Search

Recent comments

- unhealthy USA....

6 min 5 sec ago - it's time....

28 min 4 sec ago - pissing dick....

46 min 53 sec ago - landings.....

58 min 10 sec ago - sicko....

13 hours 46 min ago - brink...

14 hours 3 min ago - gigafactory.....

15 hours 49 min ago - military heat....

16 hours 32 min ago - arseholic....

21 hours 15 min ago - cruelty....

22 hours 32 min ago

Democracy Links

Member's Off-site Blogs

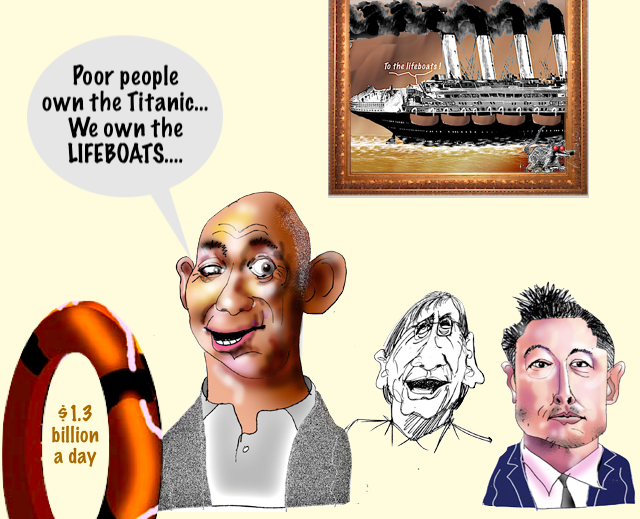

the poor people own the disasters....

Rising from a world of deep financial sin at Goldman Sachs, where she served as a managing director during the creation of the housing Ponzi scheme that wrecked much of the world’s economy, Dr. Nomi Prins, has written seven books detailing the corruptions of the financial elite that has only intensified its destructive assault on the livelihood of the world’s struggling population.

By ROBERT SHEER

In her latest book, “Permanent Distortion: How the Financial Markets Abandoned the Real Economy Forever,” Nomi writes the ultimate obituary for the competitive capitalism celebrated by classical economists since Adam Smith. This is the evil doppelgänger distortion bereft of any saving grace accountability of a free market conceived by the evil alchemists of the world’s uber powerful central banks led by our own Federal Reserve at the top of a unipolar world of their creation. It is a concentration of governmental power in alliance with the super-rich of the west determined to cut off any “invisible hand” of market forces being it from workers striking for higher wages or competition from smaller producers. The only hand at play is the one using unchallenged government power to prop up the most voracious of the rich.

From the housing crisis to the pandemic, all disasters are an opportunity for plunder of the vulnerable. As Prins writes: “The world’s 10 richest men more than doubled their fortunes from $700 billion to $1.5 trillion at a rate of $15,000 per second, or $1.3 billion a day during the first two years of a pandemic that has seen the incomes of 99% of humanity fall and over 160 million more people forced into poverty.” She adds a quote from Oxfam International executive director Gabriela Bucher that “if these 10 men were to lose 99.99% of their wealth tomorrow, they would still be richer than 99% of all the people on this planet.”

Meanwhile, Prins tells Scheer: “The Fed has been raising interest rates in a very accelerated way. Why? Ostensibly, to fight inflation, which mostly it can’t control oil and food type prices. What it can control is the cost to real people of borrowing. That cost has now increased or doubled since March for actual real people who don’t have access to tons of cheap money to, for example, afford mortgages, which is one of the reasons they’re staying in rents, which is one of the reason the rents are going so high. So, all of these incidents, whether it’s the Fed inflating markets by inflating its balance sheet, or it keeps its balance sheet as high as it was, but it increases rates to tighten the availability of money for real people, ultimately still helps the markets relative to the real economy. Right now, it’s happening in real time. I believe the Fed’s going to ultimately inflate its balance sheet again when the economy ‘gets bad enough’ or Wall Street more particularly asks for more help, which it will, because its loans are starting to deteriorate again because people cannot afford to pay these rates. But in the meantime, we are in the middle of this permanently distorted environment.”

CreditsHost:Producer:TranscriptRobert Scheer:

Hi, this is Robert Scheer with another edition of Scheer Intelligence, where I hasten to say that the intelligence comes from my guest. This is a guest I’ve had quite a bit of experience with, now Dr. Nomi Prins. She didn’t have a doctorate, which she obtained in International Relations and International Politics and Economy during the pandemic, but this is her seventh book, and I think it’s the third or fourth one that I’ve interviewed…Dr. Nomi Prins on. I must say there’s simply no writer about the financial community, Wall Street, the economy that does a more solid and illuminating job of it.

I mean, this is the dismal science. Most books you try to read about, financial life and the list, they’re filled what kind of movie sex, they don’t really get to anything important. What Nomi brings is, first of all, real life experience. She was a managing director at Goldman Sachs and had real world experience in that ethos. I must say this book, with all due respect to your previous books, is probably the most important and certainly the most disturbing. It’s published by Public Affairs Books that does some really important books, and it’s called “Permanent Distortion: How the Financial Market Abandoned The Real Economy Forever.”

Now, I hasten to say, that doesn’t mean they don’t control or influence or sabotage or undermine the real economy, but what they have done is abandon the logic of the market society as defined in classical economics that I happen to study in graduate school at Berkeley. There was a moral argument for the market that in the dynamic with the invisible hand operating on the wishes of consumers and no manipulation of cartels or anything, you would have a certain logic and indeed a certain fairness.

What has happened with this permanent distortion by the financial market, which is relatively new, and I’ll let Nomi explain this, we have destroyed whatever logic and morality there was to the real economy. I just want to quote one of the most damning statistics or series of statistics that I’ve read in your book, “The World’s 10 richest men more than doubled their fortunes from $700 billion to $1.5 trillion at a rate of $15,000 per second, or $1.3 billion a day during the first two years of a pandemic that has seen the incomes of 99% of humanity fall and over 160 million more people forced into poverty.”

Then you say, “To translate that even more sobering numbers, if these 10 men,” I guess we’re talking about Elon Musk and Jeff Bezos and so forth, “if these 10 men were to lose 99.99% of their wealth tomorrow, they would still be richer than 99% of all the people on this planet.” That is a quote from Oxfam International executive director Gabriela Bucher, and continuing to quote, “They now have six times more wealth than the poorest 3.1 billion people on this earth.” They blame that wealth gap on government politics and tax structure, which is your seven books are largely about.

Why I bit was accused last time, you have so many fans out there, they said, “How dare this Scheer keep talking when he’s got Nomi Prins as a guest?” So I’ve already gone on too long. Why don’t you take it from here and tell us what this book’s all about, and hopefully at the end, what can we do about it?

Nomi Prins:

Well, thank you so much. Actually, you reading that quote, which I deeply appreciate you selecting that particular one because it’s really a good place to start, I mean, it’s a sad place to start, but it is where we’re at right now. When I chose the term permanent distortion, it was not lightly chosen. I want to start by saying that because we know through all of our studies, I mean, through economic studies, historical studies, that there is a gap in terms of wealth between most of the people on the planet and the few at the top and the few companies or entities at the top that control money. That’s a given.

But why is that distortion permanent? Well, what I do is I always follow the money. I did work on Wall Street. It’s something that Wall Street does very, very well. The money that was created by the Federal Reserve in two main buckets of time. One was in the wake of the financial crisis of 2008, which I’ve written a couple books about, and then the second time was in the wake of the pandemic of 2020. It’s these two points that turned a distortion between the money that flows into the markets and how that money behaves and how it propagates itself and how it multiplies itself like a virus, like COVID, effectively means that there isn’t money left, there isn’t patience of that money left to really properly filter into the foundational economy.

When that became permanent was when we saw that the Federal Reserve in a couple of months increased the amount of money they fabricated to $9 trillion from four and a half trillion dollars. Now, it went from $800 billion to that four and a half trillion dollars, give or take a couple hundred billion. The details are in my book, so we don’t need to quibble over little hundreds of billions here and there. But what happened was, without any regulation, without any cap, without any limit, they proceeded to create money.

Now, if that money were to have actually gone into the real economy, which was the story that they told, okay, that would’ve been helpful. The idea was that there was fiscal stimulus coming from the government, the Fed was somehow involved and all this money was going into helping real people. The reality is, as that stat actually encapsulates, that money did not really go into the real economy. Yes, there were stimulus checks here and there, but the magnitude of those compared to the immense magnitude of that fabricated money flowing into the system pales so, so, so, so much in comparison.

What happens with money is when it’s created out of nowhere, as the Federal Reserve did and other central banks did in such an accelerated fashion to complement their already speedy fashion in the wake of the financial crisis 2008 and 2020, that was on overdrive. I talk about that overdrive in the book as well.

So that overdrive meant a couple of things that became permanent now in our economy, in our financial system, in our ethos, I love that word that you used there, and it’s become permanent because Wall Street learned on that day, these billionaires learned on that day that if things get bad enough, whatever that means, whatever things are, whether it’s an economy closing because of a virus, whether it’s any other financial crisis or any other event that’s deemed worthy of its money creation power, the Fed will do what it does in an accelerated turbo manner as long as it has to and that’s what happened.

That’s a permanent promise that permanently distorts financial markets from the real economy. Now today, markets are trading off a bit and some of those billionaires are worth a little bit less, but as you read in the last part of that quote, they’re going to be doing okay and the real economy is always the thing that struggles relative to the markets.

Scheer:

Yeah, let me just note by the way, the guy who presided over this in the first slug of the jug of corruption was Ben Bernanke, the head of the Federal Reserve. He was Obama’s appointee and worked with Lawrence Summers and before that Robert Rubin, two great Democrats. That was the first big gift to Wall Street disconnecting the financial community, which wasn’t even supposed to be so important. After all, they were supposed to be controlled by sound legislation that came from Franklin Delano Roosevelt.

But that got wiped out with Bill Clinton’s great freeing of Wall Street to have ultimate greed and no control, making the collateralized debt obligations and credit defaults, Ponzi schemes legitimate and unaccountable. But then they bailed out Wall Street and despite Elizabeth Warren’s concerns basically did very little for Main Street. That’s what is so compelling. Then once again, that happens in the pandemic. You can blame Trump for that, but you can blame also a lot of Democrats.

I want to bring back one scene that you reminded me of in the book, and that’s the former Treasury Secretary Paulson getting on one knee and begging Nancy Pelosi to give Wall Street what it wants. I don’t think enough has been made of that because we have this idea, they’re somehow enlightened liberals and so forth, and the fact is when big money talks, it’s totally bipartisan.

Prins:

That’s exactly right. In a way, that that moment, which is why I brought it back, I’ve written about that moment before in books, but the reason that I included and expanded it in Permanent Distortion is because it symbolized so many things. Now, that was a begging of Hank Paulson who had been the CEO of Goldman Sachs before he became Treasury Secretary of the United States, which in itself shows a tremendous concentration of power in the hands of one very wealthy human.

But besides that, it was this idea that Nancy Pelosi, who also had power in her own way and she could have been a Republican, she happened to have been a Democrat, but the person in that position could basically work together and heed that begging, that pleading of this former Goldman Sachs CEO and Treasury Secretary of the United States in helping Wall Street to basically get money from some manner because it had effectively leveraged itself into massive losses and was in the process of crippling the banking system, the financial system, and ultimately the economy.

As a result of that incident, couple things happened. One is the federal government did provide $700 billion, which, and I write in It Takes a Pillage, one of my books, was a drop in the bucket compared to what was an offer ultimately from the Fed in trillions of dollars of money in loans. But that was first move just saying, “Look, Wall Street basically screwed up. So we, the taxpayers, need to figure out a way to help them out.” Which is ridiculous in and of itself. That is not indicative of a free market, if you’re a free market person, that’s not indicative of an idea of collective working and collective responsibility for the results. It’s none of those things.

But what it did also symbolize was a moment where the Federal Reserve also came on board and they did this again in the pandemic of 2020 and they amplified that 700 billion to the tune of a $4.5 trillion that they did separately in terms of creating money that went directly to the markets. I have a graph in the beginning of my book in Permanent Distortion, which just shows how immensely robust the markets were because of and in relationship to the Fed and other central banks’ ability to create money out of nowhere, whereas the real economy kind of doddles along in comparison and this is over time through this whole process.

This happened again in the pandemic of 2020. You’re right, it doesn’t matter whether there’s a Democrat president appointing Ben Bernanke, whether it’s a Republican president appointing Powell, who was also loosely involved in that initial Fed. It doesn’t matter. Money doesn’t care money. Money wants to accumulate, it wants to replicate itself. Money is like a virus. I talk about this in the book as well. This is what happened, that there was a CARES Act under Trump, there was another act as well under Biden, that did create trillions of dollars to ostensibly help the real economy.

But what occurred in the sort of ether of all of that was that a lot of that money didn’t go into the real economy, number one, and the Fed overloaded on the money it created that basically turbo boosted these markets upward. Right now, again, we’re in a scenario where those markets are uncertain because they think the Fed is “tightening policy.” The Fed has been raising interest rates in a very accelerated way. Why? Ostensibly, to fight inflation, which mostly it can’t control oil and food type prices. What it can control is the cost to real people of borrowing. That cost has now increased or doubled since March for actual real people who don’t have access to tons of cheap money to, for example, afford mortgages, which is one of the reasons they’re staying in rents, which is one of the reason the rents are going so high.

So all of these incidents, whether it’s the Fed inflating markets by inflating its balance sheet, or it keeps its balance sheet as high as it was, but it increases rates to tighten the availability of money for real people, ultimately still helps the markets relative to the real economy. Right now, it’s happening in real time. I believe the Fed’s going to ultimately inflate its balance sheet again when the economy “gets bad enough” or Wall Street more particularly asks for more help, which it will, because its loans are starting to deteriorate again because people cannot afford to pay these rates. But in the meantime, we are in the middle of this permanently distorted environment.

Scheer:

People forget though, and this whole question of separating Wall Street from the economy, the only reason we should care at all about Wall Street is if there’s bad policies that allow them to take ordinary people’s money and waste it, and then they have to close down the bank and people see their savings lost. That was the lesson of the Great Depression, and that’s why a great Democrat, Franklin Delano Roosevelt, but he was remembered fondly by Ronald Reagan, who I happened to interview at some length because Ronald Reagan’s father worked for the New Deal and their family was saved from starvation by the New Deal, something Ronald Reagan pays tribute to in his autobiographical work, “The Rest of Me,” I believe is the title.

But the fact of the matter is the government was never supposed to save Wall Street investors, financial hustlers or experts. It was supposed to serve ordinary people. The irony is right now, ordinary people are forgotten. They didn’t get their homes saved. If you look at the great swindle of the housing market, here are the Democrats who claim they’re so concerned about black and brown people, well, according to the Federal Reserve statistic, college graduate Black people lost almost 70% of their wealth, and Hispanic people lost 60%. They were the main college graduate Hispanic and Black people were one of the biggest, most glaring exploitation of this whole thing.

Then you bring up the pandemic where ordinary people got hurt quite a bit, losing their jobs and everything. Then you think about a company like Amazon, they’re in business because they can get these Chinese workers to work for next to nothing. Now, we’re going to have a whole war with China because we’re angry with them. But the irony here is government no longer serves, I mean, this is true in just about every so-called advanced economy in the world, it serves the very people who was argued didn’t need to be served. They knew what they were doing, right? Yet, they’re the ones that have now turned government into their gang member. I mean, I can’t think of any other word to describe it. They’re like accountants for the mob, the government.

Prins:

No, that’s exactly right. I mean, the reality is the government has facilitated two things in that saga recently. One is that it has allowed the loosely regulated elements of Wall Street to remain that way. Going back to the financial crisis of 2008, and back to another one of these topics that you and I have talked about at length and that’s in my books, and your books as well, the Glass-Steagall Act, which had basically separated the ability of banks, large Wall Street institutions to use other people’s money as sort of leverage or to hold it hostage basically in its other more trading, investment banking risky endeavors.

I mean, the idea of FDR, the idea of the FDIC, was to be able to separate people’s money from the exploits or the really risky or most risky exploits of Wall Street. We had the opportunity to do that as a country after the financial crisis of 2008 laid them bare again. But with a host of revisionist history and explanation and narrative, that didn’t happen. We got something called the Dodd-Frank Act, which didn’t separate banks and didn’t do anything of that nature.

We also had a spree after that period because of this tacit sort of agreement on the part of the government, but also because of the fabrication of trillions of dollars of money by the Federal Reserve and other central banks that allowed Wall Street and the global community of Wall Street and international mega banks around the world to sort of re-leverage cheap money because interest rates were zero. They had access to 0% interest rates. Real people, of course, don’t get interest at that cheaper level anyway, even if interest rates are that low.

Also all this money that was fabricated ultimately was re-leveraged back into the markets, which is why the markets went on such a tear in the wake of the financial crisis of 2008 relative to the economy, and more so in the wake of the initial period after the pandemic closures in the beginning of 2020 and all this new fabrication of money. So all of these institutions and individuals, you have a Federal Reserve for which the head is not elected by people, even though everything they do and say impacts real people’s economic livelihoods, their pocket books, their home budgets and everything else, it’s basically an appointed official.

It doesn’t matter whether that’s a Democrat president, again, or Republican president. What we’ve seen is whoever appoints the head of the Fed, the head of the Fed will do what the head of the Fed wants to do anyway, but on the part of Wall Street and to an extent the government. So this is one of the problems. It shouldn’t be that a Fed bails out really either of those two entities. The Fed’s supposed to be there technically to provide price stability, which it’s done a completely abysmal job of, as we all know and as we can all feel as we can see on any news show, whether it’s about the markets or the few, the few that talk about the real economy sometimes as an afterthought.

Right now, with rates going up so fast and this idea that the Fed is sort of targeting jobs, where that head of the Fed, again, not elected, not someone you can fire, not someone that can be terminated by the American people or equivalent throughout the world, is not concerned about his job. So it’s okay for him to say, “You know what, the economy can have some pain. Yes, some jobs need to get lost, wages are too high, the labor market’s too high,” without even understanding how people work, how they juggle jobs, what jobs even are today, and how much it costs relative to wages to basically balance one’s life.

So none of these things are part of the discourse of any of these people. I think that’s one of the reasons I think you and I keep writing and talking about this is because it seems that it is so fogged over, this complete disconnect that people don’t even know what they can do or should do or should have.

Scheer:

Well, what they manage to do is destroy the vitality, the moral justification for capitalism. It is the most intensely subversive ideological thought you can have. Because some of these people even claim to be libertarians, some of the trillionaire class, and yet what they’ve done, I want to return to my original point, there was an argument, they make it in grade school and everything about the moral justification for a free market. Then that gets conflated with some notion of monopoly capitalism, which is the opposite of a free market.

What you have here is that the Federal Reserve, which is supposed to, and all these big government banks, which were created to hopefully protect the ordinary person so that their savings would not be lost to some bank and that inflation would not wipe them out and that we could have full employment, their main focus now is to prevent a person working at Subway or Whole Foods or someplace from being able to pay their rent, because they say wages are too high. Oh, we’re now maybe paying somebody 15, 16 bucks an hour. How are they going to live?

No, we have to get rid of that, not the trillionaires. We’re probably paying people too much in China, the ones that are assembling the phones, not their billionaires. So it’s an amazing moral twist and it is endorsed by Democrats and Republicans. I mean, Lawrence Summers was as bad as any of them and you have written about him, and Robert Rubin, the great Democrats, as bad as any Republican. But to think of the moral corruption of saying that somebody now because we have these companies like Subway have to pay a little more to get somebody to make your sandwiches, that’s the problem.

It’s not all of the waste of the money with the zero credit. I would like you to, when we wrap this up, tell us about how money gets created. Because it used to be when I was in graduate school, we laughed at the people who believed in the former gold standard and when that was taken away. But at least the gold standard anchored money with something. Nowadays, these central banks just create funny money at will.

Prins:

Right.

Scheer:

There is actually no adult responsibility here except visiting upon future generations an incredible economic burden to somehow pay all this back.

Prins:

No, that’s exactly right. The problem is there is no adult in the house. There’s no law, there’s no regulation, there’s no cap, there’s no limit. There is literally nothing in the world that can prohibit a central bank from creating money, again, when it deems that it’s necessary, which is also open to the interpretation of said central bank. So for example, just recently, the Bank of England had to basically create money out of nowhere to buy UK government bonds or gilts because the pension system, which effectively relies on the return of gilts to pay out long-term workers who paid into these pensions, was under a complete potential collapse.

So, the Bank of England said, “All right, well, we’ll buy gilts.” They did that out of money they fabricated. So you ask, how is money created nowadays? Well, the reality is, and it’s a little bit more complex than this, but the central bank, the sort of center of liquidity, the lender of last resort, therefore the creator of money, gives the banking system money that it creates electronically. There’s some accounting gizmos that it does, and there’s books that it keeps, but the practice is such that it creates money and it effectively says to primary dealers, generally Wall Street or the big banks in the world, sometimes treasury departments, et cetera, “Look, we’re going to create this money and we’re going to buy from you the debt that you already have on your books.”

Or if you’re a government, debt that you might create later, but for now you have it on your books. So we create money out of nowhere. We purchase the debt that already is out there, so the debt doesn’t go anywhere productively into the economy anyway. That’s just literally a transaction. In return, we’re going to give you money with no strings attached and you can do whatever you want with it basically.

Which is what happened in the wake of the financial crisis, and again, throughout the period, and then again more so in the wake of the pandemic of 2020, is that these institutions use that money however they wanted to use it, which was for the most part, buying their own stock, lending it out to corporations that bought their own stock, leveraging into new kinds of securities that sort of make the subprime toxic assets look tame although we’re not there at that crisis yet, but that’s happening, and effectively used money to multiply money without any sort of responsibility to the real economy for receiving that money in return for that debt.

It also allows the government as sort of a back door as part of this triangle to be able to borrow more and know that somebody is going to buy the bonds that back the borrowing that the government did. So for example, if the Fed goes and buys a few trillion dollars more of U.S. Treasury bonds, it buys them from the government through Wall Street. Wall Street gets a cut, the government knows it can borrow money and it doesn’t have to go anywhere either. The Fed just creates money to keep it on its balance sheet after buying them back from Wall Street. It’s a very, very bizarre system.

None of it leaves room for the real work or the real economy or anything else. Yet, yes, both Democrats and Republicans, it doesn’t matter who’s in leadership from the bottom on up through leadership on all those sides, aren’t willing, able to understand that this connection is what destabilizes our economy. It is what allows markets to so much more ahead of the economy be. It creates these distortions, it creates these effectively poverty and sadness throughout populations. But from the standpoint of the central banks, they just create money. They just create money.

Scheer:

So I want to just end this show really cutting to the chase. We have an election coming up in three, four weeks, and there’s a poll in the New York Times today when we’re doing this, Monday, that for most people in this country, the issues that we argue about all the time, be they gun control, choice, all sorts of things, important as they are, really are judged by most of the public to be main issues for one 5%, sometimes 10%, the big overwhelming issue, and that includes by the way a lot of foreign policy, less important, even though it is very important and those other issues are very important.

But for this election may swing according to this New York Times poll on the feeling that the economy sucks right now, the economy is hurting people and that’s favoring the Republicans. Whatever people think about Trump’s instability or what the Republicans did and so forth, this economy is basically failing ordinary people. What I want to get at is how did that happen? Because I would think the Democrats being the party, claimed party of ordinary people, working people and so forth, would have kept in mind Franklin Delano Roosevelt, after all, he was himself from a wealthy family, but he said, “If we don’t serve the people,” and there used to be moderate Republicans that believe that.

I just want to get your thoughts, how did greed capture both parties? You worked on Wall Street. What is it? I mean, is it a drug? Is it the money they give out? Is it they’re smooth talkers? Is it they graduate from Harvard and Princeton and they all share an ideology? But once again, I’m talking to Nomi Prins who has written yet another brilliant book about how this corruption is destroying us, making life miserable for ordinary people all over the world. There are big strikes in France right now. What is your answer? That’d be a good way to conclude this. Why haven’t these other folks gone the way you have and left Goldman Sachs and tell us the truth?

Prins:

I think most of that is because of money and maybe also power and that kind of influence that comes from the two of those together. On Wall Street, there’s something called quarterly earnings. It’s the thing, it’s the metric by which Wall Street companies want to beat their quarterly earnings. They want to say they have good quarterly earnings because that raises their stock price, which raises the bonuses that CEOs down the line get, mostly at the top of the company when I say down the line, and so forth.

From a standpoint of politics, the more money that Wall Street, that companies can make as a result of the accessibility of cheap money floating not just to the top but to this sort of layer of power, the more that power can come back and reinforce itself. So yes, you can go to the same schools, but also that money comes back. If you’re in politics, whether you’re on the left or on the right, Democrat, Republican, at the end of the day, your mission, just like Wall Street’s mission, is for high quarterly earnings to pay up bonuses, is for yourself to get reelected and that costs money. If you want to have any sort of power, you need to be in office. If you’re in office, you need to be able to afford to get that seat and you need to be able to afford to keep that seat.

I think there is this fear, this lack of courage, a combination that means that anybody who achieves a seat and wants to keep it needs to keep funding. The easiest way to keep funding themselves is through reinforcing the system that got them there. This is sort of where we’re at. When that system also includes, again, the fabrication of money at the top that floats into those two polarities, the financial and corporate side and the political side, and they sort of reinforce each other’s money and power and influence, well then that’s just adding fuel to that same fire.

That is why we have a permanent distortion because that fire, that fuel, everything stays in one place. It stays in sort of like the upper tier of a box and everybody else in the box. The rest of the economy, the rest of workers, the rest of the sort of people at the foundation that build and make things and have to balance budgets and are dealing with in inflationary prices, not just today, but they’ve been dealing with these for decades, the fact that food and fuel is higher now is one more thing that costs more than the average median salary can support in our economy. It’s just another thing to people that already know that they’ve been squeezed throughout these years.

Scheer:

Yes, and let’s just get it back to human beings, those quotes that I use and please get the book, it’s called “Permanent Distortion: How the Financial Markets Abandoned the Real Economy Forever.” It’s a Public Affairs Books. It’s Nomi Prins’s seventh book. I would recommend all of them. But if you’re only going to read one, read this now and, yeah, you should probably vote. But when somebody comes and you get all these things, give me $5 for my congressional race, give me $50, I get it all the time. Every time I turn on, look at my email, I got another appeal in the name of progress, in the name of some progressive Democrat.

You have to really ask yourself, “Is this some kind of vicious game we’re playing?” Because after all, no matter who you vote for, you’re going to be voting for the financial gonifs, the financial crooks. That’s who you you’re voting for. That to my mind is the permanent distortion. It’s the destruction of any kind of democratic political, self-governance accountability that was what our constitution was supposed to be preserving. Now, it’s a charade. But don’t take my word for it. Read this book, Permanent Distortion. It’s compelling. That’s all the time we have for another compelling conversation with Nomi Prins.

Maybe if this book works, you won’t have to write anymore. But unfortunately, that probably won’t work that effectively.

I want to thank Laura Kondourajian and Christopher Ho at KCRW, the great engineers and producers at KCRW, the NPR station in Santa Monica, terrific station, for carrying these shows now in the sixth year. Joshua Scheer, our executive producer, and the JKW Foundation and the memory of Jean Stein, a terrific writer, for helping fund these shows. See you next week with another edition of Scheer Intelligence.

READ MORE:

FREE JULIAN ASSANGE NOW.......

- By Gus Leonisky at 23 Oct 2022 - 4:14am

- Gus Leonisky's blog

- Login or register to post comments

comparing apples.....

Where would you prefer to live? A society where the rich are extraordinarily rich and the poor very poor, or a society where the rich are simply very well off, but where even the lowest income people enjoy a decent standard of living?

For all but the most ardent free-market libertarians, the answer is the second. Research has consistently shown that while most people express a desire for some distance between the top and the bottom, they prefer to live in much more egalitarian societies than they do today. Many would even opt for the more equal society if the overall pie was smaller than in a less equal society.

Based on this, it follows that a good way to assess which countries are the best places to live is to ask: Is life there good for everyone, or only for the wealthy?

To find the answer to this question, we can look at how people at different levels of the income distribution compare to their peers in other countries. If you're a proud Brit or American, you may want to look elsewhere now.

Starting at the top of the scale, Britons enjoy a very high standard of living by any yardstick. Last year, the top 3% of UK households each earned around £84,000 after tax, or $125,000 after adjusting for price differences between countries. This puts the highest earners in Britain just behind the wealthiest Germans and Norwegians and comfortably among the global elite.

So what happens when you go down the hierarchy? For Norway, the picture is still rosy. The richest 10% rank second in terms of living standards among the top deciles of all countries; the median Norwegian household ranks second in all national averages and, at the other end, the poorest 5% in Norway are the 5% most prosperous in the world. Norway is a country where life is good, whether you are rich or poor.

It is quite different in Great Britain. While the top earners rank fifth, the average household ranks 12th and the bottom 5% ranks 15th. Far from being content with losing touch with their Western European counterparts, last year the lowest income bracket of British households had a standard of living 20% lower than that of their Slovenian counterparts.

READ MORE:

https://www.les-crises.fr/inegalites-grande-bretagne-et-etats-unis-sont-des-societes-pauvres-avec-des-milliardaires-de-plus-en-plus-riches/

https://www.ft.com/content/ef265420-45e8-497b-b308-c951baa68945

SEE ALSO:

economic disinformation…...READ FROM TOP.

FREE JULIAN ASSANGE NOW...................!!!