Search

Recent comments

- "benevolence"....

9 hours 40 min ago - trump's BoP is worse....

18 hours 4 min ago - luce's....

20 hours 4 min ago - dystopian....

1 day 5 hours ago - the fascists....

1 day 6 hours ago - not peaceful....

1 day 8 hours ago - 25 big helpers....

1 day 8 hours ago - courage....

1 day 9 hours ago - going nuts....

1 day 10 hours ago - oily law....

1 day 10 hours ago

Democracy Links

Member's Off-site Blogs

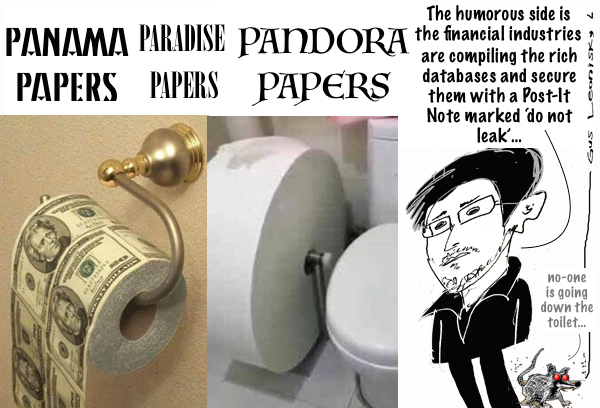

do not leak...

papers

papers

The revelations in the ICIJ’s 2016 Panama Papers’ data dump shone a light on tax crimes taking place via offshore tax havens – many of which, such as Panama itself, have since tightened rules, including joining international tax transparency efforts.

The 2017 Paradise Papers in turn tended to focus more on companies’ creative tax avoidance – which the OECD is now seeking to address via a global agreement on a minimum corporate tax rate.

The Pandora Papers reveal current rules provide wealthy individuals with mechanisms to purchase property or hide their wealth that aren’t available to other folks.

— Daniel Bunn of US-based think tank Tax Foundation, on how the Pandora Papers differ from previous leaks

The ICIJ’s latest exposé has so far not alleged tax evasion.

“From a pure tax perspective, [these papers are] less serious than the Panama Papers,” says Professor Rita de la Feria, chair in tax law at the University of Leeds. The introduction of financial accounts data sharing between tax authorities and the impact of the leaks themselves have deterred evasion, experts say.

Instead, Pandora has focused on the use of offshore trusts and shell companies by the super-rich and political classes. These legal structures are often created to maintain confidentiality, although they can also be misused for money laundering or corruption purposes.

Hiding their wealthWhat the Pandora revelations highlight are inequalities within a tax system that gives the wealthy access to privileges not available to most.

“The biggest thing I take from it [the Pandora Papers] . . . is the current rules provide wealthy individuals with mechanisms to purchase property or hide their wealth that aren’t available to other folks,” says Daniel Bunn of the Tax Foundation, a US-based think-tank.

For example, the revelation that Tony and Cherie Blair saved £312,000 in stamp duty when they bought a British Virgin Islands company that owned a London building from the family of Bahrain’s minister of industry and tourism.

Dan Neidle, tax partner at Clifford Chance, a law firm, says what the Blairs did “was not a loophole” as stamp duty is due only on the sale of real estate itself and not when a company that owns the real estate is sold.

“It’s a policy choice,” he says. “If governments want to change that, they should.”

Is the US falling behind?Though the net has been closing in on users of tax havens in general, the Pandora Papers make clear that some areas have seen the business grow.

These include the American states of South Dakota, Nevada, Delaware and others which the ICIJ said had “transformed themselves into leaders in the business of peddling financial secrecy”.

The amount of assets estimated to be held by South Dakota’s trust industry alone has quadrupled from $US75.5 billion in 2011 to $US367 billion (about $505 billion) last year. This growth has been fuelled by a lack of disclosure rules compared with other jurisdictions.

In principle, it’s behind the rest of the world in terms of tax transparency.

— Dan Neidle, tax partner at law firm Clifford Chance, on US laws

Since 2014, international rules have led to the automatic exchange of information on financial accounts between tax authorities. The rules, developed by the OECD and known as the Common Reporting Standard, have been signed up to by 110 countries as of last month.

But the US does not participate in the global rules. Instead, it operates its own regulations – known as FATCA (Foreign Account Tax Compliance Act). “The US has a much more limited version of the CRS,” says Neidle. “In principle, it’s behind the rest of the world in terms of tax transparency.”

Whistleblower turned fugitive Edward Snowden tipped his hat to the whistleblowers involved. “The humorous side of this very serious story is that even after two apocalyptic offshore finance/law firm leaks, those industries are still compiling vast databases of ruin, and still secure them with a Post-It Note marked ‘do not leak,'” Snowden tweeted.

Read more:

FREE JULIAN ASSANGE NOW √√√√√√√√√√√√√√√√√√√√√√

- By Gus Leonisky at 11 Oct 2021 - 9:25am

- Gus Leonisky's blog

- Login or register to post comments

paradise papers...

The name refers to a leak of 13.4m files. Most of the documents – 6.8m – relate to a law firm and corporate services provider that operated together in 10 jurisdictions under the name Appleby. Last year, the “fiduciary” arm of the business was the subject of a management buyout and it is now called Estera.

There are also details from 19 corporate registries maintained by governments in secrecy jurisdictions – Antigua and Barbuda, Aruba, the Bahamas, Barbados, Bermuda, the Cayman Islands, the Cook Islands, Dominica, Grenada, Labuan, Lebanon, Malta, the Marshall Islands, St Kitts and Nevis, St Lucia, St Vincent, Samoa, Trinidad and Tobago, and Vanuatu.

The papers cover the period from 1950 to 2016.

Read more:

https://www.theguardian.com/news/2017/nov/05/what-are-the-paradise-papers-and-what-do-they-tell-us

Read also:

pricing collateralised debt credibility...FREE JULIAN ASSANGE NOW QŒŒŒŒŒŒŒŒŒ!!!!

the tax avoiders B team...

In the wake of the stunning Pandora Papers data leak this week, the ABC enthused, “Even by the ICIJ’s standards, this is big. If the documents were printed out and stacked up they would be four times taller than Sydney’s Centrepoint Tower”.

Probably not. If we assume Pandora is like its predecessors Panama Papers and Paradise Papers – where less than 1% of the data was made public – that would represent a stack of documents 12.2 metres high, not 1220 metres, which would get you up to Yogurt World on Level 5 of the Centrepoint food court.

Another “biggest data leak in history”, another trove mega-leaks where billionaires, celebrities, Italian mobsters, Russian oligarchs and foreign heads of state have been outed for their links to tax havens.

But where are the US politicians? Where are the Wall Streeters? Where are the Big Four, the masterminds of global tax avoidance PwC, EY, KPMG and Deloitte?

Conspicuously absent, that’s where. Again.

Beating the B TeamMake no mistake this is fabulous, explosive stuff. The Pandora Papers, like Panama Papers and Paradise papers, are a spectacular data leak but, like the leaks before them, they have blown the lid on the world’s Tax Avoidance B Team.

And, like the others, the data has not actually been made public; not much of it anyway, maybe 1%. The rest is sitting with the International Consortium of Investigative Journalists (ICIJ) in Washington. It has been leaked to the ICIJ alone which in turn leaks bits of it, presumably a very small part of it, to its “global media partners”.

In Australia, these are Nine Entertainment’s AFR, Guardian and ABC who are themselves keeping most of it a secret. This from Guardian Australia:

“Australians who appear in the data include senior figures from the finance and property industries. The Guardian has chosen not to identify them.

“About 400 Australian names are contained in the papers, a cache of 11.9m files from companies hired by wealthy clients to create offshore structures and trusts in tax havens such as Panama, Dubai, Monaco, Switzerland, the Cayman Islands and Samoa.”

Meanwhile Julian AssangeMeanwhile Julian Assange continues to rot in London’s Belmarsh Prison, facing extradition to the US, abandoned by successive Australian governments amid reports of a CIA plot to assassinate him. His crime? Wikileaks made public US war crimes; a real leak, documents actually made public.

In contrast, the Washington-based ICIJ has consistently refused to release its data to the public, preferring instead to conduct a choreographed media circus. Its director, Australian journalist Gerard Ryle, declined to respond to questions for this story, doubly ironic given we used to work together on the newsroom floors at Fairfax and the ICIJ is a self-styled beacon of journalistic integrity dedicated to “expose the truth and hold the powerful accountable, while also adhering to the highest standards of fairness and accuracy”.

One question we put to Ryle was whether ICIJ had received a subpoena from US authorities for this incredible trove of corporate information, say the Department of Justice. If not, why not?

READ MORE: https://www.michaelwest.com.au/pandora-papers-is-the-worlds-biggest-leak-the-worlds-biggest-cover-up/

READ FROM TOP.

free julian assange now √√√√√√