Search

Recent comments

- 3Xwars is 3Xpeace?....

1 hour 23 min ago - futile trousers....

1 hour 45 min ago - reading reality....

2 hours 18 min ago - colonel blimp....

2 hours 27 min ago - ambassador, please!

10 hours 41 min ago - yuckraine is corrupt....

13 hours 31 min ago - reviving bucha....

13 hours 52 min ago - US complaints.....

16 hours 27 min ago - worse than worst.....

19 hours 52 min ago - of hostages...

19 hours 56 min ago

Democracy Links

Member's Off-site Blogs

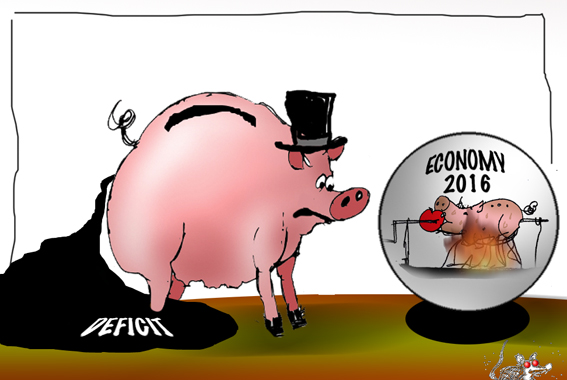

It's a very ugly picture out there...

The Royal Bank of Scotland has sent out a research note calling for clients to brace themselves for what would be a "cataclysmic year" on the markets.

The bank's advice? "Sell everything".

However, the note has been met with plenty of cynicism.

"I think it's probably the worst kind of recommendation you could make," responded Robert Pavlik from Boston Private Wealth.

Despite investment guru George Soros also recently warning of another major financial crisis, commodities analyst Edward Meir from INTL FCStone said the RBS note is way too pessimistic.

"I think that is over-blowing it. You know, we are not, we're not seeing a repeat of 2008/2009," he said.

Despite his call for calm, Edward Meir conceded the current international economic environment is not pretty.

"It's a very ugly picture out there," he added.

http://www.abc.net.au/news/2016-01-13/oil-prices-slump-rbs-sell-everything-advice-rejected/7085340

- By Gus Leonisky at 13 Jan 2016 - 3:40pm

- Gus Leonisky's blog

- Login or register to post comments

blame china syndrome...

Global markets are facing a crisis and investors need to be very cautious, billionaire George Soros told an economic forum in Sri Lanka on Thursday.

China is struggling to find a new growth model and its currency devaluation is transferring problems to the rest of the world, Soros said in Colombo. A return to positive interest rates is a challenge for the developing world, he said, adding that the current environment has similarities to 2008.

Global currency, stock and commodity markets are under fire in the first week of the new year, with a sinking yuan adding to concern about the strength of China’s economy as it shifts away from investment and manufacturing toward consumption and services. Almost $2.5 trillion was wiped from the value of global equities this year through Wednesday, and losses deepened in Asia on Thursday as a plunge in Chinese equities halted trade for the rest of the day.

“China has a major adjustment problem,” Soros said. “I would say it amounts to a crisis. When I look at the financial markets there is a serious challenge which reminds me of the crisis we had in 2008.”

read more: http://www.bloomberg.com/news/articles/2016-01-07/global-markets-at-the-beginning-of-a-crisis-george-soros-says

going down, selling the silver...

A vicious and broad sell-off has pushed the ASX to its lowest point since mid-2013, taking this year's losses to more than $110 billion, after the continuing rout in commodity prices, and particularly in oil, sparked an overnight plunge on Wall St.

http://www.smh.com.au/business/markets-live/markets-live-asx-on-the-edge-20160113-gm5g4y.html