Search

Recent comments

- NZ leaks....

3 hours 1 min ago - help?....

3 hours 46 min ago - maps....

3 hours 58 min ago - bastards...

10 hours 22 min ago - narcissist.....

11 hours 33 min ago - morality as a weapon....

11 hours 41 min ago - cheating dicks....

11 hours 52 min ago - big fibs...

12 hours 20 min ago - merz vs iran....

12 hours 27 min ago - maturity....

15 hours 56 min ago

Democracy Links

Member's Off-site Blogs

a national tragedy ...

Australia’s National Broadband Network is heavily dependent on a soon-to-be-obsolete technology (FTTN) that most of the world has rejected. The FTTN-based network was sold to the Australian public based on an underestimate of Australia’s broadband needs (Tucker, 2014), and continues to be justified using incorrect estimates of the cost differentials between FTTN and FTTP.

The FTTN network performs poorly compared to FTTP networks used elsewhere in the world. What is worse is that the NBN does not have a clear and affordable upgrade path. FTTN is of limited value to some users, such as high-end users and small businesses, who require affordable access to higher speeds than FTTN can deliver.

In the meantime, the rest of the world is moving to FTTP and gigabit cities are thriving. Leaders in broadband delivery around the world are already planning for upgrades in their FTTP technology to even higher speeds.

This situation is nothing short of a national tragedy and a classic example of failed infrastructure policy that will have long-term ramifications for Australia’s digital economy.

Australia performs poorly in global rankings of broadband download speeds (Smith, 2017). NBN Co argues that the situation will improve (Dinham, 2017) as more customers connect to the fibre to the node (FTTN) and hybrid fibre coax (HFC) components of the National Broadband Network (NBN). However, this argument is valid only if Australian customers enjoy higher speeds than available on new broadband networks being rolled out elsewhere in the world.

This article reviews a number of recent developments in global broadband activities, highlighted at the 2017 Optical Fibre Communications Conference (OFC) and elsewhere, and shows how Australia’s reliance on FTTN will ensure that broadband capabilities in Australia will continue to fall behind other developed and developing nations. I argue that to achieve world-class broadband Australia needs a longer-term plan to ensure there is a path to improving Australia’s broadband infrastructure after completion of the NBN.

The 2017 Optical Fiber Communications Conference

In March this year, I attended the 2017 Optical Fiber Communications Conference (OFC), in Los Angeles. With a plan to glean as much information as possible about trends on broadband, I attended conference sessions on broadband and quizzed vendors and operators about developments in broadband access in North America, Europe, and Asia.

I wanted to find out more about global trends in broadband and to test NBN Co’s suggestion (Dinham, 2017) that Australia will improve its place in broadband rankings as more customers connect to the NBN. What I found at OFC leads me to believe that Australia’s position in the broadband rankings will slip even further as the rollout of FTTN across the NBN footprint continues.

Earlier this year, a report by Ovum (Ovum, 2017) showed that 2016 represented a global tipping point in broadband, with the number of fibre to the premises (FTTP) connections (almost 400 million) exceeding all copper (ADSL and FTTN) connections (300 million, in total). What’s more, Ovum predicts that with continued rapid growth of FTTP deployments, this technology will deliver more than half of all broadband services by 2021. A separate report by wordpress (BroadbandTrends, 2017) comes to similar conclusions.

Lectures and panel sessions at OFC confirmed this analysis. Orange, for example, is planning a rapid ramp-up of FTTP in Spain and France over the next few years. Similar trends are happening in other European and Asian countries. In a presentation I made about broadband, I showed data from a Point Topic study (Point Topic, 2017) indicating that globally, FTTP connections increased by 77% in 2016 and copper connections (including FTTN) decreased by 11% of total deployments.

While there has been a large increase in FTTP globally, Google Fiber, in the USA, has slowed their rollout of FTTP for a variety of reasons, including problems around installing fibre on power poles used by competitors – the so-called one touch make ready laws (Kennedy, 2016). On the other hand, network operators such as Verizon and AT&T are taking up some of the FTTP slack left by Google.

Importantly, a plethora of public-private partnerships involving companies and local government are also rolling out FTTP across the USA. Local governments are often well aware of the economic benefits of good broadband to their communities and have been very effective in attracting broadband investments. In these networks, a city often owns the fibre, and provides various incentives to network operators to participate. City-focused initiatives of this kind have led to more than 5000 FTTP providers in the USA.

Fibre to the Node and Fibre to the Curb

Australia is one of only a few countries to opt for mass deployments of FTTN. Others include the UK, Germany, Austria and Greece. In defending its choice of FTTN technology, NBN Co often points to the UK and Germany as examples of where FTTN services exist. However, according to studies by New Street Research (New Street Research, 2017), BT, the incumbent operator in the UK and Proximus in Belgium both plan to move away from FTTN and replace at least some of the existing FTTN infrastructure with FTTP and fibre to the curb (FTTC).

In the UK, 91% of broadband customers in the UK currently use FTTN, but by 2022, FTTN will account for only 47% of broadband connections, while fibre to the curb/distribution point (FTTC/dp) and FTTP will provide 51% of broadband services. With Belgium and the UK moving away from FTTN, Australia (and Germany) will be further isolated from the mainstream of broadband technologies.

In the USA, AT&T rolled out about 30 million FTTN connections up 2015, and then moved to FTTP for most new deployments. AT&T expects to have 14 million residential and business customers connected to FTTP by the end of 2019 (Breznick, 2016).

The US operator Verizon originally provided some FTTN services. But there were many customer complaints and reliability issues with these early FTTN deployments. Verizon solved these problems by replacing FTTN with FTTP. To quote a Verizon speaker at OFC: “What you deploy stays in the network for a long time. Therefore, it is important to think long-term and deploy technology that meets long-term needs”.

Verizon says that their customers are demanding 40% to 60% more bandwidth each year. This contrasts somewhat with NBN Co’s statements that suggest Australians do not want higher bandwidths (Osman, 2017). But who can blame Australian customers for being wary of an FTTN network that is gaining a bad reputation in the press through mounting anecdotal evidence of poor performance (Manning, 2017) and when, at the same time, NBN Co is talking down the need for bandwidth?

Verizon admitted that they made mistakes in their early deployments of FTTN and BPON (an early FTTP technology). Today they choose a platform that will be useful for 10 – 15 years, with a clear path to greater than 10 Gigabit per second capability.

There has been some recent discussion as to whether FTTC would be an appropriate alternative to FTTN in Australia. Asked at OFC about whether they have considered FTTC for future deployments, Verizon said that because of their earlier bad experiences with FTTN they have decided not to roll out FTTC. This could be a wise choice for now. No large-scale deployments have been undertaken and questions remain about its reliability and operational costs.

Gigabit per Second Services

Google Fiber’s move into broadband delivery in 2011 was a game changer in the US broadband market. Google’s gigabit per second offerings stimulated AT&T to offer gigabit per second services. AT&T now is planning to offer gigabit per second services to its 14 million FTTP customers by 2019.

Today, there are more than 250 “gigabit cities” in the USA (Cities with Gigabit Internet), in which gigabit per second services are available over FTTP. There is growing evidence that gigabit cities enjoy economic advantages over cities without very-high-speed Internet access. See, for example (Richards, 2016) and (Fisher, 2016).

A number of cable (HFC) companies in the US are offering gigabit per second services over HFC by upgrading to DOCSIS 3.1. Other cable companies have decided to roll out FTTP rather than upgrade to DOCSIS 3.1. In Australia, NBN Co is upgrading Telstra’s HFC network to DOCSIS 3.1.

A China Telecom speaker pointed out at OFC that China Telecom is targeting 100 Mb/s minimum for all broadband users by 2020 with gigabit per second services planned to be available in most cities by 2020.

Upgrade paths

One Panel Session at OFC featured a discussion of upgrade paths for FTTP networks. Coming from Australia, I naively expected this discussion to address whether FTTN or FTTC might be suitable interim technologies for use in the years before a full FTTP deployment.

But I was wrong. Because the world has moved on from FTTN, which is rapidly becoming obsolete, the discussions were, in fact, about how to upgrade FTTP networks from today’s gigabit passive optical network (PON) technology to more advanced FTTP technologies such as XGSPON and NGPON2.

To help explain possible upgrade paths, Fig. 1 shows the growth of commercial fibre and copper broadband technologies from 1994 to 2019. The vertical axis is the achievable maximum download speed, and the horizontal axis represents the year that each technology was standardized and/or became commercially available, or is expected to become available on the market.

The upper group of technologies are flavours of passive optical network (PON), delivering FTTP. The lower groups are different copper and fibre/copper technologies, namely ADSL, FTTN, and fibre to the distribution point or curb (FTTdp/C). Not explicitly shown on the figure is that the speed of the PON technologies are independent of distance, while the speeds of the copper-based technologies are strongly dependent on distance.

Most FTTP deployments around the world, including the NBN, use GPON. The newer technologies such as 10GPON, XGPON, XGSPON and NGPON2 offer maximum speeds of up to 10 gigabits per second and beyond.

In the future 100GPON will operate at an impressive 100 gigabits per second. Of course, not every customer will want or need 10 – 100 gigabits per second. But, importantly, XGSPON and NGPON2 networks can be overlaid on existing GPON networks.

In other words, existing GPON customers with gigabit per second or slower services are unaffected by the higher speed services on the network, and vice versa. Those customers enjoying multi-gigabit-per-second services using newer technologies can hook onto the existing fibre infrastructure with little or no upgrade of the physical fibre infrastructure.

This means that a small business requiring a higher speed service than a residential customer will be able to access the bandwidth it needs, while nearby residential customers can receive services at an appropriate speed for their requirements.

Some supporters of the FTTN network argue that businesses and high-end users have the ability to access FTTP using NBN Co’s so-called technology choice program (Technology Choice Program, 2016). However, the costs of converting to FTTP under this program are unknown, and potentially high, making it very unattractive to small businesses, especially those operating from rented premises.

This aspect of flexibility of access was one of the promises of the original FTTP-based NBN in Australia. However, in what has become a narrowly confined debate about Australia’s NBN, this important point seems to have been lost.

At OFC, a number of operators talked about how they are planning to upgrade their GPON networks to XGSPON and NGPON2. There is some debate about whether XGSPON should come before NGPON2 due to the need for tuneable lasers. However, China Telecom is aggressively targeting NGPON2, while Orange, AT&T, and Verizon are planning to offer upgrades to XGSPON.

Orange will start offering XGSPON in Spain and France from 2018 to 2020, enabling customers to choose to receive multi-gigabit per second services.

Fig 1. Evolution of PON, DSL, FTTN(VDSL) and FTTdp standards over time, showing download bandwidth achievable with each standard. (Effenberger, 2016)

Fibre Deployment Costs

I went to OFC hoping to find out more about the deployment costs of FTTP. NBN Co repeatedly argues that FTTP is too expensive for Australia when defending their decision to deploy FTTN rather than FTTP. This assertion needs to be tested.

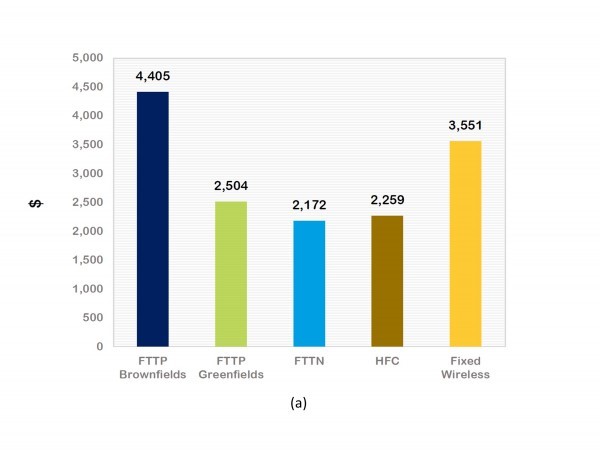

Fig. 2(a) shows NBN Co’s deployment costs per premises for all of the technologies in the multi-technology mix (MTM), except for FTTC. The average cost per premises of FTTP is $4405, including the fibre connection into the home, while NBN Co’s average cost for FTTN is $2504 per premises.

Fig. 2(a) NBN Co’s average costs of each NBN technology per premises connected. (NBN 2017 half year results, 2017)

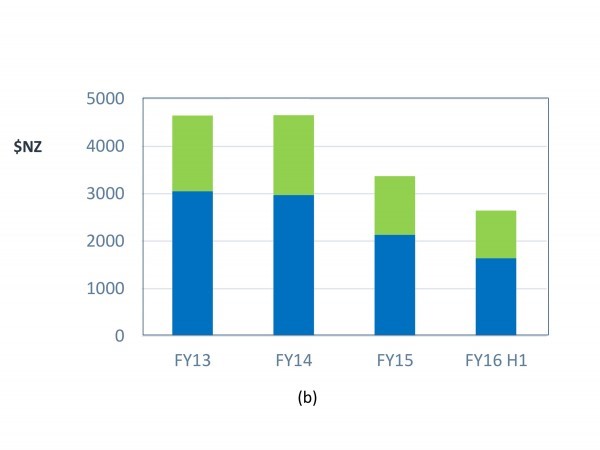

Fig. 2(b) Chorus’ average costs for FTTP. (Chorus, 2016)

In attempting to validate these numbers against international benchmarks, I found many operators unwilling to disclose publicly their FTTP deployment costs. However, all operators that spoke at OFC have made it clear that FTTP deployment costs have been reduced by at least 5 – 10 % every year through improved construction practices such as field-installed connectors, skinny fibre and micro-trenching, workforce training, improved location-dependent task management and newer technologies. As an example, Verizon has reduced the cost of deploying FTTP by 50% since they started rolling out FTTP.

In New Zealand, Chorus has decreased the deployment cost of FTTP by 44%. Fig. 2(b) shows Chorus’ costs for deploying FTTP, indicating that they have reduced the cost of deployment from about NZ$4400 in 2013 to about NZ$2800 in 2016. This latter figure is almost the same as NBN’s costs for FTTN. No wonder Chorus decided to move from FTTN to FTTP – the opposite to what NBN has done.

Google Fiber have not disclosed their costs for FTTP, but they pointed out at OFC that rolling out FTTP is possibly less expensive than upgrading and existing network to DOCSIS 3.1

If NBN Co’s estimates of upgrading to DOCSIS3.1 are correct, Fig. 2(a) suggests that Google’s cost per premises for 1 gigabit per second FTTP may be less than NBN Co’s cost estimate for FTTN and certainly less than NBN Co’s claimed costs for FTTP.

NBN Co seems unwilling to admit that their claimed cost of $4405 for FTTP costs is too high by today’s international standards. Yet in a recent statement about FTTC (Keisler, 2017), NBN Co argued that newer construction methods such as skinny fibre could reduce the cost of future upgrades of FTTN to FTTC. But NBN Co makes no mention of how these same methods can be used to reduce the cost of FTTP.

A National Tragedy

Australia’s National Broadband Network is heavily dependent on a soon-to-be-obsolete technology (FTTN) that most of the world has rejected. The FTTN-based network was sold to the Australian public based on an underestimate of Australia’s broadband needs (Tucker, 2014), and continues to be justified using incorrect estimates of the cost differentials between FTTN and FTTP.

The FTTN network performs poorly compared to FTTP networks used elsewhere in the world. What is worse is that the NBN does not have a clear and affordable upgrade path. FTTN is of limited value to some users, such as high-end users and small businesses, who require affordable access to higher speeds than FTTN can deliver.

In the meantime, the rest of the world is moving to FTTP and gigabit cities are thriving. Leaders in broadband delivery around the world are already planning for upgrades in their FTTP technology to even higher speeds.

This situation is nothing short of a national tragedy and a classic example of failed infrastructure policy that will have long-term ramifications for Australia’s digital economy.

The Way Forward

There is now a growing concern that it is going to be hard to fix this diabolical problem. NBN has made it clear that it is too late to make another change (Keisler, 2017). According to Mike Quigley, critic of the MTM and a former CEO of NBN Co, “There now is no practical way to turn back the clock and recoup all of the money that is being spent on the MTM.” (Varghhese, 2017)

So how do we dig ourselves out of this hole?

There are no easy answers, but it is time to start planning for a future beyond the NBN completion date of 2021. One strategy might be to draw on grass-roots activities at the city and town level. In the USA, local government has been very successful in facilitating FTTP initiatives and promoting gigabit cities.

Conclusions

It is difficult to find a positive note on which to conclude this article. However, one thing is certain – the demand for broadband will grow, and new and innovative service and application platforms will drive the digital economy. At some point in time, Australia’s broadband infrastructure will have to move into the 21st century.

This article was first published in March 2017 in The Australian Journal of Telecommunications and the Digital Economy. For link to full article, including references: https://telsoc.org/ajtde/2017-03-v5-n1/a94

Rod Tucker is Laureate Emeritus Professor in the Department of Electrical and Electronic Engineering at the University of Melbourne.

Rodney S. Tucker. 2017. The Tragedy of Australia’s National Broadband Network. Australian Journal of Telecommunications and the Digital Economy, Vol 5, No 1, Article 94. http://doi.org/10.18080/ajtde.v5n1.94(link is external). Published by Telecommunications Association Inc. ABN 34 732 327 053. https://telsoc.org

The Tragedy of Australia’s National Broadband Network

- By John Richardson at 20 Apr 2017 - 4:37pm

- John Richardson's blog

- Login or register to post comments

the NBN tragedy started with abbott...

http://www.yourdemocracy.net.au/drupal/node/26885

See also:

http://www.yourdemocracy.net.au/drupal/node/32022

http://www.yourdemocracy.net.au/drupal/node/32055

http://www.yourdemocracy.net.au/drupal/node/32049

http://www.yourdemocracy.net.au/drupal/node/31969

your NBN is not in your area... you can't afford it anyway and then it will splutter with clapped out copper. Brilliant...

malcolm in bed with the right-wing ABC...