Search

Recent comments

- debt-fueled....

5 hours 29 min ago - cell mate....

5 hours 37 min ago - more tension....

9 hours 8 min ago - staying alive....

10 hours 17 min ago - corrupt.....

10 hours 29 min ago - grab-snatch....

10 hours 37 min ago - the divide....

12 hours 14 sec ago - hospitalised....

12 hours 13 min ago - getting greener....

14 hours 40 min ago - matt's....

16 hours 21 min ago

Democracy Links

Member's Off-site Blogs

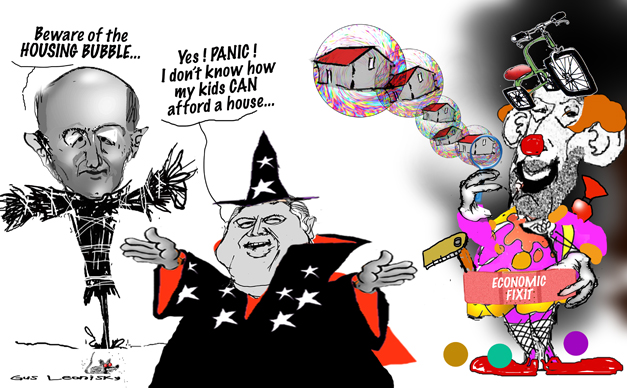

your future is in the hand of a scarecrow, a clueless wizard and a clown who blows bubbles. sleep well...

Australia should hold fire on interest-rate cuts to avoid further inflaming property prices that are at risk of "a sharp correction," the Organisation for Economic Cooperation and Development said.

"The net gains from further monetary expansion in the near term are finely balanced," the OECD said in Paris on Wednesday.

"The momentum in the housing market and possible need for expansionary firepower given uncertainties in the macro-economic outlook suggest caution."

The warning on property echoes Treasury Secretary John Fraser's observation on Monday that Sydney housing is "unequivocally" in a bubble. And financial system inquiry chief David Murray said on Tuesday that soaring house prices in Sydney and parts of Melbourne posed a risk to the economy, if the boom was followed by a crash in prices,

On Thursday, Treasurer Joe Hockey said he "wondered" how his children might afford a home but said he did not support any intervention in the market to deflate house prices.

"I like many others, if you have a home, even with a mortgage, you wonder how your children are going to get a home," the treasurer told the ABC on Thursday morning

- By Gus Leonisky at 4 Jun 2015 - 12:43pm

- Gus Leonisky's blog

- Login or register to post comments

bubble in potts point...

A couple of weeks ago while walking around the neighbouring suburb of Potts Point I happened across a crowd gathered for the onsite auction of a bedsit apartment. This unit was almost too small to swing a cat in, needed renovation, sat on a busy street with no view and was housed in a shabby 1960s block. After a frenetic 10-person bidding war it sold for around half a million dollars.

It would be interesting to know who financed that purchase.

On Monday Treasury Secretary, John Fraser, declared that Sydney and parts of Melbourne were "unequivocally" a residential property bubble. He was on the money.

http://www.smh.com.au/business/comment-and-analysis/sydney-and-melbourne-housing-bubble-stealing-oxygen-from-the-broader-economy-20150601-ghe9ar.html

worse trade deficit ever...

Australia has posted its worst monthly trade deficit on record, with imports exceeding exports by nearly $3.9 billion.

Bureau of Statistics data show the deficit of $3,888 million in April just edged the previous record of $3,881 million set in February 2008 as commodity prices slumped during the peak of the global financial crisis.

The data shocked economists, who had been expecting a poor result but nowhere near as bad as the actual figure.

The typical forecast in a Reuters survey was for a deficit of $2.25 billion, which would have already been almost twice the previous month's trade shortfall.

The actual result is more than treble March's downwardly revised $1,231 million seasonally adjusted deficit.

read more: http://www.abc.net.au/news/2015-06-04/trade-deficit-more-than-trebles/6521468

the full box set of turdy and hockey's incompetence...

Is it still possible to regard the Abbott administration as merely incompetent — or does it have another agenda? Alan Austin investigates.

"This Government’s wilful disregard for Australia’s interests is demonstrated clearly in the area of trade."

When Opposition shadow treasurer Joe Hockey condemned Julia Gillard with that put-down in June 2013, Australia’s trade deficit was -$532 million. Not brilliant, but historically not bad.

Australian Bureau of Statistics (ABS) figures released on Thursday show the deficit in April was -$3,888 million — more than seven times worse. This is a staggering increase of 216% over the March figure and the worst number in Australia’s history.

Coalition leaders were also scathing of economic growth under Labor, despite it being the second highest among developed OECD countries through the global financial crisis (GFC).

Hockey said in 2013:

"It will be my number one imperative to safeguard the economy against a significant downturn and to turbo charge economic growth and jobs.”

Wednesday’s ABS figures show GDP growth is now 2.3% — 19th in the OECD.

These two revelations and other critical events in the last week may well have shifted Australian political analysis. Is it still possible to regard the Abbott administration as merely incompetent? Or does it have another agenda?

Abbott and Hockey in Opposition identified 20 areas of economic "failure" under Labor. All 20 have deteriorated in the last 19 months. Some disastrously. The two announcements, above, on (1) trade and (2) GDP growth, complete the full boxed set.

read more: https://independentaustralia.net/article-display/what-are-abbott-and-hockey-really-trying-to-achieve-20-tries-for-20-failures,7798

unequivocally in a house price bubble...

Treasurer Joe Hockey has urged first home buyers to get “a good job that pays good money” if they want to enter the property market.

When asked at a press conference on Tuesday if residential property in Australia’s biggest city was out of the reach of many, Hockey said: “If housing were unaffordable in Sydney, no one would be buying it.”

Sydney and parts of Melbourne are 'unequivocally' in a house price bubble

“The starting point for first home buyers is to get a good job that pays good money,” he added.

The comments were slammed on social media, with many users criticising the treasurer for being simplistic and out of touch with the difficulties Generation Y faces in enter the property market.

http://www.theguardian.com/australia-news/2015/jun/09/joe-hockey-tells-aspiring-first-home-buyers-get-a-job-that-pays-good-money