Search

Recent comments

- no shipping.....

7 hours 45 min ago - digging graves....

7 hours 57 min ago - BS draft...

8 hours 4 min ago - tankers ablaze....

8 hours 51 min ago - shoes....

10 hours 49 min ago - new map....

11 hours 24 min ago - weapongeddon....

11 hours 40 min ago - squirming....

11 hours 56 min ago - UK kills russians...

16 hours 37 min ago - fury shit....

16 hours 47 min ago

Democracy Links

Member's Off-site Blogs

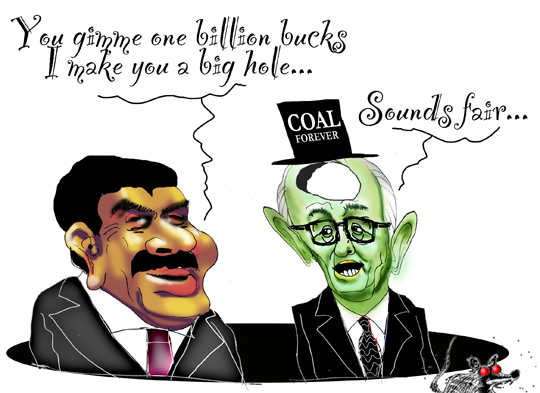

a very bad deal made by silly turnbull, especially on a warming planet due to digging big holes...

Why should Australian taxpayers invest $1 billion in Adani if the big four banks don’t think it’s commercially viable? Patrick Keane reports.

ON MONDAY, Adani Group announced early works on the Carmichael mine would begin in October.

Australia’s big four banks have ruled out investingin the Adani-Carmichael mine so why do Federal and State governments want to use our money instead?

Although Federal Leader of the Opposition Bill Shorten committed not to spend public money on Adani during the Federal election campaign last year, theroyalty deal struck between the Queensland Labor Government and Adani is effectively a subsidy of as much as $700 million to the Indian mining giant.

The Federal Government may propose lending Adani a further $1 billion through the Northern Australia Infrastructure Facility (NAIF).

BREAKING: Adani bullying our Govt into a $1bn loan by starting construction before they have finance! #StopAdani https://t.co/gfkkrf9i5Q

— Stop Adani (@stopadani) August 28, 2017The mine isn’t commercially viable.

If the mine was commercially viable then it wouldn’t need public financing because investors like money.

The public cannot afford to be financing the white elephants of the Federal and State governments.

Although unemployment in metropolitan Queensland has been improving since the last State election in 2015, in regional Queensland it is still rising.Unemployment in inner city Brisbane is currently 4.3% but in the Queensland outback, the average is 13.5%.

Queensland cannot afford to waste more money. Is there a better way to spend $1 billion?

Read more:

https://independentaustralia.net/environment/environment-display/big-fou...

- By Gus Leonisky at 2 Sep 2017 - 5:39pm

- Gus Leonisky's blog

- Login or register to post comments

ridiculous...

scandalous... Incompetent...

royalties, a big hole and a pile of dirt...

The Adani spokesman said the company “reached agreement with the Queensland government following a special cabinet meeting that approved a new royalties regime for the Galilee Basin and, indeed, other new mineral provinces”.

“Adani had previously announced it was putting the project on hold until a royalties agreement could be reached,” he said.

“It is also noteworthy that Adani announced the ‘green light’ for the project on Queensland Day [6 June]. There are no ongoing negotiations on this matter.”

Government sources have previously told Guardian Australia that Adani would be expected to pay at least $5m in royalties in the Carmichael mine’s first year of production, a discount that fell each year until full royalties were due in five years’ time.

This fell short of an original reported offer to Adani of a “royalties holiday” that would have cost the state up to $320m in revenue, with the company to pay just $2m in the first year.

That offer triggered internal uproar in Labor, with some regional MPs citing their constituents’ support for the mine and its jobs but also for Adani, as a transnational corporation, to pay its way.

read more:

https://www.theguardian.com/environment/2017/sep/03/adan-queensland-disp...