Search

Recent comments

- pax amercanus....

1 hour 53 min ago - bondi.....

9 hours 56 min ago - defection....

21 hours 9 min ago - amateur hours....

23 hours 52 min ago - in the UK....

1 day 7 min ago - the path forward....

1 day 6 min ago - multi-imperia....

1 day 10 hours ago - japan vs china....

1 day 13 hours ago - gambling<16....

1 day 14 hours ago - a pact....

1 day 14 hours ago

Democracy Links

Member's Off-site Blogs

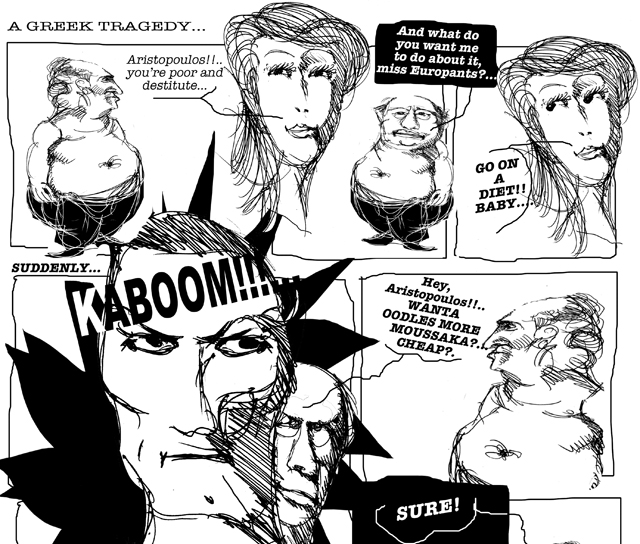

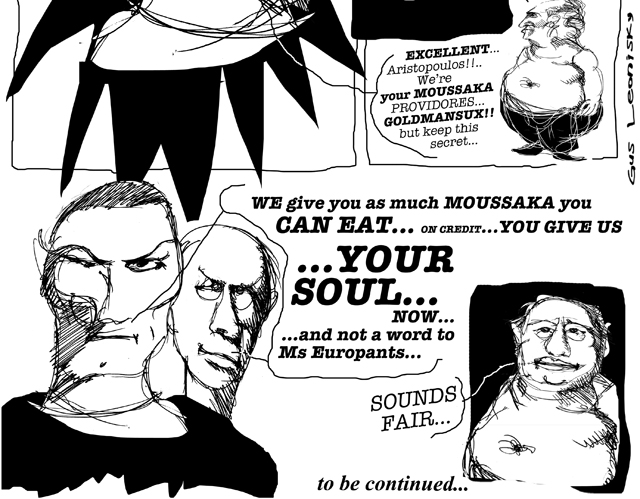

a greek tragedy...

- By Gus Leonisky at 20 Apr 2010 - 1:16pm

- Gus Leonisky's blog

- Login or register to post comments

more greek tragedy...

more toon coming here soon...

more more greek tragedy...

a greek comedy...

an arm and a leg

junkpolis...

Global stock markets tumbled after Greece's debt was downgraded to "junk" by rating agency Standard & Poor's over concerns that the country may default.

It makes the struggling nation the first eurozone member to have its debt downgraded to junk level.

Portugal's debt was also lowered on fears of "contagion", adding to the markets' rout and a fall in the euro.

Germany immediately said it would not "let Greece fall", and there were signs that an aid package could be increased.

Greece wants 40bn euros (£34bn) from eurozone governments and the International Monetary Fund (IMF) to shore up its finances.

But there are fears it will not meet conditions needed to access the funds it needs to make looming debt repayments.

------------------

Down the toilet... unless... see story unfolding in the toons above...

problems rebuilding the shack...

By NELSON D. SCHWARTZ and ERIC DASH

After a brief respite following the announcement last week of a nearly $1 trillion bailout plan for Europe, fear in the financial markets is building again, this time over worries that the Continent’s biggest banks face strains that will hobble European economies.

In a sign of the depth of the anxiety, the euro fell Friday to its lowest level since the depth of the financial crisis, as investors abandoned the currency as well as stocks in favor of gold and other assets seen as offering more safety.

In trading early Monday morning, the euro declined again, managing at one time to reach a four-year low relative to the dollar.

The president of the European Central Bank, Jean-Claude Trichet, in an interview published Saturday, warned that Europe was facing “severe tensions” and that the markets were fragile.

For Europe’s banks, the problems are twofold. Short-term borrowing costs are rising, which could lead institutions to cut back on new loans and call in old ones, crimping economic growth.

At the same time, seemingly safe institutions in more solid economies like France and Germany hold vast amounts of bonds from their more shaky neighbors, like Spain, Portugal and Greece.

Investors fear that with many governments groaning under the weight of huge deficits, the debt of weaker nations that use the euro currency will have to be restructured, deeply lowering the value of their bonds. That would hit European financial institutions hard, and may ricochet through the global banking system.

----------------------

sunny island for sale

There's little that shouts "seriously rich" as much as a little island in the sun to call your own. For Sir Richard Branson it is Neckar in the Caribbean, the billionaire Barclay brothers prefer Brecqhou in the Channel Islands, while Aristotle Onassis married Jackie Kennedy on Skorpios, his Greek hideway.

Now Greece is making it easier for the rich and famous to fulfill their dreams by preparing to sell, or offering long-term leases on, some of its 6,000 sunkissed islands in a desperate attempt to repay its mountainous debts.

The Guardian has learned that an area in Mykonos, one of Greece's top tourist destinations, is one of the sites for sale. The area is one-third owned by the government, which is looking for a buyer willing to inject capital and develop a luxury tourism complex, according to a source close to the negotiations.

Potential investorsalso looking at property on the island of Rhodes, are mostly Russian and Chinese. Investors in both countries are looking for a little bit of the Mediterranean as holiday destinations for their increasingly affluent populations. Roman Abramovich, the billionaire owner of Chelsea football club, is among those understood to be interested, although a spokesman denied he was about to invest.

-----------------------

see all the toons from the top down...

china to the rescue...

China has offered its support to eurozone countries to help them through the debt crisis that has gripped the region.

"We are ready to support the eurozone to overcome the financial crisis and realise economic recovery," said foreign ministry spokeswoman Jiang Yu.

She added that the eurozone would become "a major market" for China's foreign exchange investments.

http://www.bbc.co.uk/news/business-12065731

wall street blames the greeks?...

Greece’s financial and political crisis, compounded by new fears about the pace of the United States economic recovery, sent financial markets reeling on Wednesday.

Thousands took to the streets in Athens to protest austerity measures, and Prime Minister George Papandreou said he would reshuffle his cabinet and request a vote of confidence in Parliament. At stake is the prospect of a new bailout plan for the debt-ridden country.

Anxious investors feared the situation could spin out of control, igniting a series of crises in other heavily indebted euro zone countries, like Portugal, Ireland and Spain. That, in turn, could threaten Europe’s banks and even reach into the United States financial system.

“We are pretty much giving back everything we got yesterday and more,” said Lawrence R. Creatura, a portfolio manager at Federated Investors, noting the rise in the main American indexes of more than 1 percent Tuesday. “Today the market just can’t escape the undertow of deteriorating economic data and political events.”

After having lost more than 200 points earlier Wednesday, the Dow Jones industrial average closed down 178.84 points, or 1.5 percent, to 11,897.27. The markets rallied earlier this year on confidence about the economic recovery, and at one point the Dow was poised to break through the 13,000 mark. But stocks have been falling week after week on a drumbeat of dismal economic news from soft job creation to falling housing prices.

The market has surrendered almost all of its gains for this year, falling 7 percent since its peak at the end of April. It may be nearing what is known as a market correction, a sort of miniature bear market characterized by a 10 percent decline in a short period of time.

Greece needs to pass a new round of austerity measures by the end of the month in return for new loans from the International Monetary Fund and the European Union.

http://www.nytimes.com/2011/06/16/business/16markets.html?hp=&pagewanted=print

see toons at top...

here, have the poisoned lollypop...

France's Christine Lagarde has been named to be the first ever female chief of the International Monetary Fund (IMF).

The French finance minister is widely respected for her leadership during Europe's financial crisis over the past three years.

She was chosen to replace fellow French politician Dominique Strauss-Kahn, who resigned abruptly in May after being arrested in New York for the alleged sexual assault of a hotel maid.

Ms Lagarde was up against Mexico's Agustin Carstens. An IMF statement said both candidates "were well qualified".

The announcement of Ms Lagarde's appointment came soon after she received the backing of the US and Russia.

She will find herself immediately immersed in efforts by the IMF and European Union to head off a Greek default that could touch off an international crisis.

"The executive board, after considering all relevant information on the candidacies, proceeded to select Ms Lagarde by consensus," the IMF said in a statement.

French president Nicolas Sarkozy called the news "a victory for France," while Ms Lagarde said she was "deeply honoured."

http://www.abc.net.au/news/stories/2011/06/29/3256063.htm?section=justin

--------------------

Did he really say that, the little Napoleon? What a chauvinist idiot...

family jewels...

The first thing any insolvent private person is forced to do is relinquish the family silver. But other rules seem to apply to governments. Whether they've been living above their means for a few years or for decades, certain countries hold on tight to their assets, declare themselves unable to pay back their debts and turn to other countries for help.

The European Union has seen many an example of this. Right now, Greece is negotiating with the troika of the E.U., the European Central Bank (ECB) and the International Monetary Fund (IMF) for a new rescue package while Athens sits on an impressive 114-ton stash of gold, about what four large, fully loaded trucks could carry.

The gleaming bars in the vaults of the Greek central bank are worth $5.8 billion. If Athens were to sell that gold, the Greek state would theoretically be able to meet at least part of the debt payments due soon without any outside help.

Read more: http://www.time.com/time/world/article/0,8599,2080813,00.html#ixzz1R80CZ0wr

new markets for "mutual needs"...

The organisers of a Gaza aid flotilla banned from leaving a Greek port say they are determined to continue their campaign.

The activists say Israel has pressured the Greek government to prevent their mission.

The Greek foreign ministry denies this. But the incident highlights shifting regional relations.

The relationship between Greece and Israel, reflected in official figures, show a 50 per cent increase in Israeli visitors over the past year.

Meanwhile. the number of Israeli tourists to neighboring Turkey has dropped by nearly 90 per cent, one relationship weakening, as the other grows stronger.

It is a relationship based on mutual need. In its financial meltdown Greece has been urgently searching for new markets, and a different source of its economic lifeblood - tourism.

http://english.aljazeera.net/video/europe/2011/07/20117317752336552.html

spiraling out of control

THE warning was clear: Greece was spiraling out of control.

But the alarm, sounded in mid-2009, in a draft report from the International Monetary Fund, never reached the outside world.

Greek officials saw the draft and complained to the I.M.F. So the final report, while critical, played down the risks that Athens might one day default, with disastrous consequences for all of Europe.

http://www.nytimes.com/2011/11/06/business/global/europes-two-years-of-denials-trapped-greece.html?_r=1&hp

SEE TOONS FROM TOP DOWN..

a new black hole...

PRESSURE on Greece's recession-stricken economy has intensified after international debt inspectors admitted an additional €15 billion ($18.4 billion) would be needed to fill a newly discovered black hole in the country's finances.

On a day when Ireland's government reduced its growth forecast and Madrid told Spanish banks to raise an extra €50 billion to cover toxic assets, Brussels officials said European countries and state-owned banks would be asked for contributions to help Athens out of its fiscal troubles.

Read more: http://www.smh.com.au/world/brussels-discovers-a-new-black-hole-in-greek-finances-20120203-1qxin.html#ixzz1lMh9SwDo

See all the toons from the top

a mediterranean tragedy...

Human societies and economies depend on the biosphere's natural capital and its many life-supporting ecological services. As demand on and scarcity of these ecological resources increases, economic success can no longer be secured without carefully managing and tracking the availability and consumption of natural capital.

Nowhere is this more evident than in the Mediterranean region. For more than two years, the region has been rocked by economic crises resulting from overextension of financial resources. But Greece, Italy and other Mediterranean countries face another yawning deficit—an ecological deficit—that poses deep-seeded risks to the region’s long-term success.

Virtually every country in the Mediterranean region consumes more ecological resources than local ecosystems can replenish. To cover the widening gap between supply and demand, the region is increasingly relying on global resources, of which there are less. Meanwhile, growing competition for such resources undermines the region's ability to secure them elsewhere.

Indeed, while the Mediterranean's own ecological deficit has been growing, its relative income (compared to world average) has been declining, weakening the region's position to access the limited resources around the globe. The situation is unsustainable, and risks Mediterranean countries’ long-term economic security and their capacity to guarantee social well-being for their citizens.

http://www.footprintnetwork.org/en/index.php/GFN/page/mediterranean_initiative/

See toon from top...

a tax tragedy...

A magazine editor in Greece will appear in court after publishing the names of more than 2,000 wealthy Greeks alleged to have Swiss bank accounts, triggering a row over tax evasion that threatens the stability of the government.

Kostas Vaxevanis was arrested on Sunday, after his weekly journal, Hot Doc, printed the list of names, which including prominent members of Greece's political and business elite.

The editor was giving a live radio interview when police arrived, and broke off saying he had to go "to be arrested". At the same he tweeted about the arrest, comparing the police to German stormtroopers in the second world war. In another tweet he wrote: "They're entering my house with the prosecutor right now. They are arresting me. Spread the word."

Police officials said that Vaxevanis had illegally published personal details without proof that the people involved had broken the law. But he and other critics of the government have portrayed his arrest as part of a cover-up intended to obscure claims that the finance ministry had had the list for more than two years without taking action against those named.

"If anyone is accountable before the law then it is those ministers who hid the list, lost it and said it didn't exist. I only did my job. I am a journalist and I did my job," Vaxevanis said in the video sent to Reuters news agency.

The case has triggered a parliamentary inquiry and could provide the basis for prosecutions at a time of rising radicalism on both left and right and a sense of injustice over the widespread destitution and despair created by Greece's economic crisis set against the relative impunity of the country's rich, who have a long history of tax evasion.

http://www.guardian.co.uk/world/2012/oct/28/greek-editor-court-tax-evaders

see all the toons from top down...

acquitted...

Athens, Greece - The late night acquittal on Thursday of journalist Kostas Vaxevanis was met with an eruption of applause in courtroom number one, building two, of the Athens judicial compound. “The court has found you innocent,” was all the judge had time to say.

Vaxevanis had faced a year in prison and a 30,000 euro ($38,500) fine for allegedly breaching Greek privacy law. His offence was to publish the names of what purports to be the infamous Lagarde List, a spreadsheet of more than 2,000 influential Greeks with Swiss bank accounts who might warrant investigation as tax evaders. It is named after the former French finance minister, now IMF chief, who handed it to her Greek counterpart, Yiorgos Papakonstantinou, in 2010.

“A junior court judge had the courage to go against the prosecutor's office which created all the fuss in the first place, to listen to society, to see the results of all this activity surrounding the revelation of the list and of course to see the truth.” Vaxevanis told Al Jazeera after the verdict was announced.

http://www.aljazeera.com/indepth/features/2012/11/2012112154757722883.html

see article above...

the bank of bankers...

Ever since the stock market crashed, on the night of September 15 2008, the name Goldman Sachs, or GS, has been appearing everywhere: in the collapse of the financial system, the Greek crisis, the plunge of the euro, and the campaign to prevent regulation of financial markets.

The investment bank created in New York in 1868 has carved out its reputation and success by working silently behind the scenes.

But today GS stands accused of myriad charges: playing a key role in the subprime loan fiasco, pushing several of its competitors into bankruptcy, helping countries like Greece hide their deficits before speculating on their downfall, precipitating the fall of the euro, and influencing the consumer price index. And yet GS has come out of this latest crisis richer and more powerful than ever.

http://www.aljazeera.com/programmes/specialseries/2014/06/goldman-sachs-bank-rules-world-2014613175932453607.html

See very educational toons at top...

no deal, yet...

Greece's government has failed to reach a deal with its European partners on renegotiating its huge bailout, with talks now set to go down to the wire next week.

Finance minister Yaris Varoufakis set out Athens' proposals for a new debt program at an emergency meeting with his counterparts from the 19-country eurozone in Brussels.

Diplomats said a broad common statement on finding a way forward for Greece and the eurozone had been drafted but that the Greek delegation had not agreed to it.

Jeroen Dijsselbloem, head of the Eurogroup of eurozone ministers, said six hours of talks produced no agreement on an extension of Greece's 240 billion euro ($354 billion) bailout.

read more:

http://www.abc.net.au/news/2015-02-12/greece-fails-to-reach-bailout-deal...

the birth and death of δημοκρατία...

They reached a deal but :

Greece - it is where Europe's civilisation and the very idea of democracy began. But today the country is in crisis; a crisis that may well destroy the dream of a unified Europe.

A dream born out of the nightmare of World War II, a dream to unite different nations under one currency, has become a tragedy.

Ten years after joining the eurozone, the Greek economy has collapsed, living standards have plummeted, hundreds of thousands are out of work and thousands more have left the country to find a new future.

Many Greeks blame the European Union, and Germany in particular, for the crisis they are in. Today, almost 70 years after its military defeat in World War II, Germany is the strongest economic power in Europe and its political leadership holds the future of Greece in its hands.

Al Jazeera correspondent Barnaby Phillips travels to Greece to discover why these two countries, tied by history and culture, are now locked into a conflict. Why has the European vision, designed to heal the wounds of the past, instead brought them back to the surface? And who is to blame - the Greeks themselves, the EU or the old enemy, Germany?

http://www.aljazeera.com/programmes/aljazeeracorrespondent/2012/11/2012111262426515410.html

Gus cannot pass his silly hunch that this tragedy (as explained from the top toon) has nothing to do with Europe or Greece but has been instigated by the US banking system, secretly still trying to SABOTAGE EUROPE... The USA HATE Europe as a unified entity and since about 1946, the US has meddled in the European affairs to prevent any sort of "unification". Imagine should EUROPE become ONE, the US would have a MASSIVE competitor on the international scene... Keep them divided and conquer...

pumping the pump...

Piketty: The way Europe behaved in the crisis was nothing short of disastrous. Five years ago, the United States and Europe had approximately the same unemployment rate and level of public debt. But now, five years later, it's a different story: Unemployment has exploded here in Europe, while it has declined in the United States. Our economic output remains below the 2007 level. It has declined by up to 10 percent in Spain and Italy, and by 25 percent in Greece.

SPIEGEL: The new leftist government in Athens hasn't exactly gotten off to an impressive start. Do you seriously believe that Prime Minister Tsipras can revive the Greek economy?

Piketty: Greece alone won't be able to do anything. It has to come from France, Germany and Brussels. The International Monetary Fund (IMF) already admitted three years ago that the austerity policies had been taken too far. The fact that the affected countries were forced to reduce their deficit in much too short a time had a terrible impact on growth. We Europeans, poorly organized as we are, have used our impenetrable political instruments to turn the financial crisis, which began in the United States, into a debt crisis. This has tragically turned into a crisis of confidence across Europe.

Read more: http://www.spiegel.de/international/europe/thomas-piketty-interview-about-the-european-financial-crisis-a-1022629.html

Here in Australia, the Turdy government is still try to find the pedals of the bus which is going backwards...

See the toons at top...

false stories...

The Sunday Times has now admitted that there were "errors" in the report. In fact, the whole matter was an invention; but The Sunday Times printed it anyway and so did Britain's Daily Mail, snatching the story from The Sunday Times, but quickly removing it from its own pages when it was disclosed as an imaginative frolic in journalistic invention.

In the meantime, Murdoch's New York Post was in trouble with another false story about an innocent woman who was named as a "hooker" who had a personal acquaintance with the notorious and disgraced German womanizer, Dominique Strauss Kahn.

The New York Post has achieved a reputation for printing wild and scandalous reporting, which always turns out to have been invented.

https://independentaustralia.net/business/business-display/sunday-times-concocted-snowden-story-journalism-at-its-worst,7837

--------------------------------------

May I point out to the respectable Rodney E. Lever that Dominique Strauss Kahn is French not German... Small mistakes are often those that make articles on wrong articles loose some credit... I try hard to avoid these...

olympus versus germanicus...

http://www.smh.com.au/business/world-business/a-hilarious-monty-python-sketch-helps-explain-why-greece-is-in-a-huge-crisis-20150704-gi5boo.html

see toons from top, five years on...

DEMOCRACY in action...

With two-thirds of ballots counted, results from the Greek referendum show voters decisively rejecting the terms of an international bailout.

Figures published by the interior ministry showed 61% of those whose ballots had been counted voting "No", against 39% voting "Yes".

Greece's governing Syriza party campaigned for a "No", saying the bailout terms were humiliating.

The "Yes" campaign warned this could see Greece ejected from the eurozone.

http://www.bbc.com/news/world-europe-33403665

The Eurozone was created to counter the mighty dollar... The Yanks did not like it. They infiltrated the weaker countries of the zone with SECRET loans in DOLLARS, all designed to sink or at least bother Europe... Get a life, Europe. Tell the Yanks to piss off... They spied on on you... Why do you think they did? So they could find your weaknesses and act on it... Now, you know.

The Greeks have truer democracy. We in OrstralYa, we have shitocracy, let by Mr Turd...

the most important political event...

Irish observer says vote is "potentially the most important political event since the collapse of the Berlin Wall". Dierdre Fultonfrom Common Dreams reports.

WHILE MANY in the mainstream media focus on the nitty-gritty economic implications of Sunday's landslide anti-austerity vote in Greece, leaders of Europe's left are hopeful that the outcome – a repudiation of harsh Troika-imposed policies – will start a long-awaited domino effect of democracy across the continent.

"Our deeply unequal global economy relies on ordinary people having no real voice over economic decisions, so this 'no' vote strengthens the battle for a fairer, more humane, people-centred Europe," Global Justice Now director Nick Dearden said on Sunday.

In a column for Ireland's Journal Media, anti-austerity activist Paul Murphydescribed Sunday's vote as

'... potentially the most important political event since the collapse of the Berlin Wall.'

Noting that the win relied on an 'overwhelming mobilization' of both the working class and young people, Murphy – who works with the Irish Anti-Austerity Alliance but was in Athens for the vote – said that "[d]epending on what happens next, it can represent a turning point towards a challenge to the rule of the 1% in Europe and the dominance of Thatcherite neo-liberalism."

Germany's democratic socialist Die Linke Party (Left Party) echoed that sentiment, with party chair Bernd Riexinger declaring:

"Democracy achieved a victory in Europe today. The Greek people fought back for a second time against the catastrophic policies of social cutbacks and economic devastation. They said ‘No’ to further austerity, ‘No’ to a false medicine that always worsens the illness."

Stating that Die Linke stands in solidarity with Greece's Syriza party, Riexinger continued:

"The Greeks’ vote of ‘No’ is evidence of a vibrant democracy that has ended the continued administering of a false medicine. The way for new methods of negotiation is now free."

read more https://independentaustralia.net/politics/politics-display/dominoes-of-democracy-europes-left-finds-hope-in-anti-austerity-vote,7908

rescuing cash and letting the people sink...

The Syriza Government has betrayed the Greek people, ignoring the "No" vote of last week to agree to the hyper-austerity measures demanded by international financiers. The world has been sent a warning, writes John Pilger.

AN HISTORIC BETRAYAL has consumed Greece. Having set aside the mandate of the Greek electorate, the Syriza government has wilfully ignored last week’s landslide “No” vote and secretly agreed a raft of repressive, impoverishing measures in return for a “bailout” that means sinister foreign control and a warning to the world.

Prime Minister Alexis Tsipras has pushed through parliament a proposal to cut at least €13 billion from the public purse — €4 billion more than the “austerity” figure rejected overwhelmingly by the majority of the Greek population in a referendum on 5 July.

These reportedly include a 50 per cent increase in the cost of healthcare for pensioners, almost 40 per cent of whom live in poverty; deep cuts in public sector wages; the complete privatization of public facilities such as airports and ports; a rise in value added tax to 23 per cent, now applied to the Greek islands where people struggle to eke out a living. There is more to come.

“Anti-austerity party sweeps to stunning victory”, declared a Guardian headline on January 25. "Radical leftists" the paper called Tsipras and his impressively-educated comrades. They wore open neck shirts and the finance minister rode a motorbike and was described as a “rock star of economics”. It was a façade. They were not radical in any sense of that cliched label, neither were they “anti austerity”.

For six months, Tsipras and the recently discarded finance minister, Yanis Varoufakis, shuttled between Athens and Brussels, Berlin and the other centres of European money power. Instead of social justice for Greece, they achieved a new indebtedness, a deeper impoverishment that would merely replace a systemic rottenness based on the theft of tax revenue by the Greek super-wealthy – in accordance with European “neo-liberal” values -- and cheap, highly profitable loans from those now seeking Greece’s scalp.Greece’s debt, reports an audit by the Greek Parliament, 'is illegal, illegitimate and odious'. Proportionally, it is less than 30 per cent that of the debt of Germany, its major creditor. It is less than the debt of European banks whose “bailout” in 2007-8 was barely controversial and unpunished.

For a small country such as Greece, the euro is a colonial currency — a tether to a capitalist ideology so extreme that even the Pope pronounces it “intolerable” and “the dung of the devil”. The euro is to Greece what the U.S. dollar is to remote territories in the Pacific, whose poverty and servility is guaranteed by their dependency.

In their travels to the court of the mighty in Brussels and Berlin, Tsipras and Varoufakis presented themselves neither as radicals nor “leftists”, nor even honest social democrats, but as two slightly upstart supplicants in their pleas and demands. Without underestimating the hostility they faced, it is fair to say they displayed no political courage. More than once, the Greek people found out about their “secret austerity plans” in leaks to the media: such as a 30 June letter published in the Financial Times, in which Tsipras promised the heads of the EU, the European Central Bank and the IMF to accept their basic, most vicious demands — which he has now accepted.

When the Greek electorate voted “No” on 5 July to this very kind of rotten deal, Tsipras said:

“Come Monday and the Greek government will be at the negotiating table after the referendum with better terms for the Greek people."Greeks had not voted for “better terms”. They had voted for justice and for sovereignty, as they had done on January 25.

The day after the January election a truly democratic and, yes, radical government would have stopped every euro leaving the country, repudiated the 'illegal and odious' debt – as Argentina did successfully -- and expedited a plan to leave the crippling Eurozone. But there was no plan. There was only a willingness to be “at the table” seeking “better terms”.The true nature of Syriza has been seldom examined and explained. To the foreign media it is no more than “leftist” or “far left” or “hardline” — the usual misleading spray. Some of Syriza’s international supporters have reached, at times, levels of cheer leading reminiscent of the rise of Barack Obama. Few have asked: Who are these “radicals”? What do they believe in?

In 2013, Yanis Varoufakis wrote:

Should we welcome this crisis of European capitalism as an opportunity to replace it with a better system? Or should we be so worried about it as to embark upon a campaign for stabilising capitalism? To me, the answer is clear. Europe’s crisis is far less likely to give birth to a better alternative to capitalism …

I bow to the criticism that I have campaigned on an agenda founded on the assumption that the left was, and remains, squarely defeated …. Yes, I would love to put forward [a] radical agenda. But, no, I am not prepared to commit the [error of the British Labour Party following Thatcher’s victory].

What good did we achieve in Britain in the early 1980s by promoting an agenda of socialist change that British society scorned while falling headlong into Thatcher’s neoliberal trip? Precisely none. What good will it do today to call for a dismantling of the Eurozone, of the European Union itself …?Varoufakis omits all mention of the Social Democratic Party that split the Labour vote and led to Blairism. In suggesting people in Britain “scorned socialist change” – when they were given no real opportunity to bring about that change – he echoes Blair.

The leaders of Syriza are revolutionaries of a kind — but their revolution is the perverse, familiar appropriation of social democratic and parliamentary movements by liberals groomed to comply with neo-liberal drivel, and a social engineering whose authentic face is that of Germany’s finance minister, Wolfgang Schauble, an imperial thug. Like the Labour Party in Britain and its equivalents among former social democratic parties, such as the Labor Party in Australia, still describing themselves as “liberal” or even “left”, Syriza is the product of an affluent, highly privileged, educated middle class, 'schooled in postmodernism', as Alex Lantier wrote.For them, class is the unmentionable, let alone an enduring struggle, regardless of the reality of the lives of most human beings.

Syriza’s luminaries are well-groomed; they lead not the resistance that ordinary people crave, as the Greek electorate has so bravely demonstrated, but “better terms” of a venal status quo that corrals and punishes the poor. When merged with “identity politics” and its insidious distractions, the consequence is not resistance, but subservience. “Mainstream” political life in Britain exemplifies this.

This is not inevitable, a done deal, if we wake up from the long, postmodern coma and reject the myths and deceptions of those who claim to represent us and fight.

You can follow John Pilger on Twitter @johnpilger.

read more: https://independentaustralia.net/politics/politics-display/the-problem-of-greece-is-not-only-a-tragedy--it-is-a-lie,7938

apology about the latest tragedy...

Adelaide's only daily newspaper has apologised for a cartoon referencing the bushfires in Greece, described as "absolutely disgusting" by some members of the local Greek community.

Key points:At least 83 people have been killed in the Greek fires, which authorities suspect may have been deliberately lit.

The cartoon by Jos Valdman — featured in Thursday's edition of The Advertiser — showed Ancient Greek warriors putting out fires using ceramic vases with the title "Another Greek Tragedy".

Greek Orthodox Community of SA president Bill Gonis said the cartoon was "absolutely disgusting".

He told ABC Radio Adelaide that to say the local community was "extremely upset" was putting it mildly.

"We should know better," Mr Gonis said.

"We've got our own bushfire history — never mind nationally, but here in this state especially — but somehow we find the time to display Greeks behind the times in putting out a fire using water from vases.

Read more:

http://www.abc.net.au/news/2018-07-27/newspaper-apologises-for-greek-fir...

Had the cartoonist placed some pipes and pumps, it would have been cleverer, yet such tragedy is hard to make fun of... We see some tears used to extinguish the fires... Lucian of Samosata might have been more accepting of this image, while still feeling the tragedy of the firestorms.

The one element which we cannot mention is "global warming". Condolences to the families who have lost relatives in this tragedy.