Search

Democracy Links

Member's Off-site Blogs

Gus Leonisky's blog

fashion parade

TONY Abbott has been caught agreeing with Germaine Greer's nasty comments about Prime Minister Julia Gillard's dress sense.

- By Gus Leonisky at 30 Mar 2012 - 9:39am

- 5 comments

- Read more

tony pops in...

There are a lot of very confused feminists out there right now. Tony Abbott, long seen by the sisterhood as Australia's foremost manifestation that we're all just monkeys in clothing - some more hirsute, and scantily-clad, than others- now wants to help women get back to work after childbirth.

- By Gus Leonisky at 30 Mar 2012 - 8:00am

- Login or register to post comments

- Read more

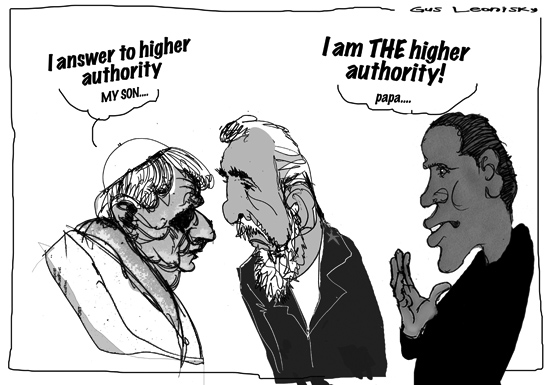

the pope does cuba...

Pope Benedict has slammed America's economic embargo on Cuba, saying it unfairly burdens the Cuban people.

- By Gus Leonisky at 29 Mar 2012 - 1:47pm

- 5 comments

- Read more

turnkey...

Americans often ascribe to economics effects that are in fact caused by politics. Before the Espionage Act, for instance, there were hundreds of radical newspapers, many of them socialist or communist - or just sympathetic to the plight of workers. After the war, most disappeared. That wasn't the result of market forces. The US government went to great pains at great expense to persuade Americans to embrace an approved ideology while it silenced dissidents with old-fashioned censorship. The Masses, along with 70 other radical publications, went out of business, because the US Post Office wouldn't deliver it.

Yet they were the lucky ones.

'A turnkey totalitarian state'

- By Gus Leonisky at 29 Mar 2012 - 8:14am

- 2 comments

- Read more

down and ups about the death penalty...

A report into executions has found capital punishment decreased by a third over the past decade worldwide, but spiked last year in the Middle East and North Africa.

- By Gus Leonisky at 28 Mar 2012 - 4:36pm

- 6 comments

- Read more

warning about warming...

picture by Gus Leonisky

- By Gus Leonisky at 26 Mar 2012 - 8:23pm

- 12 comments

- Read more

the vagaries of democracy...

Queensland is the fourth state in four years to dismiss a Labor government. Those states contain 87 per cent of Australia's population. And the federal Labor government lost its majority in the same span. Could there be a message?

- By Gus Leonisky at 26 Mar 2012 - 7:34pm

- 1 comment

- Read more

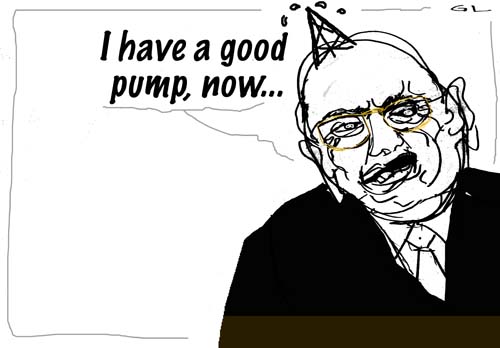

a heart of gold...

Cheney Recovering After Getting a New Heart

By SCOTT SHANE

Former Vice President Dick Cheney had a heart transplant on Saturday after 20 months on a waiting list, and was recovering in a Virginia hospital, a statement from his office said.

Mr. Cheney, 71, who has suffered five heart attacks and was in end-stage heart failure, was recovering in the intensive care unit of Inova Fairfax Hospital in Falls Church, Va.

- By Gus Leonisky at 25 Mar 2012 - 1:38pm

- 1 comment

- Read more

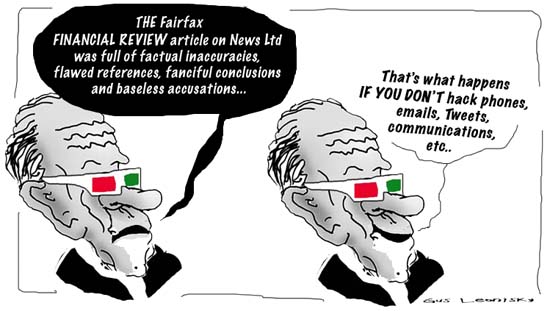

when the poor take the blame..

As for the adversarial media—forget it. This is one of Greenwald’s pet peeves, a theme that pervades his widely read column for Salon as well as this book: the coziness of the mainstream media and the power elite, with the former acting as a journalistic Praetorian Guard for the perks and privileges of the political class.

- By Gus Leonisky at 25 Mar 2012 - 12:38pm

- 6 comments

- Read more

..it happens...

In the race to the bottom, someone comes out on top

- By Gus Leonisky at 24 Mar 2012 - 8:35pm

- 3 comments

- Read more

the ultimate hoodie...

People wearing hooded sweatshirts are often going to be perceived as a menace, Rivera said.

- By Gus Leonisky at 24 Mar 2012 - 1:28pm

- 9 comments

- Read more

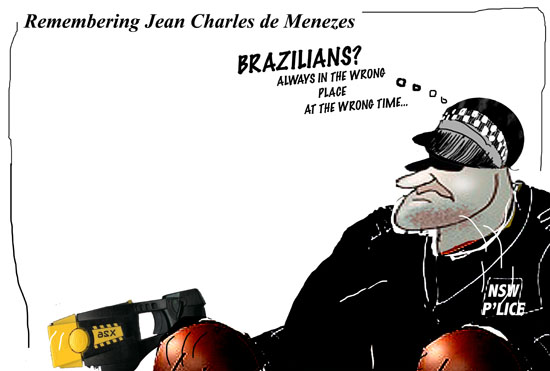

the good, the bad and a packet of biscuits...

Another Taser-related death in Australia has renewed debate about the powerful weapon and whether it is a safe option for police use.

- By Gus Leonisky at 23 Mar 2012 - 12:58pm

- 6 comments

- Read more

golf in rookwood...

A STRUGGLING Sydney golf club with a declining membership is considering joining forces with a cemetery that is overflowing.

- By Gus Leonisky at 23 Mar 2012 - 12:25pm

- 4 comments

- Read more

Recent comments

1 hour 30 min ago

1 hour 42 min ago

4 hours 27 min ago

5 hours 36 min ago

16 hours 3 min ago

16 hours 31 min ago

16 hours 37 min ago

20 hours 41 min ago

20 hours 49 min ago

21 hours 2 min ago