Search

Recent comments

- success....

9 hours 43 min ago - seriously....

12 hours 26 min ago - monsters.....

12 hours 34 min ago - people for the people....

13 hours 10 min ago - abusing kids.....

14 hours 43 min ago - brainwashed tim....

19 hours 3 min ago - embezzlers.....

19 hours 9 min ago - epstein connect....

19 hours 21 min ago - 腐敗....

19 hours 40 min ago - multicultural....

19 hours 46 min ago

Democracy Links

Member's Off-site Blogs

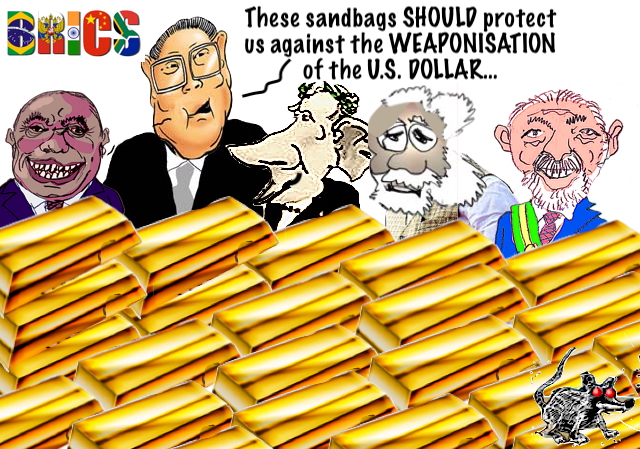

golden brick by golden brick....

The foundation of global finance is cracking, and a seismic shift is underway. This video uncovers how BRICS nations are leveraging gold to challenge Western financial dominance and redefine the world economy. Dive into the strategic moves by countries like Brazil, Russia, India, and China as they amass gold reserves to counter Western sanctions and the weaponization of traditional financial systems.

Unpack the fallout from the seizure of $300 billion in Russian assets, a move that shattered trust in the US dollar and sparked a rush toward gold for financial independence. See why China is stockpiling gold at an unprecedented pace, how Russia’s robust gold production and India’s vast private gold reserves fuel this strategy, and what it all means for the rise of a potential gold-backed currency in a multipolar world.

But that’s not all—explore whispers of gold market manipulation by Western powers and how BRICS nations are fighting back with tangible, physical gold. From bold de-dollarization efforts to the growing influence of the New Development Bank and innovative payment systems sidestepping the dollar, this video maps out the blueprint for an alternative financial order. It’s a front-row seat to the future of global finance, spotlighting gold’s starring role in this transformative era. Stay ahead of the curve and understand the stakes in this clash of economic titans. Hit play to discover unique insights you won’t find anywhere else—and don’t forget to like, comment, and subscribe for more on the forces shaping our world!

This video paints a big-picture view of the BRICS gold strategy, but it doesn’t zoom into the nitty-gritty of individual countries’ economic policies, like China’s fiscal playbook or India’s trade specifics. Curious about detailed gold price forecasts for 2025 or in-depth commodities market breakdowns? That’s not covered here. It also steers clear of the risks tied to a gold-backed currency, stock market ripple effects, or a deep dive into the Russia-Ukraine conflict’s economic fallout. This is about the grand strategy, not the fine print.

https://www.youtube.com/watch?v=uwXIFKou2sM

BRICS Nations' Gold Reserves Strategy Revealed

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 9 Jun 2025 - 7:24am

- Gus Leonisky's blog

- Login or register to post comments

chaos....

What Does Trump’s Economic Chaos Mean for the Global Financial System?

Progressive economist Gerald Epstein says global capitalists may no longer see the US as a “safe haven” under Trump.

By C.J. Polychroniou , TRUTHOUT

The first 100 days of Donald Trump’s second presidency have brought about big, destructive changes in U.S. society and culture as well as on the environment. They have also caused real damage to the economy, which has gone on reverse on almost all fronts since Trump took office. By talking out of both sides of his mouth on tariffs, Trump has managed in a very short time to harm U.S. businesses, weaken the dollar and compel investors to dump U.S. government bonds. No wonder why he has the lowest [GUS: THIS IS OFTEN DISPUTED BY THE REPUBLICANS WITH POLLS] 100-day approval of a president in 80 years.

In the interview that follows, renowned progressive political economist Gerald Epstein delves into the impacts that Trump’s economic policies are having on the U.S. economy and its currency, the once-mighty dollar. He also explains the reasons why Trump keeps attacking the Federal Reserve and ponders the future of international organizations such as the International Monetary Fund (IMF) and the World Bank as Trump’s economic policies threaten global stability. Epstein is professor of economics and co-director of the Political Economy Research Institute at the University of Massachusetts Amherst. His most recent book is Busting the Bankers’ Club: Finance for the Rest of Us. The interview that follows has been lightly edited for clarity.

C.J. Polychroniou: Trump’s erratic reciprocal tariffs represent an unprecedented shift in U.S. trade policy and are having dramatic impacts on both the U.S. and global economies. The U.S. dollar has also experienced a sharp decline due to the Trump administration’s tariffs chaos. Why are tariffs weakening the dollar? And isn’t this bad news for the average U.S. consumer and a slam for the working-class voters that support Trump?

Gerald Epstein: Trump’s tariffs are creating havoc in the world economy and for U.S. businesses, consumers and workers. Part of the problem lies in the nature of the tariffs themselves, and part of it results from the huge uncertainty generated by the on-again-off-again, maybe-maybe-not quality of them. With respect to the issue of uncertainty, economists of many stripes, from John Maynard Keynes to Milton Friedman, have argued that for capitalism (and capitalists) to prosper, uncertainty must be held in check. The main reason is that long-term investment drives the economy. Mainstream economists extol the economic importance of consumers, but we have known from at least the time of Marx that it is investment (what Marx called “accumulation of capital”) that underpins the system. But since most useful investment is relatively long lasting and requires significant upfront expenses, capitalists are reluctant to make such commitments when uncertainty is through the roof, as it is now. The result is not only a likely reduction in investment in plants, equipment and technology, but, through a downward multiplier process, a reduction in demand and employment spread throughout the economy.

Then there is the structure of the tariffs themselves.

Here there are at least two issues of relevance to the impact on the economy. The first is the massive, indeed prohibitive level of tariffs on China, in combination with high tariffs on Canada and Mexico. Together, these countries account for more than one-third of U.S. trade, so the tariffs are obviously extremely disruptive to their economies and ours. The second issue is the fact that the U.S. tariffs did not distinguish between imports of final goods and imports of parts and other intermediate products. If Trump wants to reshore manufacturing production and jobs, he is making that goal more difficult by slapping tariffs on products that these firms will have to use to produce their newly onshored final goods like cars.

Together, these policies are tanking expected corporate profits in the U.S., threatening unemployment for U.S. workers and slashing plans for corporate investment.

In this environment, profit prospects for U.S. companies based in the U.S. are way down. As a result, financial investment into the U.S. is less profitable and riskier. Hence, there is less demand for U.S. dollars to invest in the U.S. This is one main reason why the value of the dollar is going down and shows a direct connection between Trump’s tariffs and the dollar.

But there is a further reason why the dollar is falling. And this relates to a possible disruption of the trust by global capitalists in the United States as a “safe haven” in times of trouble and turmoil.

Trump has gone to war with the U.S. Federal Reserve and would have liked to be able to fire Federal Reserve Chair Jerome Powell over interest rates. First, what’s the connection between Trump’s trade deals and the Fed? Second, why is the Fed holding interest rates steady?

The connection is simple. Trump’s bumbling tariff war creates big problems for the Fed: The war creates pressures for both inflation and recession. When tariffs go up, prices of goods will go up: That will drive up inflation at least temporarily. And for the reasons I discussed earlier, the tariff war threatens a recession. This immobilizes the Fed because it has no good policy option: Increasing interest rates could fight inflation but will make recession worse; lowering interest rates would cushion the recession but could increase inflation by keeping demand high. So, the Fed is just holding steady until events become clearer.

Investors are selling off U.S. government bonds. Why is this happening now?

Part of the reason they are selling bonds is because they are worried about higher inflation which makes these bonds less valuable in real terms. But another reason — and the one that really got investors and economists’ attention — is the concern that they are selling off bonds because of a loss of confidence in the U.S. economy and the U.S. dollar as a “safe haven” in a turbulent world.

Could the U.S. dollar lose global reserve currency status on account of Trump’s tariff war? If so, how could this impact the international monetary system as well as the direction of the U.S. economy?

The U.S. dollar is unlikely to completely lose its global reserve currency status now, largely for two reasons: One is inertia. Much of the rest of the world already has a lot of business of various kinds connected to the dollar: their foreign exchange reserve holding; the financial trades they make with derivatives and other financial instruments; their offshore financial activity — for example, in London, that often does not even involve U.S. financial institutions but nonetheless is denominated in dollars; and so on.

And the second reason is the lack of a clear better alternative that could completely take over for the dollar. The two rivals are the European Union (EU) and China. But Europe is not only decentralized and lacks a unified economic and military strategy, but it is also being undermined by the same forces that Trump is unleashing — economic uncertainty and an emboldened Russia. As for China, it is still perceived as “lawless” and as a potential enemy of the global capital class.

But just because the U.S. dollar is unlikely to completely lose its status in the coming period does not mean that the dollar’s role won’t significantly decline in some areas, especially in the case of the official role of reserve holdings and in trade within a growing Chinese economic bloc in Asia and inside the EU.

An interesting question is whether this likely decline will negatively impact the United States and affect the operations of the global financial system. Economists debate the issue of whether the dollar’s global role provides the U.S. with an “exorbitant privilege,” to use the derogatory term used by the French and others. The idea is that the dollar’s role allows U.S. institutions, including the government, to borrow more extensively and more cheaply from the rest of the world than they would be able to otherwise. This idea leads to the term that the U.S. can run “deficits without tears.” This is also tied to the idea that the U.S. and its dollar are seen as “safe havens” when global turmoil erupts. When the dollar fell and U.S. government interest rates went up in the wake of the recent market tariff kerfuffle, many commentators suggested that the dollar’s safe haven “exorbitant privilege” was at risk: that Trump was wrecking a valuable U.S. advantage. I believe that this privilege is real and important, even though it has often been difficult to assess because it has been so secure. Now we are witnessing a “natural experiment” in the disruptions caused by Trump and his trade adviser, Peter Navarro.

Will the rest of the world be able to benefit from this loss of “privilege?” If chaos ensues as a result in the short-to-medium run, it seems unlikely. If China or Europe seize the moment, then they might be able to benefit and capture some of this privilege. The best thing would be for the international community to issue more international “currencies,” such as the special drawing rights issued by the IMF, and transition to a more global currency that could spread these privileges around. But this is unlikely to happen as long as the U.S. is around to block these institutions from stepping out on their own.

Trump took the U.S. out of the Paris Agreement and withdrew it from the World Health Organization. That’s bad news, indeed. But there are also concerns that he will kill the Bretton Woods System by withdrawing the U.S. from the International Monetary Fund and the World Bank, which may or may not be such bad news. Your thoughts on this matter?

This question leads us to the role of the United States in international organizations, such as the IMF, the World Bank, and other organizations. It seems pretty clear that the Trump administration either wants to completely control international organizations for its own purposes or wants to destroy them. This seems like the approach it will take with respect to the IMF and the World Bank. Since these are such big and powerful institutions, the Trump administration will first try to control them and manipulate them so as to pursue its own agenda of slashing investments in preventing and adapting to climate change, slashing programs to help support women economically, and so on. The only thing possibly forcing Trump to keep the U.S. in these organizations is the fear that China might take them over.

As such, countries in the rest of the world will have to make one of the following choices: (a) give in to Trump’s destructive demands; (b) align with China and wrest control of these institutions that way or (c) develop a truly third way to control these institutions themselves. I am not knowledgeable enough about this situation to be able to predict an outcome. But, in my view, resisting Trump and Trumpism should be the first order of business.

HELP TRUTHOUT RESIST THE NEW MCCARTHYISMhttps://truthout.org/articles/what-does-trumps-economic-chaos-mean-for-the-global-financial-system/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

crap bonds....

https://www.youtube.com/watch?v=cQRA4_sqkVU

Wall Street SHAKEN: US Struggles to Sell $22 Billion in Bonds Amid the Most Dangerous Bond AuctionREAD FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

empire's end...

https://www.youtube.com/watch?v=1Wcaoyow6AU

"What's Coming Is WORSE Than A Recession..." | Richard Wolff's Last WARNINGRichard D. Wolff is an American economist and professor emeritus at the University of Massachusetts Amherst. He is known for his critiques of economic inequality and his advocacy for worker cooperatives as a way to empower individuals and address systemic issues within the economy. Through his books, lectures, and public appearances, Wolff explores topics such as economic democracy and alternative economic models.

SEE ALSO: https://www.youtube.com/watch?v=zuw5ykf4yaQ

===================

https://www.youtube.com/watch?v=TLdAIxPac7c

How Ukraine is Accelerating the ‘Collapse of Europe’s Political Center’Brian Becker, host of BreakThrough’s The Socialist Program, joins the show to discuss the latest surrounding the escalating proxy war in Ukraine. Becker breaks down Donald Trump’s claims about ending the war, NATO’s role in fueling global conflict, and the growing disconnect between European governments and their people. “There’s really great alarm by the EU leadership that peace might break out in Ukraine,” Becker says, calling it a “bizarre turn in world politics” driven by European capitalists who are “groveling before US imperialism” that they now demand a more aggressive US posture, even at the expense of their own populations.

=================

SEE ALSO : https://www.youtube.com/watch?v=4L9pDutSpA8

===================

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

counter china....

TRUMP PUSHES CHINA OUT OF THE MIDDLE EASTBY Iman Shamas

Beirut – What message did US President Donald Trump want to send to China through his visit to the Gulf region? And how is he trying to reestablish the United States as the world’s foremost external power?

According to Zainab Rabou, a researcher at the Hudson Institute, Beijing considers the Gulf region a key arena in its strategy to displace American influence and reshape global power dynamics. This region offers Beijing various options for challenging American hegemony through five factors:

1- The Gulf can provide China with the energy it needs to support its industrial economy. The region provides nearly half of China’s crude oil imports, and Beijing views long-term energy security as essential to regime stability.

2- The Middle East is a geopolitical corridor linking East Asia with Europe and Africa. China’s Belt and Road Initiative has prioritized ports, logistics corridors, and commercial access points throughout the Gulf. This gives Beijing influence over major maritime and land trade routes. The Digital Silk Road, the technological pillar of the Belt and Road Initiative, is expected to contribute up to $255 billion to the GCC’s GDP and generate 600,000 jobs in the technology sector by 2030.

Undermining controls

3- The region provides China with capital and opportunities to export its technologies. Sovereign wealth funds in Saudi Arabia and the UAE can serve as established and politically stable investment sources for Chinese companies, making the Gulf states ideal partners for Beijing as it seeks to globalize its industrial policy and expand its technology platforms. As the Gulf states pursue rapid digital transformation, this could provide Chinese companies with greater access to financing and the opportunity to build emerging technology ecosystems from scratch.

The researcher believes that the United States no longer views the Middle East as a marginal issue, but rather as a vital arena for strategic competition.

4- The region helps China undermine US export controls and sanctions regimes. The region, particularly sanctioned entities such as Iran, and China can work together to circumvent Western restrictions. By leveraging regional networks and opaque financial channels, Chinese companies facilitate the transfer of sensitive technologies and capital, undermining the effectiveness of US sanctions and exposing the limits of Washington’s economic power.

China has developed a method for importing Iranian oil while avoiding Western financial networks and shipping services. Using “dark fleet” tankers, Iran ships oil to China and receives payments through smaller Chinese banks. With major state-owned refineries facing sanctions risks, approximately 90 percent of Iran’s oil exports are now handled by “teapots,” small, independent Chinese refineries.

5- The Middle East provides China with operational space to weaken US-led alliances and discredit American influence. Beijing presents itself as a strategic alternative, unconstrained by Washington’s political circumstances. It promotes anti-US narratives that portray US policy as destabilizing and self-interested.

This message resonates across the Global South, eroding U.S. power in key regions, and signals the growing impact of China’s influence campaign on U.S. defense relationships across the region. The collapse of Washington’s $23 billion sale of F-35 fighter jets to the United Arab Emirates has weakened one of America’s most advanced defense partnerships in the region.

China has developed a way to import Iranian oil while bypassing Western financial networks and shipping services.

Countering China’s influence

According to the researcher, China is exploiting its involvement in the Middle East as a Trojan horse to consolidate its influence through three main mechanisms:

1- Chinese technology platforms integrate AI-based surveillance and governance systems directly into state institutions, normalizing these countries’ dependence on China for infrastructure and standards.

2- Cooperation agreements make China a key state function, such as communications, which makes it difficult for Washington to compete for access and influence.

3. Beijing’s deals aim to cement long-term energy relations while expanding the scope of petroyuan transactions, undermining the US dollar’s position as a global standard. This model cements Beijing’s position as an indispensable partner in everything from data to finance to security.

The researcher believes that the United States no longer views the Middle East as a marginal issue, but rather as a vital arena for strategic competition with China. This message is underscored by Saudi Arabia’s pledge of $600 billion in US-linked investments, including more than $100 billion in arms purchases. At the same time, Washington is preparing a deal aimed at excluding China from future Gulf infrastructure in the fields of artificial intelligence, surveillance, and cloud computing,

In her view, these agreements are part of the US administration’s strategy to counter China’s growing influence by making digital sovereignty a central focus of US security partnerships. This shift is evident in Trump’s decision to lift sanctions on Damascus in an attempt to re-enter a strategic arena ceded by the Obama administration to China, Russia, and Iran, and to prevent Beijing from monopolizing a strategically pivotal region in the Middle East. She concludes by saying, “In a region characterized by shifting loyalties and strategic uncertainty, Washington affirms its renewed commitment to shaping the balance of power, not responding to it.”

nehmehamie@gmail.com

https://www.theinteldrop.org/2025/06/10/trump-pushes-china-out-of-the-middle-east/