Search

Recent comments

- peace....

26 min 31 sec ago - making sense....

3 hours 4 min ago - balls....

3 hours 8 min ago - university semites....

3 hours 56 min ago - by the balls....

4 hours 10 min ago - furphy....

9 hours 25 min ago - nothing new....

9 hours 57 min ago - blood brothers....

10 hours 54 min ago - germanic merde....

10 hours 59 min ago - englishit....

12 hours 42 min ago

Democracy Links

Member's Off-site Blogs

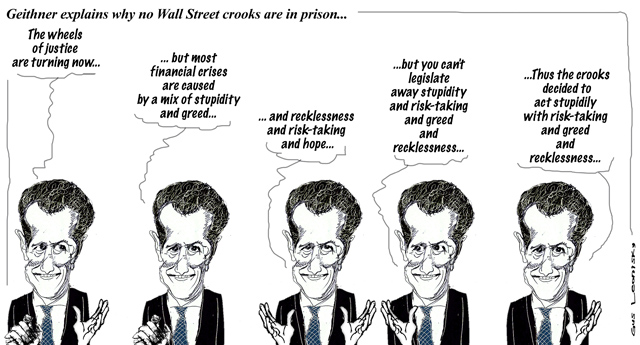

no mention of "regulations"...

Treasury Secretary Timothy Geithner has sought to reassure Americans that the Obama administration was doing what it could to rout out the bad actors from the worst financial crisis since the Great Depression.

"The wheels of justice are turning now," Mr Geithner said at an event in Portland after touring a factory there. "They are not turning as fast as people would like, but we have the best system in the world for making sure we can enforce the laws of the land," he said.

Read more: http://www.smh.com.au/business/world-business/stupidity-and-greed-cause-financial-crises-geithner-20120426-1xmks.html#ixzz1t8iK1wf3

- By Gus Leonisky at 26 Apr 2012 - 8:08pm

- Gus Leonisky's blog

- Login or register to post comments

zero interests...

The head of the United States Federal Reserve says he is prepared to launch another round of economic stimulus if the US economy falters.

Speaking after a two-day policy meeting, Federal Reserve chairman Ben Bernanke said the central bank expected to keep interest rates near zero until late 2014.

Mr Bernanke said the central bank saw economic growth picking up and unemployment falling to between 7.8 and 8 per cent by the end of the year.

http://www.abc.net.au/news/2012-04-26/fed-to-keep-rates-near-zero-until-2014/3973432?section=business

getting rich is the ultimate game...

What a wonderful time to be rich in Britain! Another 5 per cent has been added to the fortunes of our wealthiest people; last year, their combined worth surged by a fifth and, in 2010, a record 30 per cent was added to their wealth.

At a cool £414bn, the uber-rich are now better off than they were before Lehman Brothers went belly-up. No wonder, then, that market researchers at Ledbury Research project that spending on luxury goods such as expensive jewellery, flash cars and fine wine will soar from £6.5bn last year to £9.4bn by 2015. Recession? What recession?

http://www.independent.co.uk/opinion/commentators/owen-jones-the-sunday-times-rich-list-shows-its-boom-time-for-the-wealthy--and-crisis-for-the-rest-of-us-7689163.html

WE ARE THE FIRST CIVILISATION TO TREAT MONETARY ACCUMULATION AS AN ABSOLUTE GOAL, AND IT HAS OBSCURED THE WHOLE OF OUR DISCOURSE ABOUT SHARED WELL-BEING, OR THE "COMMON GOOD."

http://www.abc.net.au/religion/articles/2012/04/27/3490873.htm

Gus: ...and religion has been one of the culprit in making the poor submit to the charade of rich and poor, rather than revolt (the poor shall inherit the earth, my foot!)... Presently despite many flaws, the Labor party in Australia is "more" equitable than say the Liberals (conservative) who rely on absolution of their huge excess of greed by being "charitable"... This actually is also designed to keep the poor at arm's length... An "equitable" society would (and does) make the rich cringe...

betting the house...

Dumb risk-taking

As Joe Nocera of The New York Times said:

“In his conference call, Dimon claimed that the disastrous hedging strategy had not violated the Volcker Rule. Rather, he said, it violated the "Dimon principle." By which he meant, I think, that it was an example of the kind of dumb risk-taking that JPMorgan usually avoids.”

But that's just the point, isn't it? Even at a bank as ostensibly well-run as JPMorgan, the incentives still exist for giant, risky bets to be made that can go very wrong. JPMorgan can withstand a $US2 billion hit, but not every bank can - and who's to say that the next derivatives debacle won't be $US5 billion or $US10 billion?

Read more: http://www.smh.com.au/business/motley-fool/banking-same-as-it-ever-was-20120518-1yvzr.html#ixzz1vDZifh9o

When this financial crisis started back in 2007, I wrote something like it was going to "cost" 15 trillion US dollars per year for the next 10 years... That means that countries (mostly the west) around the world would have to add 15 trillion dollars of printed cash per year until someone stopped the bleeding... It's like a blood transfusion to someone who bleeds from ulcers to the colon... Eventually one has to take the plunge and plug the leaks via the shit hole... But of course there are tape worms, called "banks, edge funds, equity funds, private banks", who love the bleeding ulcers — and create the ulcers — as let's face it, these diseased guts provide a breeding ground for parasites... So far it seems that some of added moneys have disappeared quickly in the pocket of a few rich geezers who made the right bet. It's a game where people die —poor people that is — because they are the one who could never afford to "hedge their bets"... even if those were only worth a few dollars.

There has been some other moneys added to the slush fund, but most of it is never seen nor heard of by us the average punter... The secrecy is indecent...

"inadequate" risk controls...

A top US bank regulator has told legislators that "inadequate" risk controls at JPMorgan Chase led to a $2 billion derivatives loss, as senators questioned him and others over a failure to prevent the debacle.

Thomas Curry, who heads the Office of the Comptroller of the Currency (OCC), told the Senate Banking Committee that the issue at JPMorgan Chase was one of "inadequate risk management" in the months leading up to the bank's announcement of the losses.

Curry's office is in the spotlight for its oversight of the bank's Chief Investment Office (CIO) unit responsible for the loss. He said it would conduct a "critical self-review" focusing on where "breakdowns and failings" occurred.

Robert Menendez, a democratic senator, used the Senate Banking Committee hearing to unleash a fierce warning to regulators in the aftermath of the investment bank's derivative trade disaster reported last month that sent shudders through the still-frail financial system.

"The blood will be on all of your hands if the 'London Whale' ultimately goes belly up next time," Menendez told regulators, referring to the all-powerful London-based trader linked to the loss.

Mistakes undetected by 100 employees

But amid worries that so-called "too big to fail" banks like JPMorgan, which has $1.8tr in assets, were taking excessive risks that could damage the entire financial system, senators expressed concern that regulators were too lax in monitoring huge trades.

http://www.aljazeera.com/news/americas/2012/06/2012670364029852.html

See toon at top...

illegally tipping a friend with insider secrets...

Former Goldman Sachs board member Rajat Gupta has been convicted of illegally tipping a hedge-fund manager friend with secrets about the US investment bank, a major victory for prosecutors seeking to root out insider trading on Wall Street.

A Manhattan federal-court jury on Friday found Gupta guilty of three counts of securities fraud and one count of conspiracy, ending the four-week trial.

He was found not guilty on two other securities fraud charges. The jury delivered the verdict on the second day of its deliberations.

US District Judge Jed Rakoff has set sentencing for October 18.

The verdict marks a stunning fall for Gupta, who is also a former top executive at business consulting firm McKinsey & Co and a former director of Procter & Gamble.

"Rajat Gupta once stood at the apex of the international business community," chief Manhattan prosecutor Preet Bharara said in a statement.

"Today, he stands convicted of securities fraud. He achieved remarkable success and stature, but he threw it all away.

"Having fallen from respected insider to convicted inside trader, Mr Gupta has now exchanged the lofty board room for the prospect of a lowly jail cell."

http://www.aljazeera.com/news/americas/2012/06/201261516144498352.html

See toon at top...

no law against stupidity...

Regulators say there is no law against stupidity

by business editor Peter RyanUpdated July 13, 2012 11:05:46

The corporate watchdog has flagged a crackdown on complex financial products that could breach the spirit of the law.

The Australian Securities and Investments Commission (ASIC) is chairing a global push to crack down on risky products which can potentially be used to get around takeover regulations.

ASIC is concerned about derivative products, such as contracts for difference, which are retailed widely in Australia.

A common form of these products allows investors to bet on a share price to fall, even without putting down money upfront.

As part of the bigger picture, such derivatives can help facilitate major deals that could involve billions of dollars in proposals which can be made without proper financing.

Now ASIC chairman Greg Medcraft says he is very worried about derivatives.

http://www.abc.net.au/news/2012-07-13/asic-and-apra-speak/4128608

See toon at top... And to say the least Mr Medcraft is not the only one worried about derivatives... So is Warren Buffett and Gus as well... See "do not sneeze" and other postings on this site for educational purposes... Presently the derivative market ( a global betting house for crazy people is poised with bets totalling 10 times more than the value of the entire annual GDP of the planet... Are you worried yet?... A two percent shift one way or the other in this poker game can wipe off 15 trillion dollars off the board at any one time... Actually this is not stupidity... it is crazy greed with no safety nets, or cross-dressing in the case of CDSs...

it did not work very well...

Geithner Tried to Curb Rate Rigging in 2008

By BEN PROTESSWhen Timothy F. Geithner ran the Federal Reserve Bank of New York, he acknowledged fundamental problems with the process for setting key interest rates in the midst of the 2008 financial crisis, according to documents provided to The New York Times.

Mr. Geithner, who is now the United States Treasury secretary, questioned the integrity of the benchmark as reports surfaced that Barclays and other big banks were misrepresenting the rates. In 2008, Barclays had several conversations with New York Fed officials about the matter.

http://dealbook.nytimes.com/2012/07/12/geithner-was-aware-of-problems-with-key-interest-rates/?hp

black eyes and the price of flake...

Top central bankers - Sir Mervyn King, governor of the Bank of England, and Tim Geithner, former head of the Federal Reserve Bank of New York - have been thrust into the centre of the Libor rate-rigging scandal as the focus turned to warnings by Barclays that rates were being manipulated during the banking crisis.

A tit for tat release of documents by the Bank of England and New York Fed showed the two organisations were discussing reforms to the rate-setting system as far back as June 2008. The discussions followed Barclays raising the alarm in August 2007 that rates being submitted were lower than might be expected amid the fear in the markets following the rescue of Bear Stearns in 2007.

The documents were published as both men prepare to appear before politicians: King before the Treasury select committee on Tuesday; Geithner, now US Treasury secretary, to be quizzed over his role by the House financial services committee.

http://www.guardian.co.uk/business/2012/jul/13/tim-geithner-mervyn-king-libor

Meanwhile hitting bottom and coming up...:

JPMorgan’s black eye nears $6B as bank says traders may have tried to conceal lossesBy Associated Press, Published: July 13 | Updated: Saturday, July 14, 7:01 AMNEW YORK — JPMorgan Chase said Friday that its traders may have tried to conceal the losses from a soured bet that has embarrassed the bank and cost it almost $6 billion — far more than its CEO first suggested.

The bank said an internal investigation had uncovered evidence that led executives to “question the integrity” of the values, or marks, that traders assigned to their trades.

JPMorgan also said that it planned to revoke two years’ worth of pay from some of the senior managers involved in the bad bet, and that it had closed the division of the bank responsible for the mistake.

“This has shaken our company to the core,” CEO Jamie Dimon said.

The bank said the loss, which Dimon estimated at $2 billion when he disclosed it in May, had grown to $5.8 billion, and could grow larger than $7 billion if financial markets deteriorate severely.

Dimon said the worst appeared to be behind the bank, and investors seemed to agree: They sent JPMorgan stock up 6 percent, making it the best performer in the Dow Jones industrial average.

http://www.washingtonpost.com/business/jpmorgan-ceo-will-try-to-provide-clarity-over-trading-loss-restore-trust-at-investor-meeting/2012/07/13/gJQA9GyugW_print.html

See toon at top...

the greed of credit....

Credit card companies Visa and Mastercard and major US banks have agreed to a $7.25bn (£4.65bn) settlement to retailers over card fees.

The case, which has been going on for seven years, is over firms colluding to fix the fees that stores pay to process credit and debt card payments.

The settlement is thought to be the largest of its kind in US history.

It involves a $6bn payment to stores and an agreement to reduce swipe fees for eight months, valued at $1.2bn.

An additional $525 million has been set aside to pay to the stores which sued individually, including grocery chains Kroger and Safeway and the Rite Aid pharmacy chain.

Previous settlements

The settlement involves credit card giants Visa and Mastercard, as well as major US banks which issue their cards including JPMorgan Chase, Bank of America and Citibank.

http://www.bbc.co.uk/news/world-us-canada-18839293But of course everyone involved in the scam was deeeeemed toooo dumb to go to prison, for conspiratorial robbery... see toon at top...

still, no one is in prison...

Executives from HSBC are appearing before the US senate to acknowledge shortcomings in their anti-money laundering operations and to promise to fix what a scathing report called a "pervasively polluted" culture at Europe's largest bank.

Irene Dorner, president and CEO of HSBC Bank USA, said in testimony prepared for Tuesday's hearing by the Senate Permanent Subcommittee on Investigations that "we deeply regret and apologise" for the lapses by HSBC.

The senate report, released ahead of the hearing on Monday, came after a year-long inquiry and said HSBC had routinly acted as a financier to clients routing funds from the world's most dangerous corners, including Mexico, Iran and Syria.

Lax controls at the bank allowed Mexican drug cartels to launder billions of dollars through its US operations, the investigation found.

The extensive report said US regulators knew the bank had a poor system to detect problems but failed to take action.

http://www.aljazeera.com/news/americas/2012/07/201271714112156413.html

Yet as soon as the US asked the Wikileaks freedom of the press actions be muzzled by starving it of funds, all the banks and their subsidiaries such as credit card lackeys shut the gate faster than a speeding bullet while asking nada about the ethical purpose of what they were doing... Banks are bastards... Tony Abbott is an idiot... Alan Jones is an idiot...

quiet alarm...

Treasury Secretary Timothy F. Geithner has said that he sounded the alarm four years ago to regulators about problems with the benchmark interest rate known as Libor.

But Geithner, who was then head of the Federal Reserve Bank of New York, did not communicate in key meetings with top regulators that British bank Barclays had admitted to Fed staffers that it was rigging Libor, according to people familiar with the matter.

Instead, regulators at the Commodity Futures Trading Commission and the Justice Department worked largely without the Fed’s help to build a case against Barclays. That work has culminated in a massive scandal rocking the banking industry on both sides of the Atlantic.

As Geithner prepares to testify Wednesday morning on Capitol Hill, he returns to a familiar position as a lightning rod for critics on the left and the right who find fault in his work as a banking regulator before he joined the White House and as a bailout architect under President Obama.

He will face a key question from House and Senate members this week: Did he and others at the New York Fed, the country’s most powerful banking regulator, act urgently enough to stop fraud at Barclays and potentially other banks?

Geithner has said the New York Fed did everything in its power.

http://www.washingtonpost.com/business/economy/ny-fed-silent-on-barclays-admission-of-rigging-libor/2012/07/24/gJQA2eWg7W_print.html

see toon at top...

a former banker recants...

A legendary US banker has stunned Wall Street by publicly calling for mega banks to be broken up.

Former Citigroup chief executive Sandy Weill says consumer banking operations should be split from riskier investment banking in order to restore public confidence in the financial sector.

"There is such a feeling all over the world against the banking system," Mr Weill said.

It was his lobbying that helped create the so called 'too big to fail' banks and his aggressive deal making that built Citigroup into a financial superpower.

But now Sandy Weill says it is time to break up the big banks and separate investment banking from retail operations.

"Something that's not going to risk the taxpayer dollars," he observed.

Announcing his stunning reversal on the cable business channel, the 79-year-old American spoke of the need to restore the banking sector's dismal reputation.

"Let's have a creative investment banking system like we've always had, where the financial industry can again attract the best and the brightest young people like they do in Silicon Valley, like they are doing in engineering."

Mr Weill says times have changed since he was at the top of the banking tree.

"I think the world changes and the world that we live in now is different than the world that we lived in ten years ago," he explained.

Sandy Weill points to the Libor interest rate rigging scandal as another reason for people to hate banks, and today the US Treasury secretary Timothy Geithner faced a grilling in Congress for not doing enough to stop it when he was the head of the Federal Reserve Bank of New York.

http://www.abc.net.au/news/2012-07-26/congress-lays-into-bankers-geithner/4156408

See toon at top...

no conviction...

The US Department of Justice has decided not to prosecute Goldman Sachs over its marketing of high-risk mortgage securities, despite a damning report into its practices by a senate investigation panel.

In April last year, following a two-year inquiry, senators concluded the Wall Street investment banking giant misled clients ahead of the US financial crash by off-loading securities its traders fully expected to lose value.

Releasing the report last year, the head of the investigative committee, Senator Carl Levin, recommended that charges be brought.

"In my judgment, Goldman clearly misled their clients and they misled Congress," he said.

But on Friday, the Justice Department came to a different conclusion.

"There is not a viable basis to bring a criminal prosecution with respect to Goldman Sachs or its employees in regard to the allegations set forth in the report," it said in a statement.

The statement said its investigators had closely scrutinised the senate's evidence and conducted inquiries and witness interviews of its own, and concluded it could not prove wrongdoing.

Apparently anticipating criticism for letting one of the banks seen as deeply at fault in the 2008 crisis off the hook, the Justice Department insisted it has fiercely pursued other cases against financial giants.

http://www.abc.net.au/news/2012-08-11/us-decides-not-to-prosecute-goldman-sachs/4192130

Read toon at top...