Search

Recent comments

- losses....

43 min 53 sec ago - board of war....

2 hours 6 min ago - help...

3 hours 48 min ago - APOLOGY....

4 hours 26 min ago - humanoids....

6 hours 27 min ago - refugees....

8 hours 26 min ago - tonight....

8 hours 37 min ago - 10 days?....

8 hours 47 min ago - MI6 parrot.....

9 hours 40 min ago - not sorry....

10 hours 5 min ago

Democracy Links

Member's Off-site Blogs

schonkie enterprises .....

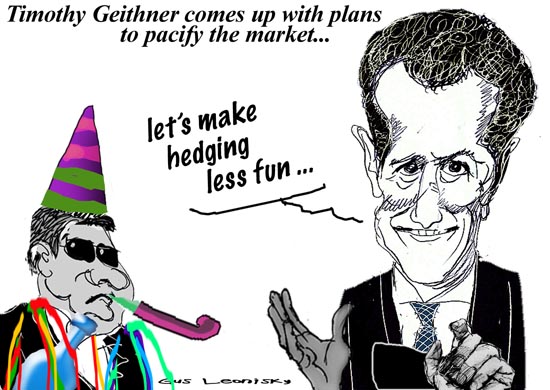

Geithner plans to make the case for the regulatory reform agenda in testimony before Congress this morning, and he is expected to introduce proposals to regulate the largest financial firms. In coming months, the administration plans to detail its strategy in three other areas: protecting consumers, eliminating flaws in existing regulations and enhancing international coordination.

http://www.washingtonpost.com/wp-dyn/content/article/2009/03/25/AR2009032502311_pf.html

outside the tent with the rest of us ….There's nothing like a grandstanding member of Congress to deflect attention from the real issues at hand by throwing a few juicy bones to the masses.

Most legislators at a House Finance subcommittee hearing last week deftly avoided the real story of AIG's collapse. Instead, they homed in on the public relations disaster of hundreds of top AIG officials and staff getting $165 million (later revealed as over $218 million) in bonuses.The key issue ignored by the congressmen and women was the potential catastrophe represented by as much as $2.7 trillion in AIG derivative contracts and how AIG and the U.S. government are dealing with them. To put that number in context, we've so far provided the company only about $170 billion.

An exception at the hearing was Rep. Joe Donnelly, D-Ind., who declared that "naked credit default swaps" were little more than "gambling ... dreamed up" by Wall Street to create additional profits, and he suggested that instead of being bailed out, "when the casino goes bust, the guys who are gambling close shop." meanwhile …..from Crikey …..

The AIG bonus scandal's strange twistAdam Schwab writes:

The AIG bonus scandal has taken a strange twist, with a former vice-president of AIG's notorious Financial Products Division resigning, and writing a letter to the New York Times strongly criticising AIG chief, Edward Liddy and the US Congress, which devised what appears to be an un-constitutional, retrospective bonus claw-back.Jake DeSantis was, until recently, an executive in the commodity and equity division of AIG. DeSantis was not involved with, nor was he responsible for the credit default transactions which crippled the insurer. In a letter to the OpEd section of the New York Times, DeSantis stated that:

After 12 months of hard work dismantling the company - during which A.I.G. reassured us many times we would be rewarded in March 2009 - we in the financial products unit have been betrayed by A.I.G. and are being unfairly persecuted by elected officials. In response to this, I will now leave the company and donate my entire post-tax retention payment to those suffering from the global economic downturn. My intent is to keep none of the money myself.I take this action after 11 years of dedicated, honorable service to A.I.G. I can no longer effectively perform my duties in this dysfunctional environment, nor am I being paid to do so. Like you, I was asked to work for an annual salary of $1, and I agreed out of a sense of duty to the company and to the public officials who have come to its aid. Having now been let down by both, I can no longer justify spending 10, 12, 14 hours a day away from my family for the benefit of those who have let me down.

In a sense, DeSantis and other AIG executives seem to have a fair grievance. For instance, Congress did not devise a knee-law law after Merrill Lynch traders, who destroyed billions of dollars of wealth, received $4 billion in bonuses days before the firm was taken over by Bank of America, necessitating a further government bail-out. Nor did any elected officials call for Merrill Lynch executives to commit suicide.Bloomberg columnist, Ann Woolner, noted AIG bonus payments, while in poor taste, were contractually agreed to well prior to their payment. Woolner opined:

If the contracts are as airtight as those who have read them say, breaking them would invite a series of lawsuits the government would surely lose. Why is that a good idea?

Yes, the government could pour taxpayer money into a bottomless pit of legal fees. But in the end it would still have to honor the bonuses. And you could expect the employees to come after the government for their legal fees, too.That's the tangible loss to the government. It would also signal that the government's contracts, its very word, can't be trusted.

Of course, it is also reasonable to argue that without a US$170 billion taxpayer funded bail-out, AIG wouldn’t be paying any bonuses as all. But that doesn't change the fact that innocent, hard-working employees, who had as little to do with AIG's missteps, are being punished for the deeds of others. As DeSantis observed, "many of the employees have, in the past six months, turned down job offers from more stable employers, based on A.I.G.'s assurances that the contracts would be honored. They are now angry about having been misled by A.I.G.'s promises and are not inclined to return the money as a favor to you."The total value of the controversial payments to Financial Product employees was around US$165 million. The vast majority of the taxpayer monies which were provided to AIG found their way into the hands of the insurer's (largely foreign) counterparties, firms like Goldman Sachs, Deutsche Bank and Société Générale SA (who collected US$6 billion).

As Bill Bonner percipiently noted, the bonus issue was a mere sideshow to the main game - which was the dishing out of tens of billion of taxpayer funded dollars to banks. As Bonner noted, "under pressure from its new proprietor - the U.S. government - AIG released a list showing who had gotten more than $100 billion of its bailout money. At the top of the list of recipients was a familiar name - Goldman Sachs. In a truly astonishing co-incidence, Goldman is the firm that had been run by the very person who headed up the AIG rescue - former Treasury Secretary Hank Paulson. And what serendipity! Lloyd Blankfein - Goldman's top man now - was actually in the room with the feds when the AIG rescue plan was put together."The payment of bonuses to employees in a taxpayer rescued enterprise is in bad taste - but it certainly isn't the worst use of taxpayer dollars witnessed in the past year.

- By Gus Leonisky at 26 Mar 2009 - 10:06pm

- Gus Leonisky's blog

- Login or register to post comments

back at the automatic teller machine .....

The political firestorm over the $165 million bonuses to executives at the failed American International Group (A.I.G.) that ripped through Washington, DC, in mid-March could be reignited by further attention on failing financial companies who were given taxpayer dollars then turned around and spent the cash on bonuses.

Anger over the bonuses at A.I.G. blew back onto members of the Obama administration as it was revealed that Treasury Secretary Tim Geithner and others had been aware of the bonus payments but failed to halt them and did not express "outrage," until the bonus checks were already cashed.Further revelations of backroom dealings and million-dollar bonuses threaten to make any kind of assistance to financial institutions politically impossible for Congress.

A larger and potentially far more explosive powder keg of bonus payments - this time to top executives at now defunct Merrill Lynch & Co. Inc. - may be about to blow.Dennis Kucinich sent out a round of letters to top Treasury officials Monday morning, questioning how much they knew about bonuses paid to Merrill Lynch executives that totaled $3.62 billion, nearly 22 times the total bonuses paid to AIG executives. The payouts made up more that 36 percent of the TARP funds the financial institution received from the Federal government.

Kucinich points out that unlike AIG, the bonuses were not locked in by preexisting contracts and were performance bonuses, as opposed to retention bonuses.The Merrill bonuses were 22 times larger than those paid by AIG ($3,620 million versus $165 million). They were also very large relative to the TARP monies allocated to Merrill. The Merrill bonuses were the equivalent of 36.2% of TARP monies Treasury allocated to Merrill and awarded to BOA after their merger.

The bonuses, awarded mostly as cash, were made only to top management at Merrill. To be eligible for the bonuses, Merrill employees had to have a salary of at least $300,000 and attained the title of Vice President or higher.http://www.alternet.org/workplace/134235/merrill_lynch_bonuses_were_22_times_the_size_of_aig%27s/

Large number of corporations

Large number of corporations went on government bailout during recession and the government spent billions for them. There are some reports that something’s wrong in the funding system of the nation as the controversy emerge about the large firms that received TARP funding. American people were angry when they found it out on the news because these three big firms received large government bailouts.