Search

Recent comments

- debt-fueled....

3 hours 40 min ago - cell mate....

3 hours 48 min ago - more tension....

7 hours 19 min ago - staying alive....

8 hours 27 min ago - corrupt.....

8 hours 39 min ago - grab-snatch....

8 hours 47 min ago - the divide....

10 hours 10 min ago - hospitalised....

10 hours 23 min ago - getting greener....

12 hours 50 min ago - matt's....

14 hours 31 min ago

Democracy Links

Member's Off-site Blogs

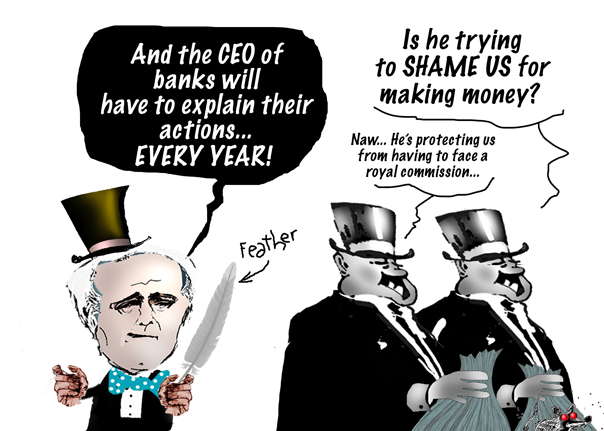

please explain banking...

Bank bosses will have to front up to a parliamentary committee annually to explain their actions on interest rates and other behaviour under new rules announced by Malcolm Turnbull.

The announcement came as Bill Shorten ramped up pressure for a royal commission into the banks, saying the industry would only respect the government if such an inquiry were implemented.

The prime minister said the move would ensure the big banks were regularly accountable to elected members in the same way as the Reserve Bank or the Australian Prudential Regulatory Authority (APRA).

Turnbull said the banks would appear before the house committee on economics. This would avoid the scrutiny of the Senate where long time campaigners on bank behaviour, such as Nationals senator John Williams, Greens senator Peter Whish-Wilson and Labor’s Sam Dastyari reside.

Asked how the government would enforce the requirement to appear, Turnbull said “the parliament has powers but they won’t be necessary, the banks will certainly appear”.

Steven Munchenberg, chief executive officer of the Australian Bankers Association (ABA), said while the federal government was entitled to the move, no other commercial businesses were required to justify pricing decisions in this way.

“We are confident banks can explain why the interest rates they set for borrowers are determined largely by the cost of funds and the pressures of a highly competitive market, not the Reserve Bank cash rate,” Munchenberg said.

There you have it... The banks don't have to say much more than : "the interest rates they set for borrowers are determined largely by the cost of funds and the pressures of a highly competitive market, not the Reserve Bank cash rate"

Could not have said it better myself...

- By Gus Leonisky at 4 Aug 2016 - 11:10pm

- Gus Leonisky's blog

- Login or register to post comments

this exchange rate would make newton proud...

Queensland man David Cooney could have bought a small car with the $14,000 in charges he incurred from Westpac and Commonwealth banks for moving money to England and back.

In 2013, Mr Cooney went to Westpac to change $357,000 into British pounds, and said the exchange rate he was given cost him $6,000 more than a benchmark Bloomberg rate referenced by big traders.

A few weeks later he had to bring some of his money back to Australia, this time with the Commonwealth Bank, and said the exchange rates cost him another $8,000.

"The least I can expect is that I can send it relatively safely through a bank and I keep most of it intact. I don't lose this huge amount of money remitting it out," Mr Cooney said.

The big banks have again avoided a royal commission, with the Government settling for the much less onerous task of requiring the banks to make an annual appearance before a parliamentary committee.

But in a sign the Government is feeling the heat, foreign exchange bank dealings with small customers are coming under scrutiny

http://www.abc.net.au/news/2016-08-04/government-ups-ante-on-banks-as-foreign-currency-dealings/7691540

When Isaac Newton was in charge of the Mint in England, he had some ingenious way to pay debts with various metals and making a killing on the exchange rate...

weak as piss...

Jeff Morris, the whistleblower who revealed a financial planning scandal at the Commonwealth Bank, has described the Coalition’s plan to haul the banks in front of a parliamentary committee as weak and “just for show”.

He also questioned whether political donations had been made by the banks to theLiberal party at the election, saying “we won’t know whether the banks have made donations until February next year”.

“What I want to see is questions asked in a royal commission with resources to test those answers,” Morris told Guardian Australia.

Asic examines claims CommInsure avoiding payouts to sick and dying

“It was a weak leader in a weak government delivering a weak response. Banks will continue to be the tail wagging the dog as long as we have that situation with government.”

But Morris remains hopeful a bank royal commission will still go ahead, saying there were a number of Coalition members who supported the move. Bank campaigner and Nationals senator John Williams supports a royal commission and resources minister Matt Canavan supported it prior to his promotion to cabinet.

Responding to criticism that his government’s plans were inadequate, Malcolm Turnbull said some banks had cultural problems which in some cases put profit before customers’ interests.

Asked if the banks were being greedy, the prime minister told radio 3AW: “well that is a fair question and that is why what we need to do is encourage a stronger culture of accountability and transparency”.

https://www.theguardian.com/australia-news/2016/aug/05/whistleblower-says-parliamentary-committee-on-banking-just-for-show

For the non-aussies who read these columns, "weak as piss" is a standard expression used to describe beer that has no taste...

show me the money...

Tens of thousands of Australians have had their lives ruined by the major banks. If there's no need for a Royal Commission because ASIC has greater powers, then why is the Turnbull Government wasting time and money on a parliamentary inquiry that has less power than both? Ian Verrender writes.

Welcome to this week's edition of Monday Conundrum. Today we have a real doozy.

Let's see if you can twist your mind around this: If there's no need for a Royal Commission into banks because the Australian Securities and Investments Commission has greater powers, then why is the Turnbull Government wasting time and money on a parliamentary inquiry that has less power than both?

You'll need quite some time to think through that one.

In salad terms, rather than the rocket, the newly elected government instead has opted for the iceberg; and a particularly wet and limp sample of the family Asteraceae it is too.

Given the admirable speed with which the government responded to the disturbing images emanating from the Northern Territory's juvenile detention centres, its longstanding reluctance to bring bankers to heel is perplexing.

You'll forever hear financiers argue that because of its strength, our banking system sailed through the financial crisis. Nothing could be further from the truth.

Surely it couldn't have anything to do with the fact that our financial services industry is the biggest political donor in the country. The big four alone donated more than $730,000 in the year to June last year. And that's before bank and finance industry lobby groups kicked the tin.

The comparison with the NT inquiry is entirely valid. Tens of thousands of Australians have had their lives ruined by the mounting toll of atrocities that have come to light in the past decade from the major banks' role in the Storm Financial meltdown, the financial planning and insurance scandals through to rigging of the interest rate setting markets.

For the past decade, we have been regaled with tales of rampant fee gouging, conflicts of interest and falsification of loan documents driven by a sales culture that has elevated profits above all else.

While last week's decision to not pass on the full Reserve Bank rate cut reignited community anger, it was merely a continuation of the cartel-like behaviour that has seen the big banks once again acting in unison, just as they have for the past 20 years.

Here are a couple of myths the banks love to perpetuate that need busting.

1. Bank funding costs

If you believe the big four banks, they simply can't pass on Reserve Bank cuts in full because the rate it sets only partially determines their cost of raising money. And the cost from other sources is rising.

That's entirely true. But before we start, it's worth remembering that banks are like every other kind of business. They buy money cheaply and make a profit by selling it at a higher price.

In a normal competitive market, businesses are price takers. They have no power over what they charge. The only businesses that can fix prices are monopolies or oligopolies, where a couple of big players act in unison. Sound familiar?

Tuesday was a classic case. Within minutes of the Reserve Bank decision, the Commonwealth Bank announced that it would pass on just half the cut to borrowers but would bump up the rate it pays to investors for some term deposits.

Blow me down, if during the course of the next hour or so, the other three did exactly the same. It was uncanny.

2. We need a strong banking system

Who has ever argued we need a weak one? This little smokescreen belches across the media every time there is any criticism about the huge profits our banks generate.

The Commonwealth Bank is hurtling towards a record $9 billion annual profit, due to be unveiled this week. There is no denying the enormity of the earnings. But that's just one measure of its heavyweight status. It is the amount it generates off its capital base that is truly astounding. Last year, it managed a return on equity of 18.2 per cent.

Compare that to Citi, one of the world's biggest banks. While its earnings were larger, Citi could only generate a return of about half that of the CBA.

The other three local banks aren't too far behind the CBA on that measure. In short, they are cash generating machines, the likes of which global banking behemoths can but dream.

A study by The Australia Institute released last week puts those earnings in another light. Our banks generate an annual income equivalent of 2.9 per cent of GDP. That's Olympic gold and puts them in a class of their own. In the US, American bank earnings - massive as they are - pull in around 1.2 per cent of GDP.

The reason they can achieve these magnificent results is because of their pricing power and their stranglehold over not just banking but insurance, superannuation and almost every other form of financial service you can think of.

We need a strong banking system, not one that exerts too much power.

3. No other industry is subject to this kind of scrutiny

That's debateable. What isn't up for argument is that no other industry enjoys the kind of taxpayer support that our financial sector enjoys.

Farmers and small businesses can go broke. The car industry can be told to pack and leave. But not the banks.

You'll forever hear financiers and their apologists argue that because of its strength, our banking system sailed through the financial crisis eight years ago unscathed.

Nothing could be further from the truth. After furious lobbying, initially from Macquarie Group, the Rudd government imposed a ban on short selling of bank and finance stocks in an effort to stave off collapsing share prices. It then guaranteed bank deposits.

On top of that, it handed our banks the keys to the country's AAA credit rating. If it hadn't done so, our entire banking system was in danger of collapse. Having borrowed hundreds of billions of dollars from wholesale credit markets offshore, they were facing ruin because credit was frozen and no-one would lend them the cash to refinance.

Taxpayers rode to the rescue. Our banks borrowed $120 billion using that taxpayer guarantee, a bailout never before seen and unlikely to ever be witnessed again. They've since argued it wasn't a bailout because they had to pay fees to use the guarantee. You have to chuckle; bankers complaining about being charged a fee.

It doesn't end there. A Reserve Bank study released as part of a FOI request in May revealed our four major banks get an annual $4 billion leg up as a result of that emergency GFC action. Foreign lenders give them a rate discount because they now know Australian taxpayers will bail them out if anything goes wrong.

4. The bad behaviour is overstated

It's all the fault of a few bad apples. Why are orchardists tarnished in this manner?

Globally, banks have been fined a collective $US200 billion and, while admitting criminal behaviour in the manipulation of interest rates, foreign exchange and gold markets have seen a mere handful of employees end up behind bars.

At least the UK and US regulators were on the front foot in those cases. Our corporate cop has only just gotten around to launching action on the rate rigging and so far, the case appears far from solid.

So, ask yourself this: Why are our banks so afraid of a Royal Commission, especially if it's all the fault of those few bad apples? The answer lies partly in the enormous bonuses paid to those interest rate traders now accused of being rogue.

You only score a $5 million annual bonus for generating vast amounts of wealth to the organisation, which in turn bumps up the bonuses for everyone above you. How much wealth? That's what our banks don't want you to know.

Ian Verrender is the ABC's Business Editor.

http://www.abc.net.au/news/2016-08-08/verrender-four-myths-busted-why-we...

a royal commission into banking is a bad idea...

Well, this is the mantra of investors.

Banking around the planet is a bit sick. Governments have to give banks extra cash to the banks for them to borrow more money because money is cheap because government keep printing more cash to stimulate a sick economy, which is so moribund, it does not respond to the treatment — and because the rich geezers siphon 90 per cent of the cash to become richer. We the plebs see nothing. Investors in bank deposit are making zilch, zero, nada, bugger all. The only things that are economically survivable in Australia are Banks and Real Estate. Everything else that had a "manufacturing sumpthin'" component has gone down the tube. We don't dirty our hands in this country, we invest into investments. Salute the flag.

Even the State Government of NSW prefers to give jobs to the Koreans for saving a bit of cash on its bottom line, ahead of giving local people who work in regional Australia and will thus soon become dole-bludgers according to the shock-jock ladder of employment and butt-kicks of the unemployed rorters. You had a decent job building trains, now you can clean the streets for a quarter of what you made playing with trains. And don't you dare ask for a hand-out from the governments.

So there, the only decent investments in this country are Banks and Real Estate.. Well real estate was good till yesterday. Now it is tanking everywhere in the country, except in Sydney because everyone you know wants to live there. So should you start an investigation into how rotten the banks are, you will discover how rotten the banks are, their share price and profits will tank and may as well close shop, sell the country to the Chinese and become their bitch.

Who cares if the banks have swindled a few dollars from poor people? Now it's time to support the Aussie Banks and make sure that when they gouge extra fees, it's for the benefit of the country as a whole. Stand proud: you're doing your bit by paying more.

and no-one is going to prison...

Wells Fargo Fined $185 Million for Creating Phony Accounts and Credit Cards

SEPTEMBER 09, 2016HEADLINESWells Fargo will pay $185 million in fines after it was caught illegally manipulating customers’ bank accounts in order to rack up fees and other charges. The Consumer Financial Protection Bureau found Wells Fargo employees secretly opened phony bank accounts and issued credit cards to customers who did not want them. These practices led to overdraft charges, late fees and other penalties. The bank has fired at least 5,300 employees involved in the illegal activity.

http://www.democracynow.org/2016/9/9/headlines/wells_fargo_fined_185_million

read from top...

the one nation connection...

In derailing Rodney Culleton's bid for a banking royal commission, Pauline Hanson has sold out farmers and proven herself to be no more than an LNP lapdog. Sydney bureau chief Ross Jones reports.

It’s fair to say the election of Rodney Culleton as a WA One Nation senator didn’t go down all that well among some of WA’s farming community.

Local farmer and Shire of Wagin President Phillip Blight said Mr Culleton’s election had left a bitter taste in the mouths of many local farmers and their families and the general community.

Do a search on "Rodney Culleton Farmers" and a litany of bitterness towards the "maverick" pours forth. Allegations of bad debts and missing funds are not hard to find.

I have never met Rodney, but I have held several telephone conversations with him and do know this: wind him up and he’s pretty hard to stop.

Rodney’s pet beef (or maybe wheat in his case) is against the banks. Get him going on forced farm foreclosures and stand back.

Rodney threatened to use his senate megaphone to push hard for a royal commission into the banking sector and its darker activities. His colourful rustic language, coupled with serious allegations of bank impropriety made under senate protection, would be media gold and pour high octane fuel on public demand for a bank RC.

The Coalition and its donors most definitely do not want a banking royal commission.

Ergo the Coalition needed to be rid of Rodney. And in the guise of Senators Brandis and Parry, it is trying to do just that.

Operation Rissole Rodney (ORR; classification: Need to Know) is a messy plot with many strands, but the LNP have a solid track-record in this regard. I give you Ashbygate.

In fact, Ashby himself has been playing a vital role in ORR.

It went like this:

Everyone, including Rodney, was surprised at his election.

Pauline picked Rodney, he did not choose her, she knew what he was a man with a tough farming background and a way with words. She assured him he would have the freedom to do what he thought was right for his constituents providing he stuck to One Nation policy.

Back then, a banking royal commission was One Nation policy (or at least, they let everyone think it was).

That is, until August 2016, when Rod and Pauline had a meeting with Turnbull. Rod explained to Malcolm, while proffering reams of evidence, that the banks were committing crimes against the farming community and this needed to be both exposed and stopped.

read more:

https://independentaustralia.net/politics/politics-display/one-nation-wa...

See toon at top...

flowers for the banks as well...

The Australian prime minister, Malcolm Turnbull, has shot down a proposal to exempt the big four banks from the government’s company tax cuts.

Some Liberal MPs are pushing for the exemption, especially after the former Queensland premier Anna Bligh was announced as the sector’s chief lobbyist.

The Australian Bankers Association on Friday named Bligh as its new head.

The Liberal backbencher Luke Howarth said Bligh’s appointment added more weight to the argument to leave the big four out of the Coalition’s policy to reduce tax rates over a decade.

read more:

https://www.theguardian.com/australia-news/2017/feb/18/excluding-big-ban...

The "business" tax cuts proposed by Turnbull and his crew of thieves actually do not have a shred of evidence that they will improve the bottom line of the country. To the countrary. The payoff is very very very thin while the cost is quite high: $54 billion.

See also:

https://www.theguardian.com/business/grogonomics/2017/feb/14/the-governm...

The government argues its plan to cut company tax will drive investment and create jobs, but a new report by progressive think tank, the Australia Institute, questions that assumption. The report’s authors argue that 15 of Australia’s largest companies – which would receive around a third of the cost of the tax cuts – are unlikely to invest in areas that would drive either economic growth or employment.

The government’s case for why we need company tax cuts has always rather struggled to match rhetoric with evidence.

Trickle trinkle trundle little tax, banks wonder why pay tax...

See toon at top...

a swallow doesn't spring make...

The Coalition has used an ANZ credit card interest rate cut of 2% as evidence that its oversight of the big four banks using a parliamentary committee is working and a royal commission is not needed.

Malcolm Turnbull and LNP MP Scott Buchholz, who sits on the house joint standing committee on economics, welcomed the cut as pressure continues to mount on the government and the big four banks for a royal commission.

Buchholz, a member of the parliamentary economics committee, has recommended any credit card customers unhappy with their current interest rates move to the ANZ.

Buchholz said although the standard variable interest rate had dropped to follow the cash rate, historically, credit card rates had not fallen.

After ANZ cut its platinum card by 2% to 11.49% on Saturday, Buchholz said ANZ showed commercial courage in making the move, which would cost the bank $25m a year.

“[ANZ] have showed commercial courage in this space and leading the charge on dropping their rates first and I would encourage anyone who has got a credit card in Australia if they are not happy with the interest rates they are paying in Australia at the moment, to migrate to the ANZ,” Buchholz told the ABC.

read more:

https://www.theguardian.com/australia-news/2017/feb/19/coalition-cites-a...

Of course these small adjustments in credit interests will be offset for the banks by a generous government TAX CUT on the way. Note that this small adjustment would cost the bank about $25 million per annum while its profit for 2016 was about $5.7 billions... The Tax break offset could bring the bank about $400 millions.

a new way to syphon your cash...

The major banks have reacted angrily against the Government’s Budget proposal to impose a bank levy, with the Australian Bankers Association (ABA) declaring there was no consultation on the issue.

ABA chief executive, Anna Bligh described the levy as "a direct attack on jobs and growth, not just a tax on the five largest banks".

"It is a tax that will hit Australians by hurting investment and could have unintended consequences," she said. "Contrary to the Government’s claim that the tax will only be levied on banking liabilities, the reality is that it will affect the entire banking system."

Related News:"This new tax is not a well thought out policy response to a public interest issue, it is a political tax grab to cover a budget black hole," Bligh said. "It is naïve and misguided and has already sent the wrong signals to global financial markets about the strength and stability of our banking sector. Market speculation about this new tax just today stripped around $14 billion from the value of life savings and superannuation accounts of ordinary Australians after bank shares plummeted."

Bligh said it was particularly disappointing there had been no consultation with industry about the new tax stating that in a period in which there had never been more consultation between Government and banks on a wide range of issues, "on this issue there has been none".

read more:

http://www.moneymanagement.com.au/news/policy-regulations/major-banks-ba...

The neat trick is that someone will have to pay for the new levy on banks and it ain't going to be the banks. It's going to be the users of the banking system. The banks won't erode their profit margin in order to save a "mate" in government. So the banks will turn on the vacuum cleaners that sweep the small change in your pockets by a couple of notches. So in the end, the government HAS TO KNOW that ordinary people will end up paying more "contribution" to its coffers, via the banks now officially collecting more dough on behalf of the government. The banks have become default tax collectors.

So why are the banks annoyed? Banks will have to find a way to disguise this new heist and minimise trauma to their customers... Like for example banks are competing for the lucrative credit card market. Here they will ask you to transfer your maxxed credit card and THEY WILL CHARGE YOU NO INTEREST on the transferred amount for twelve months. Yoohoo ! But there is a small print that says they will charge a one-off (small) transfer fee which amounts to 1.5 per cent of the amount owing on your credit card... At this level the bank appear to loose money, but in the long run, they will own you... and this is the name of the game. How many of you have closed banks accounts that still show on the registry of banks? All of you I suppose. In the last transaction of the closure, the banks make a tiny mistake in your favour. And until that debt to you is paid, the bank account is still "operative". I had to go to a bank once and demanded it gave me the two cents that the bank owned me.... It was like dealing with an international incident... See toon at top.

inside trading from within the government...

Leaked news of a budget bank levy wiped $14 billion from the banking sector in one day — will anyone be investigated for insider trading? Asks Michael West.

THE BIGGEST INSIDER TRADE of the year has just been executed before our very eyes thanks to a monumental government leak.

Word of the Federal Budget measure to hit the banks with a $6 billion tax hike spread through the market late yesterday, wiping $14 billion off the value of the banking sector.

Now, bank stocks are bouncing.

Those who sold and short-sold bank stocks on yesterday’s leak – and ensuing “rumourtrage” – will have cleaned up.

No doubt many are “covering” their positions, that is buying back bank stocks, right now.

And that may be a wise thing. Despite of the bank-lobby scaremongering in the financial press, the banks are effectively an oligopoly which will simply compensate itself for the $6 billion Federal Budget hit via shareholders or customers.

As new lobby boss Anna Bligh – former Queensland premier and now chief of the Australian Bankers Association – inferred menacingly in ABC Budget coverage last night, the banks would “make it up” elsewhere.

read more:

https://independentaustralia.net/politics/politics-display/budget-2017-t...

Complacency and complexity, arrogant and insular...

Is there anything here we didn't already know?

Complacency and complexity, arrogant and insular, a culture that allowed bank executives to operate without fear of penalty. Strong words, indeed.

For all the searing criticism, the irony of the Australian Prudential Regulatory Authority's reportinto the ethical vacuum in which the Commonwealth Bank has operated is that it perpetuates the very climate it condemns.

Despite the litany of wrongdoings, APRA has imposed no real penalties.

Instead, the bank has been forced to put aside an extra $1 billion in reserves to cover the potential fallout from its misdeeds.

And, once again, we have a regulatory body delivering the legal equivalent of a slap with a wet lettuce.

Rather than fines or charges, the bank regulator instead has resorted to "enforceable undertakings", essentially exacting a promise from the CBA that it won't do this kind of thing ever again.

Read more:

http://www.abc.net.au/news/2018-05-01/apra-talks-tough-but-feathers-cba-...

Read from top

sharks now in charge of soothing your emotions...

The big four banks have been told to tip at least $20 million each year into financial counselling services.

Treasurer Josh Frydenberg has welcomed the recommendation, contained in a report to the federal government, as he tours outback towns affected by drought.

“We certainly support increased money into financial counselling services and indeed, here in these regional communities hit by drought, we have supported that strongly,” he told ABC News on Thursday.

“We have seen the number of regional financial counsellors go from over 500 to over 700.

“So, we will continue to provide that support and we do expect the financial services companies like the banks to be investing in these important services for communities.”

Read more:

https://thenewdaily.com.au/news/national/2019/10/03/banks-counselling/

from ten years ago...

Read from top.

a sigh of relief: banks...

More than half of the recommendations made by the banking royal commissioner, Kenneth Hayne, have either been abandoned or are yet to be fully implemented, almost two years after the treasurer received the inquiry’s final report and vowed to take action on all recommendations.

Regulators put implementation of some recommendations on hold during the peak of the coronavirus crisis, but consumer groups fear Josh Frydenberg has taken advantage of the delay to undermine the pro-regulation consensus established by the royal commission, which followed more than five years of scandal in the financial services industry.

Frydenberg said that despite the coronavirus crisis more than 70% of the royal commission’s recommendations requiring action by the executive government had been implemented since he received the report from Hayne at a frosty handover meeting in Canberra on 1 February 2019.

However an analysis by Guardian Australia of all 76 of Hayne’s recommendations shows that 44 have yet to be implemented and five have been abandoned.

Three, which involve reviews of progress in making changes, are not yet due.

Read more:

https://www.theguardian.com/australia-news/2021/jan/19/banking-royal-commission-most-recommendations-have-been-abandoned-or-delayed

Read from top.

See also:

(List to come)