Search

Recent comments

- crummy....

10 hours 28 min ago - RC into A....

12 hours 21 min ago - destabilising....

13 hours 25 min ago - lowe blow....

13 hours 57 min ago - names....

14 hours 34 min ago - sad sy....

14 hours 59 min ago - terrible pollies....

15 hours 9 min ago - illegal....

16 hours 21 min ago - sinister....

18 hours 43 min ago - war council.....

1 day 4 hours ago

Democracy Links

Member's Off-site Blogs

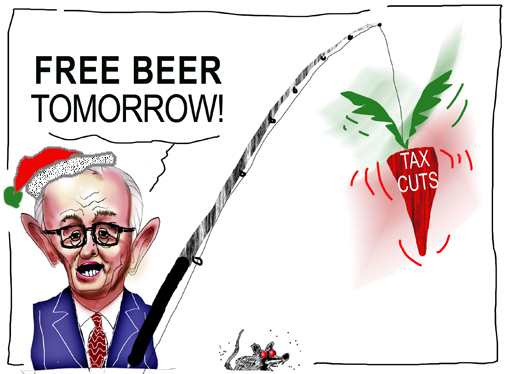

santa malcolm and the voting bunnies....

Bill Shorten has dismissed Malcolm Turnbull’s plan to cut personal income taxes, saying it amounts to a vague promise of “free beer tomorrow” to distract voters from his political woes.

The former Treasury official Chris Richardson has also undermined the prime minister’s plan to pursue tax cuts for middle Australia, saying there is no strong economic case for such tax cuts and they will come at the budget’s expense.

Turnbull raised the prospect of personal income tax cuts in a speech to business leaders on Monday night, as he attempted to shrug off the chaos of the past few months and make the case for his “measured” leadership.

He told the Business Council of Australia dinner he was “actively working” with the treasurer, Scott Morrison, and his cabinet colleagues on a plan to introduce personal income taxes while also returning the budget to surplus.

He said the tax cuts would boost efforts to address cost-of-living pressures, including measures the government had taken to reduce power bills, the budget’s housing affordability measures, childcare reforms and an overhaul of private health insurance.

“Another way of putting more money into people’s pockets is by increasing their disposable income through lower taxes,” Turnbull said.

But Shorten has dismissed Turnbull’s plan and raised questions about the timing of the announcement, given it came hours after Turnbull was roundly criticised for cancelling the penultimate week of parliament.

“It is like free beer tomorrow, isn’t it?” the Labor leader said on the Sunrise program on Tuesday.

“This bloke who just says whatever comes into his head to keep the wolves from the door. If he really wanted to support the battlers, he wouldn’t be cutting the taxes of millionaires and increasing the taxes of everyday Australians.

Shorten pointed out that the Coalition was proposing to increase the Medicare levy by 0.5% on people who earn less than $87,000 a year, so Turnbull was effectively raising taxes first before trying to claim credit for cutting them again.

Read more:

https://www.theguardian.com/australia-news/2017/nov/21/bill-shorten-call...

- By Gus Leonisky at 21 Nov 2017 - 11:11am

- Gus Leonisky's blog

- Login or register to post comments

indigestion in the coalition...

Government ministers have called on frustrated Coalition MPs to air any concerns internally following an unnamed MP's reported threat to defect to the crossbench unless Prime Minister Malcolm Turnbull is replaced as leader by someone other than Foreign Minister Julie Bishop.

The disaffected MP's threat to quit the Coalition next month and imperil Mr Turnbull's working majority in the House of Representatives was reported by conservative News Corp commentator Andrew Bolt on Tuesday.

read more:

http://www.smh.com.au/federal-politics/political-news/my-doors-always-op...

yeepeeetax...

Yippee! It's almost Christmas and Malcolm Turnbull has dropped a big hint that tax cuts are coming. Good old rich Uncle Mal has been to see his bank manager, got the overdraft extended, and is determined we'll all have a great Chrissie, no matter what.

Actually, it's all a bit vague at this stage. We don't yet know whether the cuts will even be announced before Christmas, let alone when they'll be delivered. Nor do we have any idea whether they'll be large, small or indifferent.

read more:

http://www.smh.com.au/comment/malcolm-turnbulls-tax-cut-news-scant-on-de...

hell will pay for them...

The rather unexpected allusion by the prime minister this week in a speech to the Business Council of Australia to the government’s pursuit of further income tax cuts is not one that should be treated with too much respect until he also talks about how to pay for them. With the return to surplus built on income tax revenue, any income tax cuts are unlikely to come before the next decade without either increases in other taxes or big cuts to government services.

Amid the usual “free markets are great” rah-rah that the prime minister doled out to the Business Council of Australia on Monday night, Malcolm Turnbull also slipped in a line on income tax cuts, noting that he was: “Actively working with the treasurer and all my cabinet colleagues to ease the burden on middle-income Australians, while also meeting our commitment to return the budget to surplus.”

This was a bit of a surprise given the current state of the budget is such that the government is projecting that a return to surplus only in 2020-21and that net debt at that point will total $366bn, or 17.6% of GDP.

Read more:

https://www.theguardian.com/business/grogonomics/2017/nov/23/ignore-turn...