Search

Recent comments

- nazi merz.....

48 min 38 sec ago - jewish brat.....

1 hour 4 min ago - mercenaries....

1 hour 19 min ago - sad case.....

1 hour 29 min ago - softening....

13 hours 3 min ago - welcome uncertainty...

13 hours 15 min ago - a good pope....

1 day 55 min ago - natural law?....

1 day 3 hours ago - one two three....

1 day 4 hours ago - megyn's climate....

1 day 5 hours ago

Democracy Links

Member's Off-site Blogs

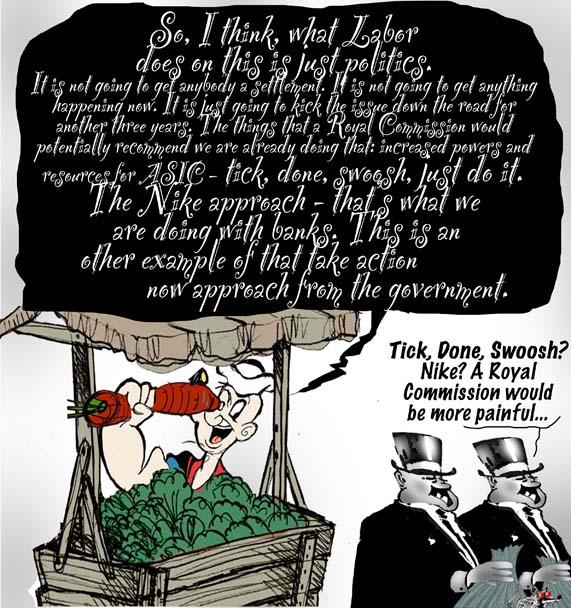

scomo popeye — the swashbuckleer and the swooshernator with gym sandals...

- By Gus Leonisky at 29 Aug 2017 - 7:56am

- Gus Leonisky's blog

- Login or register to post comments

a royal commission into the banks is needed...

Scomo is afraid of a royal commission into the banking system. Too many skeletons, moribunds and Frankenstein-like monsters lurking in the dark... So he prefers to let the wonky structure go on and on in sand-shoes as before with a band-aid fix from time to time while robbing us through an extra littlepucent bank levy...

The move for an inquiry into how banks treat small business customers should not overshadow the ongoing call for a broader royal commission on banks.

Several financial inquries (outlined below) have failed to tackle the growing concentration in the Australian finance sector, or the need to separate general banking from investment banking as the reform process in the United States, UK and Europe is contemplating.

Calls for a royal commission are also underpinned by ongoing reports of misconduct within the banks, summarised in a timeline of bad behaviour below.

Every other major industrial country is at an advanced stage in bank reform, and Australia would be isolated if it did not engage in a similar substantial and structural reform process.

read more:

http://theconversation.com/a-history-of-failed-reform-why-australia-need...

the game of money...

While a small group of mates continue to profit at the majority's expense, a growing number of innovators are implementing viable alternatives. Mike Dowson and Kevin Cox report.

THE BOOK, Game of Mates, by Paul Frijters andCameron Murray, exposes the corruption that pervades the Australian economy.

It shows how a relatively small network of well-connected people enriches itself at tremendous cost to the rest of the country.

Other recent research suggests Australia may be among the big offenders forcorruption. It seems the glare from the long resources boom has blinded us to skulduggery in the shadows. It’s not an image of our country most of us would celebrate.

So how do they do it? Few would be surprised to learn of clandestine meetings, secret deals, creative accounting and regulators looking the other way. But none of this could survive without some trickery of the first order. In fact, the biggest trick is one of the oldest. It goes back almost to the invention of money itself.

Australia's economy is at the mercy of a 'Game of Mates'https://t.co/1PSHAmsYod @IndependentAus

— Robyn Wheldall (@RWheldall) May 30, 2017The trick is to make money appear as a rare thing of value. That’s right, you read that correctly. It’s a trick.

Money certainly works as a measure and store of the value that resides in other things. Food, minerals, medicine and technology are all things of value in themselves. And money enables us to exchange them, even with people we don’t know, at a distance.

But the value isn’t in the money in the same way that nutrition isn’t in a can opener. Money is just a slip of plastic or a number in a database. What can you do with those? Nothing! Unless the rest of us who participate in the monetary system grant you the authority.

Money is permission from the people who provide goods and services for you to obtain some of them. That’s literally all it is.

Imagine if you alone could control who is granted that authority. That would be an awesome power, wouldn’t it? No matter that someone is hungry, while food is being thrown away. Without you granting your authority, nothing could be done for them. What would you make people do to get some money?

read more:

https://independentaustralia.net/politics/politics-display/australias-st...

On this site we've tackled this concept many times including:

http://www.yourdemocracy.net.au/drupal/node/7603

http://www.yourdemocracy.net.au/drupal/node/32382

http://yourdemocracy.net.au/drupal/node/29767

and for good measure:

http://www.yourdemocracy.net.au/drupal/node/9177

no tick, no done, no swoosh...

Gaping holes in the anti-money laundering systems of Australia's big banks are being exploited by crime groups to wash up to $5 million in drug cash a day, according to confidential briefings by federal and state policing agencies.

New details of police investigations reveal that the big four banks – Westpac, ANZ, NAB and CBA – have all been used by money laundering syndicates to launder drug funds offshore.

read more:

http://www.smh.com.au/business/banking-and-finance/its-not-just-cba-all-the-banks-are-exposed-to-millions-in-money-laundering-20170914-gyhhpi.html

See toon at top.

smoothing the corner-store...

No-one should be hoodwinked into believing that the move by the big four banks to drop withdrawal fees on automatic teller machines is all about putting the customer first.

While consumers will no doubt benefit from avoiding pesky $2 slugs that can add up to hundreds of dollars over a year, the planned, if not coordinated, decision is mostly about banks doing what it takes to avoid a royal commission into bad banking behaviour.

The Commonwealth Bank's play was media strategy 101 — roll the ATM decision out on a normally quiet Sunday, dominating news bulletins and forcing Westpac, ANZ and NAB to quickly follow to avoid being left behind.

While there is no evidence of price signalling or collusion, the rapid rollout of rare positive news demonstrates how closely banks negotiated within the rules to kill-off "foreign" transaction fees between their independent ATM networks, with CBA breaking ranks to seize the first mover advantage.

The positive spin throughout the day and on Sunday evening television news bulletins sent the message that the big four were "listening" to customers and were working hard to address image problems at a time when banks are on the nose more than ever.

Cynics have suggested that banks will make up the missing ATM fees elsewhere within their complex systems.

However, Australian Bankers Association chief executive Anna Bligh rejected the suggestion that banks will continue doing what they do best, assuring the ABC's AM program that "no – it's a hit to the bottom line."

read more:

http://www.abc.net.au/news/2017-09-25/banks-atm-fee-move-to-stave-off-ro...

no swoosh no swish... but a RC...

The Prime Minister has received an ominous warning from the head of a blue-ribbon New South Wales Liberal Party branch, calling on him to capitulate and establish a royal commission into the banks or face the issue contributing to a "wipe-out" at the next election.

Key points:The president of the Berowra Waters Liberal Party branch in Sydney, Peter McNamee, has made the impassioned plea, writing to Malcolm Turnbull to appeal for him to change his mind to avoid "deserting" those hurt by the banks who are the "backbone of our country".

Read more:

http://www.abc.net.au/news/2017-11-24/liberal-branch-president-wants-tur...

Read from top...