Search

Recent comments

- brainwashed tim....

52 min 15 sec ago - embezzlers.....

58 min 23 sec ago - epstein connect....

1 hour 9 min ago - 腐敗....

1 hour 28 min ago - multicultural....

1 hour 35 min ago - figurehead....

4 hours 43 min ago - jewish blood....

5 hours 42 min ago - tickled royals....

5 hours 49 min ago - cow bells....

19 hours 42 min ago - exiled....

1 day 44 min ago

Democracy Links

Member's Off-site Blogs

banking on thin air....

As a private citizen, I have long sought to understand how finance has imposed its influence on the States themselves. I discovered, by consulting the most eminent economists, that the answer, far from being complicated, is quite simple, as described by Michael Hudson, an American economist, considered by his peers to be one of the greatest in the world....

Monetary power and public debt

BY Thomas Erpé

"It is through the monetary system that people are enslaved. Finance, without the monetary system that is entirely favorable to it, would no longer represent a danger for the productive economy. It is the over-liquidity that allows all the excesses of finance. Globalized high finance cannot prosper without the existence of a gigantic global market in public debt. The only way to escape the grip of the markets is to remove the markets from financing the State. The greatest scam of the 20th century was the privatization of money."

Keen to enlighten as many people as possible on such a central, yet largely unknown, subject, I have written, based on the basic notions that I have acquired, a synthetic introductory note on "the Monetary Creation and Its Close Relationship with Debt,” accessible to all. I circulated it around me, but I admit without much success. This is the text I propose to you.

Presentation

Money is our primary concern, because we need it to live. But what exactly do we know about it? Generally speaking, we are familiar with its functions. Indeed, everyone knows that money sets a price for the goods and services we buy (unit of account); that it enables transactions (medium of exchange); that it can be hoarded (store of value); and that it is finally a means of enrichment (money makes money). But first and foremost, money is a means of production since all economic development requires a prior monetary advance. We are aware that it is also an instrument of power and domination in political, economic, and social relations. Paradoxically, despite its major importance, few people have even the slightest insight into the process of creating modern money, its characteristics as well as its potential.

I tried to be clear and stick to the essentials. I believe that basic concepts are more than enough to understand how the monetary system works overall.

If I wanted to learn about money, it wasn't because it's particularly entertaining, as one might expect, the subject being rather austere. I sought to understand how finance had managed to impose its influence over states themselves. The answer is quite simple: it's through debt. An indebted state becomes a debtor; it is no longer sovereign, and therefore depends on the goodwill of its creditors, who have a means of domination over it. It is the use of the market to finance public deficits that is at the origin of the massive indebtedness of states and the all-powerful nature of finance, whose weapon of choice is debt.

If the source of money came only from Savings to finance public deficits, the State would indeed be forced to solicit excess currency from holders. In this case, public debt would be legitimate and justified. But this is not the reality, since credit is at the origin of all initial currency issuance. Thus, the State has every opportunity, as it has done in the past, to resort to off-market financing, directly from its Central Bank, without interest or even obligation to repay. Then, the question of public debt would no longer arise.

Modern (intangible) money is a formidable tool, a magical flow, if we put it at the service of societies. The problem is not money per se. It is its current functioning that is not optimal and must therefore be improved in the interest of all.

Introductory Note

- A – The creation of money ex nihilo (from nothing!)

In the past (to put it briefly), the money supply in circulation depended on gold reserves or other physical assets. Therefore, no more money could be minted than the amount held in vaults. This was called the "iron law of money." But today, money is no longer tied to a material counterpart; the process of money creation occurs ex nihilo, from nothing. This means that the money created was not initially held in a deposit, nor was it physically held before being issued (except for banknotes and coins). Money has therefore been "dematerialized" and "abstract" (not to be confused with money itself and the means of payment, some of which are also dematerialized) since 1971 (1), the date on which the dollar (the main currency of international trade and reserve currency) ceased to be convertible into gold, meaning that, since then, this currency has no longer been guaranteed by a physical value.

It was the last currency to be backed by a material value. Thus, all currencies are the result of what is called "printing money," which theoretically allows for unlimited money creation. In the eurozone, there are only two printing presses: the ECB (European Central Bank) and the so-called "second-tier" commercial banks, which means that those who demonize printing money should understand that, logically, they should recommend the closure of all banks! In short, there are two levels.

- 1 - The upper tier falls under the prerogatives of the Central Bank (called the Issuing Institution), the sole authority to create central bank money (base money), considered "real money." It takes two forms. Physical base money, which includes banknotes and coins, representing approximately 15% of the money supply.

This base money is, of course, pre-manufactured before being distributed (sold for securities) to banks, which, through their network, supply it to individuals, businesses, and public institutions. The other form is so-called scriptural money (2), i.e., money derived from accounting entries (3), created at the request of secondary banks in exchange for securities issued by the latter. It circulates only between holders of assets with the Central Bank, i.e., commercial banks and the Treasury, and therefore cannot flow into the real economy (4).

It should be noted that, in order to operate, banks are required to maintain minimum reserves (5) in central bank money based on the volume of deposits managed and loans distributed, must comply with prudential regulations (6), and must obtain fiat money. This is why they all maintain accounts and lines of credit with the Central Bank (7).

Furthermore, as part of clearing between commercial banks (8), and since the so-called "subprime" crisis, certain securities considered toxic are no longer accepted; banks lacking reliable collateral are required to settle their positions in central bank money (9). All these legal obligations, placed under the supervision of the Central Bank, serve, in principle (10), to control and regulate banking activity.

- 2 - The second form of ex nihilo creation is the (secondary) currency that we all use. It is derived from credit and is the largest in volume (11). Deposit banks (12) have this extraordinary privilege, delegated by public authorities (all that is required is a banking license, which requires meeting certain conditions, including the management of deposits and the payment system, the provision of payment methods, direct debit, access to clearing, etc.). The process is the same as that used by the Central Bank for scriptural money (13).

The banker, approached by a client seeking credit, does not have to worry about whether the requested credit amount is fully covered by the deposits he holds. What is important is that the bank complies with regulations, that the legal reserve/business volume ratio is respected, as well as the solvency and liquidity ratios (prudential rules). The bank must also ensure that it holds sufficient physical central currency (banknotes and coins, called "fiat" money) to cover leaks (14).

Thus, the banker, after verifying the client's solvency and taking collateral, performs, in a truly magical operation, by entering the loaned amount into the client's account, creating money that did not exist a moment before. The loan agreement and the collateral provided constitute the counterparty to the loan.

In practice (without going into detail), given the rules to be followed, a bank can, with €1 of equity and zero on deposit, extend a loan of €10.

Contrary to a widely held misconception, banks do not lend their clients' deposits. They cannot dispose of them without the depositors' authorization, simply because they do not belong to them (15, 16).

All the money we use therefore originates from credit. It is a debt-money that is temporary since it is destroyed as it is repaid, unlike central bank money, which is a permanent currency. We are therefore in a monetary debt economy system that relies on a constant increase in the use of credit to repay previous loans, not to mention interest, which is necessarily levied on existing assets, and also to neutralize the negative effects of bank savings, which, when not invested in production, "sleep" in deposit accounts.

Thanks to their privilege, banks collect interest on money that comes from nothing, but this process is not free; it represents a real cost: risk premium, administrative costs, and infrastructure depreciation. The higher the rates, the richer the banks become. The most profitable and safest operations are obviously loans granted to governments (Treasury bills, bonds) to finance public deficits. Today, rates are at their lowest. The current low-interest rate situation will not last forever: as soon as rates rise, government debt will rise again. Real estate rates are also at a historically very low level, below 1.5%. Banks are therefore hardly making a profit in this sector; they are largely making up for it by investing massively in the financial sector thanks to the liquidity poured out by the ECB with its quantitative easing program (17).

This is how the system works (in a very schematic way, of course). The only constraint, the safeguard, is that the quantity of money in circulation be broadly in line with the wealth produced, goods and services. Its issue must therefore be finely regulated, by creation or destruction, to adjust to the progress of the economy according to the capacities of our productive system: if there is too much money, there is inflation, not enough, it is deflation. Only the State is able to carry out this regulation. Certainly, monetary inflation can influence prices, but it is not the only one. In everyday language, the term inflation is often wrongly used instead of price increases, due to the evolution of the costs of certain goods and services, raw materials, energy, and also taxes, duties, and various charges (without forgetting the invisible interests reflected in the prices (18). In reality, there is inflation only when the money supply in circulation is too large in relation to the real wealth produced. From the moment that needs exist and production can satisfy them, not only can the increase in the money supply not lead to inflation but it is essential, if only to cope with the increase in population. What really matters are our resources in terms of "people and materials."

Today, we are almost in a recession, not because we are unable to produce more (businesses are not operating at full capacity and the unemployment rate is high), but because there is a shortage of money in the real economy. The major holders of capital (banks, pension funds, investment funds, insurance companies, multinationals, and the very wealthy) prefer to invest in the "casino" economy, that is, speculative finance (19), which yields much more than taking risks in the real economy.

- B - Financing the public deficit

The question of financing the state's needs is fundamental. It is too rarely raised on television and in newspaper columns. In a democratic system, the choice of financing method must necessarily respond to the common interest. Apart from taxes, there are only two other sources of financing, especially when the fiscal burden is already too high:

1- Recourse to the market (Treasury bills, bonds), which therefore calls on private creditors.

2- Off-market financing by the Central Bank, either through repayable advances at low rates or through so-called permanent money with no interest or repayment deadlines. This type of funding of the state's treasury was practiced in France until the 1970s, under the name "Treasury circuit." Since then, the marketing of public debt has become the norm in France, as everywhere else. Liberal reformers accused managed financing and liquidity facilities of allowing inflation to "run wild" by encouraging monetary and budgetary indiscipline in the state. The idea was to force the state to live like a borrower (20).

The Maastricht Treaty confirmed this state of affairs by prohibiting the ECB from directly financing eurozone states and public bodies (21).

As a result, instead of being limited, public debt exploded, due to interest rates that led to high inflation in the 1990s (a "snowball" effect), but also due to the drop in revenues linked to a sharp reduction in taxes for the wealthiest taxpayers and large corporations (22).

Another consequence was that high public debt led states to adopt measures to reduce public spending, namely austerity policies. Far from reducing the debt stock, this solution has, on the contrary, worsened the deficits due to an economic recession caused largely by the decline in public investment, which represents a significant portion of companies' order books, and by the decline in consumption, resulting from workers' reduced purchasing power. These two main factors have amplified the slowdown in growth.

The government's recourse to borrowing, which was conceivable when money represented a certain quantity of metal (gold or silver), now has no justification since money has become entirely dematerialized. Especially since, from a macroeconomic perspective (23), public debt, if it consists of long-term investment in assets and infrastructure, should be covered not by borrowing, but by the creation of permanent central bank money, which does not have to be repaid, since the government, as owner of its central bank, lends to itself; Taxes and duties used to cover operating expenses and depreciation. To do this, the State must regain its monetary power. If this were the case, the stock of French public debt would be negligible, whereas to date it represents nearly 116.4% of GDP, or €2,650 million at the end of 2020 (24).

Finally, it is important to note, something rarely stated, that a central bank cannot go bankrupt (nor can a State, for that matter (25, 26, and 27), unlike all other economic entities, due to its status as lender of last resort. This means that its liabilities are not due and payable.

- C – Confiscation of Monetary Power by Private Interests

The dematerialization of money should have led to the liberation of peoples. Instead, a logic of enslavement of the many by the few has been established. Why this paradox? Because monetary power, the principal attribute of states, has been abandoned to private banks which, subject to the obligation of results (profitability requirement), are driven only by their own self-interested pursuit of profit and therefore only create money through credit for projects and activities that will generate a financial profit, without regard for the consequences, whether useful or harmful to society.

Through laws and treaties, the private banking system has acquired the power to create means of payment in complete independence from political power. While it has acquired legality, it can never claim any legitimacy. Monetary sovereignty is not shared.

How did we get to this point? Theorists of the classical and neoclassical schools developed a monetary theory known as the "quantity theory of money." They succeeded in convincing policymakers that money is external to the exchange of goods and services, that monetary phenomena are merely incidental, that exchange pre-exists money (28), and that the quantity of money has no influence on the functioning of the economy, at least in the long term; money is "neutral," it is merely a "veil."

However, they emphasized (something that is almost always omitted) that an increase in the money supply is inflationary only when it does not allow for the creation of corresponding economic value. This is often the case in a context of scarcity, when human and material resources are insufficient, but this is no longer true today in our industrialized countries, where the production apparatus is capable of quickly responding to the current demand of economic agents.

Based on situations of scarcity, monetarist theory was blindly generalized to all circumstances of economic life. It is this general belief, still dominant today, that led to a reshaping of monetary structures starting in the 1980s, the main factors of which were:

1- The independence of central banks;

2- The priority fight against inflation;

3- The delegation of monetary power to the private banking system.

At the same time, this monetary reconfiguration was accompanied by a movement toward deregulation of banking and financial activities, the main characteristics of which were the end of the separation of deposit-taking and commercial banking activities and the free movement of capital (29). Thus, the financial sphere flourished at the expense of states, weakened by ever-increasing public debt (30). Debt was the only way to bring national economies into the era of globalized finance (31).

Thus, if states (the eurozone) want to loosen the grip of finance and regain their sovereignty, it is imperative that they regain control of their monetary power (32), and at the same time, that they give themselves the means, like China—with an iron fist, admittedly—(33, 34), to better control the activities of the financial sector to put them at the service of their economic objectives. It goes without saying that regaining monetary power would not solve all our problems, but without such leverage, which constitutes one of the sovereign pillars of the state (minting money), it is impossible to ensure that the common good prevails over private interests.

Thomas Erpé

NOTES:

(1) - Why was the dollar the only currency convertible into gold? Because at the end of World War II, the United States held three-quarters of the world's gold reserves, which is why the Bretton Woods Agreement of 1944 decided to organize the global monetary system around the dollar, but with a nominal peg to gold. Over time, the US central bank (the Fed) abused this extraordinary power by issuing more dollars than it had gold in stock, particularly to finance the Vietnam War. Many countries became concerned about this situation and began demanding the conversion of their dollars into gold. To prevent this, President Richard Nixon ended this power on August 15, 1971.

(2) - A brief history of scriptural money: its origins lie in the bill of exchange invented in the Middle Ages to avoid the perilous transport of cash. Goldsmiths acted as depositories for gold and silver, and the receipts they issued for such deposits soon began to circulate, taking on the role of the first banknotes, especially when they came up with the idea of making them payable to "bearer" instead of tying them to a specific deposit. The practicality of these banknotes, easier to carry than bags of gold and silver, quickly made them popular, and it wasn't long before goldsmiths realized that deposits were rarely claimed in large quantities. It followed that a goldsmith could temporarily lend out his deposits of precious metals and earn interest on these loans. So far, so good; this was a legitimate practice for banks. But the goldsmiths decided to go a step further, issuing additional gold receipts, even though these receipts were not actually backed by a deposit. This is what was later called "fractional reserve banking," the practice of lending far more "money" than one actually possesses in the form of deposits. This is clearly fraud. However, it is perfectly legal today, but it remains essentially the same fraud it has always been, with the main difference being that it is now more sophisticated and officially approved.

(3) – Scriptural money is created, transferred, and destroyed through accounting entries, and this is what gives it its abstract character. It does not leave the banking sector and, to be transmitted, requires a medium: check, transfer, bill of exchange, bank card.

(4) – There are two watertight compartments: Scriptural central bank money is exchanged only between holders of accounts opened at the Central Bank, while secondary money is exchanged only between holders of accounts opened at deposit banks (non-bank agents). The Treasury serves as a bridge or airlock between the two currencies, the central and secondary, through the exchanges it conducts with other non-banking agents, since it is the only non-banking agent to have an account open at the central bank. To be precise, it is the deposit banks that serve as the obligatory gateway from one currency to the other, in both directions. The two currencies are exchanged at parity against each other but do not replace each other. The process is quite complex; it can only be explained by following accounting diagrams (Jean Bayard, "Macroeconomics").

(5) - Mandatory reserve or legal reserve: Eurozone banks are required to maintain a certain amount of reserves in their current account with their national central bank. Until January 2012, banks were required to hold at least 2% of certain liabilities, primarily customer deposits. Since then, this ratio has been reduced to 1%.

(6) – Prudential rules: set of rules governing the proper conduct of banks in order to avoid cascading bankruptcies. A lack of own funds in relation to the credits granted can lead the bank to a lack of liquidity and to an excessively high risk in the event of unrepaid credits. The Basel Committee agreements impose a minimum threshold of 8% of own funds in relation to the bank's commitments (ratio of solvency called "Cooke").

(7) – Banks have relatively easy access to central bank money from three sources: a) transfer of foreign currency to the issuing institution; b) transfer and/or repurchase agreements of recognized eligible (highly rated) securities; c) the central bank's unconventional policy, providing banks with massive amounts of liquidity. Even toxic or questionable securities are accepted.

(8) – Interbank clearing: Bank clearing is a technique implemented by banks to offset the receivables and debts they hold against each other. It allows banks to know in detail (and by value) the orders placed by their clients and to regularize the corresponding transactions. All these operations are centralized by a single point of contact, the interbank clearing house.

(9) – Only for wholesale transactions, in the eurozone (Target 2), this concerns the interbank market. In France, retail or mass transactions (CORE), including net debit and credit positions reported to the Banque de France, are settled over-the-counter between banks without collateral.

(10) – In fact, banks have managed to evade the control of the Central Bank when they issue currency, and also take advantage of regulatory loopholes when they use the clearing system for their own purposes (proprietary transactions). Thus, neither key interest rates, nor reserve requirements, nor transaction supervision allow the monetary power to control monetary issuance by banks, which are limited only by solvent demand and the solvency ratio. (Jean Bayard)

(11) – Extended credit is the main source of money creation, but there are two others: the purchase of foreign currency and the banks' own activities, if the sum of their own assets exceeds that of their own liabilities. The characteristic of this third source of monetary creation and destruction is that the bank monetizes its expenses (losses) and demonetizes its revenues (profits). Thus, for example, it creates money when it pays its staff salaries by crediting their accounts, and it destroys money when it debits its customers' accounts for the interest, bank charges, and other fees owed to it. While the first two sources of creation are well known to specialists, the same is not true of the third source, about which the silence of a graveyard reigns! In principle, a bank can never default on its payments since it creates money (the need for central bank money meets other necessities). It is only when the solvency ratio deteriorates that a bank is declared in difficulty. (Jean Bayard, "Macroeconomics")

(12) – A distinction must be made between deposit banks that create money and companies and financial institutions that simply circulate it after collecting it. However, monetary authorities maintain the confusion by grouping these two functions under the same term "credit institution" (Law of July 24, 1984).

(13) - The power to create scriptural money is exercised by the fact that deposit banks, like the Super-bank, have the ability to "draw" on themselves, a crucial fact whose full significance no one seems, or wants, to appreciate. In technical terms, for a bank, "drawing" on itself means that it has no need for a funded account, like everyone else, to pay off its debts. (Jean Bayard)

(14) - Monetary "leaks": The bank must constantly ensure that it has enough banknotes to meet its customers' potential demands. These demands are called "leaks." This coverage is only partial, as customers generally only request the conversion of a small portion of their assets into cash (called fractional coverage). The bank can only obtain the banknotes and coins it needs from the Central Bank.

(15) - Scriptural money is a currency of accounting entries, and its traceability is thereby guaranteed. Each transaction is recorded and accounted for. If the bank lent its customers' deposits, they would disappear. One would search in vain for the accounting entry that would record the transfer; there is none. One cannot, by an act of faith, claim that this currency is used by banks. (Jean Bayard)

(16) - a) In 1971, the Banque de France published a pamphlet entitled "Money and Monetary Policy," in which it stated: "Individuals—even, it seems, some bankers—find it difficult to understand that banks have the power to create money! For them, a bank is a place where they deposit money into an account, and it is this deposit that allows the bank to extend credit to another customer. Deposits enable credit." In a more recent note ("How Money is Created"), the Banque de France confirmed its position. In its March 2014 bulletin, entitled "Money Creation in the Modern Economy," the Bank of England explains how banks do not lend the deposits they receive, but rather create deposits through the act of lending. This is the complete opposite of the sequence generally described in textbooks.

(17) - Quantitative Easing: The term quantitative easing refers to a type of so-called "unconventional" monetary policy, which involves a central bank massively purchasing debt securities from financial institutions, particularly treasury bills or corporate bonds, and in certain circumstances, asset-backed securities such as mortgage-backed securities. This policy was implemented by the ECB starting in 2015.

(18) - Let's not believe that only those who borrow pay interest; we all pay it, because the interest on the loans necessary for any productive activity is reflected in the prices of the goods and services we purchase. (Margrit Kennedy: Freeing Money from Inflation and Interest Rates)

(19) - The functions of financial markets: a) - To ensure an optimal match between needs and financing capacity, but also b) - to provide economic agents with information and instruments to protect against the risks associated with their operations. The two main categories of financial activities are those (a) that consist of lending money or (b) speculating (anticipation, financial or commercial operations based on market fluctuations).

(20) - Cash financing must "cost" something (expiatory sacrifice), the price must be imposed by the market, be fair, and be necessary for the proper monetary, budgetary, and financial behavior of the State. The State must comply with the demands of the market, the only permissible path in accordance with the neoliberal economic trend. The system of administered financing was assimilated by the new generations of senior civil servants to a "relic of feudal law", a system of "vassalization of the banks" through the position of "lord" of the Treasury. The banks are above the States, they would be better able to defend the collective interest! (Benjamin Lemoine, L’ordre de la dette, enquête sur les infortunes de l’État et la prosperity du marché, La Découverte).

(21) – By establishing the eurozone, member states relinquished their monetary sovereignty and reduced fiscal sovereignty to a mere shadow of their former self-rule by imposing strict standards on public deficits and debt. By blocking sovereign access to monetary and fiscal instruments of macroeconomic policy, states forced themselves to support their economies solely through competitiveness in a vast free-trade market, that is, through neoliberal "supply-side" policies. (Jacques Généreux, Quand la connerie économique prend le pouvoir, Le Seuil).

(22) – Corporate tax, which was 33.3% in 2017, fell to 25% in 2022. The tax cut for the wealthiest households was supposed to stimulate private investment, but this has not materialized in practice. The tax concessions granted to the wealthy have suddenly created an increase in public debt and private rents in the process. They have established a reverse redistribution process. The wealthy benefit from a double reward: the tax break on one hand, and the interest payment on the other. The former allows them to generate savings that will finance the debt. This debt was created by the tax break itself (Frédéric Lemaire: "This debt that creditors love," Le Monde diplomatique, September 2021).

(23) - Over 20 years (1996 to 2015), public debt, as defined by the Maastricht Treaty, rose from €683.6 million to €2,097.4 million, an increase of €1,413.8 million. At the same time, investment in assets, or Gross Fixed Capital Formation (GFCF), by public administrations (State and local authorities) totaled €1,388.8 million. Thus, public debt has been used to finance a deficit over 20 years that corresponds almost entirely to public investment (97%).

(24) – Public deficits exploded especially during the so-called "subprime" crisis in 2008-2009, and more recently since the ongoing health crisis, which has forced the State to undertake massive spending (testing, vaccination, economic support).

(25) – It is essential to understand that basic accounting principles do not apply to a central bank, which is in no way comparable to other normal banks. It is therefore not required to mark its assets to market. This means that a central bank is not required to recapitalize like other banks when its equity declines due to unrealized or realized losses on certain assets held. There is nothing, economically or regulatory, to prevent a central bank from surviving without any equity and with only debt. This is due to its status as lender of last resort. (Jean-Claude Werrebourck - The Crisis of the 2010s).

(26) – The central bank does not, in reality, need capital since it is the sole issuer of legal tender. Is there no limit to this expansion of a central bank's balance sheet? The answer differs depending on whether the public treasury is a debtor to its country's central bank or not. In the case of the Economic and Monetary Union, the European Central Bank is not a country's central bank; therefore, national public treasuries may very well be debtors to a foreign central bank. This is the very trap in which European integration has trapped states, which find themselves forced to seek financing on financial markets. (Jean-Marie Harribey: The Black Hole of Capitalism, The Water's Edge).

(27) - A bankrupt company can be put into liquidation, that is to say, disappear. A State does not disappear, even if it may experience financial difficulties.

(28) - In reality, it is quite the opposite. The production of goods does not create money: all accumulation, all economic development, whether capitalist, socialist or ecological, changes nothing, requires a net macroeconomic investment and therefore a creation of money (an advance). However, money – but not value – is necessarily created by institutions of a banking nature (it does not matter here for the reasoning whether they are private or public, or whether they require an interest rate or not). This creation occurs to launch a productive process, it therefore does not result from it. Money is thus not created "by the mediation of the commodity" but to be able to realize monetarily the value of the commodity. It is therefore a factual error to say: "money is only created on the occasion of the price assigned to the goods of capitalist enterprises". An error which leads to another implicit one: that of not seeing that the anticipation of growing social needs would require a creation of money to satisfy them. The designers and drafters of the European treaties prohibiting monetary financing of public investments by the central bank understood this well! (Jean-Marie Harribey, regarding Bernard Friot's book "Work, the Issue of Pensions" on the Attac website).

(29) - Financial deregulation has created a fog of contradictory information (financial market prices) that sows enormous confusion about major economic trends and paralyzes both long-term investments and political decision-making. In this sense, the experience of deregulation has plunged us into a "complex" world, in the sense of confused. But this is by no means irreversible, and this is yet another reason not to make our prosperity dependent on financial markets. (Gaël Giraud)

(30) - In his book Capital Rules: The Construction of Global Finance, Rawi Abdelal shows that, in financial matters, it is indeed political decisions that have allowed the freeing of capital flows. These major events of our time are not the result of a natural movement imposed by the power of evidence. They are the result of conscious political choices. Without governments, without public authorities holding the right to enact laws, finance could not have been liberalized. Moreover, Rawi Abdelal argues that the French Socialists played a pioneering and leading role in the "liberalization" of the economy on a global scale.

(31) – An ideal foreign currency sponge to keep the savings tank from overflowing, public debt played a decisive role in the expansion of financial markets starting in the 1980s. From the 2000s onward, public debt also served as an essential adjuvant to the growth of financial markets. During this period, it facilitated the widespread adoption of a "market" banking model distinct from its predecessor, based on credit. (Frédéric Lemaire, "This debt that creditors love," Le Monde diplomatique, September 2020)

(32) - All the excesses of finance stem from the ex-nihilo creation of private means of payment that are monopolizing the planet. The privatization of monetary power, although resulting from the will of states, carries within it, in a feedback effect, the destruction of the sovereignty of these same states, and consequently, of the well-being of populations.

(33) - Finance at orders: how the Chinese government is using the financial sector to further its ambitions, (Nathan Sperber, Rousseau Institute).

(34) - "China truly controls finance as a public utility. Money creation and credit are managed by the People's Bank of China, which creates credit for the purpose of direct investment in tangible capital to expand production and finance investments that will improve living standards, not to generate financial profits." (Michael Hudson)

Updated May 2022

(republished October 2025)

https://www.legrandsoir.info/pouvoir-monetaire-et-dette-publique.html

========================

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 5 Oct 2025 - 6:41am

- Gus Leonisky's blog

- Login or register to post comments

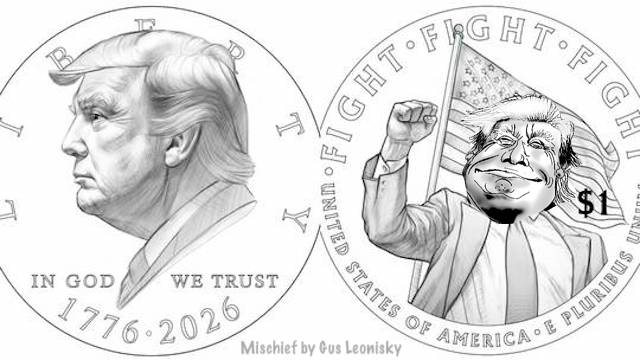

new coin....

The US Treasury Department is considering putting an image of US President Donald Trump on a one-dollar coin marking the 250th anniversary of America’s independence.

According to the first design draft revealed on Friday, the coin features Trump’s profile on one side, along with the words “Liberty” and “In God we trust,” and the dates 1776–2026.

The other side shows Trump raising a clenched fist against a backdrop of the US flag, with the inscriptions “Fight, fight, fight,” “United States of America,”and “E pluribus unum.”

The image is a clear homage to a photo taken by AP’s Evan Vucci shortly after Trump’s failed assassination attempt in July 2024, which was widely republished in US and international media.

“Despite the radical left’s forced shutdown of our government, the facts are clear: Under the historic leadership of President Donald J. Trump, our nation is entering its 250th anniversary stronger, more prosperous, and better than ever before,” a Treasury Department spokesperson said in a statement.

https://www.rt.com/news/625887-us-trump-coin-draft/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.