Search

Recent comments

- the fallout....

8 hours 33 min ago - meanwhile....

8 hours 51 min ago - extortion....

9 hours 14 min ago - death wish....

9 hours 18 min ago - heroes....

9 hours 52 min ago - joining fools....

10 hours 10 min ago - humanely....

10 hours 17 min ago - putin's pudding....

10 hours 27 min ago - hungry war.....

10 hours 38 min ago - EU panics....

10 hours 43 min ago

Democracy Links

Member's Off-site Blogs

secret money and data flow....

Today, WikiLeaks released the secret draft text for the Trade in Services Agreement (TISA) Financial Services Annex, which covers 50 countries and 68.2%1 of world trade in services. The US and the EU are the main proponents of the agreement, and the authors of most joint changes, which also covers cross-border data flow. In a significant anti-transparency manoeuvre by the parties, the draft has been classified to keep it secret not just during the negotiations but for five years after the TISA enters into force.

Despite the failures in financial regulation evident during the 2007-2008 Global Financial Crisis and calls for improvement of relevant regulatory structures2, proponents of TISA aim to further deregulate global financial services markets. The draft Financial Services Annex sets rules which would assist the expansion of financial multi-nationals – mainly headquartered in New York, London, Paris and Frankfurt – into other nations by preventing regulatory barriers. The leaked draft also shows that the US is particularly keen on boosting cross-border data flow, which would allow uninhibited exchange of personal and financial data.

Read the full press release here.

[1] Swiss National Center for Competence in Research: A Plurilateral Agenda for Services?: Assessing the Case for a Trade in Services Agreement, Working Paper No. 2013/29, May 2013, p. 10.

[2] For example, in June 2012 Ecuador tabled a discussion on re-thinking regulation and GATS rules; in September 2009 the Commission of Experts on Reforms of the International Monetary and Financial System, convened by the President of the United Nations and chaired by Joseph Stiglitz, released its final report, stating that "All trade agreements need to be reviewed to ensure that they are consistent with the need for an inclusive and comprehensive international regulatory framework which is conducive to crisis prevention and management, counter-cyclical and prudential safeguards, development, and inclusive finance."

Click on the partners listed to the left for their articles on this TISA Financial Services Annex.

Download the full secret TISA Financial Services Annex as PDF here.

Download Analysis Article of secret TISA Financial Services Annex as PDF here or read it online here.

- By Gus Leonisky at 20 Jun 2014 - 12:42pm

- Gus Leonisky's blog

- Login or register to post comments

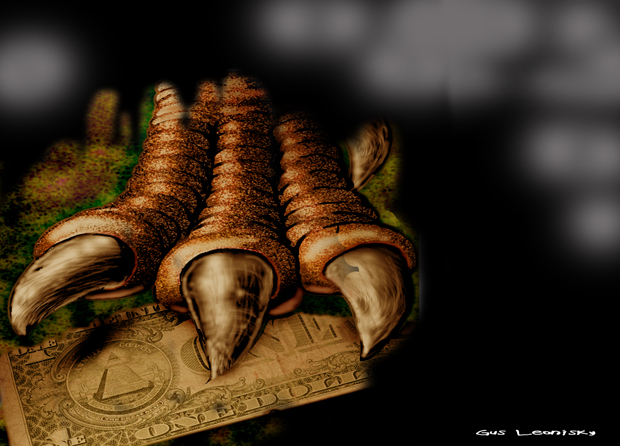

preparing the next move to rob you...

Financial Services Union national secretary Leon Carter said there was ''a real danger'' that the negotiations ''could undo the effective regulation that sheltered Australia from the global financial crisis'' and result in ''a tidal wave of finance job losses in Australia''.

AdvertisementBut Trade Minister Andrew Robb said the negotiations were a "key focus" in his policy to "open as many doors as possible" for Australian financial services. "Financial services are a key part of the negotiations for us given the strength of our sector in areas including banking and wealth management, particularly in the major, growing markets of Asia," he said.

A confidential negotiating text provided to Fairfax Media by WikiLeaks reveals that the TiSA talks have big implications for Australia's financial system, potentially pre-empting the Abbott government's Financial System Inquiry which, chaired by former Commonwealth Bank chief executive David Murray, will present an interim report on July 15.

Read more: http://www.smh.com.au/federal-politics/political-news/secret-trade-negotiations-is-this-the-end-of-the-big-four-20140619-3ah39.html#ixzz358doORIX

The Federal Government is pressing ahead with its plan to wind back Labor's financial advice laws aimed at protecting investors.

The Coalition has been under pressure over some of the controversial changes it flagged to the Future of Financial Advice (FoFA) reforms.

Labor introduced the FoFA reforms after a series of high-profile financial collapses rattled investor confidence in the sector.

The Coalition has sought to moderate them and, after a Senate inquiry largely backed the changes earlier this week, Finance Minister Mathias Cormann has told the ABC's AM program the Government will go ahead with most of them.

The Government will proceed with scrapping a legal obligation requiring financial advisers to take "any reasonable steps" in their clients' interests.

Senator Cormann says it is unnecessary as there are other safeguards in place, including six steps prescribed in the Corporations Act.

http://www.abc.net.au/news/2014-06-20/government-pushes-ahead-with-wind-back-of-financial-advice-laws/5537504

Don't trust a single word from the Abbott regime... Once the present protection are removed, you will be on your own fighting bad advice and be taken by the claws of the international money market... Who will benefit from all these changes?: THE RICH. And there won't be any tickle down... All these new financial gymnastics will widen the gap between rich and poor at a rate of knots and multiply GREED by a factor of ten... Not the societies we need, especially while now facing the threat of global warming — which is not an idle threat... So far June in Sydney has been about 3 degrees C above average (new average which discounts years before 1960).

something like the GFC won't happen again?...

Malcolm Maiden in his analysis notes, perhaps with tongue in cheek, that the putative Trade in Services Agreement may limit Australia’s ability to “decide what financial services groups come to this country and the circumstances in which they come” (‘‘The bottom line is: Will we be better or worse off under this agreement?”, June 20).

The issue of sovereignty concerning refugees pales into insignificance compared with that concerning our financial system. Part of the reason Australia escaped the global financial crisis is that our banks are prudently regulated. Any diminution of our ability to control our own financial services industry is a disaster waiting to happen. Does anyone, aside from the self-appointed Masters of the Universe, seriously think that something like the GFC won't happen again?

Ronald Binder Hurstville

Read more: http://www.smh.com.au/comment/smh-letters/chaplaincy-support-from-frontbench-reflects-influence-of-george-pell-20140620-zsfdq.html#ixzz35EVtezsK

In the comment above this one I stated this, now shown with corrections (my keyboard is missing letters):

Don't trust a single word from the Abbott regime... Once the present protections are removed, you will be on your own fighting bad advice and be taken by the claws of the international money market... Who will benefit from all these changes?: THE RICH. And there won't be any trickle down... All these new financial gymnastics will widen the gap between rich and poor at a rate of knots and multiply GREED by a factor of ten... Not the societies we need, especially while now facing the threat of global warming — which is not an idle threat... So far June in Sydney has been about 3 degrees C above average (new average which discounts years before 1960).

the system is rigged...

Sen. Elizabeth Warren (D-Mass.) has built a sizable political profile — including the requisite presidential speculation — by espousing a simple idea: that the system is "rigged" against average Americans.

And you might be surprised who agrees with her: A whole bunch of conservatives.

read more: http://www.washingtonpost.com/blogs/the-fix/wp/2014/06/27/elizabeth-warren-says-the-american-economy-is-rigged-many-conservatives-agree/

meanwhile in south america...

With one day left to pay its creditors, Argentina appears to be heading for a voluntary default.+If you’ve been following the debt saga of Latin America’s third-largest economy, you know things are a mess: A decade of restructuring following Argentina’s record default in 2001 helped the country reduce its borrowings through two debt exchanges, but a small minority of creditors held out and demanded full repayment. The sovereign bonds in question were issued under New York law. After years of litigation, subsidiaries of Elliott Management won not just a $1.6 billion settlement, but a judge’s injunction that would block Argentina from paying anyone unless it paid the holdouts, too.

+Now, Argentina is out of appeals. The deadline to pay creditors was July 1, and while the country put a $539 million interest payment for the exchange bondholders in escrow, it didn’t actually pay them or the holdouts. On July 30, a 30-day grace period ends. If Argentina can’t reach a deal that satisfies the holdouts and persuades them to ask for the injunction to be lifted, it’s default city.

+So far, Argentina’s delegation in New York has yet to even meet with the holdouts, instead working through a mediator. Even as they negotiate, Argentina’s president, Cristina Kirchner, has continued to talk tough, for example calling on the holdouts to accept the 50% to 70% haircuts imposed on the holders of the exchange bonds.

+There’s still time for a last-minute compromise, and Argentina in theory should be motivated to reach one. Policies that the government has adopted in the absence of foreign lending and investment have left the country vulnerable to inflation and recession; settling the default threat could promote the return of foreign capital.

http://qz.com/241939/argentina-is-about-to-choose-a-sovereign-default-that-could-wipe-out-its-foreign-reserves/