Search

Recent comments

- nutcrackers....

3 hours 23 min ago - brilliant US lies....

4 hours 59 min ago - going to plan....

11 hours 43 min ago - romania....

11 hours 58 min ago - falkland fudge.....

13 hours 32 min ago - not a joke....

14 hours 18 min ago - harry in lviv....

14 hours 32 min ago - decoupling.....

15 hours 4 min ago - good luck....

22 hours 22 min ago - corrupt brussels....

1 day 56 min ago

Democracy Links

Member's Off-site Blogs

the inside man .....

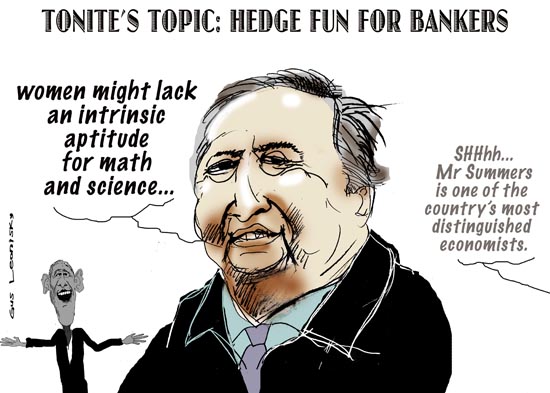

Lawrence H. Summers, the top economic adviser to President Obama, earned more than $5 million last year from the hedge fund D. E. Shaw and collected $2.7 million in speaking fees from Wall Street companies that received government bailout money, the White House disclosed Friday in releasing financial information about top officials.

Mr. Summers, the director of the National Economic Council, wields important influence over Mr. Obama’s policy decisions for the troubled financial industry, including firms from which he recently received payments.

Last year, he reported making 40 paid appearances, including a $135,000 speech to the investment firm Goldman Sachs, in addition to his earnings from the hedge fund, a sector the administration is trying to regulate.

meanwhile …..

His tenure at Harvard was not always a calm one. His aggressive personal style and sharp-edged remarks — including an observation that women might lack an intrinsic aptitude for math and science — provoked a bitter clash with the faculty, forcing his resignation after five years. Though Mr. Summers apologized for the remark about women, women’s groups were expected to object if he was nominated for a cabinet position.

After leaving Harvard, he turned his attention back to economics, making his debut as a monthly Financial Times columnist with a column titled “The Global Middle Cries Out for Reassurance.” He has said that dealing with this anxiety — making globalization work for the masses — has become the central economic issue of the day.

meanwhile …..

Does the fact that Larry Summers made $2.8 million in speaking fees from Goldman Sachs, JP Morgan, Citigroup, and others last year explain the administration's ongoing generosity to Wall Street--both in terms of defining the problem in a way that benefits Wall Street (a "lack of liquidity") and in continuing to bail out the banks at taxpayer expense?

- By Gus Leonisky at 4 Apr 2009 - 9:07pm

- Gus Leonisky's blog

- Login or register to post comments

sleeping with the enemy

As director of the president's National Economic Council, Larry Summers is currently facing the world's biggest math problem. It was encouraging, therefore, to read in Monday's New York Times that, when he applied for a job in 2006 with investment firm D.E. Shaw, "Mr. Summers was asked to solve math puzzles. He passed, and the job was his."

It's hard to imagine Summers being subjected to the same brainteasers that entry-level quants have to answer. And a White House spokesperson confirmed that it wasn't the same series of questions. But he did have to answer analytical reasoning problems asked by a member of the company's executive committee. What kinds of questions does D.E. Shaw ask?

The New York-based firm is known for its rigorous, numbers-heavy interview process. Most applicants have sterling academic backgrounds. The goal, therefore, is to see if the person can apply the concepts he learned in school to the real world. "The question is, 'Can they get past their white papers?' " says Richard Rusczyk, a former D.E. Shaw trader who conducted dozens of interviews over four years at the firm.

The type of questions most interviewers ask—and those D.E. Shaw is known for—are those with no right answers. Here's an example:

Ten people are bidding on a stock at 90, while 100 people are offering to sell it at 91. What price is the next trade?

Interviewees often say that since there are more sellers than buyers, the sellers get to determine the price. That logic usually yields an answer between 90 and 91. That's exactly wrong. "They're not thinking about what's going on in the real world," says Rubczyk. In reality, when there are more sellers than buyers, the price falls. So the next sale would probably be in the mid- to low 80s.

---------------------

One thing's for sure: economic activities are not sciences. They are an art form. A cunning art form...

Sure, they use mathematical models and "derivative" formulas to achieve a picture, but they are no more than the paint on the canvas of trust and the sable brushes of relationships. The price of fish can be manipulated. demand can be manipulated. supply can be manipulated. Relationships can be manipulated: someone tells you your neighbor is sleeping with your wife... You might have known that, but now that it is in the open, you may have to do something about it. The world just discovered that the financial market has been sleeping with the enemy: the derivatives...

say:

In calculus, a branch of mathematics, the derivative is a measure of how a function changes as its input changes. Loosely speaking, a derivative can be thought of as how much a quantity is changing at a given point. For example, the derivative of the position (or distance) of a vehicle with respect to time is the instantaneous velocity (respectively, instantaneous speed) at which the vehicle is travelling.

There are another form of derivatives : including differentials.

Henri Poincaré was a famous froggy mathematician who worked differentials to the 12th degree. Logarithms are simple forms of differentials where a plus sign (+) equals (=) a multiplying factor (X) and where a minus sign (-) equals (=) a dividing factor (:). The derived numbers and their result thus have a parallel universe in the real numeric world where multiplication (or division) would take ten times the time to get the result. There are other forms of derivatives and to my humble knowledge, there has not been any mathematicians eager to go beyond the twelve degree of Mr Poincarré.

Financial derivatives — as many jounos say daily — are barely understood and basically nobody can figure how they work, except for the magicians of finances. The illusionists... I would guess that's because someone does not want you to know... In fact, the term "derivative" I believe has been applied in order to work out the varying values of the progressive differentials between the "investment" and the final "result of the contract" in which the value can be zero for the investor, on expiry but still highly valuable five minutes before that. Financial derivatives are basically bets on the result ON EXPIRY of contract. Thus there are complex formulas with which the hedger is devaluing its chances while the horse is still running, either in front or at the back of the pack. Most financial derivatives bet on the horse that would run last. That's where it's perverse and where it can be manipulated with much greater ease.

Thus mathematics have little in common with economy's ACCEPTED VALUES. Except that we've loaded the deck so much with derivatives — derivative bets on derivatives — that the value of the original pack of horses becomes somewhat irrelevant if one does not look at it.

There is 550 trillion US dollars worth of derivative floating around (ten times the entire world GDP). On the assumption that the bets equalize each other, 50/50, there is a potential loss of 250 trillions for some and 250 trillion gains for others. But some of the bets are "counter-bet-ted" to minimise the losses. At present, there has been a small shift in the results of the bets... Say 47/53 in favor of some, and against others. This shift represents a 6 per cent bracket, or about 33 trillion dollars of negativity in one sector. That sector has been mostly in the operational slush fund of the world (120 trillions). say 50/50 of the losses are in that sector. it represents about 16.5 trillion loss in the surface financial markets. Some hedge funds pocket are bulging... Some of the money is vanished.

By my estimate, in the dungeon of my pauperdom, the world has an unserviceable debt of 15 trillion US dollars per year for the next 15 years unless confidence is restored, the bets are not paid, and global warming is factored in the limited value of the racecourse...

Pi=g+s w-ill flXy...

see toon at top and greed on credit line of comments....

depression is over... for some...

Awake and Sing!

By FRANK RICH (NYT)“I am pronouncing the depression over!” declared CNBC’s irrepressible Jim Cramer on April 2. The next day the unemployment rate, already at the highest level in 25 years, jumped yet again, but Cramer wasn’t thinking about the 663,000 jobs that disappeared in March. He was thinking about the market. Mad money. Fast money. Big money. The Dow, after all, has rallied in the weeks since Timothy Geithner announced his bank bailout 2.0. Par-tay! On Wednesday, Cramer rang the opening bell at the New York Stock Exchange, in celebration of the 1,000th broadcast of his nightly stock-tip jamboree.

Given Cramer’s track record on those tips, there’s no reason to believe he’s right this time. But for the sake of argument, let’s say he is. (And let’s hope he is.) The question then arises: What, if anything, have we learned from this decade’s man-made economic disaster? It wasn’t just trillions of dollars of wealth that went poof in the bubble. Certain American values also crumbled and vanished. Making quick killings by reckless gambling in the markets — rather than by investing long-term in new products, innovations, technologies or services that might grow and benefit America and the world — became the holy grail in the upper echelons of finance.

This was not an exact replay of the preceding dot-com bubble. As a veteran of the tech gold rush recently observed to me, in Silicon Valley “the money comes later” and “the thing you make comes first, however whimsical, silly, microscopic, recondite it may be.” On Wall Street over the past decade, the money usually came first, last and in between. There was no “thing” being made at all unless you count the slicing and dicing of debt into financial “products,” the incomprehensible derivatives that helped bring down the economy, costing some five million Americans their jobs (so far) and countless more their 401(k)’s.

On the same Friday that the Labor Department reported the latest jobless numbers, the White House released (in the evening, after the network news) some other telling figures on the financial disclosure forms of its top officials. From those we learned more about how much the bubble’s culture permeated this administration.

We discovered, for instance, that Lawrence Summers, the president’s chief economic adviser, made $5.2 million in 2008 from a hedge fund, D. E. Shaw, for a one-day-a-week job. He also earned $2.7 million in speaking fees from the likes of Citigroup and Goldman Sachs. Those institutions are not merely the beneficiaries of taxpayers’ bailouts since the crash. They also benefited during the boom from government favors: the Wall Street deregulation that both Summers and Robert Rubin, his mentor and predecessor as Treasury secretary, championed in the Clinton administration. This dynamic duo’s innovative gift to their country was banks “too big to fail.”

Some spoilsports raise the conflict-of-interest question about Summers: Can he be a fair broker of the bailout when he so recently received lavish compensation from some of its present and, no doubt, future players? This question can be answered only when every transaction in the new “public-private investment plan” to buy the banks’ toxic assets is made transparent. We need verification that this deal is not, as the economist Joseph Stiglitz has warned, a Rube Goldberg contraption contrived to facilitate “huge transfers of wealth to the financial markets” from taxpayers.

But perhaps I’ve become numb to the perennial and bipartisan revolving-door incestuousness of Washington and Wall Street.

see toon at top....

of art and science...

From David Brooks

"Blah blah..."

...

"At the end of Act V, economics will be realistic, but it will be an art, not a science."

------------------------

Gus: er... yes? We know that. As mentioned on this site many times before, "economy" is not a science but an art form. Ahah!... But, as the painter pushed his straw-coloured locks away from his creative eyes, the philosopher placed his spectacles on his inquisitive nose to better see the blob on the canvas, asking with a sigh:

"B u t w h a t i s a r t ?".

... Hum... big... BIG question.

A Dada bicycle wheel upside down on a stool, all painted white, is art, isn't it?

Bernini's sensuous and "action" marble sculptures is art, isn't it?

Our five year-old draws a colourful crooked house with stick figures and we're in awe of a new artistic genius at work, aren't we?

A Picasso's ugly sour portrait with broken pushy lines, gruffy coloured angled cheeks, distorted eyes and green teeth is art...

ART...

Art is the manipulation of our stylistic acceptance... Money is art. Religion is art. Politics is art. Art is art. Acceptance is the key in a situation where acceptance (or not) creates the relative situation. While in science, acceptance is to accept (or not) WHAT IS THERE under the terms of our stylistic understanding. Science does not create the situation.

Science is the comprehensive study of WHAT IS THERE, via our stylistic interpretations, some such as pure mathematics — an art form, a language that we can use as a tool to explore WHAT IS THERE, while economics is a structure where acceptance IS THE SITUATION. If we don't accept, there is no situation. In science if we don't accept a premise or a concept, the situation — cosmic, natural, earthly — is still there.

Lots more could be waffled on here.

I believe that David Brooks is slowly coming to terms with the illusionary and arbitrary values contained in the art of "economy", in which people have to trust to make the system work. Some people have a knack at manipulating the artistic illusions with greater skills than others though... And we accept that, to a point. When we stop accepting, the system collapses... The historical memory than we have ingrained in the system and in our own brains makes sure that we can contain the damage done by a certain amount of distrust. Thus at all (most) times, there are enough people to believe in the system so the system is only wobbly, even when there is a bit too much distrust and less acceptance...

All the formulas and fiddles within the present economic system of capital are only nice subterfuges to make us accept that some people can earn a million points a minute, while others, mostly us the toilers, will get fifteen points per hour "if we're lucky"...We "accept" that.

And art and science do meet in various ways, including the way materials can be used, such as a marble block is used by the sculptor to create an artful illusion — for which we can have various critical levels of acceptance — or such as coal used to give power that we "buy" at a "price" decided by a "manipulated" market.

The biggest damage we can do is to give ourselves so much economic artful credit, we encroach on our vital support system and forget to see the natural situation through sciences, thus we sell the future several times over and gamble the interpretations of science for the sake of dodgy art.

Global warming is real. We have artfully created this situation that we can scientifically assess.

Are you still with me?...

See toon at top...

counting on women...

By JOHN TIERNEY

The House of Representatives has passed what I like to think of as Larry’s Law. The official title of this legislation is “Fulfilling the potential of women in academic science and engineering,” but nothing did more to empower its advocates than the controversy over a speech by Lawrence H. Summers when he was president of Harvard.

This proposed law, if passed by the Senate, would require the White House science adviser to oversee regular “workshops to enhance gender equity.” At the workshops, to be attended by researchers who receive federal money and by the heads of science and engineering departments at universities, participants would be given before-and-after “attitudinal surveys” and would take part in “interactive discussions or other activities that increase the awareness of the existence of gender bias.”

I’m all in favor of women fulfilling their potential in science, but I feel compelled, at the risk of being shipped off to one of these workshops, to ask a couple of questions:

1) Would it be safe during the “interactive discussions” for someone to mention the new evidence supporting Dr. Summers’s controversial hypothesis about differences in the sexes’ aptitude for math and science?

2) How could these workshops reconcile the “existence of gender bias” with careful studies that show that female scientists fare as well as, if not better than, their male counterparts in receiving academic promotions and research grants?

Each of these questions is complicated enough to warrant a column, so I’ll take them one at a time, starting this week with the issue of sex differences.

When Dr. Summers raised the issue to fellow economists and other researchers at a conference in 2005, his hypothesis was caricatured in the press as a revival of the old notion that “girls can’t do math.” But Dr. Summers said no such thing. He acknowledged that there were many talented female scientists and discussed ways to eliminate the social barriers they faced.

-----------------

see toon at top and article above about "art"...