Search

Recent comments

- new dump....

10 hours 46 min ago - incoming disaster....

10 hours 54 min ago - olympolitics.....

10 hours 59 min ago - devil and devil....

14 hours 37 min ago - bully don.....

18 hours 33 min ago - impeached?....

23 hours 20 min ago - 100.....

1 day 7 hours ago - epibatidine....

1 day 13 hours ago - cryptohubs...

1 day 14 hours ago - jackboots....

1 day 14 hours ago

Democracy Links

Member's Off-site Blogs

wall speak .....

Myriad cultural historians have noted the American belief that success is a sign of God's favour.

Over the past couple of decades, He has had a downright love-fest with the already-rich - so much so that the richest 400 Americans now have more money stashed away than the combined bottom 150 million Americans. Some $1.6 trillion.

This was accomplished by selling off or shipping out every available asset, from jobs to seaports, smashing usury and anti-monopoly laws, raiding the public coffers and manipulating the medium of exchange and blackmailing the peasantry regarding common needs such as health care and energy to keep their asses warm, to name a few. The ultimate coup was to convince the entire nation that the well-being of the rich, meaning the well-being of Wall Street, was indeed the common man's well-being.

All went well for a while. People went into credit card hock up to their noses in order to provide 26 percent credit card interest to Wall Street, etc. And when that became untenable, flimsy mortgages were cranked out by the millions, ensuring that every American who could hold a crayon could sign to purchase a home.

To facilitate this, all sorts of shaky "mortgage instruments" were created - balloon (sign here Jeeter, you're gonna flip it in a year and make a hundred K on this house trailer), interest only, and finally, negative-balance mortgages where you only paid part of the interest and the rest was rolled back into the principal balance. And joy of joys, you could refinance a couple of times while the inflated value of these houses was on the way up. Life was good for everybody.

The bill was never gonna come due because God, in His wisdom, had deemed that capitalism would defy the second law of thermodynamics and expand forever. So every time a bank made a mortgage loan of say, $400,000, even though the debtor hadn't even made a payment yet, the loan was declared a bank asset and another $400,000 was loaned against it.

Meanwhile, the Federal Reserve Bank yelled whoopee and printed another $800,000 in currency.

Of course, at some point the country had to run out of customers, so the loans got easier and easier. No matter that debt is not wealth. Wink and call it that, and most folks won't even look up from their new big-screen high-resolution digital TVs.- By Gus Leonisky at 3 Oct 2008 - 11:46pm

- Gus Leonisky's blog

- Login or register to post comments

"additional pressure"...

A.I.G. Uses $61 Billion of Fed Loan

By MARY WILLIAMS WALSH

Published: October 3, 2008

The American International Group said on Friday that it had already drawn down $61 billion of the $85 billion emergency bridge loan it received from the Federal Reserve two weeks ago, an announcement that startled credit ratings agencies.

The emergency loan was supposed to buy the company time to sell its troubled assets in an orderly manner. But the sell-off has not yet begun, and now the insurer faces the additional pressure of trying to sell the businesses at a time when potential buyers are having trouble borrowing money.

Moody’s downgraded A.I.G.’s senior unsecured debt on Friday and said it might downgrade other types of the company’s debt, which could make it more expensive for A.I.G. to borrow money and do business.

------------------------

Gus: when talking to people in the know, the damage to banks could go as high as 10 trillion bux... The capital system has been cooked by greed to magnitude never imagined.

sailing parable...

Getting the American economy back on solid ground will require new financial regulations. Goldman Sachs alums aren’t the men for the job.

By Eamonn FingletonAs bewildered Americans survey the wreckage of their nation’s once vaunted financial system, they could do worse than reacquaint themselves with one of Wall Street’s oldest and most revealing parables.

The story goes that an out-of-town customer dropped by to talk to his broker and afterwards was ushered around Lower Manhattan’s yacht-filled docks.

“Here is Mr. Morgan’s yacht,” his guide pointed out. “This is Mr. Bache’s, and over there is Mr. Drexel’s.”

“Where are the customers’ yachts?” the visitor naïvely asked.

The story is at least a century old and its punch line long ago figured as the title of a hilarious tell-all book by a Wall Street insider. But if we substitute executive jets for yachts, the message remains as true today as ever: Wall Street is run for the benefit of Wall Street.

read more at the American Conservative and see toon at top...

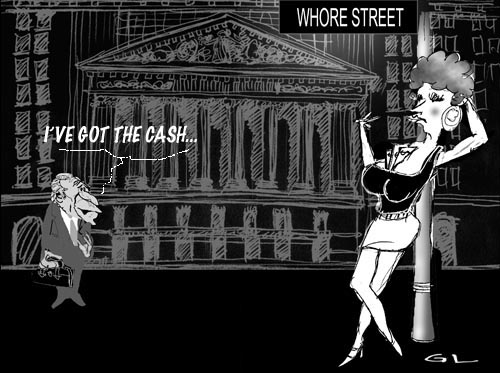

high class pro...

Wall Street's Comeback as the Place Americans Love to Hate

By Steve Fraser

Wall Street sits at the eye of a political hurricane. Its enemies converge from every point on the compass. What a stunning turn of events.

For well more than half a century Wall Street has enjoyed a remarkable political immunity, but matters were not always like that. Now, with history marching forward in seven league boots, we are about to revisit a time when the Street functioned as the country's lightning rod, attracting its deepest animosities and most passionate desires for economic justice and democracy.

For the better part of a century, from the 1870s through the tumultuous years of the Great Depression and the New Deal, the specter of Wall Street haunted the popular political imagination. For Populists it was the "Great Satan," its stranglehold over the country's credit system being held responsible for driving the family farmer to the edge of extinction and beyond.

--------------

see toon at top...