Search

Recent comments

- guns, guns, guns....

12 min 34 sec ago - a link?....

6 hours 10 min ago - kk BS....

9 hours 13 min ago - ISIS.....

11 hours 56 min ago - start now....

13 hours 1 min ago - AI vs poetry.....

14 hours 29 min ago - memories....

17 hours 1 min ago - putin said....

1 day 10 min ago - santa sans snow....

1 day 2 hours ago - media for war.....

1 day 2 hours ago

Democracy Links

Member's Off-site Blogs

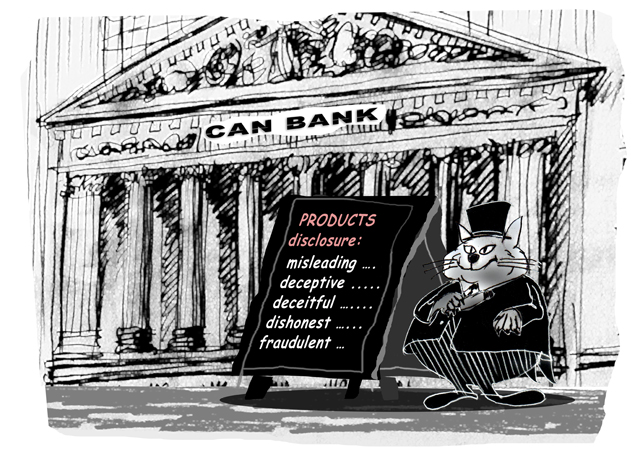

and no-one went to prison, as they lived happily ever after with bigger bonuses...

The country's biggest banks and wealth managers have enjoyed a $20 billion rally in their combined market value, after it became clear the royal commission would not squeeze their lucrative mortgage businesses, nor force banks out of the scandal-prone wealth sector.

Mortgage brokers, in contrast, suffered dramatic share price falls as the industry warned that consumers would face higher interest rates and find it harder to compare loans, under a plan to up-end the broking business model.

The sharemarket had its strongest day since late 2016 on Tuesday, driven by sharp rises in bank shares, with Westpac shares posting their biggest one-day gain in a decade, in response to the royal commisison's final report into misconduct in finance.

Against fears the commission would further put the brakes on housing credit growth, which is critical to bank profitability, commissioner Kenneth Hayne on Monday said there was no case for changing the laws on responsible lending.

"We saw the short positions had picked up significantly last week. [Today's surge] is people seeing that is nothing surprising in the report so they are covering their short positions. People were betting it would fall and when that didn't happen and the catalyst is passed, they look to buy back their positions," she said.

Westpac shares surged 7.4 per cent to $26.70, ANZ Bank soared by 6.5 per cent to $26.86, and embattled wealth manager AMP leapt by 10 per cent to $2.43.

Commonwealth Bank and gained 4.7 per cent to $73.6, while National Australia Bank gained 3.9 per cent.

Read more:

https://www.smh.com.au/business/banking-and-finance/banks-in-20b-boost-a...

- By Gus Leonisky at 6 Feb 2019 - 4:29am

- Gus Leonisky's blog

- Login or register to post comments

are bankers humans?

Timing is everything to drive complex, difficult and overdue change in sectors with deep pockets and powerful interests — just ask Wayne Swan about his venture into mining super profits taxes.

But released in the shadows of a general election expected no later than May, Justice Hayne can bank on most of his suggested changes, and possible prosecutions, being driven through to completion regardless of who forms the next government.

In his own words, Commissioner Hayne exhorts governments, regulators and the regulated to correct the lax compliance and greed-inducing incentives that he regards as a pressing national project.

The imperative was not lost on either current or aspiring Treasurers — Josh Frydenberg declaring that a Morrison Government would "take action on all 76 recommendations" and Chris Bowen matching with "in principle" support for all of them.

With those positions declared, the only question remaining is what political potency the Hayne recommendations will have in the dozen or so weeks remaining between now and election day.

Read more:

https://www.abc.net.au/news/2019-02-05/kenneth-hayne-royal-commission-re...

For the witnesses who stood up to the country's biggest banks and told their harrowing stories of financial ruin and predatory behaviour, the royal commission's recommendations do not go far enough.

Read more:

https://www.abc.net.au/news/2019-02-05/banking-royal-commission-victims-...

some are human...

National Australia Bank CEO Andrew Thorburn and chairman Ken Henry have resigned from the bank.

Key points:Mr Thorburn will leave at the end of the month, while Dr Henry will stay on until a new, permanent chief executive is appointed.

Both men had been singled out for criticism by banking royal commission head Kenneth Hayne.

In a statement, Mr Thorburn said his decision to retire followed a number of conversations with Dr Henry this week.

"I acknowledge that the bank has sustained damage as a result of its past practices and comments in the royal commission's final report about them," Mr Thorburn said.

In the banking royal commission's final report released on Monday, Mr Hayne said he had doubts that NAB had learned from its past mistakes, and criticised Mr Thorburn's characterisation of the fees for no service scandal as "nothing more than carelessness".

Former ANZ executive Philip Chronican, currently a board director at NAB, will step in as acting CEO from March 1.

Shareholder revolt saw boss take a $2m pay cutThe fallout from the royal commission caused a revolt at NAB's annual general meeting last year, when 88 per cent of shareholders voted down the company's remuneration report — the largest protest vote in Australian corporate history.

Mr Thorburn saw his pay cut by $2.1 million, but still took home $4.3 million for his year's work.

NAB shares are expected to return to trade tomorrow morning, after being halted this afternoon ahead of the announcement.

Read more:

https://www.abc.net.au/news/2019-02-07/nab-ceo-and-chairman-both-resign-...

Read from top.

zero and 19 billions...

Editorial

Loyal commission

Two numbers tell the same story. One is zero and the other is 19 billion. The first is the number of prosecutions recommended by the Hayne royal commission. The second is the amount invested in a record day for bank stocks following the release of its report. One is like the other: craven, predictable and depressing. The report is eviscerating, as were the hearings. Its recommendations are conservative, as was its commissioner.

Hayne’s ‘disinfectant’ sees banks’ share prices rise

“As banking insiders describe it, the share price rises reflected the industry’s response to Hayne’s decision not to tear them apart – ‘phew’.”

Karen Middleton In the wake of the Hayne royal commission, the big banks’ share prices rose, raising questions of how much the culture of greed is threatened by its recommendations.

remember when...

... stale bread for the working convicts and butter for his banking mates...a sick baby...