Search

Recent comments

- humanoids....

2 min 55 sec ago - refugees....

1 hour 44 min ago - tonight....

1 hour 54 min ago - 10 days?....

2 hours 4 min ago - MI6 parrot.....

2 hours 58 min ago - not sorry....

3 hours 23 min ago - trump's law.....

3 hours 30 min ago - confiscation....

4 hours 34 min ago - mocking....

5 hours 40 min ago - never met....

6 hours 39 min ago

Democracy Links

Member's Off-site Blogs

good night & good luck .....

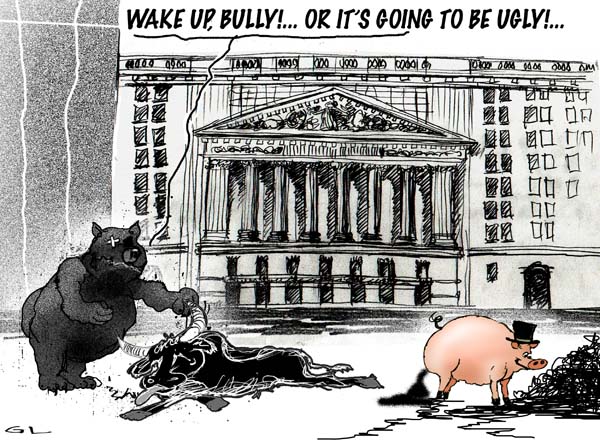

The Australian share market is experiencing its biggest one-day fall since the September 11 terrorist attacks in 2001.

Local stocks have plunged 6.4 per cent, after heavy losses on Asian and European markets overnight.

Wall Street was closed for a public holiday, but it is expected to follow suit tonight.

The local share market has lost more than 20 per cent since its November peak.- By Gus Leonisky at 22 Jan 2008 - 8:11pm

- Gus Leonisky's blog

- Login or register to post comments

A shot in the arm...

from the NYT

Fed Cuts Rate 0.75% and Stocks Swing

By MICHAEL M. GRYNBAUM and JOHN HOLUSHA

Published: January 22, 2008

The Federal Reserve, responding to an international stock sell-off and fears about a possible United States recession, cut its benchmark interest rate by three-quarters of a percentage point on Tuesday, an aggressive move that came ahead of a regularly scheduled meeting of the central bank.

The Fed’s policy-making group, known as the Federal Open Market Committee, lowered its target for the federal funds rate, which regulates overnight loans between banks, to 3.5 percent, from 4.25 percent.

The surprise move, unusual in both its scale and its timing, underscored the severity of the current strains facing the economy.

“It’s a once-in-a-generation event,” said Mark Zandi, chief economist at Moody’s Economy.com. In recent years, the Fed has rarely acted between scheduled meetings of the committee, and almost always in increments of one-quarter or one-half point. It was the biggest single cut since October 1984.

Mission accomplished?...

Creators of Credit Crisis Revel in Las Vegas

Barbara P. Fernandez for The New York Times

By VIKAS BAJAJ

Published: February 8, 2008

LAS VEGAS — It was Monday night on the Strip, and John Devaney was giving a party for himself and fellow connoisseurs of risk who have seen their hot hands go cold.

In a gilded ballroom at the Venetian, the revelers sipped cabernet, dined on surf and turf and crowed as the Blue Man Group put on a private show.

The partygoers had traveled to Sin City this week — Mr. Devaney by chartered jet — for an event that before the current credit squeeze might have been called the Predators’ Ball of this era.

This time, with mortgage securities replacing the junk bonds of the 1980s, the gathering felt more like group therapy.

The occasion was, officially, the 5th annual conference of the American Securitization Forum, a celebration of the financial wizardry that supposedly turns risky mortgages and other loans into gilt-edged securities but, as Mr. Devaney belatedly discovered, does not always make them safe. Mr. Devaney, a 37-year-old money manager, lost big on bond investments last year. This week, in Las Vegas fashion, he said he was doubling down.

The four-day event at the Venetian drew more than 6,500 financial professionals from across the country. Many came in search of ways to ride out — or better yet, to profit from — the mortgage mess their industry helped to create.

Wall Street banks played a crucial role in the mortgage crisis by buying home loans and bundling them into securities. Regulators are examining whether investment banks and mortgage lenders hid the risks of subprime debt from investors.

------------------

Gus: the Subprime debt crisis is not worth more than 120 billions in the US. But the way these acrobats structured the deals makes it now approach 1 trillion dollars and counting. This kind of money does not evaporate... Sure some money bits were fictitiously inflated but at least half of it has been cashed in dineros: Someone somewhere collected an amazing loot...

And the US government is re-priming the pump of the economy while the hose is still leaking.

And the little people who basically got robbed blind with their mortgages are getting NOTHING. Brilliant! More money to leak in the grand tricksters buckets...

Mishun accumplished, my friends, in Las Vegas? Too greedy?...

home bittersweet mortgage...

The credit crisis is no longer just a subprime mortgage problem.

As home prices fall and banks tighten lending standards, people with good, or prime, credit histories are falling behind on their payments for home loans, auto loans and credit cards at a quickening pace, according to industry data and economists.

The rise in prime delinquencies, while less severe than the one in the subprime market, nonetheless poses a threat to the battered housing market and weakening economy, which some specialists say is in a recession or headed for one.

--------------

Gus: see toon at top...

machotestos market...

Does a macho culture cause problems?

Hormone surges among City traders could be partly responsible for driving "boom and bust" economics, say researchers.

A Cambridge University team found testosterone levels were directly linked to the profit they made.

The Proceedings of the National Academy of Sciences study also found levels of the stress hormone cortisol could affect the risks they took.

A psychologist who works with investment bankers said it may help explain seemingly irrational behaviour.

easy repayments in another lifetime...

Consumers Feel the Next Crisis: Credit Cards

By ERIC DASHFirst came the mortgage crisis. Now comes the credit card crisis.

After years of flooding Americans with credit card offers and sky-high credit lines, lenders are sharply curtailing both, just as an eroding economy squeezes consumers.

The pullback is affecting even creditworthy consumers and threatens an already beleaguered banking industry with another wave of heavy losses after an era in which it reaped near record gains from the business of easy credit that it helped create.

Lenders wrote off an estimated $21 billion in bad credit card loans in the first half of 2008 as more borrowers defaulted on their payments. With companies laying off tens of thousands of workers, the industry stands to lose at least another $55 billion over the next year and a half, analysts say. Currently, the total losses amount to 5.5 percent of credit card debt outstanding, and could surpass the 7.9 percent level reached after the technology bubble burst in 2001.

“If unemployment continues to increase, credit card net charge-offs could exceed historical norms,” Gary L. Crittenden, Citigroup’s chief financial officer, said.

--------------------------

is he talking about historical perfect storm? see toon everwhere...