Search

Recent comments

- saint rube....

44 min 55 sec ago - patience....

2 hours 53 min ago - pretending....

4 hours 20 min ago - stenography.....

18 hours 37 min ago - black....

18 hours 35 min ago - concessions.....

19 hours 37 min ago - starmerring....

23 hours 42 min ago - unreal estates....

1 day 3 hours ago - nuke tests....

1 day 3 hours ago - negotiations....

1 day 3 hours ago

Democracy Links

Member's Off-site Blogs

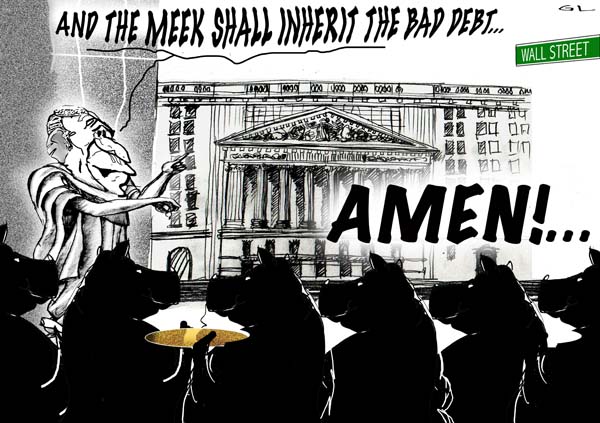

gimme that old time religion .....

The bailout doesn't smell right to the people of Manassas Park, where the foreclosure signs are as common as azaleas. They know all about bad debt here.

This is a terrain of oversize dreams, misjudgement, financial calamity - and empty houses. "Foreclosure. Foreclosure. Foreclosure," said Ed Merkle, 58, as he pointed to the "for sale" signs lining his street.

But Merkle, a defense contractor, said he has lived within his means in an era of easy credit. He didn't take on a huge loan even when his bank encouraged him to dream bigger.

"I've been financially responsible with my own money. Why should I now be responsible for the fact that you were not?" he said.

This may be a Main Street bailout backlash in the making. The details of the financial crisis are still hard for most people to follow - what with talk of exotic "derivatives" known as "credit-default swaps" and so on - but the central fact of the matter hasn't been lost on anyone in this Northern Virginia community: The taxpayers are on the hook for the bad judgment of others.

A Sense Of Resentment Amid The 'For Sales' Signs

meanwhile, old habits die hard …..

Stocks fell sharply and oil prices suddenly spiked on Monday as investors anxiously waited for Washington lawmakers to hash out the details of the biggest government bailout in history - a politically fraught process that will create a new slate of winners and losers on Wall Street.

That uncertainty, about a shaken financial system still in flux, appeared to spook investors away from assets tied directly to the health of the American government. The dollar dropped sharply against the euro, and oil prices jumped, closing up more than $16 a barrel.

The Dow Jones industrials closed down 372 points after spending the day deep in negative territory. The broader Standard & Poor’s 500-stock index finished down 3.8 percent.

“What can I say? Every market is just out of control right now,” said Tom Bentz, an energy analyst at BNP Paribas. Analysts had trouble finding reasons for the sudden $25 rise in the price of oil, which rocketed up to more than $130 a barrel, just days after falling below the century mark.- By Gus Leonisky at 23 Sep 2008 - 10:05pm

- Gus Leonisky's blog

- Login or register to post comments

hard sell

September 24, 2008

Buyout Plan for Wall Street Is a Hard Sell on Capitol Hill

By MARK LANDLER and STEVEN LEE MYERS

WASHINGTON — Treasury Secretary Henry M. Paulson Jr. received an angry and skeptical reception on Tuesday when he appeared before the Senate Banking Committee to ask Congress to promptly give him wide authority to rescue the nation’s financial system.

Mr. Paulson urged lawmakers “to enact this bill quickly and cleanly, and avoid slowing it down with other provisions that are unrelated or don’t have broad support.”

The Federal Reserve chairman, Ben S. Bernanke, who appeared with Mr. Paulson, said the financial system “continues to be very unpredictable, and very worrisome,” and that inaction could lead to a recession.

But after hours of back-and-forth, the committee’s leaders said explicitly what had seemed clear all day: that they rejected the administration’s plan. “What they have sent us is not acceptable,” the committee chairman, Senator Christopher J. Dodd, Democrat of Connecticut, told The Associated Press.

The panel’s ranking Republican agreed. “We have to look at some alternatives,” Senator Richard C. Shelby of Alabama told The A.P.

One after another throughout the session, senators from both parties said that, while they were prepared to move fast, they were far from ready to give the administration everything it wanted in its proposed $700 billion plan to buy up and hopefully resell troubled mortgage-backed securities.

--------------------

Why is the rescue such a hard sell:

Some Conservatives see the rescue plan as turning capitalism into "socialism"...

Some Democrats believe the rescue plan is not tough enough on the people responsible for the problem...

Some Liberals (US) think that "free market" forces would solve the problem anyway without having to fork out 700 billions or more for it...

And Gus believes that at the moment the rescue package is geared to keep the rich rich — despite the rich having profited from dubious manipulation of the market — but the package is also designed to make the "average poor" pay for it — with the intent of making the poor "not to get poorer"... That's the conundrum...

Package... and average Joe Blow pays for the sins of the upper crust...

No package... and banks could collapse. The first thing that would to evaporate is our superannuation (or what's left of it) that was used as collateral for the rich to play horsies...

Should the system "collapse", the "average poor" like you and me would have no option but to go in the street and storm Capitol Hill in a massive revolution.

Cuba, don't move! Here we come!

murdochodrum...

News Corporation chief executive Rupert Murdoch says the US has no option but to pour money into salvaging the battered US financial system, though he's opposed to the bailout in principle.

Mr Murdoch was speaking to the ABC in New York as he made his way to the Australian Consul General's residence for a meeting with Prime Minister Kevin Rudd.

Asked how much trouble the US was in, Mr Murdoch signalled concern for the US economy, despite the US government's $US700 billion package to buy out the so-called toxic debt of failing financial institutions.

"We'll see. If they can get this thing through this week and hurry up about it, I think we'll be OK. But we're in for a hard time," Mr Murdoch said.

robbers and strippers

Rowan Williams calls for tighter regulation as John Sentamu criticises short-selling and 'asset strippers'

The Church of England's two most senior clerics have launched a scathing attack on the financial industry, calling the bankers and speculators behind the credit crisis "bank robbers" and "asset strippers".

Dr Rowan Williams, the Archbishop of Canterbury, demanded tighter regulation of the industry and said it was out of touch with reality.

Williams added that Karl Marx had been right in his assessment of the nature of capitalism.