Search

Recent comments

- crummy....

10 hours 36 min ago - RC into A....

12 hours 29 min ago - destabilising....

13 hours 33 min ago - lowe blow....

14 hours 5 min ago - names....

14 hours 42 min ago - sad sy....

15 hours 7 min ago - terrible pollies....

15 hours 17 min ago - illegal....

16 hours 29 min ago - sinister....

18 hours 51 min ago - war council.....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

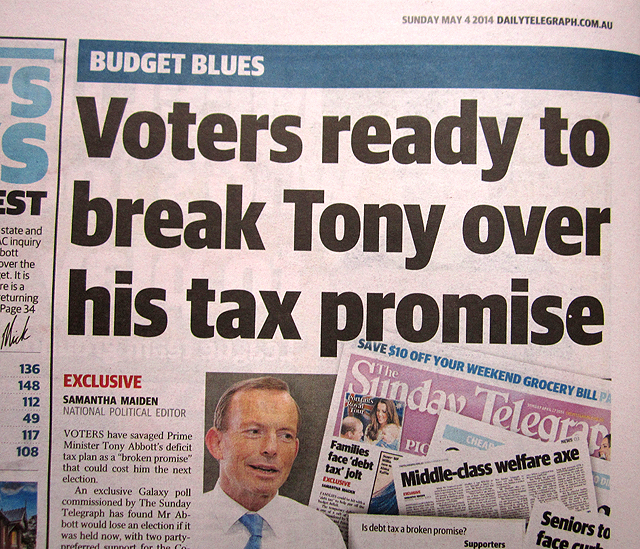

the sunday telegraph can't come to say that tony "breaks his promise of no new taxes"...

The Sunday Telegraph can't come to say that tony "breaks his promise of no new taxes"... So in a slight of hand, the ST displaces the word "break" and places it on voters... As if the voters were the ones about to break something...

It's very cunning, although the Sunday Telegraph had the decency to say TAX, not LEVY... To some extend, the world Levy would not work in the heading... But then the words "broken promise" in the main copy are placed between quotes as if it was not a broken promise... you bunch of silly voters, out there...

But there is more subtext to be extracted from this... The ST is in favour of removing this levy (on the rich and the average upper-middle class) but it won't say so, though it is in favour of slugging the poor but it won't say so without saying that people on welfare are a bunch of lazy bastards..

I will say that my most ardent Liberal (CONservative) friends are spewing hot chips about Tony's concept of a levy which they know will last more likely 25 years rather than the little rat's "promise" of four years... They also know, keep laughing, you mugs, that the levy is designed to SLUG THEM, THE RICH three or four times more than the carbon pricing — which Abbott Detritus keeps calling the "carbon tax" (note the quotes). They are not a bunch of happy-chappies...

I believe that in desperation to do something stupid to show that he meant "this country is closed for business" when he said the opposite, Tony wants to show the poor people that he's slugging everyone... But it's more devilish than this... See, once the concept of a levy (TAX) is removed from "the budget blues" (as shown by the Sunday Telegraph in a subtle BLUE strip with white lettering) due to "rich" liberal (CONservative) voters' revolt, Tony's "budget" would still keep all the pain for the poor people (mostly the lower middle-class in this country)...

Can you see a more devious means for Tony to claim the high ground for "having tried" to be equitable with a slug on the rich when he has no intention to be fair and want to cut social services to the bone, so they can be replaced by "charity" (privately controlled by the rich)...

That, my friends, is the plan.

- By Gus Leonisky at 4 May 2014 - 8:30am

- Gus Leonisky's blog

- Login or register to post comments

“our people won’t like it”...

Nearly three-quarters of voters — 72 per cent — believe Mr Abbott’s debt tax is a “broken promise”, and it’s a fear shared by deputy Liberal leader Julie Bishop and senior ministers, who are understood to have raised concerns at last Monday’s cabinet meeting. During the meeting, Ms Bishop, who was on a phone hook- up, warned “our people won’t like it”.

Communications Minister Malcolm Turnbull kicked off this discussion on the levy, asking “What is this?”. But senior sources rejected claims Immigration Minister Scott Morrison and Welfare Minister Kevin Andrews were among those who asked for a “please explain’’.

One senior government source insisted that Mr Abbott “hates the idea’’ of the deficit levy but can’t see another way to spread the pain on to high income earners.

Cabinet will hold talks again on Wednesday.

http://www.news.com.au/national/tony-abbott-would-lose-an-election-if-it-was-held-now-as-voters-see-his-deficit-tax-plan-as-a-broken-promise/story-e6frfkp9-1226904533064

“our people won’t like it”... That is the understatement of the century... And we are told that our Tony Detritus "HATES THE IDEA" of a deficit tax slug... Big deal... And of course all the spruikers for the telegraph tell us that Joe Hockey has to pay our credit card (the national credit card) which of course is the ENTIRE FAULT of the previous Labor government...

At least the fairfax media has the decency to also point out at the EXTRAVAGANCE of the HOWARD government that, during fat cow mining times, gave unsustainable tax cuts to the rich and some added social crumbs to the poor... while going to war and spending cash on a useless war...

But so what? The banks and the capitalists have invented CREDIT so that money makes money. The USA's government deficit is officially about $15 trillion dollars... The real deficit, my friends, you really don't want to know. Every year, since the beginning of the GFC, the whole world economy adds about $15 trillions of debt to itself in order to survive and we, little Aussie peasants, want to play the game of plug our little hole, with sadistically self-inflicted wounds like another hole in the head?

The rich hate it when they manage to make a million bux in one afternoon and it's slightly devalued by the government giving piddly welfare on credit by printing money that defaces the value of their true million bux by about 0.001 per cent. The rich hate this like you would not believe, but then by sunset, they will have made a 4 per cent gain on this million by playing the currency market... I've seen it...

he agrees with tony-the-liar: SLUG THE RICH...ahahaha...

The tax and other laws of Australia are currently being designed to increase rather than limit the inequality between rich and poor citizens and the Abbott Government's budget looks set to continue widening this disparity, writes Bill Mavropoulos.

The question of fairness in our tax system was brought to the fore with the handing down of the Federal Commission of Audit (COA) on last week.

One of the recommendations was cutting the Federal income tax rate and allowing each of the States to set their own levy on top of it. Instead of refuting this and many similar ideas from the COA directly, it is perhaps better to examine their policies with reference to the current global tax debate on addressing inequality sparked by a French economist who is quickly becoming notorious.

The world is indeed a funny place. Had someone suggested a few months ago that the number one best seller on Amazon would be a book on tax and wealth distribution, they would have been laughed out of the office. It would seem however that tax is finally (and deservedly) cool. We can thank the unlikely hero who gave rise to these circumstances, Thomas Piketty. His book Capital in the Twenty-First Century has catapulted him into ‘rockstar’ status.

The book is the product of fifteen years of research by Piketty and a team of economists into income and wealth inequality in the US and a host of other developed economies around the world.

The popularity of the book is even more unlikely when you consider that Piketty was trying to prove something that most sensible people already know — that the inequality between rich and poor people is increasing. Piketty’s team spent untold hours compiling and making sense of historic tax data from multiple jurisdictions to prove this point. Perhaps then, the reason for the fanfare is what he does once he answers this obvious question — he goes out on a limb and tells the world how to go about fixing the problem.

The book outlines how our current economic systems tend to concentrate wealth into the hands of a comparatively small group of people.

http://www.independentaustralia.net/politics/politics-display/revolutionising-tax-and-decreasing-inequality,6443

--------------------------------