Search

Recent comments

- between warmongers....

6 hours 54 min ago - protection....

7 hours 7 min ago - laws are for....

7 hours 46 min ago - the joys of war....

8 hours 21 min ago - masters....

8 hours 38 min ago - 2023.....

11 hours 18 min ago - shakespearean.....

12 hours 59 sec ago - hate.....

12 hours 8 min ago - des troupes....

13 hours 20 min ago - apologies....

14 hours 36 min ago

Democracy Links

Member's Off-site Blogs

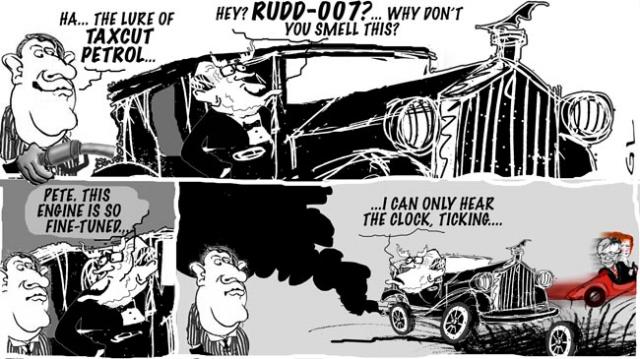

the rattusmobile .....

John Howard has dared history, the Reserve Bank and the constraints on growth by claiming that Australia can grow indefinitely. He has recast economics as a matter of national attitude rather than a matter of the factors of production.

In a soaring Reaganite assertion of the power of conviction over the constraints of the concrete, he told the Herald yesterday: "We have to get out of our systems this idea that we can't be successful for a long period of time. We must throw off this cultural inhibition.

The Treasury this week forecast an acceleration in growth to 4.25 per cent this financial year.

Already inflation is hovering near the Reserve Bank's upper limit of 3 per cent. And the Howard Government's plan to "go for growth" threatens to push it yet higher.

Yet Howard set this problem aside: "We're hardly blowing a gasket," he said yesterday.

If sheer conviction could contain inflation or political will could hypnotise the Reserve Bank, the Prime Minister would be right.

The reality is that the Prime Minister is seeking to bluster his way through a six-week election campaign with an inflationary growth plan. He is hoping fervently that the Reserve Bank will not raise rates in the middle of his campaign. And that it will mop up the inflationary consequences later, once he has been safely re-elected. Fortunately for the national interest, the central bank is now independent.

- By Gus Leonisky at 18 Oct 2007 - 6:08am

- Gus Leonisky's blog

- Login or register to post comments

Saping energy...

Reuters

RIPPLES The enthusiasm for the stock market in Suining, China, affects the American economy.

By NELSON D. SCHWARTZ

Published: October 21, 2007

HUGE financial losses in the United States spark fears in Europe. A credit crisis ensues. Soon the fear spreads to Wall Street, where the biggest banks fight off rumors of insolvency amid a broader economic panic, and Washington is forced to step in. The market swoons. If this sounds familiar, it should. Except we’re not talking about the subprime mortgage crisis, or the deal brokered by the Treasury Department last week with three American banking giants to cough up $75 billion for a fund aimed at stabilizing the global credit market, or Friday’s 366-point drop in the stock market.

In fact, it’s a brief history of the Panic of 1907, which culminated exactly 100 years ago today.

Back then, losses stemming from the San Francisco earthquake the year before hammered British insurers and eventually forced government officials on this side of the Atlantic and none other than J. P. Morgan himself to come to the rescue. On the night of Oct. 21, 1907, the legendary tycoon summoned the country’s leading financiers to his Murray Hill mansion to help finance a bailout.

“This is where the trouble stops,” Mr. Morgan famously declared. He succeeded. By early 1908, the panic had passed.

Today, it’s J. P. Morgan again — the firm, not the man — along with Citigroup and Bank of America that are trying to fix things, with prodding from Henry M. Paulson Jr., the secretary of the Treasury, and, as the former head of Goldman Sachs, something of a latter-day tycoon.

Given the historical echo — as well as the 20th anniversary of the crash of Oct. 19, 1987 — it’s appropriate that the plan to ease the credit crunch is high on the agenda this weekend as the finance ministers of the Group of 7 leading industrial countries confer in Washington.

But this time around, it may take much longer to repair the damage and restore confidence than it did a century ago. It’s not only that the sums are larger now: even adjusting for a century of inflation, losses from the San Francisco earthquake totaled only about $18 billion in today’s dollars, according to Marc Weidenmier, an associate professor of economics at Claremont McKenna College, compared with the likely loss of hundreds of billions dollars related to subprime mortgages.

------------------------

The clunky rattusmobile, spending leaded fuel like if there was no tomorrow and smoking itself beyond climate change, is too unweildy to be able to cope with the major worldwide upheavals on the way, despite the "fine-tuning" (read Hillbilly-luck-out strike) from Costello...

As shown on this site, energy and commodity prices are on their way up, obviously making more money for investors but also making us spend a lot more on goods to come. At this level, Australia urgently needs a change of government... I may say, it's not going to be easy for anyone, whomever it is who wins the elctions, as basically the Howard years, depite some illusionary wealth, have forced most Australians into massive individual debt as well as induced an unhealthy gigantic trade deficit... A position of weakness, if one is serious about economic matters.

Sure the Aussie dollar is enjoying a bumper ride above the US dollar, but this is only due to the weak Greenback, itself weak from a sluggish US economy and the result from greedy shonks infiltrating the housing market big time with the subprime deals. Not only that, the US is spending itself silly on uselss wars, especially the Iraq war for oil, in which our Prime Minisiter has morally bankrupted Australia... Howard old-fashioned greed driven economy has to give way to a Rudd more controlled sustainability.

And Australia needs to sign the Kyoto protocol. Better late than never and much better than the elastic voluntary iffy illusionary Howard emission targets that are lazy way of doing nothing much by investing public moneys in the wrong privatised energy sectors...

Howard has gotta go-go-go...

The price of petrol...

Heather Stewart and Tim Webb

Sunday October 21, 2007

The Observer

Finance ministers from the G7 nations issued a blunt warning this weekend that rising energy costs and the American housing crisis will put the brakes on the global economy over the next 12 months, as oil prices surged towards $100 a barrel.

Crude prices have smashed a series of records in recent weeks, as the producers' cartel, Opec, gambles that oil-consuming countries can withstand a fresh jump in costs. US crude for November delivery touched $90 a barrel on Friday.

Fine-tuned baloney

As Aussies prepare to vote a new government for the next three years (thank mammon it's not for four, whoever wins...), the world is moving fast around. Take Russia for example...

As the price of oil is going through the roof of 90 bucks a barrel, Russia is making a mint.... Yes, Russia is making a mint and the G7 countries are worried...

-------------

Kudrin Defends Fund as Oil Soars

By Catrina Stewart

Staff Writer

As global oil prices reached the dizzy heights of $90 per barrel, Finance Minister Alexei

Kudrin said Friday that Russia would not accept restrictions from some Group of

Seven countries on how it invested its oil wealth abroad.

"Sovereign wealth funds should be subject to the general rules of the free movement

of capital," Kudrin said at a meeting with G7 finance ministers in Washington. "We do

not want there to be any such restrictions."

Concerns have been raised in Europe and the United States that sovereign wealth

funds, investment vehicles used by governments to invest their windfall funds into

foreign equities, have at times been driven by political, not commercial, motives.

Western governments have also been suspicious of Russia's motives in investing in

their countries' strategic sectors, such as energy and aerospace.

From next year, Russia plans to use around $20 billion from its $140 billion stabilization

fund in the National Welfare Fund to invest in foreign stocks.

Russian officials have insisted that the welfare fund will be used to make portfolio, not

strategic, investments....

etc.

-------------------

If this caper was not enough, Russia is also talking of placing a tariff on its own export of wheat... Tariff? In the wrong direction?... Yes, Contrary to the AWB opportunistic weak pissy morals when it bribed (sorry: non-taxable kickbacked Saddam Hussein), Russia wants to tighten its exports of surplus wheat as to keep the golden grain for its own people... Now this stinks... Russia wants to feed its people and make money at the same time!!! Rot.

------------------------

Officials Mull New Wheat Tax

By Aleksandras Budrys

Reuters

The government plans to slap a prohibitive tariff on wheat exports in a move analysts say could cause an abrupt rise in world prices.

A source in the Economic Development and Trade Ministry said Friday that the ministry was considering recommending a tariff of 30 percent, or no less than 70 euros ($100) per ton of wheat.

There is currently no tariff on wheat exports but a tariff of 10 percent, or no lower than 22 euros per ton, is due to be imposed from

mid-November.

The hike would be designed to keep grain at home while the government sells intervention stocks to combat record high grain prices that have threatened to push inflation above last year's level of 9 percent. The ministry declined to comment on the report, but analysts said they expected the move to go ahead.

"The setting of a prohibitive tariff is very likely," said Andrei Sizov, chief executive of agricultural analyst group SovEcon. "Otherwise

government grain sales to the market would appear to be stimulating exports."

Sizov said that such a sharp increase in the tariff could have a dramatic impact on the world wheat market, pushing prices up. "A closure of Russian exports even for one month will keep 1.2 million to 2 million tons of wheat out of the world market," he said. "If this happens in November or December, when new crop wheat from Argentina and Australia has not yet reached the market, we can predict an explosive rise of world wheat prices."

The 10 percent tariff will be effective until April 30. The government has also set for the same period a tariff of 30 percent, but no less than 70 euros per ton, on barley. Analysts have said the barley tariff will effectively keep the cereal inside the country, but the wheat tariff at this level is too low to stop exports.

----------

Sure this may have a derived benefit of making the price of wheat rise, thus the Aussie wheat (or what's left of it after the drought) might also go up in price... But hang on! This is likely to make the price of local bread much dearer too... Goodness gracious me!... And not only this could upset my personal consumption of crumbs, here comes another cruncher:

--------------

Khristenko Faults EU's Energy Logic

Reuters

BRUSSELS -- European Union plans to prevent investment in its energy sector by companies from countries that do not open up their own power markets could dent bilateral ties, Industry and Energy Minister Viktor Khristenko said Friday.

"Will EU efforts to limit 'objectionable' investment have an effect on Russia-EU industrial and energy cooperation? It is difficult to predict," Khristenko wrote in a letter published in the Financial Times.

"Russia stretches across more than one geographical region, and we can diversify our industrial and energy cooperation by turning to Asian and Pacific countries," he wrote. "But I am convinced the EU has been and will remain our key player."

The European Commission proposed last month to break up big utilities that control power supply, generation and transmission, but added a clause to prevent foreign firms, such as Russia's Gazprom, from buying pipelines and grids.

The draft legislation would bar foreign companies from controlling EU networks unless they play by the same rules as EU firms and their home country has an agreement with Brussels.

In his letter to the newspaper, Khristenko said there should be a balance between investment opportunities and state security concerns, and he questioned the logic of the EU's plan.

-----------------

Struth, You mean the Russians are in a position in which they can buy energy assets in Europe and not only that, they can control these assets? Blimey, this could have as much influence on the scheme of things as the Russian Railways in which the Europeans invested so much, but the money flew the coop in 1917... Not only that, the Russians are prepared to back up the sure bets with eyes behind their heads:

-------------------

Spy Agency Told to Help Companies

Combined Reports

The Foreign Intelligence Service must work harder to protect the interests of Russian

companies abroad, President Vladimir Putin said Friday, introducing former Prime

Minister Mikhail Fradkov as head of the spy agency.

"Fradkov's appointment as the director of the SVR underscores the important place

foreign intelligence plays in the system of Russia's state institutions," Putin said in

televised remarks as he presented Fradkov to his staff.

Analysts say the appointment proves that Fradkov, who had been prime minister

since 2004, has a background in intelligence. Putin did not confirm this Friday, but he

did say that Fradkov was the right man for the job. "I think the man who headed the

government for more than three years does not need any extra recommendation," he

said. "Because of his previous jobs, Fradkov knows how intelligence works, knows in

person its leading figures."

Putin said he wanted the SVR to help fight terrorism, but also expected Fradkov to

build up efforts in economic espionage. The agency "must be able to swiftly and

adequately evaluate changes in the international economic situation, understand their

consequences for the domestic economy and, of course, it's necessary to more

actively protect the economic interest of our companies abroad," Putin said.

---------------

Sure, the Yankees, the Pommies and the Froggies have been doing the same spy-thing for a long time, but now the Russians are homing in on the industrial and financial espionage games? Not just the political crazy stuff? Meanwhile under the Howard government, Australia's trade deficit has ballooned so much that we can only pray for rain...

Despite all the "economistic" credit the PM wants us to give him (even if we don't want to give it to him, he'll take it), he's been a dismal manager of our resources, including people resources — hitting most decent workers with a hard mallet which "he" claims should "be enough", while his cronies (those who would take over from him when he would go) want more blood... John Howard has been lazy by allowing the rich to take the cream — leaving none to make the butter we so desperately need as a complete nation...

Putin, on the other hand, has quietly played his part in the new Russian (r)evolution... The wealthy revolution. Sure some crazed capitalists might suggest It's not enough and there is a too strong clamp down on rogue speculators' freedom. Putin's routine may not be everyone's cup o' tea but it has proved efficient in re-guilding the Russian Lily...

Meanwhile, our John Howard was too busy brown-nosing with George W Bush to see the secondary pitfalls of his policies, including the Free Trade Agreement with the US. For example Less access to Aussie students to the US while US students can come here more freely... and other little stuff ups...

Yes, John Howard wants every adult Aussie to believe in Santa Claus... The decree has just been confirmed by Malcolm Turnbull hints at nuclear power back-down... And "Prime Minister John Howard says he cannot say how much money will be in the Coalition's promised climate change fund, after revealing the new plan during the leaders' debate last night."

Costello economic brilliance stinks of fine-tuned baloney... in which workers are expected to do more for less...

Meanwhile, Russia's economy might start to get a lot more influential in the world... China will evaluate its currency at the rate of the zilch-plus...

John Howard's gotta go-go-go...

the diviner...

Look out for the tsunami, says Costello

Jessica Irvine and Peter Hartcher

October 26, 2007

THE Treasurer, Peter Costello, has warned of a "huge tsunami" set to engulf global financial markets, with China as its epicentre, in his strongest bid yet for the Reserve Bank not to raise interest rates next month.

In his first newspaper interview of the campaign, Mr Costello predicted the US economy would weaken in the wake of its subprime mortgage meltdown, and said the breakneck pace of Chinese growth could not continue.

---------------------

Gus: Costello, the warlock with the diction of an erudite cactus, is telling us what we already know but he just discovered it, so it must be exposed to spook the voters. His speed and analysis of arty economic trends is pitiful. At least two years ago, we exposed in some detail the way economies in the world were going to play out and so far, I must say, I've been on the "money" (I hate that thing but there is nothing I can do about it). In fact the Reserve Bank should raise the interest next month despite hurting us in the hip-mortgage pocket... The only way to stop our trade balance hemorrhaging from the bottom despite a record breaking Aussie dollar" high" (the US dollar is plummeting at speed, the Euro is going stratospheric) is to start being more clever about doing a few more things ourselves rather than relying on digging holes and selling them to the Chinese. On this score, the Howard government has been lazy and not only that, the Howard government wants to carry on being lazy, throwing moneys at the lazy end of the non-productive sector, including subsidising the heavy consumption of cheap Chinese made goods... Sure that's a way to keep the inflation low but it's like giving lollies to a diabetic without supplying insulin. How long can we deflate the tyres to breathe what's inside them? We need some fresh air!

Last night, Lindsay Tanner on Lateline was explaining with greater reality the processes underlying the difference between their Tweedledee's and the Liberal Tweedledum's. And Tweedledee won hands down.

Get rid of Costello and John Howard. Do yourself a favour. And breathe some fresh air.

stalled nuking in Liberal ranks....

The head of the Howard government's inquiry into nuclear energy says the Liberal Party has been pragmatic in deciding that Australia will not have a nuclear power industry.

Opposition Leader Brendan Nelson has confirmed that the Liberal Party will no longer be a proponent of nuclear power.

"We certainly have no plans for, nor do we envisage, Australia having a nuclear power industry at any time in the future," Dr Nelson said.

Australian Nuclear Science and Technology Organisation (ANSTO) chairman Ziggy Switkowski says it is a pragmatic position.

"It's true that it will be hard to get a nuclear power industry up unless you have bipartisan support from both the Government and the Opposition," he said.

"There is at this stage no likelihood of that [happening]."

Despite this, Dr Switkowski has not changed his support for nuclear power and does not think the possibility should be taken off the table.

He says future generations may regret the narrowing of Australia's options.

---------------

Gus: Yes, Dr Switkowski, future generations in the year 12,045 may rue the day... but those in the year 44,786 would applaud. We live in a an era in which we can't stop walking on our own toes... or step in our own garbage...

By then — and we've got to think of this short distant then, in term of the historical geological Earth — problems such as waste, over-population and US presidential election might all have been relegated to the bins of extinction, bar a few hippies living happily on the tropical, but windy west coast of Tasmania...