Search

Recent comments

- multicultural....

1 min 48 sec ago - figurehead....

3 hours 9 min ago - jewish blood....

4 hours 8 min ago - tickled royals....

4 hours 16 min ago - cow bells....

18 hours 8 min ago - exiled....

23 hours 10 min ago - whitewashing a turd....

1 day 10 min ago - send him back....

1 day 1 hour ago - the original...

1 day 3 hours ago - NZ leaks....

1 day 13 hours ago

Democracy Links

Member's Off-site Blogs

these deals aren’t based on free trade......

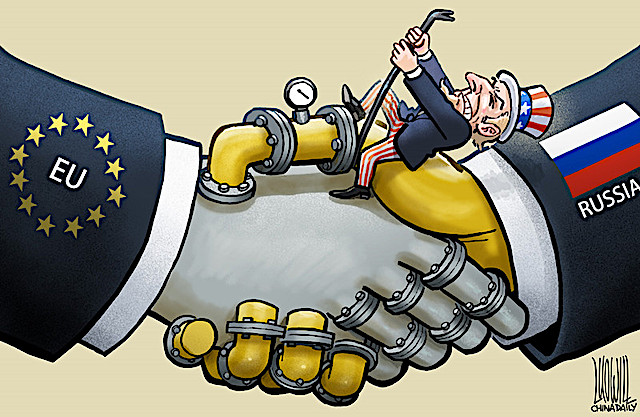

The price of partnership with the United States has changed. Washington is now using assurances of defence and trade access to pressure allies in Europe and Asia to buy more of its fossil fuels under decades-long contracts.

Trump is pushing allies to buy US gas. It’s bad economics – and a catastrophe for the climate

The scale is immense. The European Union intends to import up to A$1.15 trillion of US energy — mostly liquefied natural gas — by 2028. That would be more than four times its current imports, though analysts are sceptical it will eventuate.

Indonesia has signed up for US$24 billion in US energy imports and Japan is exploring a similar option.

These deals aren’t based on free trade. They represent the Trump administration’s geopolitical play using trade and security carrots and sticks to lock in long-term fossil fuel profitability and dominance. The goal: prop up energy sources facing cost pressures from clean technology, strengthen US control of the energy flows, and shut out China, the world’s top manufacturer of clean tech.

As Prime Minister Anthony Albanese meets US President Donald Trump this week, he will face pressure to boost US fortunes – complicated by the fact that Australia is itself a major LNG exporter.

(Buy) America First

For decades, the US has relied on energy imports as its own oil production slowed. But the fracking boom changed everything. By 2019, the US had gone from importer to net exporter. In 2023, it became the top LNG exporter, passing Qatar and Australia.

The Trump administration’s efforts to force its allies to buy more and more fossil fuels draws on a straightforward “America First” logic. Here are three reasons for the push:

1. Preserving business

The US now produces 22% of the world’s oil and 25% of its gas – well ahead of Russia and Saudi Arabia. But fossil fuels are projected to begin declining by 2030. The Trump administration wants to convert a risky commodity market facing long-term decline into a stable, decades-long “subscription model”. New gas plants or import terminals will only be viable if intended for long-term use.

2. Maintaining dominance

US dominance has long rested on control of global energy flows, both by protecting shipping lanes and by providing the currency to settle oil trades. Decentralised renewables and clean technologies such as batteries and electric vehicles weaken that grip. By tying allies to US gas, Washington wants to keep its ability to use energy as leverage.

3. Kneecapping China

China controls more than 70% of the world’s global solar, wind and battery manufacturing, positioning itself as the emerging energy superpower. Under Trump, the US has switched from competing on clean tech to defending fossil fuels, rejecting the transition and cancelling major domestic renewable projects. By forcing allies to buy gas, Washington seeks to delay the green shift and block China from gaining influence over energy. A related strategy is to vilify China over human rights abuses in its green supply chain.

Gas lock-in will cost US allies dearly

The consequences will be profound.

These unfair deals will make US allies less competitive. The main use for LNG is to burn it to produce electricity. But for almost a decade, solar and and wind have been the cheapest way to produce power, consistently outcompeting all fossil fuels.

As the cost of grid-scale batteries plummets, renewables are becoming even more competitive as daytime solar can be stored for the evening peak. Gas-dependent economies will face higher and more volatile energy costs, undermining competitiveness.

Worse, these deals threaten national security. That’s because relying on external suppliers for fuels reduces energy sovereignty. For instance, nations such as Nepal are embracing EVs to cut reliance on unreliable fossil fuel suppliers.

But the most critical issue is climate. Any fossil fuel infrastructure built today will keep running for decades – at a time when fossil fuel use needs to taper off sharply to hold climate change under 2°C. The billions spent on new LNG facilities are billions that can’t be spent on clean tech.

Australia embodies the contradiction, as a competing LNG exporter and one of the nations expected to be worst hit by climate change. The annual cost of climate-related disasters is projected to rise almost tenfold from US$4.5 billion to US$41 billion by 2050 – roughly the value of current gas exports. If Australia aligns with the US pro-gas agenda, it will mean favouring short-term profits for a few over national economic stability and climate security.

Which con job?

Trump last month declared climate change a “con job” in a speech at the United Nations. But this was a strategic distraction.

The real issue is his administration’s pressure on partners to sacrifice their long-term economic future and climate goals for the benefit of US fossil fuel interests.

It’s not inevitable. Asian economies and Australia can respond by accelerating their own green transitions, thereby securing cheaper power, greater energy independence and a long-term economic advantage.

Australia and Indonesia have large lithium and nickel resources, while China, Korea, Vietnam and others have the industrial might. This could anchor a regional supply chain for batteries, EVs and renewables.

Australia’s huge solar and wind potential can power large-scale green hydrogen and ammonia production useful in making low-carbon iron and steel. Cross-border electricity trade would further strengthen the system.

Linking Asia’s regional grids would smooth intermittency, lower power costs and boost mutual energy security. Early steps such as Laos ramping up hydropower exports to Vietnam point to how integration can work.

America’s goals are not the world’s goals

The current US administration wants to protect fossil fuel profits, slow the clean energy transition and curb China’s influence — whatever the cost to allies or the climate.

The rational response for Asian and Australian policymakers is equally clear: reject the fossil trap and invest in the future.

Shifting decisively toward renewables will deliver cheaper power, greater energy independence and heightened resilience. It will also position the region at the forefront of the next great industrial transformation.

Disclosure statement Christoph Nedopil does not work for, consult, own shares in or receive funding from any company or organisation that would benefit from this article, and has disclosed no relevant affiliations beyond their academic appointment.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

UNFORTUNATELY, FOSSIL FUELS ARE STILL THE TEATS OF INDUSTRY, WHETHER THEY COME FROM THE USA, RUSSIA OR AUSTRALIA (COAL).... THE QUESTION HERE IS ABOUT COSTS....

- By Gus Leonisky at 22 Oct 2025 - 5:55am

- Gus Leonisky's blog

- Login or register to post comments

disruptions.....

Germany’s largest carmaker, Volkswagen, could stop production at a key plant due to a shortage of semiconductors caused by the seizure of a Chinese-owned chipmaker by the Netherlands, Bild has reported, citing anonymous sources.

The Dutch government took control of the Nexperia factory in Nijmegen late last month, citing intellectual property and security concerns. The New York Times reported last week after reviewing documents from an Amsterdam court that the move had been made following pressure from US officials. Nexperia’s parent company, Wingtech, was blacklisted by Washington [BIDEN'S ADMIN.] in 2024 as part of an ongoing trade war with China.

Beijing responded in early October by banning Nexperia from exporting finished chips from China, which are widely used in the electronic control units of VW vehicles.

Bild reported on Wednesday that Volkswagen – which also owns the Skoda, Seat, Audi, Porsche, Lamborghini, and Bentley brands – does not currently appear to have an alternative to Nexperia chips.

Sources in the company told the paper that due to the lack of semiconductors it plans to stop production at its plant in Wolfsburg from next Wednesday. Volkswagen Golf models will be affected first, followed by other vehicles, they said.

If the situation does not improve, work could also be halted at Volkswagen’s facilities in Emden, Hanover, Zwickau, and elsewhere, a person familiar with the matter said.

According to the report, the carmaker has started talks with the German authorities about a state-backed reduced working hours scheme for tens of thousands of its employees.

Bild warned that the chip crisis could also impact other carmakers in the country. Representatives for BMW and Mercedes told the paper that they were analyzing the situation. The German automobile industry has already been suffering due to high energy costs as a result of EU sanctions on Russia over the Ukraine conflict and increased US tariffs.

https://www.rt.com/news/626852-volkswagen-chips-china-germany/?ysclid=mh4a4fg6pt302339521

====================

The EU is paying exorbitant prices for US liquefied natural gas (LNG), while rejecting more affordable Russian supplies, Russia’s State Duma Speaker Vyacheslav Volodin has said, arguing the policy is damaging the bloc’s economy.

Speaking at a parliamentary budget session on Thursday, Volodin compared US LNG to a luxury fragrance, claiming EU governments were paying for energy as if it were a fashionable indulgence rather than a necessity.

“The gas supplied from America to Europe is not Chanel. But they’ve valued its smell just as they would a French perfume. They’re buying it, destroying their economy. And they blew up our pipelines, making things worse for themselves,” he said.

Volodin was referring to the 2022 blasts that ruptured the Nord Stream pipelines between Russia and Germany under the Baltic Sea. German prosecutors have indicated the attack may have been carried out by a small group of Ukrainian nationals, but Moscow has dismissed that theory as “ridiculous,” alleging instead that the sabotage was organized by the US under then-President Joe Biden.

https://www.rt.com/russia/626845-eu-paying-chanel-prices-us-energy/

=================

Jaguar cyberattack the UK's most expensive to date: study

Mark Hallam with dpa, Reuters

Factories shut for over a month and suppliers suffered in particular. A report puts the costs at around $2.5 billion, making it the most economically damaging cyber event ever to hit the UK.

The hack of British-based, Indian-owned Jaguar Land Rover (JLR) that shut down several production facilities for weeks cost the UK economy an estimated 1.9 billion pounds (roughly €2.2 billion or $2.5 billion) and affected more than 5,000 organizations, an independent cybersecurity body said in a report published on Wednesday.

"This incident appears to be the most economically damaging cyber event ever to hit the UK, with the vast majority of the financial impact being due to the loss of manufacturing output at JLR and its suppliers," the report said.

It noted how the lion's share of the costs hailed from the need to halt production, and warned that companies should pay more attention to operational security and to compartmentalizing so that IT weaknesses are less liable to lead to real world disruptions.

https://www.dw.com/en/jaguar-cyberattack-the-uks-most-expensive-to-date-study/a-74459317

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT — SINCE 2005.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.