, but the well-off are losing their master suites and saying goodbye to their wine cellars.

The housing bust that began among the working class in remote subdivisions and quickly progressed to the suburban middle class is striking the upper class in privileged enclaves like this one in Silicon Valley.

Whether it is their residence, a second home or a house bought as an investment, the rich have stopped paying the mortgage at a rate that greatly exceeds the rest of the population.

More than one in seven homeowners with loans in excess of a million dollars are seriously delinquent, according to data compiled for The New York Times by the real estate analytics firm CoreLogic.

By contrast, homeowners with less lavish housing are much more likely to keep writing checks to their lender. About one in 12 mortgages below the million-dollar mark is delinquent.

Though it is hard to prove, the CoreLogic data suggest that many of the well-to-do are purposely dumping their financially draining properties, just as they would any sour investment.

“The rich are different: they are more ruthless,” said Sam Khater, CoreLogic’s senior economist.

Five properties here in Los Altos were scheduled for foreclosure auctions in a recent issue of The Los Altos Town Crier, the weekly newspaper where local legal notices are posted. Four have unpaid mortgage debt of more than $1 million, with the highest amount $2.8 million.

Not so long ago, said Chris Redden, the paper’s advertising services director, “it was a surprise if we had one foreclosure a month.”

The sheriff in Cook County, Ill., is increasingly in demand to evict foreclosed owners in the upscale suburbs to the north and west of Chicago — like Wilmette, La Grange and Glencoe. The occupants are always gone by the time a deputy gets there, a spokesman said, but just barely.

In Las Vegas, Ken Lowman, a longtime agent for luxury properties, said four of the 11 sales he brokered in June were distressed properties.

currency debt on credit...

Volatility of currency exchange rates has increased markedly in recent months. During the European debt crisis, in a matter of days, the dollar strengthened by around 10 per cent. The weakness of the Euro and resultant appreciation of the Renminbi by over 14 per cent reduced Chinese exporter's earnings and competitiveness. Some of the moves reversed equally quickly when markets stabilised.

Now, to paraphrase Oscar Wilde, the US dollar has no enemies, but is intensely disliked by its friends, especially key investors like the Chinese. The Euro is now the "Drachmark" (a derisory combination of the former Greek Drachma and German Deutschemark). Investors assumed that the Euro would be a new Deutschemark, supported by German commitment to fiscal and monetary rectitude avoiding Gallic and Mediterranean extravagance. Instead, investors have been left holding a currency underpinned by unexpected German extravagance and Gallic and Mediterranean rectitude.

Despite sclerotic growth, public debt approaching 200 per cent of GDP and a budget where borrowing is greater than tax revenues, the Japanese Yen has risen to its highest level against the dollar in 15 years. China is even switching some of its currency reserves into Japanese government bonds with returns only apparent under powerful electron microscopes.

Fears about the value of any currency have seen a resurgent interest in gold. Traders are now reading their John Milton: "Time will run back and fetch the age of gold."

Amongst currencies, it is simply a race to the bottom. On 27 September 2010, the Brazilian finance minister Guido Mantega stated the obvious speaking of an "international currency war" as governments around the globe compete to lower their exchange rates to boost competitiveness. In the words of English philosopher Thomas Hobbes it is "war of every man against every man".

http://www.abc.net.au/unleashed/40032.html

---------------------------

See toon at top...

spend a penny wise...

By PAUL KRUGMAN

“How many of you people want to pay for your neighbor’s mortgage that has an extra bathroom and can’t pay their bills?” That’s the question CNBC’s Rick Santelli famously asked in 2009, in a rant widely credited with giving birth to the Tea Party movement.

It’s a sentiment that resonates not just in America but in much of the world. The tone differs from place to place — listening to a German official denounce deficits, my wife whispered, “We’ll all be handed whips as we leave, so we can flagellate ourselves.” But the message is the same: debt is evil, debtors must pay for their sins, and from now on we all must live within our means.

And that kind of moralizing is the reason we’re mired in a seemingly endless slump.

The years leading up to the 2008 crisis were indeed marked by unsustainable borrowing, going far beyond the subprime loans many people still believe, wrongly, were at the heart of the problem. Real estate speculation ran wild in Florida and Nevada, but also in Spain, Ireland and Latvia. And all of it was paid for with borrowed money.

This borrowing made the world as a whole neither richer nor poorer: one person’s debt is another person’s asset. But it made the world vulnerable. When lenders suddenly decided that they had lent too much, that debt levels were excessive, debtors were forced to slash spending. This pushed the world into the deepest recession since the 1930s. And recovery, such as it is, has been weak and uncertain — which is exactly what we should have expected, given the overhang of debt.

The key thing to bear in mind is that for the world as a whole, spending equals income. If one group of people — those with excessive debts — is forced to cut spending to pay down its debts, one of two things must happen: either someone else must spend more, or world income will fall.

http://www.nytimes.com/2010/11/01/opinion/01krugman.html?_r=1&hp=&pagewanted=print

--------------------------

Gus: the main problem here is the "fair" distribution of the new largess that takes governments into debt... Should this extra debt be spent on greed and gambling (banking), then we may as well close shop. The distribution of benefits from a new debt needs to be carefully crafted.

In Australia, as the economic crisis hit the world, the Labor government decided to spend. But spend in areas that would maintain employment and keep the poor out of trouble. Thus most of the money went out of reach from the banking system, apart from securing savings. One of the key decision was to give a $900 flat tax rebate to anyone earning less than a certain (generous) tax bracket. This did the trick to protect the "poor". The other decisions were to spend money on "schools" and on "insulation of homes".

Lindsay Tanner (Finance Minister) saw problems in the fast implementation of these two schemes. He also was against the tax rebate, but after some persuasive outmanoeuvring, he acquiesced to all those. Tanner was actually kept out of the loop...:

-------------------

KEVIN RUDD and his senior ministers were so suspicious of Lindsay Tanner that they used to hold fake pre-budget meetings to ensure their plans did not leak.

According to accounts of the meetings of the now abandoned Strategic Priorities and Budget Committee, nicknamed the gang of four, some meetings with Mr Tanner would deliberately be light on detail. After the meeting concluded and the then finance minister had left, the other three members of the committee - Mr Rudd, Julia Gillard and Wayne Swan - would reconvene and discuss their budget plans in detail.

http://www.smh.com.au/national/out-in-the-cold-rudd-held-fake-budget-meetings-to-stop-leaks-20101101-17agh.html

--------------------

But despite minor problems with the insulation and school programs, the result in terms of preventing a recession was spot on. It provided employment — and would it not have been for some profiteering sharky "liberal" opportunist shonks, there would have been not a single problem with schools and insulation of homes...

Overseas, most of the "rescue" money went to BANKS... Hello?!!... Even if the banks redirected the money eventually, first and foremost they would repay their own debts (mostly gambling debts) and take their "normal" profit and bonus cut, like any Mafia — but with less percentage to be "legal". The end-trickle of this suction, would make sure the poor stay poor and sink further into the mud, while the richer section of the community would collect the dosh. The middle class seeing zip-of-nothing would thus blame the poor for their middle-class trouble since they can see the rich doing well — and it's always easier to blame the donkey for troubles, than put up a fight with the lion.

Nothing new here. In the middle ages, in order to keep people employed, kings and popes would employ oodles of low paid poor crafties to build cathedrals, forts and palaces to make sure the low paid poor people could not get in these palaces or had to pray, head bowed to the floor, on their knees for their sins, inside the glorious glittering building they built, belonging to their master — not god, but the church.

The trick is to manage the supply-and-demand fluctuations in a social network of which, in reality, 60 per cent of the population is producing zip of any value. These days, we employ people to shuffle paper, officially. If the "free market" was really left to its own devices, we would have a revolution every second day of the week. The next trick is to let the illusion of a free market where everyone can dream of becoming rich while 99 per cent stay at the bottom of the pile... Welcome to the sociopath structure of human society.

And the rich don't like government "going into debt" on behalf of the poor, because it tends to devalue their exclusive stash of the loot. But the rich will love a government that props up their little gambling games, such as rescue the banks...

In reality, the relative value of things is only the strength of envy of what others have — while the earth suffers. As we all know as well there is a bracket of uncertainty to define "value for money". One cannot say that the price we pay for this is the "right price". In time of war for example one would pay squillions for a dead rat...

So far, our world economies have not included the environmental degradation factor in the accounting. Only on the margins of environmental degradation — when an oil spill affect us overtly — will we make a noise, but in the end there will be little "action" of environmental value. Talkfeists and committees are trying to remedy this aspect, but as one big banker said to me once "mining chiefs are macho boofheads"... With this comment coming from a big banker, I thought the planet is in big big trouble...

See toon at top...

amassing gains, diverting losses...

By LOUISE STORYOn the third Wednesday of every month, the nine members of an elite Wall Street society gather in Midtown Manhattan.

The men share a common goal: to protect the interests of big banks in the vast market for derivatives, one of the most profitable — and controversial — fields in finance. They also share a common secret: The details of their meetings, even their identities, have been strictly confidential.

Drawn from giants like JPMorgan Chase, Goldman Sachs and Morgan Stanley, the bankers form a powerful committee that helps oversee trading in derivatives, instruments which, like insurance, are used to hedge risk.

In theory, this group exists to safeguard the integrity of the multitrillion-dollar market. In practice, it also defends the dominance of the big banks.

The banks in this group, which is affiliated with a new derivatives clearinghouse, have fought to block other banks from entering the market, and they are also trying to thwart efforts to make full information on prices and fees freely available.

Banks’ influence over this market, and over clearinghouses like the one this select group advises, has costly implications for businesses large and small, like Dan Singer’s home heating-oil company in Westchester County, north of New York City.

This fall, many of Mr. Singer’s customers purchased fixed-rate plans to lock in winter heating oil at around $3 a gallon. While that price was above the prevailing $2.80 a gallon then, the contracts will protect homeowners if bitterly cold weather pushes the price higher.

But Mr. Singer wonders if his company, Robison Oil, should be getting a better deal. He uses derivatives like swaps and options to create his fixed plans. But he has no idea how much lower his prices — and his customers’ prices — could be, he says, because banks don’t disclose fees associated with the derivatives.

“At the end of the day, I don’t know if I got a fair price, or what they’re charging me,” Mr. Singer said.

Derivatives shift risk from one party to another, and they offer many benefits, like enabling Mr. Singer to sell his fixed plans without having to bear all the risk that oil prices could suddenly rise. Derivatives are also big business on Wall Street. Banks collect many billions of dollars annually in undisclosed fees associated with these instruments — an amount that almost certainly would be lower if there were more competition and transparent prices.

Just how much derivatives trading costs ordinary Americans is uncertain. The size and reach of this market has grown rapidly over the past two decades. Pension funds today use derivatives to hedge investments. States and cities use them to try to hold down borrowing costs. Airlines use them to secure steady fuel prices. Food companies use them to lock in prices of commodities like wheat or beef.

The marketplace as it functions now “adds up to higher costs to all Americans,” said Gary Gensler, the chairman of the Commodity Futures Trading Commission, which regulates most derivatives. More oversight of the banks in this market is needed, he said.

http://www.nytimes.com/2010/12/12/business/12advantage.html?_r=1&hp=&pagewanted=print

------------------------

Gus: see also how derivatives work in do not sneeze and pass the parcel.... It would be called insider trading by any other means but we haven't got a clue as what they're trading in... It could be cocaine, war futures, pork bellies, insurance on insurance, red sox, the hot line to god, or the street address of the latest Ali Baba statch... see toon at top.

Please note what I wrote in "do not sneeze":

And the fun of this scheme is that one does not have to be a bank to play this hot game. You and me, mere stingy mortals, could place a bet with an investor for example that the Euro won't be down against the dollar at the end of a fixed period. The investor will pay you regular cash against your bet (CDS) and you can enjoy the life of Midas — until you have to pay twice what you have in reserve (because you're a "spend-drift"), should the Euro take a nosedive at five minutes to midnight of the "contract". You sink. You're dead meat.

Unless you refuse to cough up. Like the "investors/insurers" have protection, you have "thugs" working for you that will protect your assets against the "investors/insurers" you don't want to pay. They're called "lawyers" and private beefy blokes or "bodyguards", but their palms need to be well-oiled, so you need heaps of cash to afford this snubbing privilege.

In regard to the Euro, I am prepared to believe there was foul play from some "secret" quarters to create the problem... knowing that some government are "lazy".. see a greek tragedy...

an “avoidable” disaster...

By SEWELL CHAN

WASHINGTON — The 2008 financial crisis was an “avoidable” disaster caused by widespread failures in government regulation, corporate mismanagement and heedless risk-taking by Wall Street, according to the conclusions of a federal inquiry.

The commission that investigated the crisis casts a wide net of blame, faulting two administrations, the Federal Reserve and other regulators for permitting a calamitous concoction: shoddy mortgage lending, the excessive packaging and sale of loans to investors and risky bets on securities backed by the loans.

“The greatest tragedy would be to accept the refrain that no one could have seen this coming and thus nothing could have been done,” the panel wrote in the report’s conclusions, which were read by The New York Times. “If we accept this notion, it will happen again.”

While the panel, the Financial Crisis Inquiry Commission, accuses several financial institutions of greed, ineptitude or both, some of its gravest conclusions concern government failings, with embarrassing implications for both parties. But the panel was itself divided along partisan lines, which could blunt the impact of its findings.

Many of the conclusions have been widely described, but the synthesis of interviews, documents and testimony, along with its government imprimatur, give the report — to be released on Thursday as a 576-page book — a conclusive sweep and authority.

The commission held 19 days of hearings and interviews with more than 700 witnesses; it has pledged to release a trove of transcripts and other raw material online.

Of the 10 commission members, the six appointed by Democrats endorsed the final report. Three Republican members have prepared a dissent focusing on a narrower set of causes; a fourth Republican, Peter J. Wallison, has his own dissent, calling policies to promote homeownership the major culprit. The panel was hobbled repeatedly by internal divisions and staff turnover.