Search

Recent comments

- workers disunited....

54 min 42 sec ago - no "brotherly" help....

3 hours 9 min ago - at the UTS...

4 hours 10 min ago - no surrender....

6 hours 48 min ago - bombs are cheap....

1 day 5 hours ago - political firestorm....

1 day 6 hours ago - eurasian future....

1 day 6 hours ago - dehistorisation....

1 day 8 hours ago - not freedom....

1 day 8 hours ago - dropping ratings.....

1 day 9 hours ago

Democracy Links

Member's Off-site Blogs

life was meant to be easy...

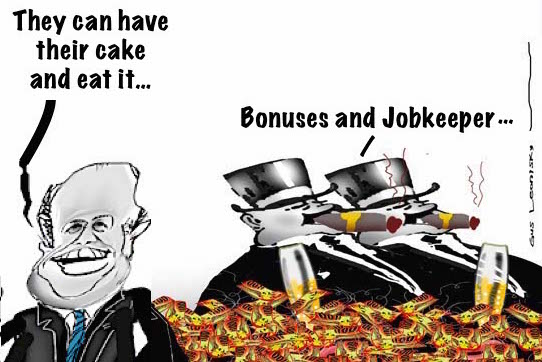

Millions of dollars have been scooped up in CEO bonuses and paid out in stock dividends by corporations that also claimed the JobKeeper wage subsidy, a Labor MP claims, in a situation described as “disgraceful”.

The makeup of the wage subsidy program, which was officially extended by the federal parliament on Tuesday for another six months, has been criticised in a speech from Labor MP, Dr Andrew Leigh.

JobKeeper was meant to be for businesses that had sustained a serious downturn in income due to the COVID pandemic.

However, in an address to the parliament on Monday, Dr Leigh shared a list of big companies that claimed JobKeeper from the federal government while also paying out hundreds of thousands – or even millions – of dollars in CEO bonuses and share dividends.

Read more:

https://thenewdaily.com.au/news/2020/09/01/jobkeeper-ceo-bonuses/

- By Gus Leonisky at 1 Sep 2020 - 8:21pm

- Gus Leonisky's blog

- Login or register to post comments

boardroom decisions...

Treasurer Josh Frydenberg says he is confident JobKeeper will be sufficiently scaled back as the pandemic is brought under control, but says executive bonuses for eligible businesses are decisions for their boardrooms.

see:

Frydenberg says it's up to JobKeeper-eligible businesses to decide on big executive bonusespreparing to face the media...

jobkeeper — how it works...

soup 5 stars...

or less...

When the pandemic hit, billionaire Solomon Lew was quick to plead for government assistance. In one telephone call, he reportedly cried when asking Treasurer Josh Frydenberg to establish the JobKeeper program. Lew’s firm, Premier Investments, temporarily shut down many of its stores, including Smiggle, Dotti, Portmans and Just Jeans. The company applied for JobKeeper and ultimately received more than $40 million in taxpayer assistance.

Then Lew’s business came roaring back. Stores reopened and online sales boomed. In 2020, Premier Investments made a bigger profit than it had in 2019. The company paid shareholders $57 million in dividends. As the largest shareholder, Lew himself received more than $20 million.

Despite receiving a handout from the taxpayer, Premier Investments also paid its chief executive Mark McInnes a $2.5 million bonus, taking his total pay packet to more than $5 million.

This month, shares in Premier Investments shot to a record high.

...

But the big question is: should Solomon Lew pay the taxpayer back?

It isn’t just me who thinks Premier Investments has already stepped out of line. Almost half of Premier’s shareholders voted against the remuneration report in December, a backlash that could trigger a spill of the board if repeated this year.

The Business Council of Australia says that it doesn’t believe companies that receive JobKeeper should be paying executive bonuses. The practice has also been criticised by the Australian Taxation Office and by former Victorian Liberal premier Jeff Kennett.

These critics recognise the basic economic reality that while JobKeeper must be passed on to workers, it also provides relief to the company’s bottom line by covering part of the firm’s wage bill. If a firm has enough spare cash to give the boss a multimillion-dollar bonus, it doesn’t need taxpayer subsidies to pay its workforce.

And there’s a good precedent for giving the subsidies back. Last week, Toyota Australia returned taxpayers $18 million in JobKeeper payments. The company acknowledged there was no legal obligation for them to do it. But chief executive Matthew Callachor said that the board and management had decided that "returning JobKeeper payments was the right thing to do as a responsible corporate citizen". This week, Super Retail Group, which owns Rebel and BCF, announced that its stores had turned a healthy profit, so the firm would repay $1.7 million in JobKeeper subsidies.

Read more:

https://www.smh.com.au/national/australian-billionaires-must-repay-jobkeeper-not-pocket-millions-in-bonuses-20210118-p56v0v.html

Read from top.