Search

Recent comments

- 2019 clean up before the storm....

3 hours 34 min ago - to death....

4 hours 13 min ago - noise....

4 hours 20 min ago - loser....

7 hours 45 sec ago - relatively....

7 hours 23 min ago - eternally....

7 hours 28 min ago - success....

17 hours 56 min ago - seriously....

20 hours 40 min ago - monsters.....

20 hours 48 min ago - people for the people....

21 hours 24 min ago

Democracy Links

Member's Off-site Blogs

a joke in the history of world economics.......

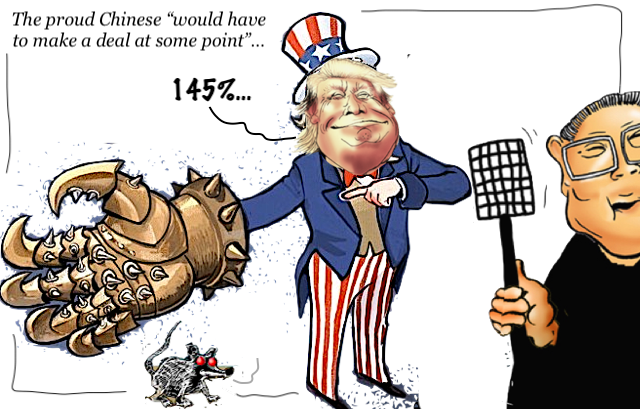

China likened the United States’ tariff policy to a ‘numbers game’ with no practical meaning after the administration of US President Donald Trump imposed multiple rounds of duties on Chinese imports over the past few weeks.

In a statement on Friday, the Chinese government accused Washington of using tariffs as a weapon for bullying and coercion, while hitting back with its own reciprocal trade duties.

”Even if the US continues to impose even higher tariffs, it would no longer have any economic significance and would go down as a joke in the history of world economics,” a spokesman for the Ministry of Commerce said, as cited by Reuters.

The US has imposed four major tariff hikes on China in just over two months, with the latest escalation on Wednesday bringing the duties from an initial average of 20% to a cumulative rate of 145%.

China has retaliated, announcing its latest reciprocal hike to 125% on all American imports on Friday.

The Ministry of Commerce said Beijing would not retaliate any further, indicating that it may turn to other ways of responding and vowing to “fight to the end.”

Trump argues that the increased duties are needed to address trade imbalances and stop China from “ripping off the USA.” Earlier this week, he opined that the “proud”Chinese would have to “make a deal at some point.”

China has also filed a lawsuit with the World Trade Organization challenging the latest US tariff hike, asserting that Washington’s actions have significantly disrupted the global economy.

READ MORE: Global tariff war: Key developmentsThe trade dispute between the world’s two largest economies has caused extreme volatility in global stock markets, sent oil prices to four-year lows, and caused concerns regarding global supply chains.

https://www.rt.com/news/615629-china-us-tariff-numbers-game/

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

- By Gus Leonisky at 12 Apr 2025 - 4:44am

- Gus Leonisky's blog

- Login or register to post comments

decoupling.....

The Case for “Avalanche Decoupling” From China

Planning for Dramatic U.S. Action in a Crisis Will Make One Less Likely

Eyck Freymann and Hugo Bromley

January 29, 2025

As tensions rise in the Taiwan Strait and the South China Sea, U.S. efforts to deter Chinese aggression suffer from a fundamental credibility problem. The United States has conventional and strategic tools to deter Beijing, including the threat of punishing economic sanctions. But China is much too big and integrated into the global trading system to expel it from the world economy overnight. A sudden economic break between Beijing and Washington would be devastating for the United States and catastrophic for the rest of the world. Financial panic and supply chain disruptions would fracture the international economic order.....

https://www.foreignaffairs.com/china/case-avalanche-decoupling-china

Decoupling From China? The Consequences of a Stupid Idea

Ricardo Martins, October 10, 2024

There are ongoing discussions about the need for the West, especially the United States (US) and the European Union (EU) to de-risk and/or decouple from China. These discussions pervade all spheres, including journalistics, think tanks, academia and politics

https://journal-neo.su/2024/10/10/decoupling-from-china-the-consequences-of-a-stupid-idea/

The Real Strategic End Game in Decoupling From ChinaGoing all-in on the transatlantic economy is the only serious option for Western democracies seeking to counter China.

By Valbona Zeneli and Joseph VannSeptember 18, 2020In the shadow of the global COVID-19 disaster, governments around the world are rethinking trade practices with China. That effort requires some much-needed reflection about what a real economic partnership should look like. A near perfect example of that kind of partnership is the transatlantic economy. Built on foundations of the Industrial Revolution and then purposefully redesigned for greater success in the aftermath of World War II, the transatlantic economy has produced the largest and most successful trading bloc in the world, remaining the most dominant and interconnected force in the global economy.

In spite of the transatlantic economy’s successes, the argument could be made that the transatlantic community has overlooked the importance of this partnership. The evidence lies in the fact that we are not seriously maximizing investment opportunities within the partnership and thus limiting its potential. For too long our attention has shifted toward China, hoping to strike it rich quick.

https://thediplomat.com/2020/09/the-real-strategic-end-game-in-decoupling-from-china/

Here’s Why the Great Decoupling From China is Long Overdue

Jarrett Stepman | April 10, 2025

In the last few weeks, the world has been on a roller coaster ride over President Donald Trump’s proposals to massively increase tariffs.

Whether by intention or not, American trade policies now stand in an interesting place. Trump has paused America’s largest tariffs increases on virtually every country, save one: China. On China, the Trump administration announced Thursday that it will now apply a 145% tariff, an amount that seems to be climbing by the minute.

Who knows where this ride will end, but it very much appears that the U.S. economic decoupling from China is beginning in earnest, and not a moment too soon.

https://www.dailysignal.com/2025/04/10/heres-why-the-great-decoupling-from-china-is-long-overdue/

17 May, 2024 20:49

HomeBusiness News

Decoupling from China may be ‘impossible’ – survey

The Asian nation remains a “critical supplier” globally, according to an Allianz Trade report

Total economic decoupling from China would be “difficult, if not impossible,” a new report by international insurance company Allianz Trade has suggested, saying that the Asian power remains a “critical supplier” for much of the world.

The survey by Allianz Trade polled over 3,000 companies in China, France, Germany, Italy, Poland, Spain, the UK, and US on their outlook for global trade in 2024.

The intensity of import dependency on China varies, with the US, UK, and France being among the most exposed. Nearly 50% of US imports from China are critical dependencies, it said.

“There is no evidence of a full decoupling from China yet,” the report said, noting that more than one-third of respondents plan to increase their footprint in China.

Despite talk of decoupling and diversifying away from China, “there is probably a limit to what extent this can happen,” Allianz said, adding that European countries remain bullish about their prospects there.

Some 39% of companies in Germany and Spain, and more than 30% in France, expect to increase their footprint in China, according to the survey. That’s compared with 27% in the US who plan to do the same.

“European companies are clearly less worried than US firms,” the report said.

The trend of diversification rather than decoupling seems more apparent, Allianz said, with a quarter of German, French and US firms expecting their footprint in China to represent “a smaller share of their global supply investments going forward.”

US and EU officials have been struggling to come up with a unified strategy on China as they try to reduce trade dependence on Beijing, which they have repeatedly accused of economic coercion.

The Chinese government, meanwhile, has claimed that Washington and its allies have weaponized trade regulations in order to advance anti-China policies and accused them of “economic bullying.”

READ MORE: EU trade chief rules out China decouplingWestern officials, however, have recently shifted from the ‘decoupling’ rhetoric to that of ‘de-risking and diversifying.’ That approach was reflected in a joint communique adopted by the G7 during its summit in Japan in May, which accused Beijing of trying to “distort the global economy.”

Beijing rejected the allegations, saying the West is stuck in a “Cold-War mentality.”

https://www.rt.com/business/597806-china-decoupling-impossible-survey/?ysclid=m9d5nb08m4231587331

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

not a joke....

The president of the African Development Bank (AfDB), Akinwumi Adesina, said on Friday that an onslaught of US tariffs would send "shock waves" through African economies.

In a speech at the National Open University of Nigeria, Adeisna warned of reduced trade and higher debt-servicing costs on countries across the continent.

"Inflation will increase as costs of imported goods rise and currencies devalue against the US dollar," Adesina said. "The cost of servicing debt as a share of government revenue will rise, as expected revenues decline," he added.

If Trump restarts the tariffs after the 90 day pause, most African countries would be subject to a baseline 10%, but 47 African countries at risk of even higher tariffs.

The AfDB chief said this will cause local currencies to weaken on the back of reduced foreign exchange earnings.

Additionally, Adesina warned that Europe and Asia "will buy less goods from Africa" amid the global shocks.

European stocks slide amid volatilityEuropean stocks finished the week with a downturn, after a week of volatility in the market following Trump's tariff delay and increasing trade war with China.

The pan-European STOXX 600 edged 0.1% lower, after China raised tariffs on US goods to 125% from 84%. The index briefly hit a near 1-1/2-year low earlier this week, then surged on Thursday after the tariff pause.

Both the benchmark and several regional indexes had their strongest session since 2022.

Friday's figures, however, represent a straight week in the red for the STOXX 600.

Meanwhile, the regional indexes had mixed results. Germany's DAX fell by 1%, while the UK's FTSE 100 went up 0.6%.

ECB President Christine Lagarde said that despite the volatility, euro zone financial markets are still functioning well.

US President Donald Trump is "optimistic" about striking a trade deal with China, the White House said Friday.

"The president has made it very clear he's open to a deal with China," White House Press Secretary Karoline Leavitt said, adding, "He's optimistic."

China said Friday it will raise tariffs on US goods to 125%, up from the 84% levy announced on Wednesday.

"If China continues to retaliate, it's not good for China," Leavitt said.

Earlier this week Trump paused import taxes for other countries, but he raised tariffs on China and they now total 145%.

https://www.dw.com/en/trump-tariffs-china-slaps-new-125-levy-on-us-goods/live-72211113

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

about china....

Trump Concocted the 'Tariffs Hoax' to 'Decouple' with China BY MIKE WHITNEYThe Trump tariff extravaganza was never about trade deficits, reindustrialization, or bringing jobs back to America. It was always about China. Now that Trump has either eased or lifted the tariffs on 90 other countries, we can see what’s actually going on. Trump is using the ‘tariffs smokescreen’ to implement his decoupling policy, a strategy that is designed to isolate, encircle and eventually crush the People’s Republic of China. That’s the motive that drives the policy. The tariffs were just a means to an end. This is from CNN:

President Donald Trump announced a complete three-month pause on all the “reciprocal” tariffs that went into effect at midnight, with the exception of China, a stunning reversal from a president who had insisted historically high tariffs were here to stay.

But enormous tariffs will remain on China, the world’s second-largest economy. In fact, Trump said they will be increased to 125% from 104% after China announced additional retaliatory tariffs against the United States earlier Wednesday. All other countries that were subjected to reciprocal tariff rates Wednesday will see rates go back down to the universal 10% rate, he said.

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump said in his social media post. “At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable,” he wrote. Trump announces 90-day pause on ‘reciprocal’ tariffs with exception of China, CNN

China’s “lack of respect”? So, Trump is setting US trade policy based on bruised feelings??

That’s just not a credible explanation. Something else is going on here.

China is being targeted because China’s meteoric rise and explosive growth has made it a threat to America’s global hegemony. That is why China has entered Washington’s crosshairs. By imposing prohibitive 125% tariffs on Chinese exports, Trump is indicating that the era of integrated markets in a globalized system is over. The world is being redivided into warring blocs by wealthy Capitalists in the West who cannot compete with China’s government-led model that controls the nation’s critical industries and recycles massive profits back into vital infrastructure, education, R&D and technology. The West’s highly financialized model—that increasingly depends on skimming the cream off toxic securities and stock buybacks—cannot remake itself into a manufacturing powerhouse willing to compete with China on a level playing field. Instead, it must use its waning influence to jolt the system with some unexpected fireworks display (the tariffs) that sends shockwaves through the system and panic across the markets. These contrived spectacles, that border on economic terrorism, are all part of Uncle Sam’s repertoire that are used to subdue the opposition and maintain Washington’s tenuous grip on power.

But do they work?

Trump seems to think so. Here’s Trump with his billionaire friends discussing ‘the killing’ they made when he eased the tariffs and markets soared.

https://x.com/Megatron_ron/status/1910238378064257143?

We should have seen through this hoax from the very beginning. After all, if Trump was serious about bringing jobs back to the US, wouldn’t he have convened a Blue-Ribbon panel of industry experts and economists to create an industrial policy that would provide a roadmap for how to proceed? Wouldn’t he have looked into the feasibility of re-industrialization in a country that has already shuttered the bulk of its factories and no longer has a workforce that is trained to do the jobs that are about to be created? And wouldn’t he have solicited the support of wealthy Capitalists who could be persuaded to make the long-term investments required for an industrial project of this magnitude?

Yes, he would have. But he didn’t do any of those things, because he wasn’t serious about any of it. The whole tariffs-fracas was just an illusionist’s trick aimed at creating a pretext for attacking China. That’s why it was so easy for Trump to end the charade with a wave of his hand as if nothing had happened. Because nothing had happened. It was all a glitzy light-show devoid of any real substance.

And no one makes my case that ‘this was all about China’ better than Trump’s right-hand man, Treasury Scott Secretary Bessent. Check out this clip of Bessent boasting about how he tricked China.

https://x.com/BehizyTweets/status/1910032448676626726?

Bessent is obviously pleased that he and Trump were able to ‘pull a fast one’ on China. Bessent thinks that’s good policy. And, of course, the American people—most of whom are distrustful of China to begin with—agree. “China is ripping us off”, says the president whose nation’s bank account is $36 trillion overdrawn and whose country lives on ‘the generosity of strangers.’ “China is stealing our jobs”, say the corporate bosses who uprooted their businesses and factories lock-stock-and-barrel and shipped them to China to take advantage of the cheap labor and free security. But now China must be crushed for aspiring to compete with “their betters” in the USA. Now China must be ‘brought to heel’.

Isn’t that what’s really going on? (if we’re honest with ourselves) Isn’t this really a case of sour grapes?

Indeed, it is. China has overtaken the US as the manufacturing capitol of the world through intelligence, hard work, ingenuity and an organizational model (recycled profits into productive activity) that is the result of good governance. That is why China is rapidly surpassing the US in science, technology, AI, quantum computing, robotics and nearly everything else. Because they are governed by people who aspire to create a civilization in which individuals and community achieve their full potential. This is why the entire country is crisscrossed with high-speed rail linking shiny, space-age cities together in a vision of 21st century modernity that is unrivaled in the world today. Whatever one may think about China, they must admit that—as a civilization and a society—they are headed in the right direction while the dilapidated, threadbare and deeply polarized US is in steep decline.

In any event, China’s success has generated considerable envy among western elites who are now determined to do everything in their power to turn back the clock to the post war era when the global economy was their oyster, and the “rules-based order” was the only game in town. The goal is to “contain China’s growth”, which is a sobriquet for subverting China’s development at every turn. The particular strategy even has a name. It’s called “decoupling” which refers to the process by which the United States (and other Western countries) reduce their economic, technological, and financial interdependence with China. In other words, western elites want to terminate trade with China as much as possible which will lead to isolation, encirclement and eventually, regime change. Sound familiar?

The trick is to make “decoupling” (economic isolation) look like it is being forced upon the United States which is why Trump keeps repeating the inane phrase, “China is ripping us off.”

Just to clarify that point: China gives US consumers quality merchandise that requires expensive resources, factories and investment in exchange for green sheets of paper of diminishing value. On which end of that deal would you rather be?

Take a minute and watch this short video with economist Larry Summers who explains that China is NOT cheating anyone by producing inexpensive goods that it is willing to exchange for USD.

https://x.com/RnaudBertrand/status/1910296288610189704?

Lawrence Summers: “If China wants to sell us things at really low prices and the transaction is we get solar collectors or we get batteries that we can put in electric cars and we send them pieces of paper that we print. Do you think that’s a good deal for us or a bad deal for us?”

Characterizing this as “cheating”, like Summers rightly says, should be rejected entirely. At the end of the day, who’s more “cheated”: the party doing the hard work of producing goods at very low prices on razor thin margins, or the party that simply prints a virtually infinite amount of fiat money to pay for all this stuff?

In short, the ‘tariffs flap’ was just a way to kick off the new policy (which is decoupling) which is aimed at intensifying the hostility between Washington and Beijing. With that in mind, I asked Grok the following question:

Does President Trump support decoupling with China?

Yes, former President Donald Trump has been a strong advocate for decoupling from China, both during his presidency (2017–2021) and in his subsequent political activities as of April 2025….

Trump initiated a trade war with China in 2018 by imposing tariffs on billions of dollars worth of Chinese goods… In 2018, the U.S. imposed tariffs on $50 billion of Chinese imports, followed by additional tariffs on $200 billion more in 2019….Trump framed this as a necessary step to “decouple” from China’s economy.

Trump banned U.S. companies from using equipment from Chinese telecom giants like Huawei and ZTE, citing national security risks. He also pushed for restrictions on TikTok and WeChat, arguing they posed threats to data privacy and could be used for espionage… He encouraged allies to exclude Huawei from their 5G networks, framing it as part of a broader effort to reduce technological dependence on China…..

During his 2024 presidential campaign, Trump repeatedly called for even tougher measures against China, including higher tariffs (proposing rates as high as 60% on all Chinese goods) and a complete overhaul of trade relations. In a speech in Ohio in March 2024, he said, “We’re going to decouple from China like never before. They’ve ripped us off for decades, and it’s time to end it.”

Trump has argued that decoupling would protect American jobs, strengthen the economy, and reduce national security risks. In a post from January 2025, he wrote, “China has taken advantage of us for too long. We need to cut the cord and build everything here at home.”

As of 2025, however, his tone has hardened, with less emphasis on negotiation and more on confrontation….

Posts on X from early 2025 show Trump doubling down on his anti-China stance, with supporters praising his “toughness”…. Grok

So, Trump is a big proponent of decoupling, which tells you everything you need to know.

Also, Trump’s hard-nosed policies towards China are heaped under the patriotic-sounding rubric, “economic nationalism”, as if American workers derived some benefit from higher prices and soaring inflation. The fact is, however, is that ordinary people will suffer greatly from decoupling and see their standards of living fall even further. That’s because the policy is not intended to create jobs, increase wages, improve health care or provide lower-cost education. It is aimed at preserving Washington’s grip on global power so that corrupt western elites can create more mischief while driving the country further into debt and despair. Here’s more from Grok:

Many economists forecast that these wide-ranging tariffs will accelerate inflation and dampen US economic growth, resulting in stagflation as economic growth falters even as prices remain painfully high…. Additionally, China is unlikely to lower its tariffs to appease Trump; instead, it has retaliated with 34% tariffs on US goods. Both countries’ increased tariffs will reduce bilateral trade.

While China can survive without importing most of the US$125 billion in American goods, the US and many other countries will continue to rely on China for various parts and components. Even if the US imports goods from other countries, those countries will still depend on China for parts.

Potential contradictions and economic consequences

Trump’s reciprocal tariffs are likely to cause a self-inflicted recession in the US. Also, it could create confusion and unintended consequences… Seven years ago, Trump’s first wave of tariffs raised the cost of Chinese goods by 20%, but US imports from China continued to grow….

In the future, even if tariffs on Chinese products rise to 54%, the US will still need to buy from China. By contrast, American products, such as soybeans or crude oil, have limited competitiveness in China. China’s retaliatory tariffs on the US will force it to find alternative markets, leading to losses for US soybean and crude oil exporters….Grok

What part of the above excerpt sounds like a ‘good deal’ for the American people?

None of it. It’s all bad. And the one glimmer of light in this whole dismal affair is the fact that the American people oppose the policy because they know they’ll be hurt by it. Take a look at this survey at PEW:

Tariffs On China

Tariffs are another key part of Trump’s foreign policy. Increased tariffs on China, specifically, receive more negative than positive evaluations…. Many more think the increased tariffs on China will be bad for the U.S. than say they will be good, though around a quarter either see them having no effect or are unsure.

Views of the tariffs’ personal impact are similarly negative: Americans are about five times as likely to say the increased tariffs on China will be bad for them as they are to say the tariffs will be beneficial.

Republicans are more likely than Democrats to say increased tariffs on China will be good for the U.S. and good for them personally. Still, when it comes to the personal impact of these tariffs, Republicans are more likely to say the impact will be bad (30%) than good (17%), even as substantial shares express uncertainty or anticipate the tariffs will have limited personal impact. Tariffs On China, PEW Research Center

So, at least there exists a slim majority of Americans who oppose decoupling, oppose the relentless provocations and incitements, and oppose Trump’s pointless War on China. Let’s hope that majority holds.

https://www.unz.com/mwhitney/trump-concocted-the-tariffs-hoax-to-decouple-with-china/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

about china....

Trump Concocted the 'Tariffs Hoax' to 'Decouple' with China BY MIKE WHITNEYThe Trump tariff extravaganza was never about trade deficits, reindustrialization, or bringing jobs back to America. It was always about China. Now that Trump has either eased or lifted the tariffs on 90 other countries, we can see what’s actually going on. Trump is using the ‘tariffs smokescreen’ to implement his decoupling policy, a strategy that is designed to isolate, encircle and eventually crush the People’s Republic of China. That’s the motive that drives the policy. The tariffs were just a means to an end. This is from CNN:

President Donald Trump announced a complete three-month pause on all the “reciprocal” tariffs that went into effect at midnight, with the exception of China, a stunning reversal from a president who had insisted historically high tariffs were here to stay.

But enormous tariffs will remain on China, the world’s second-largest economy. In fact, Trump said they will be increased to 125% from 104% after China announced additional retaliatory tariffs against the United States earlier Wednesday. All other countries that were subjected to reciprocal tariff rates Wednesday will see rates go back down to the universal 10% rate, he said.

“Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump said in his social media post. “At some point, hopefully in the near future, China will realize that the days of ripping off the U.S.A., and other Countries, is no longer sustainable or acceptable,” he wrote. Trump announces 90-day pause on ‘reciprocal’ tariffs with exception of China, CNN

China’s “lack of respect”? So, Trump is setting US trade policy based on bruised feelings??

That’s just not a credible explanation. Something else is going on here.

China is being targeted because China’s meteoric rise and explosive growth has made it a threat to America’s global hegemony. That is why China has entered Washington’s crosshairs. By imposing prohibitive 125% tariffs on Chinese exports, Trump is indicating that the era of integrated markets in a globalized system is over. The world is being redivided into warring blocs by wealthy Capitalists in the West who cannot compete with China’s government-led model that controls the nation’s critical industries and recycles massive profits back into vital infrastructure, education, R&D and technology. The West’s highly financialized model—that increasingly depends on skimming the cream off toxic securities and stock buybacks—cannot remake itself into a manufacturing powerhouse willing to compete with China on a level playing field. Instead, it must use its waning influence to jolt the system with some unexpected fireworks display (the tariffs) that sends shockwaves through the system and panic across the markets. These contrived spectacles, that border on economic terrorism, are all part of Uncle Sam’s repertoire that are used to subdue the opposition and maintain Washington’s tenuous grip on power.

But do they work?

Trump seems to think so. Here’s Trump with his billionaire friends discussing ‘the killing’ they made when he eased the tariffs and markets soared.

https://x.com/Megatron_ron/status/1910238378064257143?

We should have seen through this hoax from the very beginning. After all, if Trump was serious about bringing jobs back to the US, wouldn’t he have convened a Blue-Ribbon panel of industry experts and economists to create an industrial policy that would provide a roadmap for how to proceed? Wouldn’t he have looked into the feasibility of re-industrialization in a country that has already shuttered the bulk of its factories and no longer has a workforce that is trained to do the jobs that are about to be created? And wouldn’t he have solicited the support of wealthy Capitalists who could be persuaded to make the long-term investments required for an industrial project of this magnitude?

Yes, he would have. But he didn’t do any of those things, because he wasn’t serious about any of it. The whole tariffs-fracas was just an illusionist’s trick aimed at creating a pretext for attacking China. That’s why it was so easy for Trump to end the charade with a wave of his hand as if nothing had happened. Because nothing had happened. It was all a glitzy light-show devoid of any real substance.

And no one makes my case that ‘this was all about China’ better than Trump’s right-hand man, Treasury Scott Secretary Bessent. Check out this clip of Bessent boasting about how he tricked China.

https://x.com/BehizyTweets/status/1910032448676626726?

Bessent is obviously pleased that he and Trump were able to ‘pull a fast one’ on China. Bessent thinks that’s good policy. And, of course, the American people—most of whom are distrustful of China to begin with—agree. “China is ripping us off”, says the president whose nation’s bank account is $36 trillion overdrawn and whose country lives on ‘the generosity of strangers.’ “China is stealing our jobs”, say the corporate bosses who uprooted their businesses and factories lock-stock-and-barrel and shipped them to China to take advantage of the cheap labor and free security. But now China must be crushed for aspiring to compete with “their betters” in the USA. Now China must be ‘brought to heel’.

Isn’t that what’s really going on? (if we’re honest with ourselves) Isn’t this really a case of sour grapes?

Indeed, it is. China has overtaken the US as the manufacturing capitol of the world through intelligence, hard work, ingenuity and an organizational model (recycled profits into productive activity) that is the result of good governance. That is why China is rapidly surpassing the US in science, technology, AI, quantum computing, robotics and nearly everything else. Because they are governed by people who aspire to create a civilization in which individuals and community achieve their full potential. This is why the entire country is crisscrossed with high-speed rail linking shiny, space-age cities together in a vision of 21st century modernity that is unrivaled in the world today. Whatever one may think about China, they must admit that—as a civilization and a society—they are headed in the right direction while the dilapidated, threadbare and deeply polarized US is in steep decline.

In any event, China’s success has generated considerable envy among western elites who are now determined to do everything in their power to turn back the clock to the post war era when the global economy was their oyster, and the “rules-based order” was the only game in town. The goal is to “contain China’s growth”, which is a sobriquet for subverting China’s development at every turn. The particular strategy even has a name. It’s called “decoupling” which refers to the process by which the United States (and other Western countries) reduce their economic, technological, and financial interdependence with China. In other words, western elites want to terminate trade with China as much as possible which will lead to isolation, encirclement and eventually, regime change. Sound familiar?

The trick is to make “decoupling” (economic isolation) look like it is being forced upon the United States which is why Trump keeps repeating the inane phrase, “China is ripping us off.”

Just to clarify that point: China gives US consumers quality merchandise that requires expensive resources, factories and investment in exchange for green sheets of paper of diminishing value. On which end of that deal would you rather be?

Take a minute and watch this short video with economist Larry Summers who explains that China is NOT cheating anyone by producing inexpensive goods that it is willing to exchange for USD.

https://x.com/RnaudBertrand/status/1910296288610189704?

Lawrence Summers: “If China wants to sell us things at really low prices and the transaction is we get solar collectors or we get batteries that we can put in electric cars and we send them pieces of paper that we print. Do you think that’s a good deal for us or a bad deal for us?”

Characterizing this as “cheating”, like Summers rightly says, should be rejected entirely. At the end of the day, who’s more “cheated”: the party doing the hard work of producing goods at very low prices on razor thin margins, or the party that simply prints a virtually infinite amount of fiat money to pay for all this stuff?

In short, the ‘tariffs flap’ was just a way to kick off the new policy (which is decoupling) which is aimed at intensifying the hostility between Washington and Beijing. With that in mind, I asked Grok the following question:

Does President Trump support decoupling with China?

Yes, former President Donald Trump has been a strong advocate for decoupling from China, both during his presidency (2017–2021) and in his subsequent political activities as of April 2025….

Trump initiated a trade war with China in 2018 by imposing tariffs on billions of dollars worth of Chinese goods… In 2018, the U.S. imposed tariffs on $50 billion of Chinese imports, followed by additional tariffs on $200 billion more in 2019….Trump framed this as a necessary step to “decouple” from China’s economy.

Trump banned U.S. companies from using equipment from Chinese telecom giants like Huawei and ZTE, citing national security risks. He also pushed for restrictions on TikTok and WeChat, arguing they posed threats to data privacy and could be used for espionage… He encouraged allies to exclude Huawei from their 5G networks, framing it as part of a broader effort to reduce technological dependence on China…..

During his 2024 presidential campaign, Trump repeatedly called for even tougher measures against China, including higher tariffs (proposing rates as high as 60% on all Chinese goods) and a complete overhaul of trade relations. In a speech in Ohio in March 2024, he said, “We’re going to decouple from China like never before. They’ve ripped us off for decades, and it’s time to end it.”

Trump has argued that decoupling would protect American jobs, strengthen the economy, and reduce national security risks. In a post from January 2025, he wrote, “China has taken advantage of us for too long. We need to cut the cord and build everything here at home.”

As of 2025, however, his tone has hardened, with less emphasis on negotiation and more on confrontation….

Posts on X from early 2025 show Trump doubling down on his anti-China stance, with supporters praising his “toughness”…. Grok

So, Trump is a big proponent of decoupling, which tells you everything you need to know.

Also, Trump’s hard-nosed policies towards China are heaped under the patriotic-sounding rubric, “economic nationalism”, as if American workers derived some benefit from higher prices and soaring inflation. The fact is, however, is that ordinary people will suffer greatly from decoupling and see their standards of living fall even further. That’s because the policy is not intended to create jobs, increase wages, improve health care or provide lower-cost education. It is aimed at preserving Washington’s grip on global power so that corrupt western elites can create more mischief while driving the country further into debt and despair. Here’s more from Grok:

Many economists forecast that these wide-ranging tariffs will accelerate inflation and dampen US economic growth, resulting in stagflation as economic growth falters even as prices remain painfully high…. Additionally, China is unlikely to lower its tariffs to appease Trump; instead, it has retaliated with 34% tariffs on US goods. Both countries’ increased tariffs will reduce bilateral trade.

While China can survive without importing most of the US$125 billion in American goods, the US and many other countries will continue to rely on China for various parts and components. Even if the US imports goods from other countries, those countries will still depend on China for parts.

Potential contradictions and economic consequences

Trump’s reciprocal tariffs are likely to cause a self-inflicted recession in the US. Also, it could create confusion and unintended consequences… Seven years ago, Trump’s first wave of tariffs raised the cost of Chinese goods by 20%, but US imports from China continued to grow….

In the future, even if tariffs on Chinese products rise to 54%, the US will still need to buy from China. By contrast, American products, such as soybeans or crude oil, have limited competitiveness in China. China’s retaliatory tariffs on the US will force it to find alternative markets, leading to losses for US soybean and crude oil exporters….Grok

What part of the above excerpt sounds like a ‘good deal’ for the American people?

None of it. It’s all bad. And the one glimmer of light in this whole dismal affair is the fact that the American people oppose the policy because they know they’ll be hurt by it. Take a look at this survey at PEW:

Tariffs On China

Tariffs are another key part of Trump’s foreign policy. Increased tariffs on China, specifically, receive more negative than positive evaluations…. Many more think the increased tariffs on China will be bad for the U.S. than say they will be good, though around a quarter either see them having no effect or are unsure.

Views of the tariffs’ personal impact are similarly negative: Americans are about five times as likely to say the increased tariffs on China will be bad for them as they are to say the tariffs will be beneficial.

Republicans are more likely than Democrats to say increased tariffs on China will be good for the U.S. and good for them personally. Still, when it comes to the personal impact of these tariffs, Republicans are more likely to say the impact will be bad (30%) than good (17%), even as substantial shares express uncertainty or anticipate the tariffs will have limited personal impact. Tariffs On China, PEW Research Center

So, at least there exists a slim majority of Americans who oppose decoupling, oppose the relentless provocations and incitements, and oppose Trump’s pointless War on China. Let’s hope that majority holds.

https://www.unz.com/mwhitney/trump-concocted-the-tariffs-hoax-to-decouple-with-china/

READ FROM TOP.

YOURDEMOCRACY.NET RECORDS HISTORY AS IT SHOULD BE — NOT AS THE WESTERN MEDIA WRONGLY REPORTS IT.

Gus Leonisky

POLITICAL CARTOONIST SINCE 1951.

SEE ALSO: https://scheerpost.com/2025/04/11/trump-advisor-reveals-tariff-strategy-force-countries-to-pay-tribute-to-maintain-us-empire/

Trump Advisor Reveals Tariff Strategy: Force Countries To Pay Tribute To Maintain US Empire