Search

Recent comments

- nukes?...

1 hour 30 min ago - rape....

2 hours 8 min ago - devastation.....

4 hours 20 min ago - bibi's dream....

6 hours 9 min ago - thus war....

10 hours 21 min ago - trump's gift....

11 hours 38 min ago - friendly fire....

11 hours 43 min ago - energy vs energy....

22 hours 29 min ago - killing kids....

1 day 1 hour ago - the die is cast....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

in search of optimism .....

The four most dangerous words for investors are: This time is different.

In 1999, technology companies with no earnings or sales were valued at billions of dollars. But this time was different, investors told themselves. The Internet could not be missed at any price.

They were wrong. In 2000 and 2001 technology stocks plunged, erasing trillions of dollars in wealth.

Now investors have again convinced themselves that this time is different, that the credit crisis will push economies worldwide into the deepest recession since the Depression.

Fear runs even deeper today than greed did a decade ago.

But in their panic, investors are ignoring 60 years of history. Since the Depression, governments have become far more aggressive about intervening when credit markets seize up or economies struggle. And those interventions have generally succeeded. The recessions since World War II, while hardly easy, have been far less painful than the Depression.

Now some veteran investors, including G. Kenneth Heebner, a mutual fund manager who has one of the best long-term track records on Wall Street, say that the sell-off has gone much too far and stocks are poised to rally powerfully if the downturn is less severe than investors fear.

“The fact is, there are a lot of tremendous bargains out there,” said Mr. Heebner, who manages about $10 billion in several mutual funds. Indeed, by many measures stocks are as cheap as they have been in the last 25 years.- By Gus Leonisky at 12 Oct 2008 - 10:12pm

- Gus Leonisky's blog

- Login or register to post comments

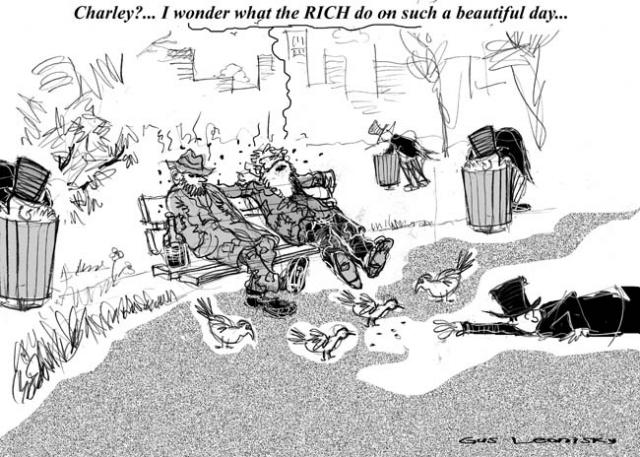

looking in the trash...

There are predictions of market gains as bargain hunters move in at the start of trade on the Australian stockmarket today.

Commsec chief economist Craig James says the futures market is pointing to a gain of 26 or 27 points after last Friday saw the biggest drop in the sharemarket since 1987.

Mr James says it is a good day for bargain hunter investors, with fire sale prices on offer.

"Investors who are embracing the sharemarket at the moment, they may not get in at the total bottom but we believe we're pretty close to the bottom and that shares are trading very very cheaply, the cheapest in around about 24 years," he said.

insiders...

trimming the hedges...

Hedge Funds’ Steep Fall Sends Investors Fleeing

By LOUISE STORYThe gilded age of hedge funds is losing its luster. The funds, pools of fast money that defined the era of Wall Street hyper-wealth, are in the throes of an unprecedented shakeout. Even some industry stars are falling back to earth.

This unregulated, at times volatile corner of finance — which is supposed to make money in bull and bear markets — lost $180 billion during the last three months. Investors, particularly wealthy individuals, are heading for the exits.

As the stock market plunged again on Wednesday, with the Dow Jones industrial average sinking 514 points, or 5.7 percent, the travails of the $1.7 trillion hedge fund industry loomed large. Some funds dumped stocks in September as their investors fled, and other funds could follow suit, contributing to the market plummet.

No one knows how much more hedge funds might have to sell to meet a rush of redemptions. But as the industry’s woes deepen, money managers fear hundreds or even thousands of funds could be driven out of business.

The implications stretch far beyond Manhattan and Greenwich, Conn., those moneyed redoubts of hedge-fund lords. That is because hedge funds are not just for the rich anymore. In recent years, public pension funds, foundations and endowments poured billions of dollars into these private partnerships. Now, in the midst of one of the deepest bear markets in generations, many of those investments are souring.

Granted, hedge funds are not going to disappear. In fact, some are still thriving. Even many of the ones that have stumbled this year are doing better than the mutual fund industry, which has also been hit with withdrawals that have forced their managers to sell.

But the reversal for the hedge fund industry represents a sea change for Wall Street and its money culture. Since hedge funds burst onto the scene in the 1990s, they have recast not only the rules of finance but also notions of wealth and status. Hedge-fund riches helped inflate the price of everything from modern art to Manhattan real estate. Top managers raked in billions of dollars a year, and managing a fund became the running dream on Wall Street.

Now, for lesser lights, at least, that dream is fading.

see toon at top...

not only the stock market....

Sparrow numbers 'plummet by 68%'

The population of house sparrows in Britain has fallen by 68% in the past three decades, according to the RSPB.

A report by the charity said the paving over of front gardens and removal of trees had caused a big decline in insects which the birds eat.

It suggests that sparrows are now disappearing altogether from cities such as London, Bristol and Edinburgh.

Dr Will Peach, from the RSPB, said many gardens had become "no-go areas for once-common British birds".

Starving chicks

Scientists from the RSPB joined forces with De Montfort University and Natural England to investigate the decline of the house sparrow.

They studied numbers in Leicester over a three-year period and found that they fell by nearly a third.

Dr Peach said every pair of house sparrows must raise at least five chicks a year to maintain the population, but many were starving to death in their nests or were too weak to live long after fledging.

---------------------

Are we getting so low as to destroy other species' right to exist? see toon at top, especially the fellow trying to steal the bread crumbs from the birds: it's an allegory on what we're doing bad....

bring on the bulldozers...

US environmentalists have accused President George W Bush of trying to rush through changes to the Endangered Species Act in his last days in office.

They say the changes could take away protection for animals and plants facing possible extinction.

The Bush administration wants to make it easier for drilling, mining and major construction projects to go ahead without a full scientific assessment.

Under current rules, the impact of such projects must be assessed by experts.

The changes proposed by the Bush administration would let federal agencies make the decisions without a full scientific assessment as to the likely impact on the environment.

Mr Bush has already been criticised by environmentalists for adding fewer than 10 species of plant and animals a year to the endangered list.

That contrasts with former President Bill Clinton, who added an average of 65 species a year.

-------------------------------

Bushit: "exterminate, exterminate the earth... "

a disturbing trend...

Record number of Americans using food stamps: report

By Roberta Rampton

WASHINGTON (Reuters) - Food stamps, the main U.S. antihunger program which helps the needy buy food, set a record in September as more than 31.5 million Americans used the program -- up 17 percent from a year ago, according to government data.

The number of people using food stamps in September surpassed the previous peak of 29.85 million seen in November 2005 when victims of hurricanes Katrina, Rita and Wilma received emergency benefits, said Jean Daniel of the USDA's Food and Nutrition Service.

September's tally -- the latest month available -- was also boosted by hurricane and flood aid, Daniel said on Wednesday.

But anti-hunger groups said the economic downturn is the main reason behind the higher figures.

"It's a disturbing trend," said Ellen Vollinger, legal director with the Food Research and Action Center. She said she expects more people will turn to food stamps as unemployment figures rise and the economy remains weak.

One in 10 Americans were participating in the food stamp program as of September, said Dottie Rosenbaum, analyst with Center on Budget and Policy Priorities, a think tank.

read more at reuters and see toon at top...