Search

Recent comments

- pivotal history.....

7 hours 55 min ago - corrupt....

8 hours 5 min ago - protests-for/against....

8 hours 9 min ago - chaos....

8 hours 21 min ago - eurovision 2024.....

8 hours 28 min ago - the brawl.....

8 hours 39 min ago - hegemonitis....

9 hours 1 min ago - follow the bread crumbs....

11 hours 22 min ago - cohen lies....

15 hours 35 sec ago - elon's bet.....

15 hours 58 min ago

Democracy Links

Member's Off-site Blogs

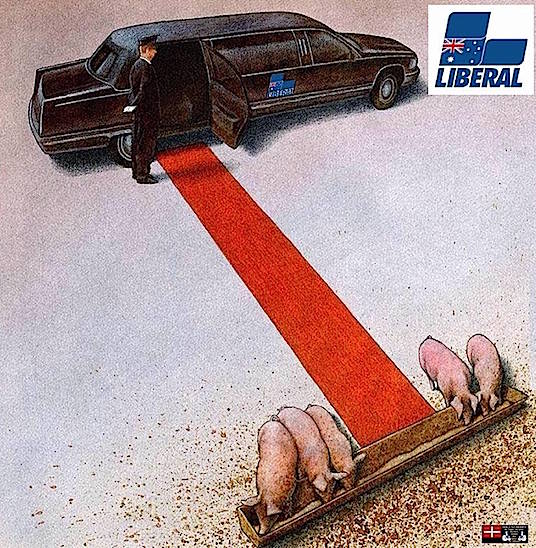

trough or tax....

The latest ATO annual transparency report reveals one-third of large companies are paying zero tax. Alan Austin reports.

THINGS MUST BE GRIM at AGL Energy. This year’s tax transparency report released by the Australian Taxation Office (ATO) reveals AGL paid $107 million less in tax in 2018 than back in 2014.

You would deduce from this that business must be tough, profits must be down disastrously and executives and shareholders having a thin time of it. You would be wrong.

AGL paid its executives $13.4 million in 2018. This was up 28.4% on the $10.4 million in 2014. Dividends paid to shareholders were a staggering 253% higher, up from $269 million to $682 million.

Companies which paid no company taxAt least AGL did declare a profit and pay some company tax — even if it was just 1.6 cents in every dollar of its colossal revenue.

Many big corporations declared huge profits in 2017-18 but paid no tax whatsoever. These include Shell Energy ($200.5 million profit), Bluescope Steel ($60.6 million profit), Murdoch’s News Australia ($58.5 million), Food Investments Pty Ltd ($65.2 million profit), Lendlease Corp ($69.2 million), Pratt Holdings ($59.2 million) and Woodside Petroleum ($1.3 billion).

Yes, billion with a "B".

A total of 2,214 companies are listed with gross earnings shown. Of these, only 1,649 reveal their taxable income. The others either did not generate any taxable income or have not revealed it. These include some of the world’s biggest exporters of Australia’s resources — Chevron, ExxonMobil, Peabody and Santos.

Only 1,504 companies paid company tax, which means 710 or 32% didn’t.

Read more:

https://independentaustralia.net/politics/politics-display/the-corporati...

- By Gus Leonisky at 17 Dec 2019 - 7:35am

- Gus Leonisky's blog

- Login or register to post comments

gross...

too much pig food...

What is the world coming to when the New York Fed can’t mix up $1 trillion of almost-free money in its punch bowl and get the mega Wall Street banks to drink freely?

The New York Fed handed out $129.60 billion this morning at an average interest rate of 0.112. That was for a one-day loan to one or more of Wall Street’s trading firms. The specific names of which firms are doing the borrowing are a closely-guarded secret at the Fed – just as they were during the financial crisis in 2008 until media lawsuits and a legislative amendment forced the banks’ names out into the open. All that the public is allowed to know today is that any of the Fed’s 24 primary dealers (Wall Street trading houses) are allowed to borrow from the facility. (See list below.)

The New York Fed also offered $500 billion in a 28-day loan this morning and, stunningly, it only had offers for $18.45 billion of the $500 billion, which was loaned at an average interest rate of 0.151 percent.

Despite that poor showing at its money spigot party this morning, the New York Fed made a surprise announcement and said it was throwing another money giveaway of $500 billion at 1:30 p.m. today. Again, only takers for $19.40 billion of the $500 billion showed up. The loans were made at the incredibly low average interest rate of 0.102 percent.

There was this same lack of demand last Thursday and Friday when the Fed tried to give away, almost for free, $1.5 trillion over the two-day span.

What could possibly account for this lack of greed from the typical pigs at the trough?

The reason that jumps to mind to anyone who has been following the Fed’s money spigot closely, is that there are only a handful of Wall Street banks that are in desperate need of this cash. Since the beginning of this program last fall, the New York Fed has imposed caps on how much any one of the 24 Wall Street firms could borrow at each offering. It refers to this limit as a “proposition.”

So, for example, on the lastest $500 billion loans, firms can make a “proposition” up to $20 billion on loans backed by U.S. Treasury collateral and up to $20 billion on loans backed by government-backed mortgage securities. It’s not clear if the Fed would provide an individual bank with a total of $40 billion on that specific loan or just $20 billion for both propositions.

It’s also not clear if the Fed has, without the public’s knowledge, imposed an overall cap on how much any one bank can borrow within a specific period of time.

But what today’s unscheduled afternoon loan operation suggests is that a bank that borrowed last Thursday or Friday or this morning, may have been in need of more assistance this afternoon.

We looked at how the Fed’s primary dealers were trading today to see which banks were showing the most distress. At approximately 2:30 today, these banks were showing large percentage declines on the day: Citigroup was down a scary 18.24 percent; Morgan Stanley was down 14.35 percent; Bank of America was down 14.38 percent; and JPMorgan Chase was down 13.64 percent.

Deutsche Bank had earlier in the day traded at a new all-time low of $4.99 before bouncing back to $5.39 for a percentage decline of 9.67 percent. That leaves the bank with just $11.5 billion in common equity capital versus tens of trillions of dollars (notional) in derivatives exposure.

Read more:

https://wallstreetonparade.com/2020/03/the-fed-tried-to-give-away-1-tril...

Read from top.