Search

Recent comments

- naked.....

5 hours 3 min ago - darkness....

5 hours 26 min ago - 2019 clean up before the storm....

10 hours 46 min ago - to death....

11 hours 25 min ago - noise....

11 hours 32 min ago - loser....

14 hours 12 min ago - relatively....

14 hours 35 min ago - eternally....

14 hours 40 min ago - success....

1 day 1 hour ago - seriously....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

cash cows and environmental chaos......

U.S. Banks Break Climate Promises by Propping Up Big Meat

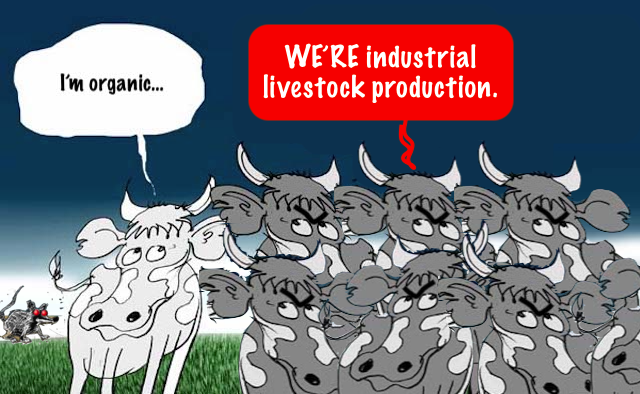

To uphold commitments to reducing climate emissions, U.S. banks should stop providing financial support to companies focused on industrial livestock production.

As concerns over the climate crisis grow, banks in the United States have faced increased pressure from shareholders, policymakers, and civil society to reduce greenhouse gas (GHG) emissions linked to their loans and financial services. Many big banks have pledged to reduce their investment in high-emitting sectors to help reach net-zero goals.

MONIQUE MIKHAIL AND WARD WARMERDAM

However, they are still financially entangled in industries whose emissions are choking the planet and putting global climate targets at risk.

Investing in climate-unfriendly industries is bad for banks and investors, too, as asset managers themselves admit. In a 2020 letter to CEOs, Larry Fink, the chairman and CEO of BlackRock, the world’s largest asset manager, emphasized the growing concern among investors about how climate change will affect their investments.

This encompasses both the physical impacts of climate change (as costs increase, supplies are interrupted, and the demand equation changes) and the impacts of climate policies that change the economics of climate-harming activities.

Banks aren’t doing everything they should to reduce the climate impacts of their investments. Agriculture—and, in particular, industrial livestock production (raising animals like cows, pigs, and chickens to produce meat, dairy, and eggs and growing the feed they eat)—is an emissions-heavy industry where the banks have not yet made significant changes in their financing patterns.

Reducing their financial support of industrial livestock would be a relatively small change for the banks, but it would take them a long way toward their emissions reduction goals.

The Climate Impact of Industrial AgricultureOne estimate shows that industrial livestock production already contributes up to 19.6% of global emissions. Global emissions must be capped to achieve a maximum global temperature increase of 1.5 degrees Celsius or below. However, livestock is currently on track to consume roughly half the global emissions budget by 2030 and up to 80% by 2050.

Industrial livestock is an integrated global industry, much of it conducted in massive feeding operations in countries like Brazil and the U.S. Its emissions come from:

- The cows themselves in the form of methane (a particularly potent greenhouse gas)

- Feed production and processing

- Manure processing and storage

- Deforestation

In addition to these emissions, the industry causes immeasurable animal cruelty, environmental damage (biodiversity loss and pollution), human health harms, and social impacts like labor rights violations. Following are some of the significant secondary impacts.

DeforestationMost meat and dairy products come from animals raised on previously forested land, often old-growth tropical forest land cleared to make room for livestock. Cattle raising and animal feed production cause an estimated 48% of global tropical deforestation.

Cutting down forests to replace them with livestock or feed for livestock (like soy) releases carbon stored in trees and soil, which means those trees are no longer available to absorb and store CO2 and help reduce future climate change effects.

Land Grabbing and Human Rights AbusesBecause raising livestock requires so much land, it is common for industrial livestock companies to purchase cattle from producers who are raising animals on land stolen from Indigenous and local communities.

Habitat Destruction, Biodiversity Loss, and Animal Rights AbusesWhen forests are converted to meat, dairy, and feed production, animals, plants, and insects lose their wild habitats and are threatened with their survival. Industrial livestock production is one of the biggest drivers of deforestation and biodiversity loss. Habitat loss and pesticide pollution from feed production are also key drivers of biodiversity loss.

Industrial livestock production is also a source of massive animal rights and welfare abuses.

Water Scarcity, Pollution, and Health ImpactsIndustrial livestock production requires vast amounts of fresh water, even though fresh water is often scarce in production areas. Industrial livestock facilities, or factory farms, discharge concentrated animal waste and chemicals, polluting nearby communities’ air and contaminating rivers, watersheds, and drinking water supplies.

Pesticides and fertilizers used in feed production pollute soil, air, water, and food. They are linked to a wide range of adverse health impacts, including cancers, neurological disorders like Parkinson’s, reproductive disorders like infertility, and endocrine disruption.

Infectious Diseases and Antimicrobial ResistanceDiseases can spread quickly and easily among animals kept in crowded and unsanitary facilities used for industrial livestock production, and they can sometimes spread to wildlife and humans. The widespread overuse of antibiotics for growth promotion in industrial livestock has also driven the rise of antibiotic-resistant bacteria, making it harder to treat human diseases.

Violation of Labor RightsIndustrial livestock and slaughterhouse workers rank among the world’s most vulnerable to injury, illness, and lack of legal protections. These workers often face hazardous working conditions, including exposure to dangerous machinery and chemicals, repetitive and strenuous tasks, and high-pressure environments.

Furthermore, many are immigrants or low-wage laborers who may not have access to adequate healthcare, fair wages, or the ability to advocate for their rights.

Banks financing meat, dairy, and animal feed companies to operate and grow directly enable their emissions and all the other negative environmental and social consequences.

The 2024 report “Bull in the Climate Shop,” which we co-authored for our organizations, Friends of the Earth and Profundo, details how much damage U.S. banks do to the climate, the environment, and society by investing in meat, dairy, and feed corporations.

The “Big Three” Banks Financing Eco-DisasterWe investigated the 56 largest companies by production volume across six sectors and reviewed their emissions reports. The six sectors were:

- animal feed

- soy trade

- beef

- poultry

- pork

- dairy

Overall, we calculated that these corporations emit 1.14 billion metric tons of CO2-equivalent emissions each year, more than the entire country of Japan, the world’s eighth-largest emitter.

Dozens of U.S. banks provide financing to meat, dairy, and feed corporations, but the “Big Three” banks dominate: We calculated that Bank of America, Citigroup, and JPMorgan Chase alone provide over half of the $134 billion in U.S. lending to these corporations.

Although this represents only 0.25% of these banks’ outstanding loans, livestock production generates 11% of their portfolios’ reported emissions because it is so emissions-intensive.

Compared to auto manufacturing, Bank of America’s livestock finance generates twice the emissions per dollar, Citigroup’s generates 2.5 times as much, and JPMorgan Chase’s generates four times as much. Based on their disclosures, JPMorgan Chase’s financing in meat, dairy, and feed corporations generates nine times the emissions intensity of their oil and gas investments.

Our analysis found that 2022 financing from these three banks to meat, dairy, and feed corporations led to 24.4 million metric tons of CO2 equivalent emissions. This is equivalent to the carbon released by burning 27.3 billion pounds of coal or driving 5.4 million cars over a year.

Methane, a significant contributor to climate change with 80 times the global warming potential of CO2 over a 20-year period, accounts for a substantial part of banks’ emissions impact. Methane accounts for almost 50% of the 58 U.S. banks’ financed emissions from meat and dairy clients.

The banks in our report recognize that their oil and gas investments generate methane and are beginning to address the damage. Still, they are not addressing methane from industrial livestock emissions, even though the per-dollar impact is much more significant.

The Biggest Livestock Offender: JBSA few enormous companies—Cargill, ADM, Bunge, Nestlé, and JBS—are some of the worst climate offenders among the banks’ agriculture clients.

Brazil-based JBS S.A., the worldʼs largest meat company, has faced scrutiny for its involvement in:

Meat-importing countries like the U.S. require producers to be honest about where they raise their animals. Still, investigations in Brazil revealed irregularities in JBS’s beef sourcing, suggesting ties to illegal deforestation in the Amazon rainforest.

In 2023, the U.S. Senate Finance Committee highlighted JBSʼs “cattle laundering” practices, where cattle raised on “dirty” ranches carved out of deforested land are moved to “clean” ranches, concealing the forest destruction.

JBS has claimed it is on track to reach net-zero emissions by 2040, but it’s not clear how; as of mid-2024, they still hadn’t published a concrete plan, and New York State Attorney General Letitia James sued JBS in February 2024 for lying to consumers about its net-zero commitment.

JBS’s scandal-ridden past has kept it off the New York Stock Exchange, but it announced in 2023 that it would try again. Meanwhile, despite all the controversy, Bank of America and Citigroup continue to provide loans to JBS.

They shouldn’t: To uphold commitments to reducing climate emissions, U.S. banks should stop providing financial support to JBS.

Unreliable Numbers Obscure the Actual Emissions ImpactMeat and dairy companies underreport and obfuscate their data, making it hard for banks to gauge the extent of companies’ climate impacts. Only 22% of the reviewed corporations disclosed Scope 3 emissions, which can make up over 90% of total emissions. 56% did not report emissions at all.

JBS excluded Scope 3 emissions from their “purchased goods and services” category, even though sourcing livestock and poultry from over 50,000 producers accounts for up to 97% of its climate footprint.

The meat and dairy industry also advocates for a new emissions metric, GWP*, to replace the global warming potential (GWP) metric currently used for climate emissions accounting. Their proposed metric could enable companies to claim climate neutrality via minimal methane emission reductions, making them look better and weakening calls for urgent methane reductions to limit near-term temperature rise in line with a 1.5 degrees Celsius pathway.

For instance, a company like Tyson might achieve a 30% reduction in emissions by 2030 as measured under the current GWP100 standard (which accounts for emissions impacts over a 100-year timeline). However, the same emissions reduction measured under GWP* might actually be negative, inaccurately implying that their climate mitigation work is done.

This distorting climate metric may exempt large historical methane polluters like Tyson from responsibility for continued methane emissions because it does not consider historical emissions.

Facing the Bull in the Climate Shop: What Should Banks Do?Since industrial livestock production has far-reaching negative impacts beyond greenhouse gas emissions, banks must reconsider how they are financing meat, dairy, and feed corporations. Major banks can take three meaningful steps to meet their climate commitments:

- Halt all new financing that enables the expansion of industrial livestock production.

- Require their clients to set emission-reduction targets aligned with scientific pathways and attach consequences to a lack of progress. Even honest and accurate company reporting would be a good start.

- Address the additional social and environmental harms from industrial livestock production.

Curtailing support for industrial livestock production is a relatively small change for the banks: These agricultural corporations represent just a tiny fraction (0.25%) of the banks’ portfolios. Still, it would mean an enormous improvement in their emissions impact. In other words, taking this step is good for the planet and the public, but the banks win, too.

And the banks must act now before it is too late. As UN Secretary-General António Guterres said in February 2024 in his remarks to the UN Security Council’s open debate on climate change and food insecurity,

“We need massive investment in a just transformation to healthy, equitable, and sustainable food systems. And we need governments, businesses, and society working together to make such systems a reality.”

This article was produced by Earth | Food | Life, a project of the Independent Media Institute.

https://www.laprogressive.com/climate-change/u-s-banks-break-climate-promises

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

- By Gus Leonisky at 19 Aug 2024 - 4:32pm

- Gus Leonisky's blog

- Login or register to post comments

dollar dolor....

https://www.youtube.com/watch?v=AUKfPzmdJh8

PetroYuan Plans?| Saudi Arabia - China Ties Are Expected to Strengthen Crude Oil Trade in Yuan

https://www.youtube.com/watch?v=qaIKeXnX1UM

China VS America | Yanis Varoufakis on Big Tech, Capitalism and Techno-Feudalism (Part 3)

The world-famous economist and former Greek Finance Minister joins Ash Sarkar to argue that capitalism is dead and present a game-changing new paradigm: technofeudalism. The owners of big tech have become the world's feudal overlords—replacing capitalism with a fundamentally new system that enslaves our minds, defies democracy, and rewrites the rules of global power. But as Varoufakis will also reveal, technofeudalism contains new opportunities to thwart and overturn it, bringing into focus more clearly than ever the revolution we need to escape our digital prison. Watch Ash and Yanis open your eyes to the new power that is reshaping our lives and the world Part 1 - "This is not Capitalism Anymore!" Yanis Varoufakis on Technofeudalism, Big and Big Tech

READ FROM TOP

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.