Search

Recent comments

- blinkenings.....

5 hours 50 min ago - georgia's NGOs

6 hours 50 min ago - breeding insanity....

16 hours 30 min ago - american "diplomacy"

19 hours 26 min ago - deceit america....

21 hours 45 min ago - police-state....

1 day 7 hours ago - the war continues....

1 day 8 hours ago - scott is angry.....

1 day 15 hours ago - a catastrophe?....

1 day 18 hours ago - 3Xwars is 3Xpeace?....

1 day 20 hours ago

Democracy Links

Member's Off-site Blogs

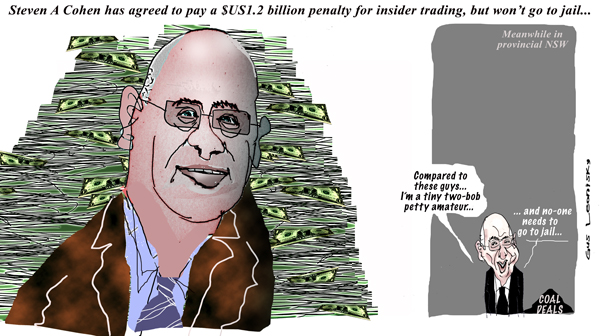

the luck of the devil

He owned a $US115 million Manhattan penthouse and spent millions on artworks to hang on his walls. But now Steven A. Cohen will be spending his billions on record fines imposed on his hedge fund for insider trading.

SAC Capital Advisors, fully owned by Cohen, has agreed to pay a $US1.2 billion ($1.26 billion) penalty for insider trading, becoming the first large Wall Street firm in a generation to confess to criminal conduct.

Cohen's compensation and conspicuous consumption have made him an emblem of the new Gilded Age. But SAC's admission that employees traded stocks based on secret information has coloured Cohen's astounding investment track record, which saw the fund post average annual returns of nearly 30 per cent since 1992.

Cohen has not been criminally charged but the plea deal is a devastating blow for him, as the firm that bears his initials will acknowledge that it was a corrupt organisation. The $US1.2 billion penalty adds to the $US616 million in insider trading fines that SAC agreed to pay to federal regulators earlier this year. Cohen will pay those penalties.

"The scope and the pervasiveness of the insider trading that went on at this particular place is unprecedented in the history of hedge funds," Preet Bharara, the US attorney in Manhattan, said this summer, referring to SAC.

Cohen, 57, has told his friends that he at all times acted appropriately and complained that the government was obsessed with destroying him and his firm.He has also said he thinks it is unfair that he is paying nearly $US2 billion in penalties out of his pocket for the crimes of what he believes are rogue employees. Eight former SAC traders have been charged with securities fraud.

In recent weeks, friends say, Cohen's spirits have been high in the hopes that the SAC settlement will put his legal problems behind him. On Wednesday, he appeared relaxed sitting courtside at Madison Square Garden, where he watched the New York Knicks basketball team defeat the Milwaukee Bucks in the season opener.

The guilty plea and fine paid by SAC are part of a broader plea deal that federal prosecutors in Manhattan announced on Monday, which will also impose a five-year probation on the fund and require SAC to terminate its business of managing money for outside investors. The firm will probably continue to manage Cohen's fortune.

Read more: http://www.smh.com.au/business/world-business/billionaire-steven-cohens-hedge-fund-sac-hit-with-126-billion-fine-20131105-2wy4h.html#ixzz2jkloAWa3

- By Gus Leonisky at 5 Nov 2013 - 7:08pm

- Gus Leonisky's blog

- Login or register to post comments

legal aid by flogging the furniture...

The financial fallout from a spate of corruption inquiries is beginning to hit (alleged) crooked former Labor powerbroker Eddie Obeid.The Obeid family mansion, Passy, one of the grandest houses in Hunters Hill, is understood to have been quietly put on the market with an initial asking price of $10 million.

In addition, the Obeid family recently took out two loans. The first was a three-month loan for $300,000 with an interest rate commencing at 20 per cent and rising to 25 per cent for late payments. The family has also borrowed $3.4 million for a 12-month period, at an interest rate of between 8.95 and 12.95 per cent. Passy has been used as security for the loans.

Read more: http://www.smh.com.au/nsw/obeid-falls-on-hard-times-20131106-2x1tc.html#ixzz2jtZRLGt8