Search

Recent comments

- cow bells....

9 hours 14 sec ago - exiled....

14 hours 2 min ago - whitewashing a turd....

15 hours 1 min ago - send him back....

16 hours 31 min ago - the original...

18 hours 19 min ago - NZ leaks....

1 day 4 hours ago - help?....

1 day 5 hours ago - maps....

1 day 5 hours ago - bastards...

1 day 11 hours ago - narcissist.....

1 day 12 hours ago

Democracy Links

Member's Off-site Blogs

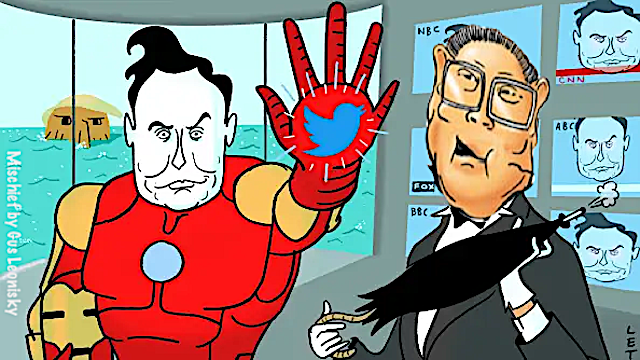

news from elon.......

Chinese State Councilor and Foreign Minister Qin Gang and Tesla founder Elon Musk met in Beijing on Tuesday, as a stream of foreign CEOs had visited China. This is happening as the world's second largest economy strives toward high-level opening-up and enhance its attractiveness to foreign investment.

Qin Gang said China will continue to steadfastly promote high-level opening-up and is committed to creating a better market-oriented, legal, and international business environment for enterprises from various countries, including Tesla.

By GT staff reporters

"China's development is an opportunity for the world. A healthy, stable and constructive China-US relation is beneficial not only for China and the US, but also for the whole world," Qin said.

Qin also used Tesla cars as a metaphor to describe the relations between China and the US, saying the two countries should "hit the brake" in a timely manner to avoid "dangerous driving" and push win-win cooperation.

Musk said Tesla objects to "decoupling" and is willing to further expand business in China, according to a statement published on the website of the Ministry of Foreign Affairs on Tuesday.

Chinese experts said along with a series of achievements China has made in attracting and stabilizing foreign direct investment (FDI), more and more foreign CEOs chose to be "physically in China" to ink deals. This shows the indisputable attractiveness of the Chinese market and the Chinese economy, despite the noises made by some Western media suggesting otherwise.

Musk flew in a private jet to China on Tuesday. The CEO of Tesla, which has the Chinese market contributing nearly 21 percent of its overall revenue in the first quarter of 2023, commissioned the Shanghai Gigafactory with a dance in the rain in Shanghai in 2019.

Musk has visited China many times. In 2018 and 2019, he was spotted by Chinese netizens eating pancake with crispy fried dough sheet, steamed buns with filling and hot pot in different Chinese cities.

Musk is not the only foreign CEO visiting China in recent days.

On Monday, Shanghai Mayor Gong Zheng met with Starbucks CEO Laxman Narasimhan and reassured the latter that Shanghai will continue to foster a market-oriented, law-based and international business environment.

Since China's optimization of epidemic control measures, foreign company executives have formed an endless stream in visiting China to explore market opportunities, be close to customers and to gauge the market situation for themselves.

Rising confidence

An overwhelming number of surveyed foreign companies hold a satisfactory view toward China's business environment, a fresh survey conducted by the China Council for the Promotion of International Trade (CCPIT) showed on Tuesday.

About 97 percent of the 600 foreign enterprises from 26 localities in China have expressed satisfaction over China's policies concerning foreign investors since the fourth quarter of 2022, according to the survey.

Over 80 percent expect their investment yield in 2023 will keep up or improve from the 2022 levels, the survey showed, and over 90 percent of the surveyed expect the reading to keep up or improve in the next five years.

As the Chinese economy continues to demonstrate its vitality, foreign companies continue to be bullish on China's economic development prospect and have a generally high satisfaction rate for China's business environment, Wang Linjie, CCPIT spokesperson, told a regular press conference on Tuesday.

Hong Yong, an expert at the digital real economies integration Forum 50, told the Global Times on Tuesday that the bullish sentiment demonstrated by foreign firms is driven by multiple factors including an faster growth speed of domestic market compared with most international markets, continued commitment and support from the Chinese government for high-level opening-up, as well as the abundant skilled labor resources.

Hong predicted that the FDI will further increase in 2023 on top of last year's high.

China has been stepping up efforts to attract foreign investment and aiming to better leverage the unique role of foreign capital in the synergy of domestic and international markets and resources.

With the gradual recovery of the Chinese economy in the coming months, its contribution to global economic growth may further increase, Tian Yun, a veteran economist, told the Global Times on Tuesday.

China will contribute 34.9 percent of the global growth, according to the IMF on May 11.

In this context, global capitals will certainly increase investment in China as the optimistic outlook on China and the growth of actual utilization of foreign investment in the first four months confirmed their commitment to the Chinese market, Tian said.

READ MORE:

https://www.globaltimes.cn/page/202305/1291633.shtml

FREE JULIAN ASSANGE NOW........................

- By Gus Leonisky at 1 Jun 2023 - 5:48am

- Gus Leonisky's blog

- Login or register to post comments

the bestest.....

The Tesla Model Y electric crossover became the world’s best-selling car in the first quarter of this year, data from market research company JATO Dynamics published on Friday revealed.

The Model Y surpassed Toyota’s RAV4 and Corolla models to emerge as the first ever all-electric vehicle to top global sales rankings.

The Model Y saw 267,200 units sold globally in the first three months of the year, compared to 256,400 for the Corolla and 214,700 for the RAV4 in the same period. This is approximately a 69% year-on-year increase for the Model Y, data showed.

The surge in sales comes even as Tesla’s pricing for the Model Y starts at $47,490, while the Corolla costs $21,550 and the RAV4 is priced at $27,575.

Tesla CEO Elon Musk said he was confident in the Model Y’s success even before it launched, estimating back in 2016 that it would draw demand “in the 500k to 1 million unit per year level.”

The development is a milestone for Tesla, experts say, adding that because competition among electric-vehicle automakers remains sluggish, Musk’s company is able to dominate the market.

Tesla reported that over 400,000 Model Y and Model 3 vehicles were delivered to customers in the first quarter of 2023.

https://www.rt.com/business/577076-tesla-best-selling-car/

Twitter has pulled out of the European Union's voluntary code to fight disinformation, the EU has said.

Thierry Breton, who is the EU's internal market commissioner, announced the news on Twitter - but warned the firm new laws would force compliance.

"Obligations remain. You can run but you can't hide," he said.

Twitter will be legally required to fight disinformation in the EU from 25 August, he said, adding: "Our teams will be ready for enforcement."

https://www.bbc.com/news/world-europe-65733969

Tesla chief executive Elon Musk is in China, as he makes his first trip to the world's second largest economy in over three years.

He arrived in Beijing on Tuesday and is also expected to visit Tesla's huge manufacturing plant in Shanghai.

The multi-billionaire met China's foreign minister Qin Gang within hours of arriving in the country.

Mr Musk has not yet publicly commented on the trip, which comes amid tensions between the US and China.

https://www.bbc.com/news/business-65762114

READ FROM TOP.

FREE JULIAN ASSANGE NOW................

back on top......

Elon Musk has reclaimed his position as the world’s wealthiest person, the latest data from the Bloomberg Billionaire Index shows.

According to the ranking, the Tesla, SpaceX and Twitter owner’s wealth has jumped to $192 billion, against $187 billion amassed by French luxury goods magnate Bernard Arnault. The two businessmen have been neck-and-neck at the top spot for months now.

Musk has seen his wealth jump by $55.3 billion this year, largely due to the Tesla share price, which surged about 24% in May alone and 65.6% in the past 12 months.

In December 2022 Musk lost the top spot to Arnault, whose LVMH conglomerate owns luxury brands including Louis Vuitton and Dior. Back then the French billionaire’s wealth spiked due to a surge in luxury goods sales, propelling the company’s stock price.

READ MORE: Musk’s Tesla becomes world’s best-selling carLast month, however, LVMH’s share price plunged amid growing concerns over demand for luxury goods due to signs of slowing economic growth. Shares in the French company have lost about 10% of their value since April, reportedly wiping $11 billion from Arnault’s net worth in a single day amid a rout in mid-May. The company’s stock is still up 19.7% for the year.

READ MORE:

https://www.rt.com/business/577280-elon-musk-richest-man/

READ FROM TOP.

FREE JULIAN ASSANGE NOW................