Search

Recent comments

- to death....

21 min 19 sec ago - noise....

28 min 24 sec ago - loser....

3 hours 8 min ago - relatively....

3 hours 30 min ago - eternally....

3 hours 36 min ago - success....

14 hours 4 min ago - seriously....

16 hours 48 min ago - monsters.....

16 hours 55 min ago - people for the people....

17 hours 32 min ago - abusing kids.....

19 hours 5 min ago

Democracy Links

Member's Off-site Blogs

I wish... not really....

Berkshire Hathaway is a gigantic conglomerate that owns a bunch of boring businesses outright and has big stakes in a few arguably less-boring ones. That its annual shareholder meetings have nonetheless became pop-culture spectacles dubbed “Woodstock for Capitalists” can be chalked up in large part to the folksy charm of chairman and chief executive officer Warren Buffett and his long-running buddy act with tart-tongued vice chairman Charles Munger.

That buddy act technically ended with Munger’s death in late November — at “99.9 years,” Buffett said, as Munger had been due to turn 100 on New Year’s Day — but it was still a chief theme of Saturday’s annual meeting in Omaha, Nebraska. The ceremonies began with a movie about the Munger-Buffett partnership, which unlike past such films was broadcast to viewers outside the CHI Health Centre Arena as well as those within. And during the long Q&A that followed, Buffett’s occasional invocations of Munger provided most of the bright spots.

Apart from that, it was hard work: long disquisitions on the workings of utilities, real estate and other industries by vice chairman of non-insurance operations and Buffett heir apparent Greg Abel; shorter ones on a variety of insurance topics by vice chairman of insurance operations Ajit Jain; and rambling remarks on management style, climate change, overseas investing, taxes and other topics by the gravelly voiced Buffett that were at times profound and at times entertaining but suffered from the absence of Munger’s pithy interruptions.

Subtract Buffett, and you have an event that I doubt many people will want to travel to Omaha for or watch on CNBC, and the 93-year-old made clear that he didn’t think he had many more annual meetings to go. “I feel fine,” he said, “but I know a little about actuarial tables, and I shouldn’t be taking on any four-year employment contracts.”

There is, of course, another thing beyond the charms of Buffett and Munger that gave Berkshire shareholders such strong feelings of attachment to the company. Investing in Berkshire over decades made many of them very rich — allowing them to do things like donate $US1 billion ($1.5 billion) to the Albert Einstein College of Medicine in New York to make it tuition-free, which Ruth Gottesman, whose late husband was an early Berkshire investor, did in February and was applauded for at the meeting.

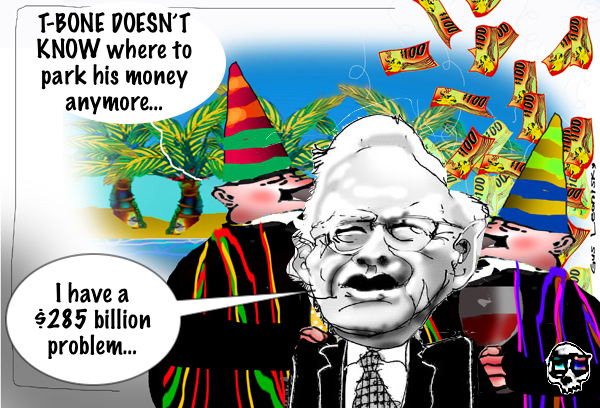

But in his most recent letter to shareholders, released in February, Buffett made clear that he didn’t think such stories would be part of the company’s future, either. “All in all, we have no possibility of eye-popping performance,” he wrote — Berkshire has simply become too big. The company is sitting on a cash pile of around $US189 billion ($285 billion) that Buffett expects to reach $US200 billion by the end of this quarter, but he said that he and his managers don’t see an opportunity to deploy it.

So what is the company good for? From the shareholder letter again: “Berkshire should do a bit better than the average American corporation and, more important, should also operate with materially less risk of permanent loss of capital.” That’s not nothing! It’s just also not really deserving of a cult following. The days of Woodstock for Capitalists are clearly numbered. Does anybody have a replacement in the works?

Bloomberg

Buffett Issues A Truly Bizarre Warning

https://www.youtube.com/watch?v=xWeK-Yj9hYI

-----------

SEE ALSO:

https://www.youtube.com/watch?v=3sp2YWvD1g8

END OF US HEGEMONY: Multipolar World Order, Economic Decline & Failed Sanctions| Prof. Glenn Diesen

- By Gus Leonisky at 12 May 2024 - 5:40am

- Gus Leonisky's blog

- Login or register to post comments

red is black....

https://www.youtube.com/watch?v=5-_zJO-d_k4

spend, spend, spend........ deficient deficit.... Robbing the future....

THE PONZI SCHEME BECOMES MORE AND MORE OBVIOUS...............

READ FROM TOP

FREE JULIAN ASSANGE NOW....

coming apart....

BY Moon of Alabama.

The magazine for and by multi-millionaires and billionaires, The Economist, warns that the end is imminent:

The liberal international order is slowly coming apart – (archived)

Its collapse could be sudden and irreversible

For years the order that has governed the global economy since the second world war has been eroded. Today it is close to collapse. A worrying number of triggers could set off a descent into anarchy, where might is right and war is once again the resort of great powers. Even if it never comes to conflict, the effect on the economy of a breakdown in norms could be fast and brutal.

It is, in my view, true that the ‘liberal international order’, which after World War II largely regulated world trade and politics is in demise.

But who’s fault is that?

The examples The Economist gives to support its central claim point to one culpable nation:

As we report, the disintegration of the old order is visible everywhere. Sanctions are used four times as much as they were during the 1990s; America has recently imposed “secondary” penalties on entities that support Russia’s armies. A subsidy war is under way, as countries seek to copy China’s and America’s vast state backing for green manufacturing. Although the dollar remains dominant and emerging economies are more resilient, global capital flows are starting to fragment, as our special report explains.

The institutions that safeguarded the old system are either already defunct or fast losing credibility. The World Trade Organisation turns 30 next year, but will have spent more than five years in stasis, owing to American neglect. The IMF is gripped by an identity crisis, caught between a green agenda and ensuring financial stability. The un security council is paralysed. And, as we report, supranational courts like the International Court of Justice are increasingly weaponised by warring parties. Last month American politicians including Mitch McConnell, the leader of Republicans in the Senate, threatened the International Criminal Court with sanctions if it issues arrest warrants for the leaders of Israel, which also stands accused of genocide by South Africa at the International Court of Justice.

It is the U.S., the country which arguably benefited the most from the liberal international order, which is actively destroying it.

Others, if they did not attract random U.S. rage and war against them, also saw some benefits from it. Those small to medium countries will most likely lose out should the current regime collapse.

That would not be unprecedented:

Unfortunately, history shows that deeper, more chaotic collapses are possible—and can strike suddenly once the decline sets in. The first world war killed off a golden age of globalisation that many at the time assumed would last for ever. In the early 1930s, following the onset of the Depression and the Smoot-Hawley tariffs, America’s imports collapsed by 40% in just two years. In August 1971 Richard Nixon unexpectedly suspended the convertibility of dollars into gold; only 19 months later, the Bretton Woods system of fixed-exchange rates fell apart.

Similar ruptures, like the examples above again caused by the U.S., may happen soon.

Interestingly the Economist does not name a solution or way to avoid it. It sees a collapse coming, blames -more or less- the U.S. for causing it, but does not point to way out of it.

That is an uncharacteristically pessimistic view for writers who otherwise like to paint a positive picture for those with big money.

https://ronpaulinstitute.org/a-pessimistic-economist-laments-the-end-of-order/

READ FROM TOP

FREE JULIAN ASSANGE NOW....