Search

Recent comments

- crummy....

10 hours 29 min ago - RC into A....

12 hours 22 min ago - destabilising....

13 hours 26 min ago - lowe blow....

13 hours 57 min ago - names....

14 hours 34 min ago - sad sy....

15 hours 13 sec ago - terrible pollies....

15 hours 10 min ago - illegal....

16 hours 21 min ago - sinister....

18 hours 44 min ago - war council.....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

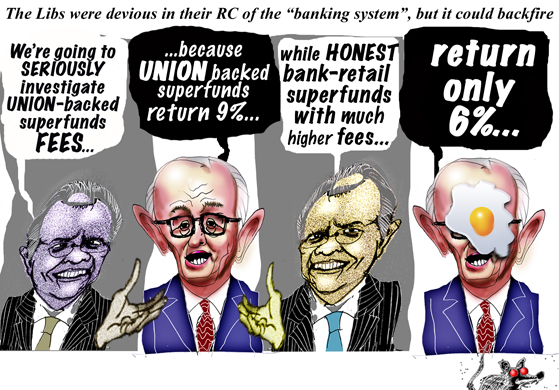

investigating your retirement pudding...

The Government and the banks — through various lobby groups like the Financial Services Council — seem obsessed with the makeup of industry super boards.

Surely, performance should be the main issue.

For 25 years, industry funds have delivered better returns to their members than ban-run retail funds. During that period, billions of dollars in fees have been raked off for the benefit of bank executives and directors, many of whom have been paid obscene bonuses for pathetic results.

Former prime minister Tony Abbott once remarked that industry super funds were run by "venal" and "corrupt" union officials. He may be right, although Justice Dyson Heydon uncovered precious little corruption relating to super in his Royal Commission, despite his best efforts.

It is quite likely there has been corrupt activity within industry funds that has not been exposed. But what has been revealed to date pales into insignificance when compared to the litany of complaints, criminal behaviour and the ongoing revelations of wrong-doing within our banking system.

Perhaps the final word on the matter should be left to the banking regulator APRA.

In its most recent adjudication of superannuation fund performance, industry funds produced a 9 per cent return on investment in both the 12 months to the end of September 2016 and the year to the end of September this year.

The bank-run retail funds were no match. They notched up a 6.1 per cent return last year and just 6.3 per cent this year.

It has been the same story for a quarter of a century. That alone is worthy of investigation.

Read more:

http://www.abc.net.au/news/2017-12-04/verrender-banking-royal-commission...

- By Gus Leonisky at 4 Dec 2017 - 6:29am

- Gus Leonisky's blog

- Login or register to post comments

"we regret the necessity of the decision"...

In the end, resistance was futile.

Malcolm Turnbull has called the royal commission he had spent a year and a half opposing.

"Government policy remains the same until it is changed," he conceded.

To stop an inquiry happening against his will, he had to give in.

"While we regret the necessity of the decision, we have taken it is in the national economic interest," Mr Turnbull said.

Since April last year, the Government gradually squeezed the banks harder as it tried to fend off the escalating push for an inquiry.

It forced them to appear at parliamentary inquiries, promised a new financial complaints-handling body and ordered reviews and inquiries.

read more:

http://www.abc.net.au/news/2017-11-30/analysis-malcolm-turnbull-hates-th...

twisting like an injured writhing snake...

Much has been made of the extraordinary backflip this week by the prime minister, Malcolm Turnbull, on the issue of a banking royal commission – from two weeks ago when he was telling Channel Nine’s Karl Stefanovic that a royal commission “doesn’t do anything other than write a report”, to this week announcing one.

But of course this isn’t really a banking royal commission – it is instead a royal commission whose own framers see little need for it. It has been given just one year – a year less than was given to the trade union royal commission – and with terms of reference that are poorly focused, and which you could be excused for believing are designed to produce little change to our financial system.

It is the weirdest announcement for a royal commission that I can recall.

read more:

https://www.theguardian.com/business/grogonomics/2017/dec/03/shades-of-s...

lovely framing of the miniature RC into the banking system...

While the Turnbull Government is setting up a quick, superficial and corporate-friendly Royal Commission, time will tell if Australia really has the political appetite to take on the banks, writes Professor Carl Rhodes.

IT'S A CASE of walking before they might have to run, with Prime Minister Malcolm Turnbull teaming up with the heads of Australia’s four big banks to call the banking Royal Commission.

The bankers chose their words carefully. In the letter sent to Treasurer Scott Morrison expressing their new-found desire for the commission, there is no mention of the rip-offs, dodgy-dealing and selfish skulduggery that has come to define the Aussie banking scene.

Their motives, by their own account, are patriotic, pure and altruistic. They want to support the "national interest" and put "political certainty to an end" so that they get back to the business of making Australia great.

Never mind solving the endemic problems of a concentrated industry racked by crime and scandal, the banks just want this "costly and unnecessary distraction" to be all over and done with — quick smart.

SKY: "Wouldn't it be remiss to not consult the banking industry before calling a RC"?

— Noely (@YaThinkN) November 30, 2017umm since when do we involved the people being investigated prior to setting up a Royal Commission?

The industry is not even trying to conceal its penchant for haste and superficiality.

Without the thinnest pretence that there might be anything rotten in the state of the banks, an analyst from Deutsche is worried about the

‘ ... risk that further misconduct issues could arise in the course of the inquiry’.

In what myopic world view can this inquiry be reduced to being a risk to be mitigated? Uncovering misconduct is the whole purpose of the commission — not a potentially damaging and unwanted side effect.

Never mind, the risks are small anyway.

A J P Morgan analyst seems quite chuffed to say that the "downside" will be minimal:

' ... given the narrow focus of the inquiry and short timeframe involved’.

Great! So, the good thing about the inquiry is that it won’t do much and will be over within no time?

What analysts said about the banking royal commission - The Australian Financial Review https://t.co/DvitlUp7fo pic.twitter.com/t7TRC5p8Un

— World Media Group (@WorldMediaAus) December 1, 2017Even Immigration Minister Peter Dutton chimed in hoping the inquiry would provide "closure around what’s been a difficult situation". There is just a willful ignorance of the fact that the reason Australians were demanding the inquiry was to uncover these "issues", not to close them down because they make wealthy business people squeamish.

The Government does not appear remotely willing to admit that the reason for the inquiry is because of the sector’s atrocious record of injurious and illegal behaviour. So why are having this commission? Scott Morrison’s answer is that‘politics is doing damage to our banking and financial system’.

What about the bankers themselves, Scott? Isn’t the commission supposed to be uncovering the damage they have done? You can just see it coming, bankers will be found breaking the law to line their own pockets and Labor and the Nationals will be held to blame.

Despite all this talk of a low risk, rapid results Royal Commission, surely the commitment should be to fully lift the lid on whatever has been going on the industry? Not so for the Coalition. The status of this as a "Clayton’s" royal commission is written straight into the Terms of Reference. As you’d expect, it states that it will find out what’s been going wrong, why it’s been going wrong and how new laws and practices can fix it.

read more:

https://independentaustralia.net/politics/politics-display/the-coalition...

of keeping the lid on the foul smell...

When it comes to Turnbull's reluctant Banking Royal Commission, the fix is in, writes banking corruption investigator Dr Evan Jones.

You couldn’t make it up. It’s the Royal Commission follies. And this is just early days.

Those fronting for the banks, the Liberal Party front bench to the fore, have been denying the necessity for a banking Royal Commission for yonks. Overnight, the Big Four decide to OK a Royal Commission, so we are going to have a Royal Commission. On the banks’ terms. Brilliant!

The much desired Royal Commission is decapitated from the start. Check out Turnbull’s draft Terms of Reference.

The first paragraph is a giveaway:

'Australian has one of the strongest and most stable banking, superannuation and financial services industries in the world, performing a critical role in underpinning the Australian economy. Our banking system is systematically strong with internationally recognised, world’s best prudential regulation and oversight.'

What a gigantic fib, or set of fibs. This opener sets the scene for a short inquiry, because there’s implied to be nothing much to see under the covers.

Sections 4 & 5 of the draft Terms are the main worry, with respect to discretionary exclusions. Moreover, a key issue remains unanswered: will victims gain direct access to the Commission’s hearings and investigations?

Section 1(c) looks like a backdoor attempt at yet another union bashing inquiry with a potential attack on industry super funds. Numerous commenters have made the same point, including former NSW Liberal Party leader Peter Collins.

One has to hope that appointed ex-High Court judge Kenneth Hayne has no way of keeping the lid on the foul smell once the lid has been lifted.

read more:

https://independentaustralia.net/politics/politics-display/the-claytons-...

Read from top

limiting the damage...

and if you have not understood the evolution of the process please visit:

morrison is hoping that plundering YOUR pockets via the banks will make you hate them more than ever before...

scoring an own goal...

Given how important Saturday's Batman by-election is for Bill Shorten's political momentum, it is very odd — to say the least — that the Opposition decided to make its latest tax announcement in the campaign's last week.

Labor is in a head-to-head battle with the Greens in Batman. ALP sources are talking down the chances of their candidate, former ACTU president Ged Kearney, though the party is not writing off the seat.

It was entirely predictable that the Opposition's plan to scrap cash refunds for excess dividend imputation credits would generate some backlash and a big scare campaign from the Government.

Read more:

http://www.abc.net.au/news/2018-03-16/grattan-what-batman-soft-voters-sa...

Bill, stop fiddling with how the middle class is earning cash from shares and other crap such as superannuation... The tax system is not perfect and never will be — but trying to screw more out of some people will turn them away from you and go back to Trumble... wake up! Stop the zingers!

keeping the fees coming...

A tailor pushing $122 million in home loans, gym owners assessing peoples' finances, paper envelopes filled with cash bribes, and a bank chief executive revealing his own customers are getting a raw deal.

And that was just four days.

It was an astonishing first week of public hearings at the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry, better known as #BankingRC.

Things started badly for NAB. Then they got worse.

The commission heard NAB's Introducer Program rewarded people such as solicitors and accountants for pushing customers towards its home loans. It was a program that got out of control in greater western Sydney.

Just one "introducer", believed to be a tailor, pushed $122 million in home loans and reaped $488,000 in fees. A gym owner was another key introducer.

The benefits became so lucrative that cash bribes in paper envelopes were being given to brokers to help them overlook fraudulent or missing details in applications — to keep the fees coming.

Read more:

http://www.abc.net.au/news/2018-03-17/banking-royal-commission-hears-mor...

who advised billy?

One of the intriguing questions of the week in federal politics has been why Bill Shorten picked Tuesday to unveil one of the most contentious changes to tax policy Labor has countenanced during this period of opposition.

Shorten and the shadow treasurer, Chris Bowen, knew their proposal to end cash rebates for excess imputation credits for individuals and superannuation funds was going to kick a political hornets’ nest.

While dividend imputation is a relatively obscure tax topic for Australians who live from paycheck to paycheck and have no assets apart from a home that they are likely still paying off, the beneficiaries of the arrangements implemented by John Howard and Peter Costello nearly 20 years ago are acutely aware of how the system works, and have structured their financial planning to take advantage of it.

Read more:

https://www.theguardian.com/australia-news/commentisfree/2018/mar/17/why...

your super is not in the bank...

Just when they appeared on the cusp of victory, the major banks and AMP have had their ambitions to grab control of a lucrative section of the superannuation industry crushed.

After just two fortnight-long public sessions, Royal Commissioner Kenneth Hayne and his ruthlessly efficient senior counsel Rowena Orr have unearthed widespread corruption, lax regulatory oversight and even potential criminal behaviour at the most senior levels of our financial institutions.

Senior government ministers, including Prime Minister Malcolm Turnbull, have been forced to backflip on their attitude to the industry, with many expressing regret for their staunch opposition to a royal commission.

It may also nudge them to rethink their unwavering support for the banks in a long-running campaign to muscle their way into the MySuper default schemes.

For the past two years, the banks have railed against the current system that restricts their access to around half a trillion dollars of savings in the MySuper system.

Suddenly, they've gone very quiet on the issue which, given the crisis now engulfing AMP and casting a pall over the four majors, is hardly surprising.

Oddly, despite a quarter of a century of outperformance by industry funds over their bank-run rivals, the Government until recently has thrown its weight behind the banks in the fight, arguing not-for-profit industry funds needed greater transparency and accusing them of siphoning off money for unions.

While superannuation — and the role of industry funds in particular — has yet to be examined by the royal commission, only the bravest punter would bet they could come even close to our major banks on corruption, malfeasance and outright theft.

Read more:

http://www.abc.net.au/news/2018-04-30/the-banks-the-government-and-the-h...

Join a union today...

Read from top.

super super...

The move, which has also been backed by the Productivity Commission and given the in-principle support of both the Morrison government and the Labor opposition, would see employees defaulted once to a super fund, and stay in that fund throughout their working lives as they travel to different jobs.

This shift, aimed at preventing the creation of additional small super accounts every time workers change jobs, would be a boon for the likes of Rest super, the standard fund for more than 1 million retail workers and the $33 billion Hostplus fund, the default for many hospitality workers

Read more:

https://www.smh.com.au/politics/federal/the-super-funds-set-to-win-out-o...

read from top.