Search

Recent comments

- fall guy....

21 hours 30 min ago - a mole....

22 hours 41 min ago - threats!!!!!

23 hours 13 min ago - bibi's RC....

23 hours 21 min ago - charges dropped....

23 hours 25 min ago - empires?....

23 hours 43 min ago - mixed messages....

1 day 12 min ago - problem....

1 day 37 min ago - no RC....

1 day 2 hours ago - inmates.....

1 day 2 hours ago

Democracy Links

Member's Off-site Blogs

demanding answers and getting the wrong ones...

The Commonwealth Bank is facing the prospect of a royal commission into a fraud scandal that left thousands of its customers millions of dollars out of pocket.

A Senate committee has recommended the judicial inquiry as part of its report on the performance of the Australian Securities and Investments Commission (ASIC).

The committee looked at a scandal which saw a group of planners working for Commonwealth Financial Planning (CFPL), a subsidiary of CBA, accused of putting clients' money into risky investments without their permission.

They were also accused of forging documents and earning hefty commissions along the way.

CBA is accused of trying to cover it up.

"These actions were facilitated by a reckless, sales-based culture and a negligent management, who ignored or disregarded non-compliance and unlawful activity as long as profits were being made," committee chairman Senator Mark Bishop said.

http://www.abc.net.au/news/2014-06-26/senate-inquiry-demands-royal-commission-into-asic-cba/5553102

----------------------------------

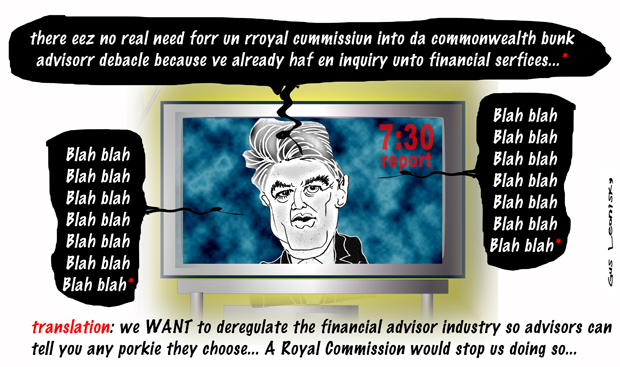

Note that the financial advisor laws were tightened by the previous Labor government. Now the Abbott regime wants to "reform" the advisor industry by removing as much control as possible. Mathias Cormann leads the charge and guess who is chairing the present inquiry by the government to push these UNWANTED reforms? Yes you know the former CEO of the Commonwealth Bank himself... Of course there is no "conflicts of interests" between him and his former mates.

- By Gus Leonisky at 1 Jul 2014 - 9:36pm

- Gus Leonisky's blog

- Login or register to post comments

sick and tired of Abbott-the-liar ...

Bill Shorten has opened up a 10-point lead over Tony Abbott as preferred prime minister and the Labor opposition is leading the Coalition government by the same margin on a two-party preferred basis, according to the latest Newspoll.

The poll, published in the Australian newspaper on Tuesday, provides a snapshot of the political landscape as the new Senate takes effect and the government contemplates the need to secure the support of six of eight crossbench senators to pass any contentious legislation.

Seven weeks after the government delivered its first budget, the poll shows Shorten holds a 44% to 34% lead over Abbott as preferred prime minister. Shorten’s score was up four points compared with the previous Newspoll a fortnight earlier while Abbott’s was down three points.

The telephone poll of 1,161 voters, which has a margin of error of up to 3%, showed the Coalition would attract 35% of the primary vote if an election were held now, compared with 37% for Labor, 13% for the Greens, and 15% for others.

Based on preference flows at the last election these figures translate to a two-party preferred result of 55% for Labor and 45% for the Coalition.

This represents a two-point increase for Labor since the previous fortnight’s poll. The Coalition won the last election when it attracted 53.5% of the two-party vote and Labor mustered just 46.5%.

http://www.theguardian.com/world/2014/jul/01/tony-abbott-falls-further-behind-bill-shorten-in-latest-newspoll

bad advice from bank advisors...

Merv and Robyn Blanch were self-funded retirees for 21 years.

After receiving dodgy advice from their Commonwealth Bank financial planner, Don Nguyen, they lost around $170,000.

By 2009 they were reliant on social security to survive.

They were just two of thousands of clients who fell victim to rogue planners at the bank.

The Commonwealth Bank initially offered the Blanchs a derisory $6,000 in compensation, which they rejected.

Their daughter, Merilyn Swan, then transformed herself into a financial super-sleuth - tracking, collecting and sifting through mountains of paperwork – looking for evidence that would help her parents.

In the process she discovered fraud as well as deceptive and misleading conduct.

After a protracted battle with the bank, her parents settled in 2010. They just could not take anymore.

http://www.abc.net.au/news/2014-07-01/asic-commbank-royal-commission-recommendations/5564256

the abbott regime protection racket...

You have to admire the government’s dogged determination to look after the big banks. In the face of almost universal opposition to its plans to remove consumer protections from financial advice regulation, including at one stage from the key financial planning industry body, it has ploughed on, bringing in by regulation what it couldn’t do by legislation, even though its drafters mucked up the regulation and reintroduced open slather on conflicted payments to financial planners.

This is despite the Commonwealth Bank’s best efforts to demonstrate, in painful detail, what exactly happens when planners are encouraged by remuneration systems to direct clients into wholly inappropriate platform products, and if clients don’t agree to be so directed, fraudulently manufacture their agreement. Even the Treasurer’s mother-in-law ended up being a victim of “rogue planners”, a term that makes it sound like the problem was isolated to a handful of miscreants rather than reflecting the way Commonwealth Financial Planning did business.

The government is now torn between declaring everything is now fine with the Commonwealth Bank, and with financial planning more generally, and keeping an eye on the extent to which the CBA’s government-prompted apology and compensation process pass the basic test of community trust. It’s a little hard to pass judgment on that at this point given we don’t know which independent experts will form the bank’s assessment panel, a crucial detail missing from yesterday’s announcement.

read more: http://www.crikey.com.au/2014/07/04/regulation-by-mateship-ian-and-mathias-show-the-way-in-financial-planning/

See toon at top...

transformed into hyper aggressive investment portfolios...

The Conmenwealth Bank racket

On 4 June 2013, a regular meeting of ASIC senior personnel before the Senate Estimates Committee transcended the conventional formalities. ASIC deputy commissioner Peter Kell displeased several senators in his convoluted answerto a question. Thus on 20 June 2013, the Senate agreed to an Inquiry by the Senate Economics Committee into ASIC’s performance. The Report of that Inquiry was published on 26 June 2014.

The spark that ignited the inquiry was the debacle at the CBA’s subsidiaryCommonwealth Financial Planning Ltd. The spark was provided by a whistleblower trio led by financial planner Jeff Morris, beginning in October 2008.

Fanning the combustion was the Fairfax press, led by journalist Adele Ferguson, with the first article appearing on 1 June 2013. The 12 months coverage by Fairfax of the issue has been exemplary.

The CBA promised those nurturing a nest egg expert advice and consummate husbandry if the said nest egg was committed to CFPL’s keeping. Instead, the customers were sucked into a racket.

The Senate report is a mammoth 553 pages in length. There were 474submissions, some in multiple parts. Many submissions are designated Name Withheld or Confidential — a tangible reflection of power imbalance, skullduggery and victim fears. Kudos to the Secretariat staff who had to master the material and write the bulk of the report.

The report’s scale is forbidding. However, ready access to the guts of the issue can be found in the initial 39-page submission by Jeff Morris, numbered #421 (Morris made seven supplementary submissions).

Morris joined the CBA as a financial planner in April 2008 for personal reasons. He soon smelled the dead fish. Morris came with wide experience that gave him the skills to discern the internal problems and the detachment to confront and expose them.

Rogue ‘advisor’ Don Nguyen, operating from the Sydney suburban Chatswood branch soon appeared on the radar. His entire modus operandi was corrupt. Fabricated client ‘risk profiles’, translated uniformly into ‘hyper aggressive investment portfolios’. Purloined client files, bribes to fellow staff to hide his procedures, false billing of the bank itself, and so on. A very rotten apple — and there were more.

But this story is not about rotten apples. It is rather about the venality of the CBA itself.

Nguyen was suspended in September 2008. He was reinstated in October precisely in order to quarantine his victims. Nguyen was retrenched in mid 2009 on ‘health’ grounds and given a pension. Thus, he was protected by his superiors.

read more: http://www.independentaustralia.net/business/business-display/cba-asic-and-the-political-class-partners-in-crime,6646

Is this highly technical enough?

Cormann did not dispute an account presented by Labor senator John Faulkner, who suggested the government had handed the regulation to the table office on 1 July among other legislative instruments ready for tabling on 7 July, the next sitting day.

Faulkner asked: “Is it true that late on Friday 4 July, 2014 a further message was conveyed to the tabling office advising that the Treasury wanted to tabling of the Fofa regulations to be delayed until Tuesday 15 July, 2014, the statutory deadline for tabling?”

Cormann replied: “I’m not involved in the specific mechanics of all of that but nothing that Senator Faulkner has said to the chamber is in any way inconsistent with what I’ve said on behalf of the government.”

Cormann said he wanted to “brief new crossbench senators in relation to matters that are highly technical and in relation to which a lot of misleading information has been spread in the public domain”.

http://www.theguardian.com/world/2014/jul/10/labor-closer-to-axing-regulation-that-weakens-financial-safeguards

------------------------------------

I am happy to spread true rumours "in relation to matters that are highly technical and in relation to which a lot of misleading information has been spread in the public domain”... But I, Gus, swear solemnly that I won't disseminate misleading information... though there is nothing more misleading than Mr Cormann himself... Well, actually he may not be misleading, he seems to be very up-front about wanting financial advisers to get more of your cash or tell you to invest in Chinese pesos... or if he does not, then why is fiddling with this aspect of regulations which suit nearly all investors?

When I go to some "national" parks, boy, do I hate those ugly barriers that stop me from getting close to the edge... But when money is concerned, oh boy, I think we need to rein in the ability of some people to push us over the edge while picking our pockets. Is this highly technical enough?

making no sense at all...

Watching Cormann performance in Parliament today trying to say some "pensioner association" was wrong on the subject of financial advisors, was like watching "Macbeth" in Dutch... It only made sense to people who understood Chinese.

waking up to palmer's tricks...

The Federal Government has potentially been dealt a major blow, with four crossbench senators, including Jacqui Lambie and Ricky Muir, teaming up with Labor and the Greens to scrap its changes to financial advice laws.

The Government struck a deal with the Palmer United Party (PUP) in July to push its changes to Labor's Future of Financial Advice (FoFA) laws through the Senate.

Labor strongly opposed the changes and today revealed it had secured the support it needed in the Senate to undo that deal and reverse the Government's regulations.

Senator Lambie, Senator Muir, Senator John Madigan and Senator Nick Xenophon announced they were uniting to oppose the laws.

It came on the same day that Senator Lambie was removed as deputy PUP Senate leader and deputy whip of the party for failing to attend three party meetings this week.

Senator Xenophon held a press conference this morning to explain the decision to vote against the financial advice laws.

He was flanked by Labor's Sam Dastyari, Greens senator Peter Whish-Wilson and senators Madigan, Lambie and Muir, who has previously formed an alliance with PUP.

"Despite our political differences, we have banded together as a coalition of common sense," Senator Xenophon said.

http://www.abc.net.au/news/2014-11-19/labor-greens-crossbench-senators-unite-in-bid-to-overturn-fofa/5902312

Waking up to Palmer's tricks...

cormann lies and talk shit...

Finance Minister Mathias Cormann denies the Federal Government has broken its election commitment not to cut the ABC's budget.

Yesterday, Communications Minister Malcolm Turnbull announced the ABC's budget would be reduced by $254 million over the next five years.

Mr Turnbull said the ABC would receive $5.2 billion in funding over that time - a cut of 4.6 per cent - and SBS's operating budget would be reduced by $25.2 million, or 1.7 per cent, over the same period.

Before last year's federal election, then opposition leader Tony Abbott promised there would be no cuts to the ABC and SBS under a Coalition government.

Senator Cormann said the Government had imposed an efficiency dividend on the public broadcasters in line with other Government departments.

"These are not cuts.

read more: http://www.abc.net.au/news/2014-11-20/cormann-denies-breaking-election-commitment-on-abc-budget-cuts/5904884

-----------------------

That is a lot of boloney, bulinosh, bulimonkey baloney booloony shit lies ten times bigger than the cigar Cormann smokes... The ABC is functioning at 95 per cent efficiency whether you like the programmes or not... NO ORGANISATION NOR PRIVATE ENTERPRISE CAN RUN at this level of efficiency without burning out personnel... Most private enterprises and public offices run at 75 per cent which is the best for efficient EFFICIENCY, including giving time for employees going to the loo. EFFICIENCY ABOVE THIS KILLS people... I know. The Abbott regime is cutting the ABC budget and is breaking its promise made before the elections. Mathias Cormann is a BIG liar.