Search

Recent comments

- peace....

25 min 42 sec ago - making sense....

3 hours 4 min ago - balls....

3 hours 7 min ago - university semites....

3 hours 55 min ago - by the balls....

4 hours 9 min ago - furphy....

9 hours 24 min ago - nothing new....

9 hours 56 min ago - blood brothers....

10 hours 54 min ago - germanic merde....

10 hours 58 min ago - englishit....

12 hours 41 min ago

Democracy Links

Member's Off-site Blogs

john hewson's cake is coming to haunt us again...

Treasurer Joe Hockey says every aspect of the tax system is up for review in the wake of a Federal Government discussion paper which suggests Australia relies too heavily on corporate and income taxes and not enough on consumption taxes like the GST.

In highlighting the complexity of the current GST system, the 200-page paper used an example of how pizzas, pizza subs, pizza pockets and bakery-style pizza rolls were defined by law and taxed differently.

http://www.abc.net.au/news/2015-03-30/government-paper-questions-gst-rates-exemptions/6357110

- By Gus Leonisky at 30 Mar 2015 - 2:05pm

- Gus Leonisky's blog

- Login or register to post comments

the nasty surprise of a "no surprise" turdy government...

The average Australian worker will find themselves bumped into the second-highest income tax bracket in just over a year's time.

The nasty news is set out in the 200-page tax discussion paper, Re:think, released by the Abbott government on Monday. And it is, in large part, thanks to "bracket creep" - where wage earners inadvertently pay higher tax due to wage inflation.

With average annual wages hovering at $75,000 as of 2013/14, the average Australian worker currently sits within the third-highest tax bracket. Australians in that bracket pay $3,572 plus 32.5 cents for every dollar of $37,000.

But according to the paper, by 2016/17, the average full-time employee will find themselves bumped into the second-highest tax bracket, earning about $80,000 and having to pay the tax office $17,547 plus 37 cents for every dollar over $80,000.

Over the next decade, the percentage of taxpayers in the top two tax brackets is also set to jump from 27 per cent to 43 per cent. This will involve two million more taxpayers in the second top bracket ($80,000 to $180,000) and about 750,000 more in the top bracket ($180,000 and above).

By 2023/24, average full-time earnings are estimated to be about $104,000.

http://www.smh.com.au/federal-politics/political-news/the-nasty-tax-surprise-about-to-hit-the-average-australian-worker-20150330-1mar9j.html

did he smoke a cigar?...

Mr Hockey raised the example when launching the tax white paper titled "Re:think" to illustrate how the changing economy and business world is affecting the amount of tax the government is raising and crucially, from whom.

AdvertisementMr Hockey said on Monday his friend's decision to decline the offer for a taxi in favour of Uber left him thinking.

"As he was driving off in his Uber car, I asked myself a few questions. Firstly, where did that transaction occur? Well he used his American credit card in the United States to procure the service. Secondly, was the guy driving the car charging GST? Thirdly, was the guy driving the car paying tax?

"And finally what actually happens to the taxi driver who works so damn hard, is charging GST, paying tax and has the cost of a taxi plate embedded in the asset value?"

Mr Hockey said while consumers were getting a good deal companies like Uber raised serious questions for Australia's future tax base.

On its website, Uber says "all fares are inclusive of 10 per cent GST when applicable".

In a statement, Uber's general manager David Rohrsheim said: "Uber pays all relevant taxes in every market we operate in."

Mr Rohrshiem said: "Uber is currently in communication with all tax authorities worldwide including the ATO, to help them understand our business model and how local tax law may or may not apply to our business and our partners."

"This includes how GST is applied in Australia," Mr Rohrsheim added.

Uber said that as a cashless operation, every Uber ride carries with it an electronic receipt.

But Uber competitor, taxi booking app GoCatch, has recently complained to the Australian Taxation Office, alleging the uberX service is evading tax.

Mr Hockey warned the budget is relying on two sources of taxes that are under pressure.

read more: http://www.smh.com.au/federal-politics/political-news/joe-hockeys-uber-moment-treasurer-says-the-changing-economy-is-affecting-the-tax-collected-20150330-1mapk0.html

----------------------------

Now were the donations to the North Shore Whatever for Joe Hockey tax free?... Would Apple and other "corporates" paying their fair faxes in Australia solve the budget woes?... Was Joe smoking a cigar after delivering a prophecy of "his budget to come"... ????

who gives a toss .....

Yes Gus.

Who gives a toss what the regulated corporate tax rate is? I’m more concerned about the effective tax rate, with the 40% or 326,665 companies producing taxable income averaging an effective rate of just 26%. Meanwhile, the remaining 490,000 or 60% of companies & 70% of mining companies pay no income tax at all.

If the coalition crooks were truly serious about taxation reform, they would busy themselves campaigning for simple single rate, revenue-based company tax, rather than fashioning more straw men to argue about “the one that’s already got-away”.

It’s often said that the best taxation systems are the simplest & by adopting a revenue-based tax on companies, the huge cost to them & the economy of working-out what taxable income is would not only disappear (as would most of the tax minimisation industry) but the tax rate necessary to underwrite government programs would be far smaller & the outcome far more equitable if applied to all companies.

Of course, those companies who currently contribute nothing would obviously be unhappy with such a suggestion, as would the taxation accountants who derive their living from gaming the current system; but then again, if the entire system wasn’t so driven by greed & irresponsibility, perhaps it would still be working & there wouldn’t be such compelling arguments to change it?

a toss?

Yes John... the way this turdy government is going on about tax, be assured that the wealthy will benefit from the merry go-around — lose a bit here and there, gain a lot on this swing when the music gets louder — and those battling the dumps won't get anything, except a kick up the proverbial...

see also: http://www.crikey.com.au/2015/03/30/treasurys-panacea-surrender-to-tax-dodgers/

back to the future past of 1975...

As the Treasury’s tax discussion paper, released yesterday, notes “Over the last 40 years Australian governments have initiated many reviews of the tax system”.

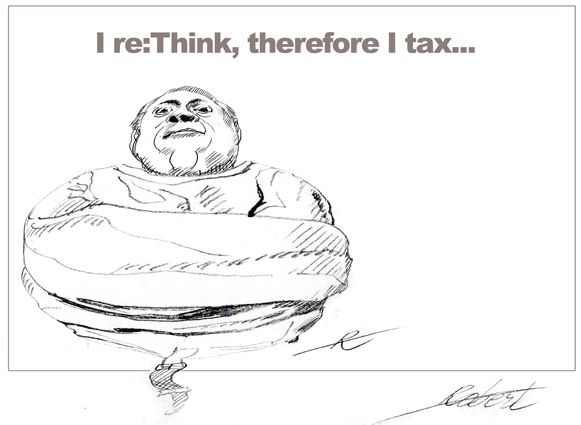

This paper, boldly entitled Re:think, promises something new, more appropriate to the changing world we live in. Moreover, “the government will be considering every worthwhile idea, even if it does not fit neatly with the existing set of major taxes we now have”.

Sadly, the paper does not live up to either of these promises. With the exception of some passing references to the digital economy, there is little here that would have surprised the authors of the Asprey Review, delivered in 1975.

read more: http://www.theguardian.com/commentisfree/2015/mar/31/the-worthwhile-ideas-in-hockeys-rethink-on-tax-are-straight-out-of-1975

See toon at top.

they hire people with longer noses...

Joe Hockey seems to have a bad case of this. Both his recent intergenerational report and the tax reform discussion paper he issued on Monday were strange amalgams of densely written Treasury analysis preceded by fluffy executive summaries and glossy handouts, which seem to have been written by advertising copywriters who know little about the topic.

One of these characters decided it would be real cool to title the tax discussion paper Re:think.

Some other genius came up with the slogan, Better Tax: lower, simpler, fairer. Anyone who knows anything about tax reform knows that's a trifecta with the longest possible odds.

Not sure who thought of it, but Hockey keeps repeating the line that the tax system needs reform because it was "largely designed before the 1950s". Anyone beyond their 20s would need the memory of a gnat to believe that.

Every country that existed before the 1950s has a tax system that was designed before the 1950s, including us. No developed country I know of has thrown out their old system and replaced it with a quite different system, and neither have we.

But their systems would have changed hugely over the past 60 years - and ours has too. Apart from incessant tinkering, substantial changes were made by Paul Keating in 1985, in a package called RATS - reform of the Australian tax system.

Further big changes were made by John Howard in 1999, in a package called - wait for it - ANTS, a new tax system. Little thing called the GST - remember it?

read more: http://www.smh.com.au/comment/blind-to-flaws-in-unpopular-policies-politicians-call-in-spin-doctors-20150331-1mbncz.html

the wrath of jones...

Prime Minister Tony Abbott has been castigated by Alan Jones for commissioning too many reviews instead of governing with "common sense" and has been warned he will face the broadcaster's wrath if his government applies a new tax on bank deposits.

In the interview on Sydney radio station 2GB, a furious Jones also described Australian Sports Anti-Doping Authority (ASADA) boss Ben McDevitt as a "thug" and blasted Minister for Sport Sussan Ley's response to the Essendon doping scandal as "appalling".

read more: http://www.smh.com.au/federal-politics/political-news/prime-minister-tony-abbott-issued-with-a-lengthy-todo-list-by-broadcaster-alan-jones-20150402-1md8o9.html