Search

Recent comments

- peer pressure....

1 hour 57 min ago - strike back....

2 hours 3 min ago - israel paid....

3 hours 6 min ago - on earth....

7 hours 36 min ago - distraction....

8 hours 46 min ago - on the brink....

8 hours 55 min ago - witkoff BS....

10 hours 10 min ago - new dump....

22 hours 2 min ago - incoming disaster....

22 hours 10 min ago - olympolitics.....

22 hours 14 min ago

Democracy Links

Member's Off-site Blogs

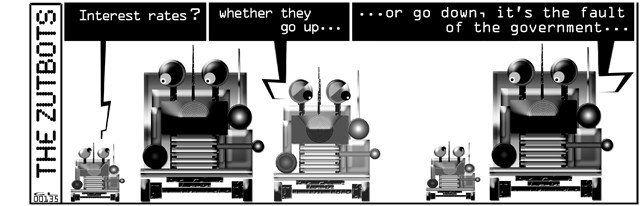

the zutbots...

- By Gus Leonisky at 3 Jul 2012 - 4:19pm

- Gus Leonisky's blog

- Login or register to post comments

no surprise...

The Reserve Bank has left interest rates on hold at 3.5 per cent in July, after cutting them by 75 basis points over the previous two months.

The decision came as no surprise to the 28 market economists surveyed by Bloomberg, who all expected rates to remain unchanged.

Many of those economists expect the Reserve Bank to cut again next month, after official inflation data comes out in late-July.

That data is expected to show that price pressures remain low, giving the RBA scope to reduce its official cash rate target further.

However, the Reserve Bank's governor Glenn Stevens says there has already been a "material easing" in interest rates over the past six months.

http://www.abc.net.au/news/2012-07-03/rates-on-hold-in-july/4107478

diamond gets rough with regulators...

At the hearing Wednesday, furious British politicians seemed to put Diamond on trial as the Gordon Gekko character from the “Wall Street” films, blaming him for importing a Wall Street culture of risk and big bonuses to London. The 60-year-old American sought to defend his response to the Libor scandal, insisting he only learned last month about the extent of wrongdoing among an “abhorrent” but “small” group of 14 rogue traders at Barclays who had been manipulating rates for personal gain.

But Diamond also painted a picture of the bank’s accusers — government regulators — as being at least partially to blame. Documents released by Barclays on Tuesday night said the bank had “raised concerns” with British regulators, the Bank of England and the U.S. Federal Reserve that other financial institutions were not being honest about interbank lending rates during the financial crisis that peaked in September 2008.

Other banks, Diamond said, were routinely underreporting the rates at which they were borrowing, afraid that revealing just how high their costs had soared would spark an investor panic or government nationalizations. He seemed to suggest that regulators were content to see misreporting of interbank lending during times of crisis, when strict accounting of high rates could tighten lending even more, and only acting to curb such activity during less sensitive periods.

Asked how regulators responded to Barclays’ reports of widespread misreporting, Diamond responded: “Various levels of acknowledgment, but no action.”

“There was an issue out there,” Diamond added, “and it should have been dealt with more broadly.”

http://www.washingtonpost.com/world/europe/bob-diamond-former-barclays-chief-cites-regulators-role-in-rates-scandal/2012/07/04/gJQALdCmNW_print.html

------------------------------------

If I remember well Barklays was the only Pommy bank that did not need "governmental" cash injection during the height of the GFC... It had made a few bets that paid of, including an 8 billion US dollar with a US bank...

who did know what...

As the ousted Barclays chief executive, Bob Diamond, denounced the behaviour of some of his staff as "reprehensible" – but refused to quell any controversy about a potential payoff – the chancellor declared that Labour ministers were "clearly involved" in intervening on the Libor rate.

The carefully staged intervention by Osborne, immediately dismissed by Balls's team as "desperate" and "frenzied", was designed to intensify the pressure on Labour as Ed Miliband tries to establish a judge-led inquiry into the banking scandal.

The Labour leader, who clashed with David Cameron in the Commons on Wednesday on the best way to investigate the manipulation of interest rates at Barclays, will table a motion calling for a time-limited inquiry along similar lines to the Leveson inquiry into press ethics.

http://www.guardian.co.uk/business/2012/jul/04/libor-bob-diamond/print