Search

Democracy Links

Member's Off-site Blogs

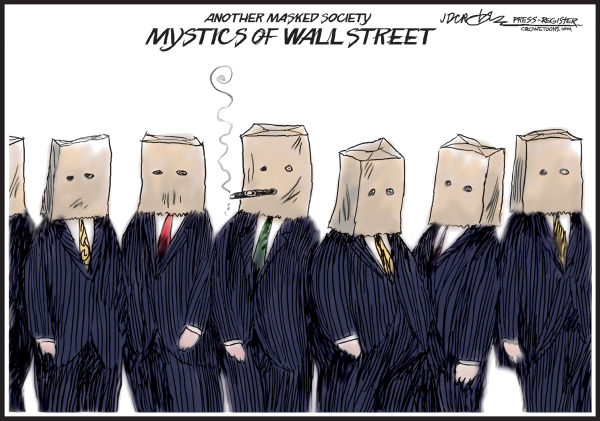

a new era of transparency & accountability .....

Members of Congress are scoring political points tongue-lashing Wall Street for its role in the economic meltdown, but they are proving less willing to put their campaign money where their mouths are.

The list of 400 companies that have taken advantage of the $700 billion bailout package includes some of the biggest donors in politics: Goldman Sachs, Citigroup, JPMorgan and Morgan Stanley, among others.Altogether, TARP recipients doled out $5.2 million to members of the Senate Banking and House Financial Services committees in the 2008 election cycle, according to the Center for Responsive Politics.

Bank lobbyists were working through Ellen Tauscher and the New Democrat Coalition, in conjunction with the Blue Dogs, tried to kill the bill that would allow bankruptcy judges to write down mortgages, cutting foreclosures by 20% at no cost to taxpayers.Thanks to a big public outcry, the New Dems backed down and the bill passed the House. A bankruptcy judge in Kansas speaks today about how important it is going to be that it pass the Senate and that judges be given the powers that they need to help deal with an unmanageable crisis

But the fact that bank lobbyists continue to have so much control over our laws is, at this point, obscene. It's equally absurd that the Fed refuses to answer questions posed by members of Congress demanding to know where all the bailout money has gone.

http://www.alternet.org/blogs/peek/130913/bank_lobby_still_getting_a_lot_of_bang_for_their_bucks/meanwhile …..

Stanford L. Kurland was a name familiar to few outside the banking industry until he was nominated as 'Creep of the Week'. Now he stands to test the new media's powers to pillory people in the market place, not to mention the limits of tolerance of the beggared American consumer.You could say he's brilliant. Anybody still holding a job on Wall Street probably does. But rarely has an obscure name aired in a news story set such a firestorm of rage. A week ago, a Google of his name came up with a few dry reports on the progress of the company of which he was President. Now it triggers an avalanche of blog-born outrage which has spread across the web.

This, in a nutshell, is Stanford Kurland's excellent adventure: as President of Countrywide Financial, until the meltdown of America's largest domestic mortgage lender, he invented and peddled the sub-prime mortgage; he bailed out in time to cash a personal $200 million-worth of shares; now he is buying back these same toxic mortgages for pennies on the dollar, and making millions all over again.- By John Richardson at 11 Mar 2009 - 9:59pm

- John Richardson's blog

- Login or register to post comments

Recent comments

52 min 18 sec ago

1 hour 7 min ago

1 hour 55 min ago

4 hours 9 min ago

3 hours 4 min ago

5 hours 50 min ago

7 hours 59 min ago

9 hours 26 min ago

23 hours 43 min ago

23 hours 41 min ago