Search

Recent comments

- merde-a-lago...

1 hour 54 min ago - targets....

2 hours 29 min ago - WW2

3 hours 1 min ago - lawlessness....

4 hours 6 min ago - superman....

4 hours 32 min ago - a split....

4 hours 58 min ago - not semite....

22 hours 23 min ago - force for me....

22 hours 36 min ago - no legal justification....

1 day 6 hours ago - CIA lies....

1 day 6 hours ago

Democracy Links

Member's Off-site Blogs

olive oil glut...

The head of the International Monetary Fund has warned that the crisis in Greece could spread throughout Europe.

Dominique Strauss-Kahn said that every day lost in resolving Greece's problems risks spreading the impact "far away".

World financial markets, recovering slightly on Wednesday, have been badly hit by fears of contagion from Greece.

http://news.bbc.co.uk/2/hi/business/8648029.stm

------------------------

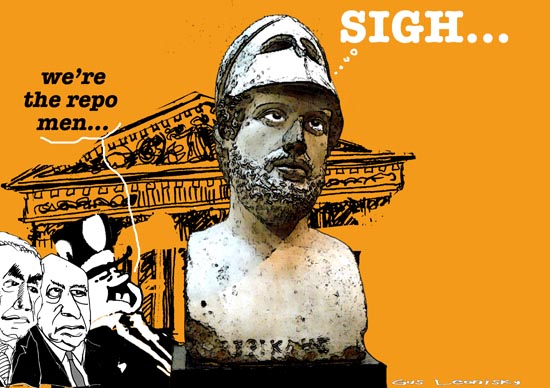

Gus: the proud Greek history is just that: history... The "Greek" status changed many times since Pericles was the principal instigator in the success of one of the first democracy in the world: the Athenian democracy... Of course Athenian democracy worked for you if you were not a slave. But at least the seeds were sown for better workings of political systems —one in which we believe so much, here on this site, that we lampoon it with a vicarious loving compassion... and unlike some political satire, we often offer some practical solutions to its numerous intrinsic problems.

How the mightys have fallen to their own carelessness and to the trickery of bankers. But the "Greeks" of today are far removed from those of 2500 years ago. According to a friend, scholar in Greek and Latin histories, invasions and melts of people have led present Greek ancestry not going much further back than 150 years in the cultural heritage of modern "Greece". The salient Solon (594 BC), Cleisthenes (508/7 BC), and Ephialtes (462 BC) all have been dead for yonks, in body and in spirit.

Meanwhile, if you have a few bobs to spend, get a copy of "OLD SOX on trumpeting" by E T Gundlach... Published in 1928, it's about a master advertiser having to promote "x brand" of olive oil into a "saturated" Greek market, 2000 years ago — a market having a glut full of olive oil... Of course the process is partly about the sneaky manipulation of growers, manufacturers, retailers and the public into believing that "x brand" was better. The major part of the "advertising" is to make the client pay as much as possible for the campaign without sending the goose broke. Nothing new — replace advertising gurus with banking execs... except that the goose is nearly dead, but it won't die. It can't die... It can suffer, sure...

So, it appears now that someone else is going to pay for the Greek debacle...

May be, all the democracies the world should pay a royalty (in proportion to their tooting of the idea of freedom in it — the US being of course the biggest contributor) to the Greeks for "inventing" the idea of democracy... Hum. May be Hollywood should pay for all the Greek mythologies it plundered in the past and the future, and all respectable museums around the world, those which hold "Greek treasures", should pay a rental fee. Furthermore, the Greek populace should tighten its belt in a healthy way, eat less moussaka, reduce the cosy pensions and should start making marble copies of Pericles' bust to sell to the tourists (if they're not doing this already, in China).

Meanwhile, the banks that illegally (according to the strict European code) lent money to the previous Greek government should be told "half or nothing" and graciously loose a tad (or win half as much by delaying profit takings) without rocking the boat. Make sure the banks understand if the boat rocks, the banks burn, democratically. They ought to understand that step... Their greed was the cigarette butt (it was a lit Molotov-cocktail camouflaged in a sweet-drink bottle) that started the bush-fire. Of course the previous Prime Minister of Greece should be pilloried, feathered and tarred — just to let some steam off and for general fun. We need culprits, don't we...? We need to apportion blame...

May be, we, the elite cooks, us, should buy more olive oil, from Greece... A huge dilemma, since I only buy Aussie olive oil to support the locals. Ah decision, decision... And to top it up, the other producers of olive oil seem to be in financial trouble too... Spain, Italy, Portugal and the Irish... The Irish?... They don't make olive oil, do they? May be the Greeks should rekindle slavery — like sending all the overpaid pensioners and public servants to Pericles statue-making camps...

Aarrh! Buy Aussie olive oil, drink more Guinness... and let the money "men" sort it amonst themselves to rob the poor once more... May be Pericles will wake up from the dead and, becoming part of a new mega-mythology, fight to kill the hydra-banks in one stroke of the blade...

Apparently when all the "banks" stopped lending in 2007, some still gave black-cash under the table to the Greeks... Where's the mafia when you need a bit of kneecapping?

- By Gus Leonisky at 29 Apr 2010 - 11:14am

- Gus Leonisky's blog

- Login or register to post comments

buying junk...

Europe's biggest economy is refusing to hand over any money to help the indebted Greek government until more due diligence is done to make sure the money from the bailout is not misused.

The heads of the International Monetary Fund (IMF) and the European Central Bank have appealed to Germany to make good on its promise to help debt-stricken Greece, saying Eurozone stability is hanging in the balance.

It follows a day of chaos on the financial markets after the downgrading of Greece's credit rating to junk bond status.

-------------------------

Gus: when one is deliberately paying through the nose to buy junk from a friend in need, one has to know the friend is not going to waste the cash on booze...

lost their marbles...

The British Museum is Europe’s Western front in the global war over cultural patrimony, on account of the marbles. The pamphlets give the museum’s version for why they should stay in Britain, as they have for two centuries — ever since Lord Elgin, the British ambassador to the Sublime Porte at Constantinople, and with the consent of the ruling Ottomans (not to mention a blithe disregard for whatever may have been the wishes of the Greek populace), spirited them from the Acropolis in Athens. The pamphlet stresses that the British Museum is free and attracts millions of visitors every year from around the world, making the sculptures available to, and putting them in the context of, a wide swath of human civilization.

For their part the Greeks, before their economy collapsed, finally opened the long-delayed New Acropolis Museum last year to much fanfare: it’s an up-to-date facility, forbidding and frankly ugly outside, but airy and light-filled inside, a home-in-waiting for the marbles, whose absence is clearly advertised by bone-white plaster casts of what Elgin took, alongside yellowed originals that he left behind. The view through a broad picture window, eloquent but baleful under the circumstances, looks onto the ruined Parthenon, playing on visitors’ heartstrings. Greeks deem the museum a slam-dunk argument for the marbles’ return.

---------------------

Gus: as I have indicated in the top comment, Europeans museums exhibiting "Greek stolen goods" should pay a royalty for doing so... and this could go towards the repayment of the Greek debt... see toon at top.and read comment below it.

austerity measures...

Greece is "on the brink of the abyss", President Karolos Papoulias has warned, after three people died during protests over planned austerity measures.

"We are all responsible so that it does not take the step into the void," the president said in a statement.

It followed a day of violence during which protesters set fire to a bank, killing three employees.

Greece's government has vowed to pursue the spending cuts - a condition of its 110bn euro ($142bn; £95bn) bail-out.

"We are prepared to pay the heavy political cost," Finance Minister George Papaconstantinou told parliament during Wednesday's debate on the bill.

"We will not take a single step backwards."

The euro hit a fresh 13-month low against the dollar and European stock markets were also hit, amid concerns over Greek bail-out plans.

yourp woes...

By NELSON D. SCHWARTZ and ERIC DASH

After a brief respite following the announcement last week of a nearly $1 trillion bailout plan for Europe, fear in the financial markets is building again, this time over worries that the Continent’s biggest banks face strains that will hobble European economies.

In a sign of the depth of the anxiety, the euro fell Friday to its lowest level since the depth of the financial crisis, as investors abandoned the currency as well as stocks in favor of gold and other assets seen as offering more safety. And in an interview published Saturday, the president of the European Central Bank, Jean-Claude Trichet, warned that Europe was facing “severe tensions” and that the markets were fragile.

Contagion, a loss of confidence that feeds on itself and leads investors to sell assets in one country after another, remained a possibility, he said.

For Europe’s banks, the problems are twofold. Short-term borrowing costs are rising, which could lead institutions to cut back on new loans and call in old ones, crimping economic growth.

At the same time, seemingly safe institutions in more solid economies like France and Germany hold vast amounts of bonds from their more shaky neighbors, like Spain, Portugal and Greece.

Investors fear that with many governments groaning under the weight of huge deficits, the debt of weaker nations that use the euro currency will have to be restructured, deeply lowering the value of their bonds. That would hit European financial institutions hard, and may ricochet through the global banking system.

Bourses and bank shares in Europe plunged on Friday because of these fears, with Wall Street following suit. Shares were also down in Tokyo and Australia in early trading on Monday.

-------------------

see toon at top...

a year and a half later...

Dozens of stone-throwing youths have clashed with police in Athens as public sector workers went out on strike in protest at Greece's austerity measures.

The 24-hour strike saw flights and ferry services cancelled, government offices and tourist sites closed, and hospitals working with reduced staff.

Many strikers expressed frustration and anger at the cuts.

The European Commission is discussing ways of propping up banks in Europe to protect them from the Greek crisis.

The general strike is the first since the Greek government announced an emergency property tax and the suspension of 30,000 public sector staff last month.

http://www.bbc.co.uk/news/world-europe-15177457

see toon and Gus' editorial at top...