Search

Recent comments

- unhappy bibi?....

6 hours 3 min ago - petit minus....

8 hours 20 sec ago - murdered by trump....

9 hours 39 min ago - peace?.....

10 hours 28 min ago - coincidences....

10 hours 42 min ago - destroying libya...

10 hours 53 min ago - dying....

17 hours 1 min ago - trump plays europe....

17 hours 45 min ago - genocide

18 hours 11 min ago - losses....

18 hours 46 min ago

Democracy Links

Member's Off-site Blogs

the economy is going to improve...

Coronavirus Australia live news: ABS unemployment figures set to be released as research finds job market may be about to turn corner

Research from employment website Seek has found WA and SA look to have experienced the smallest falls in job vacancies, while NSW and Victorian job seekers appear to be the worst-hit in the pandemic, but the availability of work may have started to turn the corner.

It comes as the Australian Bureau of Statistics prepares to release its official unemployment estimate for April.

Read more:

https://www.abc.net.au/news/2020-05-14/coronavirus-australia-live-news-covid-19-latest-seek-employment/12244480

The latest wages figures released by the bureau of statistics is one of the last lot of “normal” data that is relatively unaffected by the coronavirus. As such it serves as a good reminder that even before the virus hit, the economy was stuttering.

The March quarter wage price index is the last data that the ABS will release outside of next month’s national accounts that mostly shows little sign of the coronavirus.

Wages are “sticky” because most workers have six-month or year-long contracts or are in permanent positions covered by multi-year agreements. But even then they do respond to the labour market and so once the impact of the surge in unemployment flows through we are likely to see a steep fall in wages growth.

But as it is, wages growth was already falling.

The March quarter marked the fifth consecutive quarter where the trend annual growth of private sector wages fell – this time down from 2.3% in December to 2.2%, while overall wage growth was down to 2.1%:

Read more:

https://www.theguardian.com/business/grogonomics/2020/may/14/coronavirus...

- By Gus Leonisky at 14 May 2020 - 10:25am

- Gus Leonisky's blog

- Login or register to post comments

pity about the flies, the forest fires and the stinking heat...

A gradual lifting of borders has been proposed by the EU's executive in an attempt to kick-start a tourist industry hit hard by the coronavirus pandemic.

"Our message is we will have a tourist season this summer," said economic affairs commissioner Paolo Gentiloni, "even if it's with security measures and limitations."

Borders closed across the EU, including the border-free Schengen zone.

But states are starting to reopen them.

Austria and Germany have become the latest EU countries to agree to remove travel restrictions.

From Friday there will be random checks at border crossings and then on 15 June free movement should resume. "We want to make people's everyday lives easier and take another step towards more normality," said Chancellor Sebastian Kurz.

UK travellers have already been warned not to expect "lavish" international holidays, with plans for a 14-day quarantine on air arrivals. But travel without quarantine will be possible to France and Ireland.

Read more:

https://www.bbc.com/news/world-europe-52644816

Yeah... Go on a cruise...

struggling to stay afloat...

Australia's unemployment rate has posted its steepest monthly rise on record, with 594,300 people losing their jobs in April as restrictions to limit coronavirus shut thousands of businesses and affected many more.

Key points:However, the official jobless rate published by the Australian Bureau of Statistics only climbed by 1 percentage point, from 5.2 to 6.2 per cent in April, taking it back to levels seen as recently as September 2015.

The ABS said that was because of a slump in the proportion of people looking for work.

"The large drop in employment did not translate into a similar-sized rise in the number of unemployed people because around 489,800 people left the labour force," observed Bjorn Jarvis, the head of labour statistics at the ABS.

"The participation rate plunged from 66 per cent to 63.5 per cent, the lowest it has been in 16 years," observed Capital Economics analyst Marcel Theliant.

Mr Jarvis said that the 2.4-percentage-point slump in the participation rate — those people either in work or actively looking for it — was unprecedented.

"This means there was a high number of people without a job who didn't or couldn't actively look for work or weren't available for work," he explained.

With many businesses shut or struggling to stay afloat, job ads slumped by almost two-thirds in April, according to employment advertising website Seek.

Read more:

https://www.abc.net.au/news/2020-05-14/unemployment-jobs-abs-april-recession/12247154

trading inside the coronavirus...

The chairman of the United States Senate Intelligence Committee, Richard Burr, has stepped aside after the FBI served a search warrant for his mobile phone as part of an ongoing insider-trading investigation tied to the coronavirus pandemic.

Key points:

Senate Majority Leader Mitch McConnell announced the move, saying he and Mr Burr had agreed that it was in the committee's best interests.

FBI officials showed up at Mr Burr's home with the warrant on Wednesday (local time), two people familiar with the investigation said on Thursday, marking a significant escalation into the Justice Department's investigation into whether Mr Burr broke the law with a well-timed sale of stocks before the coronavirus caused markets to plummet.

The people spoke on condition of anonymity because they were not authorised to discuss an ongoing investigation.

The search warrant was served on Mr Burr's lawyers, and FBI agents went to Mr Burr's home in the Washington area to retrieve the phone, a senior Justice Department official said.

The decision to obtain the warrant, which must be authorised by a judge, was approved at the highest levels of the department.

The official could not discuss the ongoing investigation publicly and spoke to The Associated Press on condition of anonymity.

Read more:

https://www.abc.net.au/news/2020-05-15/richard-burr-steps-down-as-fbi-issues-insider-trading-warrant/12251020

Read from top.

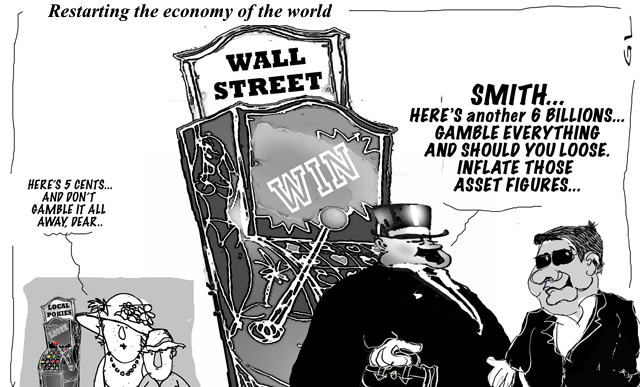

restarting the engine...

tweaking the furnaces...

The Chinese government is reportedly warning state-owned power plants not to buy new shipments of Australian thermal coal and instead favour domestic products.

Deputy Prime Minister Michael McCormack says he is concerned coal exporters could face a tougher time selling the commodity into China.

Mr McCormack said Trade Minister Simon Birmingham and diplomats were attempting to fix the issue.

“Of course we’re very concerned by it,” he told the ABC on Friday.

“But we have a two-way relationship with China. China needs Australia as much as Australia needs China and we want to make sure that whatever we do is in a careful and considered way.”

The Global Times – considered a media voice of the Chinese government – has warned Australian iron ore imports could be hurt by political tensions between the two countries.

“This is another implicit warning to Australia,” Yu Lei, a chief research fellow at Liaocheng University, told the newspaper.

“It is associated with how Australia has acted, and a general decline in demand for steel on the global level.”

Read more:

https://thenewdaily.com.au/news/national/2020/05/22/australian-coal-expo...

In this regard, China was doing Australia a favour. China has more coal than one can poke a stick at... So, in regard to Australia playing the game of US giant kangaroo — A Chinese tabloid widely considered to be a mouthpiece of the ruling communist party has printed some harsh words about Australia over the country’s support of the US attack on Beijing’s Covid-19 response. Tensions between the US and China have lately been focused around Beijing’s response to the coronavirus outbreak in Wuhan and Washington’s accusation of a cover-up regarding its severity and possible origin. Some of the US’ global allies, like Australia, have been following its lead, provoking Chinese displeasure. — at the arse end of the USA's rattle with China, what can you expect?

Lucky, coal is not coal. Some coal have structures and impurities that are not used in furnaces presently, but it's only a matter of tweaking the furnaces and bingo: Chinese steel with Chinese coal... Piece of cake...

Read from top.

...and the dollarvirus is spreading...

The Fed's Cure Risks Being Worse Than the Disease

March 27, 2020

An alphabet soup of new asset-buying programs will essentially nationalize large swaths of the financial markets, and the consequences could be profound.

The economic debate of the day centers on whether the cure of an economic shutdown is worse than the disease of the virus. Similarly, we need to ask if the cure of the Federal Reserve getting so deeply into corporate bonds, asset-backed securities, commercial paper, and exchange-traded funds is worse than the disease seizing financial markets. It may be.

In just these past few weeks, the Fed has cut rates by 150 basis points to near zero and run through its entire 2008 crisis handbook. That wasn’t enough to calm markets, though — so the central bank also announced $1 trillion a day in repurchase agreements and unlimited quantitative easing, which includes a hard-to-understand $625 billion of bond buying a week going forward. At this rate, the Fed will own two-thirds of the Treasury market in a year.

But it’s the alphabet soup of new programs that deserve special consideration, as they could have profound long-term consequences for the functioning of the Fed and the allocation of capital in financial markets. Specifically, these are:

To put it bluntly, the Fed isn’t allowed to do any of this. The central bank is only allowed to purchase or lend against securities that have government guarantee. This includes Treasury securities, agency mortgage-backed securities and the debt issued by Fannie Mae and Freddie Mac. An argument can be made that can also include municipal securities, but nothing in the laundry list above.

So how can they do this? The Fed will finance a special purpose vehicle (SPV) for each acronym to conduct these operations. The Treasury, using the Exchange Stabilization Fund, will make an equity investment in each SPV and be in a “first loss” position. What does this mean? In essence, the Treasury, not the Fed, is buying all these securities and backstopping of loans; the Fed is acting as banker and providing financing. The Fed hired BlackRock Inc. to purchase these securities and handle the administration of the SPVs on behalf of the owner, the Treasury.

In other words, the federal government is nationalizing large swaths of the financial markets. The Fed is providing the money to do it. BlackRock will be doing the trades.

This scheme essentially merges the Fed and Treasury into one organization. So, meet your new Fed chairman, Donald J. Trump.

In 2008 when something similar was done, it was on a smaller scale. Since few understood it, the Bush and Obama administrations ceded total control of those acronym programs to then-Fed Chairman Ben Bernanke. He unwound them at the first available opportunity. But now, 12 years later, we have a much better understanding of how they work. And we have a president who has made it very clear how displeased he is that central bankers haven’t used their considerable power to force the Dow Jones Industrial Average at least 10,000 points higher, something he has complained about many times before the pandemic hit.

When the Fed was rightly alarmed by the current dysfunction in the fixed-income markets, they felt they needed to act. This was the correct thought. But, to get the authority to stabilize these “private” markets, central bankers needed the Treasury to agree to nationalize (own) them so they could provide the funds to do it.

In effect, the Fed is giving the Treasury access to its printing press. This means that, in the extreme, the administration would be free to use its control, not the Fed’s control, of these SPVs to instruct the Fed to print more money so it could buy securities and hand out loans in an effort to ramp financial markets higher going into the election. Why stop there? Should Trump win re-election, he could try to use these SPVs to get those 10,000 Dow Jones points he feels the Fed has denied everyone.

If these acronym programs were abused as I describe, they might indeed force markets higher than valuation warrants. But it would come with a heavy price. Investors would be deprived of the necessary market signals that freely traded capital markets offer to aid in the efficient allocation of capital. Malinvestment would be rampant. It also could force private sector players to leave as the government’s heavy hand makes operating in “controlled” markets uneconomic. This has already occurred in the U.S. federal funds market and the government bond market in Japan.

Fed Chair Jerome Powell needs to tread carefully indeed to ensure his cure isn’t worse than the disease.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Read more:

https://www.bloomberg.com/opinion/articles/2020-03-27/federal-reserve-s-...

Read from top.

not everyone is dancing in the streets...

From Virginia Trioli

It's called "theory of mind": a social-cognitive skill that is necessary to understand that others have beliefs, desires, intentions, and perspectives that are different from your own.

You can slide empathy in there too, if you like — the feelings of care and sympathy that arise when you realise the different perspective and experience of others — but unless you develop this ability, life can have its social challenges.

I had a powerful moment of needing to tune into the mind of others this week as I was banging on happily about how we in Melbourne were finally able to book a meal at a pub, or at a restaurant as this state joins the rest of the country in beginning to lift COVID-19 restrictions.

Happy day! A lunch at a cafe with friends. Life returns!

And then this fell into the ABC Melbourne text messages:

"Not everyone can afford to go out to eat. I now have to manage my kids' disappointment when they want take away or to eat out and we can't afford it.

Declining offers to go out to eat by making excuses because I'm embarrassed. I enjoyed ISO. It made me feel ok about not having money to spend."

"ISO made me feel ok about not having money to spend" — that shut me up.

Read more:

https://www.abc.net.au/news/2020-06-06/virginia-trioli-weekend-reads-i-thought-life-was-back-to-normal/12325270

Read from top.

yoyo on the brakes...

Australian shares are expected to fall sharply after a recent surge of enthusiasm hit the brakes overnight.

Market snapshot at 7:45am (AEDT):ASX futures were down 86 points (or 1.4 per cent) by 7:45am AEST.

Investors piled into safe haven assets like gold as optimism about the economic recovery from COVID-19 took a breather. The spot price of gold jumped (+1.2pc) to $US1,714.32 an ounce.

The Australian dollar fell sharply (-0.9pc) to 69.51 US cents, and was weaker against other major currencies.

It was a big drop compared to Tuesday, when the local currency jumped as high as 70.4 US cents.

"The move lower coincided with headlines that China was issuing an alert to Chinese students studying or proposing to study in Australia due to rising discrimination," NAB director of economics Tapas Strickland said.

Read more:

https://www.abc.net.au/news/2020-06-10/nasdaq-wall-street-record-asx-market-optimism-fades/12338154

Read from top.