Search

Recent comments

- pub test....

18 min ago - between....

2 hours 20 min ago - sad victories.....

2 hours 38 min ago - in jirikov.....

2 hours 23 min ago - ICC failure....

13 hours 7 min ago - yuckrainian nazis....

13 hours 19 min ago - buying toys....

15 hours 10 min ago - megyn believes.....

16 hours 24 sec ago - hot water....

16 hours 36 min ago - zelensky's end....

18 hours 32 min ago

Democracy Links

Member's Off-site Blogs

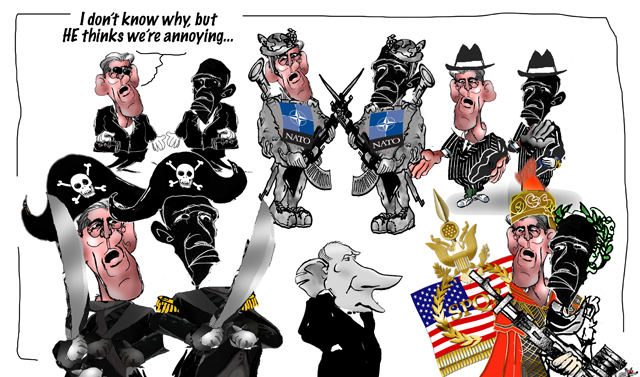

nato: holier than thou...

On its website, NATO tells us it is not encircling Russia. Don't smile. Without laughter NATO also tell us that the Kosovo removal from the former Yougoslavia cannot be compared with the removal of Crimea from Ukraine, despite strong ethnic lines. See, it took more than 3,000 days of negotiations including three years of murderous war to "liberate" Kosovo (now a hotbed of terrorists in Europe), while it only took two days for the Russians to "liberate" Crimea. NATO resents the fact it was not allowed to bid on making the conflict last longer — at least three years or more.

Not "encircling" Russia? Pull the other leg.

- By Gus Leonisky at 9 Jun 2016 - 5:03pm

- Gus Leonisky's blog

- Login or register to post comments

war made easy...

https://www.youtube.com/watch?v=R9DjSg6l9Vs

Norman Solomon (born July 7, 1951) is an American journalist, media critic, antiwar activist, and former U.S. congressional candidate. Solomon is a longtime associate of the media watch group Fairness & Accuracy In Reporting (FAIR). In 1997 he founded the Institute for Public Accuracy, which works to provide alternative sources for journalists, and served as its executive director until 2010. Solomon's weekly column, "Media Beat", was in national syndication from 1992 to 2009. More recently Solomon focused on his 2012 congressional campaign in California's 2nd congressional district.

Solomon came under FBI scrutiny after he picketed for the desegregation of a Maryland apartment complex at age 14. He drew further FBI surveillance for his efforts on behalf of the Montgomery County Student Alliance activist group both while a student and after dropping out of high school.[1] He became aware of their surveillance later, through a Freedom of Information request. According to Solomon's autobiography, a book he titled Made Love, Got War, he chose to drop out of high school during the summer after he completed his Junior year of high school.

After high school, Solomon briefly attended Reed College in Oregon taking some writing courses but left before graduating. In college, he began a lifelong commitment to peaceful protests against nuclear power and nuclear weapons. Solomon engaged in civil disobedience as part of the anti-nuclear movement, and eventually spent 40 days in jail as a result. He made eight trips to Moscow during the 1980s, including one during which he and a leader of a veterans' group organized a sit-in at the U.S. Embassy, demanding that the U.S. join the Soviet Union in a halt to tests of nuclear bombs.[2]

Writer and media critic

As a freelance reporter, Solomon worked for a number of years for Pacific News Service.[3] In 1988, Solomon worked briefly as a spokesperson for the Alliance of Atomic Veterans in Washington, D.C.. He was hired in August 1988 to run the new Washington, D.C., office of Fairness and Accuracy in Reporting.

In 1997, Solomon published The Trouble With Dilbert, in which he charges that the popular comic strip Dilbert is a capitalist tool that promotes the evils of corporate America by pretending to satirize all the inhumane treatment, so employees will purchase Adams' works, thinking that they are supporting their own cause. Dilbert creator/author Scott Adams responded in his 1999 book The Joy of Work, which included an imaginary interview between Norman and Adams' canine character Dogbert. He remarked that Solomon was wrong as most workers in corporate America should simply go capitalist themselves.

A book of Solomon's collected columns, The Habits of Highly Deceptive Media, won the 1999 George Orwell Award for Distinguished Contribution to Honesty and Clarity in Public Language. Jonathan Kozol's introduction to the book noted "the tradition of Upton Sinclair, Lincoln Steffens, and I. F. Stone does not get much attention these days in the mainstream press ... but that tradition is alive and well in this collection of courageously irreverent columns on the media by Norman Solomon...."[3]

In 2000, Solomon teamed up with fellow investigative reporter Robert Parry to write a series of investigative reports on George W. Bush's Secretary of State Colin Powell, published on consortiumnews.com.[4]

His book Target Iraq: What the News Media Didn't Tell You (co-authored with Reese Erlich) was published in 2003 and translated into German, Italian, Hungarian, Portuguese, and Korean. War Made Easy: How Presidents and Pundits Keep Spinning Us to Death appeared in 2005. The Los Angeles Times called the book "a must-read for those who would like greater context with their bitter morning coffee, or to arm themselves for the debates about Iraq that are still to come."[5] A documentary based on the book was released in 2007.

Solomon is the founder and former executive director of the Institute for Public Accuracy, an organization founded in 1997 "as a national consortium of independent public-policy researchers, analysts and activists."[3][6] According to its web site, the mission of IPA is to increase "the reach and capacity of progressive and grassroots organizations (at no cost to them) to address public policy by getting them and their ideas into the mainstream media".[6]

https://en.wikipedia.org/wiki/Norman_Solomon

See also: http://yourdemocracy.net.au/drupal/node/11276 and many articles on this site about the crap that is sold to us by the USA. WAKE UP !

time to get rid of the US straightjacket...

Europe Should 'Make a Break From US' to Avoid Austerity, Re-Embrace Russia

The current standoff between the G-7 and Russia will remain, unless the European members of the group makes a break from US and NATO policy, Michael Hudson, President of the Institute for the Study of Long-Term Economic Trends, told Radio Sputnik.

Happier Together: Europe Should Overcome Brussels' Restraints and Form New Union With Russia, UKIn an interview with Sputnik, Michael Hudson, President of the Institute for the Study of Long-Term Economic Trends, warned that the ongoing standoff between the G-7 countries and Russia will be in place, unless the group stops taking cues from NATO and the United States.

The interview came after German Minister for Economic Affairs and Energy Sigmar Gabriel called for the G-7 nations to allow Russia to rejoin the economic group as soon as possible.

Hudson, for his part, warned Europe against being politically subjugated by the United States.

"As long as Europe remains almost a political colony of America they can look forward to further austerity and further industrial shrinkage," he said.

Touching upon relations between the G-7 and Russia, Hudson also warned against Washington's influence on the group.

"The relations will not improve much, unless the G-7 is willing to make a break from the United States and NATO and as long as G-7 countries are basically letting their foreign policy being set by the military commanders put in charge by NATO," he said.

Meanwhile, in an interview with the German website Russlandkontrovers, Sigmar Gabriel called Russia an important global player and said that long-term exclusion of the country from the group would only deepen existing divisions and would not help achieve a political solution.

Gabriel also stressed that despite current tensions and problems, Russia remained an important economic partner for Germany. He added that it was particularly important to strengthen international bodies when there were differences to overcome.

PACE Head Wants Russia to Take Part in All Activities of Council of EuropeThe comments of the German Minister for Economic Affairs came a few days after a top advisor to German Chancellor Angela Merkel said it was too early to discuss the lifting of sanctions against Russia.

Earlier this week, the Financial Times reported that with some EU countries calling for softening the restrictive measures against Moscow, Brussels is, however, set "to roll over its Ukraine-related sanctions against Russia for a further six months."

The extension of the anti-Russian sanctions will be high on the agenda of the two-day EU summit, which kicks off on June 28. Hungary, Cyprus, Greece, Italy and Slovakia are expected to call for the easing or lifting of the restrictive measures.

Read more: http://sputniknews.com/world/20160611/1041170151/europe-russia-us-relations.html#ixzz4BG4VjsYt

Michael Hudson would not be too popular in the US, as he basically tells the truth:

Views[edit]On prices[edit]

Hudson argues that even if higher labor-productivity has reduced the value of commodities produced, higher prices can nevertheless be charged when a few large corporations control most of the supply chain for those commodities. And when accumulated savings are used by investors to buy up assets for the purpose of capital gain, companies can "bid up" asset prices, with the end result that price-levels rise regardless of real production costs. In that case, the final prices charged for goods and services include an "economic rent" component, i.e. an "unearnt income" or rental which is appropriated by those who own the property rights of a resource, and which is quite unrelated to the real production costs.[9] The extraction of property rent is often not clearly visible, because it is disguised as the cost of a "service". When the interest and rent component in the cost structure of products becomes large, Hudson thinks one can validly speak of a "rentier capitalism".[10]

On parasitic financing[edit]Hudson states finance has been key to guiding politics into reducing the productive capacity of the U.S. and Europe, even as the U.S. and Europe benefit from finance methods using similar and expanded techniques to harm Chile, Russia, Latvia, and Hungary.[11] He states parasitic finance looks at industry and labor to determine how much wealth it can extract by fees, interest, and tax breaks, rather than providing needed capital to increase production and efficiency. He states the "magic of compounding interest" results in increasing debt that eventually extracts more wealth than production and labor are able to pay. Rather than extracting taxes from the "rentiers" to reduce the cost of labor and assets and use the tax revenue to improve infrastructure to increase production efficiency, he states the U.S. tax system, bank bailouts, and quantitative easing sacrifice labor and industry for the benefit of the finance sector.

He states the Washington Consensus has encouraged the IMF and World Bank to impose austerity that the U.S. itself is not exposed to (thanks to dollar dominance) which leads to subjecting other countries to unfair trade that depletes natural resources and privatizing infrastructure that is sold at distressed prices that uses parasitic finance techniques (including western-style tax breaks) to extract the maximum amount of the country's surplus rather than providing a price-competitive service.

On the banking crisis[edit]Hudson states that the mortgage crisis was caused by parasitic finance that used law and outright fraud, and that the government backing of toxic debt andquantitative easing are ways to keep real estate inflated while the banks shift the real losses to U.S. labor, taxpayers, and the international community. Hudson states "quantitative easing" and "restoring stability" are euphemisms for the U.S. finance sector using the Federal Reserve and dollar dominance to engage in financial aggression to a degree that previously required military conquest.[2] He points out Joseph Stiglitz has similar views. He states banks should have been allowed to fail with the government stepping in to protect savings and continue with qualified loans towards real productive capacity rather than financial loans that merely inflate asset prices. He states the Federal Reserve needs to understand inflating asset prices with low interest rates does not increase the long term productive capacity of the economy.

On dollar dominance[edit]Hudson views dollar hegemony as grossly unfair and gives various opinions as to why countries tolerate it: desire to prevent their currency from appreciating, limited options in purchasing alternative U.S. assets, fear of the U.S. military, wanting to be part of the U.S. "orbit", and "lack of imagination". He states the dominance protects the U.S. from austerity that it has subjected other countries to through the IMF and World Bank. He states the U.S. treasury debt is limited only by the net productive surplus of the world as measured by the balance of payments. He states it will end only when countries decide to take political action in their own best interests and break dollar dependence.[7]

He states that the world is dividing into two currency blocs as countries, led by China, try to get away from dollar dependence by creating non-dollar trade between the BRIC countries as well as most of Asia, Iran, Nigeria, and Turkey. He says it's happening now because "the United States is trying to rescue the real estate market from all the junk mortgages, all the crooked loans, all of the financial fraud, instead of just letting the fraud go and throwing the guys in jail like other economists have suggested."[2]

Hudson views foreign central banks buying treasuries as a legitimate effort to stabilize exchange rates rather than a currency "manipulation". Foreign central banks could sell the excess dollars on the exchange market which would appreciate their currency, but he calls this a dilemma because it decreases their ability to continue a trade surplus, even though it would also increase their purchasing power. He believes "keyboard credit" and treasury outflows in exchange for foreign assets without a future means for the U.S. to repay the treasuries and a decreasing value of the dollar is akin to military conquest. He believes balance of payments "surplus" countries have the right to stabilize exchange rates and expect repayment of the resulting loans even as industry shifts from the U.S. to creditor nations.

Hudson states that a balance of payments "deficit" is mostly the result of military spending and capital outflows rather than the trade deficit. It "forces" foreign central banks to buy U.S. treasuries that are used to finance the federal deficit and thereby a large U.S. military.[11] The balance of payments deficit is also caused by quantitative easing that encourages purchases of foreign currencies and assets that results in even more treasury purchases.[12] In exchange for providing a net surplus of assets, commodities, debt financing, goods, and services, foreign countries are "forced" to hold an equal dollar amount of U.S. treasuries. It drives U.S. interest rates down which enables a currency trade that causes a feedback process that exacerbates the problem, as long as foreign countries insist on off-loading the dollars by buying U.S. treasuries despite the risks of a dollar devaluation.

https://en.wikipedia.org/wiki/Michael_Hudson_(economist)