Search

Recent comments

- unhinged....

1 hour 11 min ago - nasty frog....

1 hour 21 min ago - words....

1 hour 29 min ago - The Seth Rich Question 15

1 hour 55 min ago - very serious....

2 hours 7 min ago - propaganda....

2 hours 12 min ago - grab....

5 hours 42 min ago - enlightenment....

6 hours 53 min ago - victory....

6 hours 58 min ago - unrest....

7 hours 57 min ago

Democracy Links

Member's Off-site Blogs

perfect storm .....

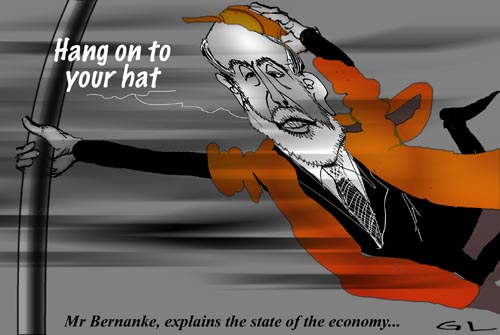

The credit crisis has created the most challenging economic and monetary policy environment in recent memory, the chairman of the US Federal Reserve has admitted.

Ben Bernanke presented a downbeat assessment of the economic effects of the unfolding crisis when he addressed the US central bank's annual symposium in Jackson Hole, Wyoming, yesterday.

And he warned Wall Street not to expect the Fed to continually come to its rescue, as it had to when the investment bank Bear Stearns teetered on the brink of collapse in March. Mr Bernanke called for sweeping new powers for the Fed to counter risks to the financial system, plus new regulations to tame the world of derivatives trading, whose opacity has contributed to a climate of fear and uncertainty since the credit crisis exploded a little over a year ago.- By Gus Leonisky at 24 Aug 2008 - 1:07am

- Gus Leonisky's blog

- Login or register to post comments

As the storm blows

Bob Ellis writes:

Unfettered private enterprise can bring on a world depression and elective government has a reason not to. Unfettered private enterprise pays trillions for television commercials and elective government, these days, doesn't dare to. Unfettered private enterprise doesn't mind killing people, as when it sells them cigarettes, fast cars, and supersize cheeseburgers, and elective government doesn't dare to. Unfettered private enterprise can evict six million Americans from their houses - a convenient figure, an economic Holocaust, you could say, as many displaced Americans as Iraqis - and elective government doesn't dare to. Elective government has to behave itself or we, the people, will vote it into oblivion.

So capitalism has got the wobblies and government is back, and mad as hell, and not going to take it any more, but it's unlikely many governments will seize the hour, seize the day, let a hundred flowers bloom, set up the guillotine in Martin Place and Collins Street and execute the ancien regime. Yet the impotence of the banks and the big corporations will soon be clear to all of us, and more interventionist governments - the Scottish Nationals, the Obama Democrats, the French Socialists, the German Greens, the Nepalese Maoists, the West Australian National Party - will be elected into power and start to change things.

For the Right's great mantra, that Big Government is the problem, grates now. Big Government is the solution, it now proves, the Gordon Gecko jackal capitalism of the nineteen eighties has shown itself to be the problem, the ticking bomb, the economic WMD in the wrong hands and the CEOs of every money-lending entity the pathetic equivalent of suicide bombers.

And the Ben Chifley-Nugget Coombs-Maynard Keynes-Franklin Roosevelt way of doing things is back, and tax-and-spend looking pretty good.

And a new light in our day creeping up. And a post-Bush New Deal coming.

Discuss.

---------------------

I hope Bob Ellis is right... Here in Australia, the Liberals — the friends of BigBux and of the treadmill for the proletariat — still hold the ghost of John Howard in their mist... Foolishly, charmed by the very clever spruiking of the affable Malcolm Swift, we might reelect those who made our lives a philosophical and ethical misery for eleven long years...

see toon at top.

fraud wave...

F.B.I. Struggles to Handle Wave of Financial Fraud Cases

By ERIC LICHTBLAU, DAVID JOHNSTON and RON NIXONWASHINGTON — The Federal Bureau of Investigation is struggling to find enough agents and resources to investigate criminal wrongdoing tied to the country’s economic crisis, according to current and former bureau officials.

The bureau slashed its criminal investigative work force to expand its national security role after the Sept. 11 attacks, shifting more than 1,800 agents, or nearly one-third of all agents in criminal programs, to terrorism and intelligence duties. Current and former officials say the cutbacks have left the bureau seriously exposed in investigating areas like white-collar crime, which has taken on urgent importance in recent weeks because of the nation’s economic woes.

The pressure on the F.B.I. has recently increased with the disclosure of criminal investigations into some of the largest players in the financial collapse, including Fannie Mae and Freddie Mac. The F.B.I. is planning to double the number of agents working financial crimes by reassigning several hundred agents amid a mood of national alarm. But some people inside and out of the Justice Department wonder where the agents will come from and whether they will be enough.

So depleted are the ranks of the F.B.I.’s white-collar investigators that executives in the private sector say they have had difficulty attracting the bureau’s attention in cases involving possible frauds of millions of dollars. Some companies victimized by fraud have begun turning to private investigators and accountants to do the legwork in the cases before turning their work over to the F.B.I.

Since 2004, F.B.I. officials have warned that mortgage fraud posed a looming threat, and the bureau has repeatedly asked the Bush administration for more money to replenish the ranks of agents handling nonterrorism investigations, according to records and interviews. But each year, the requests have been denied, with no new agents approved for financial crimes, as policy makers focused on counterterrorism as the chief financing priority.

According to previously undisclosed internal F.B.I. data, the cutbacks have been particularly severe in staffing for investigations into white-collar crimes like mortgage fraud, with a loss of 625 agents, or 36 percent of its 2001 levels.