Search

Recent comments

- delayed food....

5 hours 26 min ago - free expression....

5 hours 49 min ago - macrolympicus....

7 hours 18 min ago - obsession....

8 hours 24 min ago - forever....

8 hours 49 min ago - no recall...

9 hours 57 min ago - whacked bushmaster....

12 hours 4 min ago - american delusions....

15 hours 56 min ago - weaponry....

16 hours 54 min ago - REVEALED: THE PENTAGON’S

17 hours 11 min ago

Democracy Links

Member's Off-site Blogs

from the top of the pile ....

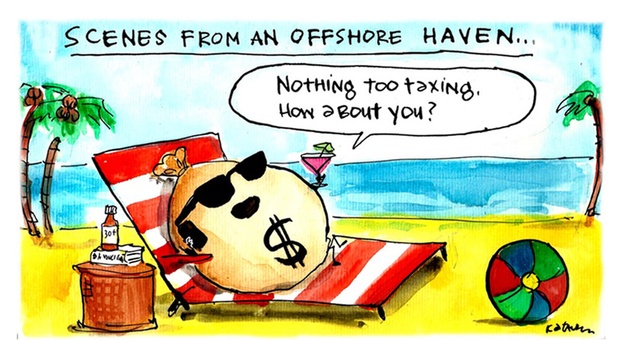

The companies robbing the world, and why it finally matters.

It is more truly global than the “global war on terrorism”, more quixotic than the global war on the drug trade, and vastly more costly than either of these.

We’re talking about the global struggle between governments and multinational corporate tax dodgers.

Would you call it a war? There are no bullets, but the conflict bears other hallmarks of war. It involves a threat to national sovereignty. And it is fought at huge human cost – in lives impoverished or cut short by lack of access to food, health services and infrastructure that governments cannot provide for their citizenry because they have been cheated of trillions of dollars.

Trillions? With a “T”, as in millions of millions? Perhaps you think I exaggerate.

Then hear this, from Edward Kleinbard, a Professor of Law at the University of Southern California (USC), and former Chief of Staff of the US Congress’s Joint Committee on Taxation.

Because of an anomaly in US tax law, which requires that companies report their holdings in offshore tax havens, says Kleinbard, “we can say with some precision that US firms have about $2 trillion today in offshore, unrepatriated, low-tax earnings.

“Now, not all that $2 trillion is cash; some is invested in real subsidiaries doing real things, but about 40 per cent is cash,” Kleinbard told The Global Mail.

To give some idea of the magnitude of this corporate stash of money, consider that the gross domestic product of Australia is only about $1.5 trillion.

And Australia is the 12th largest national economy in the world.

Furthermore, says Kleinbard: “Other [non-US] multinationals would have proportionately just as much super-low-taxed or untaxed income. It’s just that because of US tax rules, the extent to which US firms do it is more visible.”

Given that the US economy these days makes up about one-quarter of the global economy, you might well multiply that number by four. Given that the US has one of the more meticulous tax regimes, you might well multiply it by much more. Some estimates place the global total that multinationals have stashed away in tax havens at around US$20 trillion.

But no one knows for sure. “I think [calculating it] is an impossible exercise,” says Professor Jason Sharman of Griffith University, who, over a decade of studying the subject, has seen a wide spread of estimates of the scope of corporate tax avoidance.

Whatever the true number, though, it’s huge and growing fast. It’s big enough that the Organisation for Economic Co-operation and Development (OECD), in a recent report on the subject (page 8), warned: “What is at stake is the integrity of the corporate income tax.”

“All the multinationals are doing it,” says Kleinbard, who later corrects himself, saying maybe 70 per cent of the biggest US corporations do it.

“The other 30 should fire their tax directors.”

Kleinbard is not an expert on Australia’s biggest corporations, but if he’s right and it’s a universal problem, one might expect them to similarly make use of tax havens – perhaps even to a greater degree, given that Australia is proportionately a bigger trading economy.

And sure enough, most of them do have subsidiaries in tax havens or, as they are more precisely called by people who look into these things, “secrecy jurisdictions”.

In all, 61 of Australia’s top 100 companies have active subsidiaries in secrecy jurisdictions, according to a comprehensive recent investigation by the Justice & International Mission of the Uniting Church.

The Justice and International Mission is, as their name implies, concerned with social justice. If the Australian Treasury is being diddled of several billion dollars a year in corporate tax – which is their best guess – then that means the tax burden falls more heavily on others less able to pay. It means less for government to spend meeting the needs of its citizens.

So, which companies have subsidiaries in secrecy jurisdictions?

All of Australia’s big four banks have them, in varying measure. The Commonwealth Bank has eight, Westpac five, ANZ four and National Australia Bank just one.

Other big companies have many more. AMP has 15, Computershare, 18. Telstra has 19, Downer EDI, 32; Toll Holdings, 64; Goodman group, 67 – and way out ahead of the pack is Rupert Murdoch’s News Corp, which has 146.

Before we go any further, perhaps we should define what is meant by the term “secrecy jurisdictions”.

It refers to countries, dependencies of bigger countries, or even states within countries which provide to companies and wealthy individuals varying degrees of protection against the tax authorities, financial regulation, inheritance laws, rules of litigation and in some cases even the criminal laws of their home countries.

The Tax Justice Network, an international coalition of researchers and activists with whom the Uniting Church’s Justice and International Mission collaborate, identifies more than 70 such jurisdictions offering varying degrees of … shall we say … discretion. The TJN has developed an index which scores these places on a range, from the moderately secretive, such as Spain, to almost-anything-goes places, such as Nauru and the Maldives.

As the network notes: “Most jurisdictions assessed are clustered towards the murkier end of the secrecy spectrum.”

Now, we should say that the fact that a company has a subsidiary in a secrecy jurisdiction is not of itself evidence of any illegality.

In fact, the nub of the problem is the legality of such practices. The rules governing international trade and taxation, established the better part of a century ago, focused on making sure corporations were not taxed twice when they dealt with two countries. The rules did not envisage companies using aggressive means of moving money around in order to avoid being properly taxed anywhere.

Furthermore – let’s be brutally frank here – for decades, centuries even, the big countries of the world didn’t care a whole lot about the offshore behaviour of their big corporations.

National interest dictated that they shouldn’t care. After all, the rip-off of the developing world brought the developed countries cheap resources to fuel their growth. It brought their corporations healthy profits, which flowed to their shareholders. It produced stuff for their consumers to buy. So what if these companies exploited unsophisticated people and governments in little busted-arse countries – to use the famous phrase of Australia’s egregious former Foreign Affairs Minister Alexander Downer? No skin off their rich noses.

But globalisation has changed all that. For a start, the big western economies are not nearly as dominant as they used to be. As recently as the early 1990s, the world’s developing nations accounted for just 20 per cent of the global economy. In 2013, according to the European Central Bank, it’s more than 50 per cent.

More important than that has been the phenomenal growth in international trade. Its value has increased close to 50-fold, having grown since 1970 at twice the rate of the world economy, driven by neo-liberal theories of greater productivity through specialisation, by growing demand for goods and services, and of course by communications advances.

And more important still has been a change in the pattern of trade. International trade has grown fast, but intra-firm trade has grown even faster, as the OECD noted in a 2011 paper on the subject.

“The organisation of multinational firms has dramatically changed over the last two decades with the emergence of ‘global value chains’ which has increased the importance of intra-firm trade flows,” it says.

In simple terms, what that means is that instead of company A in Australia (or the US or Britain, or anywhere) selling something to company B overseas, it now is increasingly likely that company A in Australia is selling to a subsidiary of itself overseas.

More than half the trade of many developed countries is now intra-company. Australia is one of those countries.

The OECD report noted: “This transformation has already thrown into question the ‘national identity’ of MNEs [multi-national enterprises].”

That seems something of an understatement. Multinational corporations – some of them financial entities larger than middle-sized nation states – now move production to where labour and other input costs are cheaper, claim research costs where the R&D incentives are greatest, and declare their profits where the corporate taxes are lowest.

Like we said before, for a long time policy-makers in developed nations didn’t care much about what “their” multinationals did overseas. Quite suddenly, though, they are coming to realise these companies are not theirs anymore.

They are citizens of the world, generating ever-increasing amounts of what USC’s Prof. Edward Kleinbard calls “stateless income”, laundered through some secrecy jurisdiction or other.

Of course, there can be legitimate business reasons for a multinational company to have a presence in, say, Singapore, even though Singapore rates well up on the secrecy scale. It is, afterall, a major regional financial centre.

And 40 of Australia’s top 100 companies have, between them, 174 subsidiaries located in Singapore. Likewise Hong Kong, where 32 of the Top 100 have 114 subsidiaries.

But that doesn’t change the fact that these places are widely used by high-wealth people and corporations as a means to dodge tax.

Indeed, says Mark Zimsak, director of the Uniting Church’s Justice and International mission, Singapore in particular is a big growth centre for tax dodgers, especially now that Switzerland – once a by-word for financial secrecy – is becoming more willing to share financial information with other governments.

“The latest information shows there has been a massive shift to Singapore. The numbers I’ve seen suggest Singapore is home to between $100 billion and $1 trillion of stashed money,” Zimsak says.

But when a multinational operates subsidiaries in some of the more obscure and egregious of the secrecy jurisdictions, it can, on the face of it, look more suspicious. I mean, what legitimate reason could a multinational corporation have for operating in a flyspeck place such as Nauru – unless it were somehow involved in the business of bunging up asylum seekers on behalf of the Australian government?

In their survey of Australia’s top 100 companies, the Uniting Church’s investigators wrote to all of them, seeking to establish if they had legitimate reasons for operating subsidiaries in tax havens. Then the investigators removed from the list any subsidiaries that were no longer operating or were shown to be operating proper businesses. That left a total of 692 subsidiaries whose purpose was unexplained. (The numbers we cite throughout this story come from that amended list.)

To cite one example of a subsidiary which was explained and removed, the Fosters Group has a subsidiary in Western Samoa, one of the more secretive countries. But as it turned out Fosters is the main brewer in Samoa, where it employs 160 people. Thus that subsidiary was removed from the list of questionable entities in the report.

But only 31 of the 100 companies responded to the church’s enquiries, and many of those responses were vague or dismissive. The rest of the companies didn’t bother replying at all.

In most cases, the report’s authors got their information from corporate annual reports. But in some cases even those were no help.

For example, in the case of that champion user of secrecy jurisdictions, Rupert Murdoch’s News Corp, the report’s authors had to glean their information on its 146 offshoots from a 2008 report by the United States Government Accountability Office, on companies which used tax havens.

In the absence of any explanation from News Corp, we can only wonder what media business it conducts through its 62 subsidiaries in the British Virgin Islands, 33 in the Cayman Islands, 15 in Mauritius and others in Panama, Belize, Bermuda, Hong Kong, Luxembourg, Marshall Islands, Singapore and Switzerland.

Of the 692 subsidiaries the ASX Top 100 companies operate in secrecy jurisdictions, about 40 per cent – or 288 – were in Singapore and Hong Kong, which, like we said before, are financial hubs. The other 60 per cent were in rather more questionable places. There were, for example 97 in Jersey, 83 in the British Virgin Islands, 55 in the Cayman Islands, and others in places which seem even less likely to host legitimate businesses. You can see the whole list, and read the rationales of the companies who bothered to explain themselves, in the church report.

Let us stress again, we’re not suggesting these arrangements are illegal. But the locales of many of these subsidiaries do give rise to suspicion about the corporate motives for locating there.

Let’s have a look at just one of those secrecy jurisdictions, the British Virgin Islands, selected both because it was one of the most popular among Australia’s multinationals and because it was used as a case study for a landmark report published this year by the Organisation for Economic Cooperation and Development.

The report Addressing Base Erosion and Profit Shifting, examined the “serious threat to tax revenues, tax sovereignty and tax fairness” posed to rich and poor countries alike by corporate tax dodging.

The British Virgin Islands is a tiny place of white-sand beaches and lush vegetation; population a little over 31,000; total land area, 153 sq km; and without natural resources or obvious attraction except as a tourist destination.

But if you look at the tiny local paper, you get some idea of what really drives the place. Among the hyper-local headlines like “Trash to be collected at some houses” and “Fruit fans flock to Mango Array” in the July 16, 2013 edition is this: “Incorporation stats show 6.7 per cent drop.”

The story records the fact that in the first three months of the year, Virgin Islands trust firms formed only 16,666 new companies, compared with 17,865 formed in the corresponding period for the previous year.

It goes on to recite a bunch of other statistics, like the number of local investment houses (up to 530), and to express hope that new investment regulations, lately passed by the Islands’ House of Assembly, will “lure business away from the Cayman Islands”.

What sort of business? Well, tourism, of a sort. The Virgin Islands is one of the favourite places for multinational companies – and high-wealth individuals – to send their money for a holiday.

In 2010, the OECD report says, BVI, along with its two nearby island tax havens, Bermuda and Barbados, accounted for more than five per cent of world capital inflows. That’s more than went into Germany or Japan.

Among the Australian companies with subsidiaries in BVI are BHP, Computershare, Ramsey Health, Amcor and Downer EDI. Oil Search has five subsidiaries there. Toll Holdings has five. Telstra has 10. News Corp, as mentioned earlier, has 62.

Yes, money flows into BVI in spectacular measure, but it also flows out in equally spectacular measure. In 2010, BVI was the nominal source of 14 per cent of all foreign direct investment into the world’s second-largest economy, China. (The largest source country was Hong Kong – which also rates high on the secrecy scale – with 45 per cent. The United States, in comparison, provided just four per cent.)

In the same year, BVI along with three other tax havens – Cyprus, Bermuda and the Bahamas – accounted for 53 per cent of direct foreign investment in Russia.

Highly-secretive Mauritius is a dot in the Indian Ocean 1,000 km east of Madagascar. It has a population of about 1.25 million, but it was the top source of investment into India, which has a population 1,000 times greater.

The OECD report cited other examples too, but you get the picture. Vast, vast amounts of money are being channelled through these secrecy jurisdictions.

And lest the examples given so far give the impression that it is mostly happening in tiny renegade states, it is not. The OECD report went on to cite examples of so-called “special purpose entities” set up by multinationals in otherwise respectable nations, such as the Netherlands.

These SPEs, it defined as “entities with no or few employees, little or no physical presence in the host economy, whose assets and liabilities represent investments in or from other countries and whose core business consists of group financing or holding activities”. In plain language, the “special purpose” of those entities is dodging tax.

In 2011, the report reckoned, more than US$2.6 trillion flowed into SPEs in the Netherlands – which amounted to some 82 per cent of all inward flows – and about $3 trillion flowed out.

Other estimates come up with even more startling numbers. The Dutch Central Bank said that in 2010 multinational companies routed 10.2 trillion euros through 14,300 Dutch “special financial units”, according to a Bloomberg report earlier this year.

For a more detailed account of how the Netherlands lends itself out to multinationals seeking to minimise their tax, see The Global Mail story from 2012, on the means by which Google Australia used the so-called “double Irish Dutch sandwich” stratagem to pay just $75,000 in Australian tax on estimated revenue of $900 million.

A bunch of other surprising countries make the list of tax havens. Lovely little Luxembourg, a favourite of Australia’s top 100 companies (11 companies have 50 subsidiaries there), saw about US$2 trillion flow in, and a similar amount flow out of special-purpose entities in 2011.

And several states in the US, are extraordinarily opaque to authorities and obliging to tax avoiders.

France and Canada are considered “moderately secretive” by the Tax Justice Network. And while the UK itself is pretty open, it should not be forgotten that a lot of the more secretive little jurisdictions, including Bermuda, the British Virgin Islands, Cayman Islands, Gibraltar, Anguilla, Montserrat, Turks and Caicos Islands, Jersey, Guernsey and Isle of Man, are semi-autonomous British-crown dependencies or overseas territories.

Only earlier this year, British Prime Minister David Cameron moved to force these 10 territories to set up a register of companies using their services, and to be more transparent in sharing information. And they have agreed to be more open about revealing the true owners of shell companies.

However, there is a fair degree of scepticism about whether it will change much.

The BVI Beacon’s story about its efforts to make its regulatory regime more competitive with the Caymans for the tax-avoidance dollar does not bode well.

Still, this development might give pause to the tax planners of Australia’s top 100, among other multinationals. For it happens that, between them, they have 264 subsidiaries in the British territories David Cameron is trying, in his half-hearted Tory way, to make more transparent.

Cameron is far from alone. The governments of most western countries – at least those not sheltering corporate tax dodgers – are fretting, individually and collectively, through groups such as the OECD, G8 and G20, about the whole subject they call BEPS – the acronym for Base Erosion and Profit Shifting.

Why the sudden concern? It’s only been in the past few years that the issue has come on to these policy makers’ agendas, although academics and other tax experts have been warning about it for decades.

The thing that really concentrated their minds, says Mark Zimsak, was the global financial crisis. “Suddenly you’ve got OECD countries having suffered huge hits to the revenue bases, looking for every dollar they can claw back. That made them suddenly focus on the kind of dodging that’s going on.”

For the previous 15 years, the so-called “great moderation”, a period of relative economic stability, sustained increases in asset prices, corporate profits and government revenue had masked such dodging. The prophets of globalism were congratulating themselves on the success of their model of deregulation, lower corporate tax rates and trade liberalisation.

Then, in 2007-08, it all went to hell.

Corporate tax payments as a share of GDP, across OECD countries, dropped about 20 per cent between 2007 and 2011.

No doubt much of the decrease was due to declining company profits during the great recession. But the OECD suspected a lot was not. And the Australian Treasury, in its own investigation of possible tax dodging, released in May this year, provides support for that suspicion.

The Treasury noted that receipts from company taxes declined sharply, as might be expected, immediately after the GFC. By 2011-12, business profits had recovered to their previous level, “however, company tax collections remained well below the level expected in the 2008-09 Budget,” says the report.

It continued, “Conceptually, everything else being equal, a decline in the aggregate effective tax would be consistent with an increase in BEPS activity.”

Furthermore, it noted, “In comparison with other countries, Australia’s corporate tax collections have fallen by more and recovered less since the onset of the GFC.”

But Australia is only guessing. The US has a much better idea. And boy, are some US lawmakers ticked off by what they see.

This was never clearer than in a confrontation in May this year, between a US Senate subcommittee looking into tax dodging and the senior executives of computer company Apple.

Apple CEO Tim Cook indignantly told the committee: “We pay all the taxes we owe, every single dollar. We not only comply with the laws, but we comply with the spirit of the laws. We don't depend on tax gimmicks.”

Senators saw it differently.

As Senator John McCain summed up: “Today, Apple has over $100 billion dollars, more than two-thirds of its total profits, stashed away in an offshore account.”

Said Democrat Senator Carl Levin: “Apple successfully sought the holy grail of tax avoidance. It has created offshore entities holding tens of billions of dollars while claiming to be tax resident nowhere.”

Yes, that’s right. Parts of Apple’s complex web of international subsidiaries pay no tax, anywhere.

For a more comprehensive account of how they arranged it, read this, fromThe New York Times.

Levin, a long-time campaigner against corporate tax dodging, said he had never seen anything like it.

Even Kleinbard, the expert in the various ways companies move money around the world, was impressed by the “brutally simple structure” by which Apple avoided tax on its income outside the Americas.

Lots of companies get big, and then look for ways to dodge tax, says Kleinbard; Apple’s “genius” was to set up its shell operation in Ireland way back at its very beginning, in 1980.

“It claims this Irish shell company – without any brains, without people, without any independent resources – nonetheless agreed to absorb the development costs of all the intangibles attributable to Apple business outside the Americas. And therefore it owns 60 per cent of the income stream of the entirety of Apple’s intangible assets,” says Kleinbard.

Kleinbard often jokes about “stateless income, sailing the seas until it finds a welcoming harbour”, but Apple’s arrangements literally went beyond the joke.

“Here the company itself is stateless and never comes to rest anywhere in the world and never pays tax anywhere in the world,” he explains.

It would be funny if it weren’t so serious. Richard Denniss, of the progressive Australian think tank, the Australia Institute, captures the absurdity well.

“Imagine if individuals could do what multinationals can do. Imagine if I could incorporate myself in Ireland, and rent my human capital off myself,” he riffs. “If I could tell them that degree I possess lives in Ireland now, and I’m just physically here in Australia. This is not Richard, this is just Richard’s body. Richard’s intellectual property lives elsewhere.”

In essence, this is exactly what these companies do.

They structure themselves in such a way that the parts of the company in high-tax jurisdictions make large payments to subsidiaries in low-tax jurisdictions, particularly for intangible “services”.

Apple may be the most egregious example, but all the big tech companies – Google, Amazon, Microsoft, Facebook et cetera – do it. Pharmaceutical companies are also among the worst tax avoiders, says Sharman. Which is easy to grasp, because the value of their output is in intellectual property rather than in physical goods.

But there is pretty much infinite scope to dodge tax, no matter what your line of business, as Kleinbard pointed out in a recent paper: Through a Latte, Darkly: Starbucks's Stateless Income Planning.

His subject was the coffee chain, which, writes Kleinbard, “follows a “classic brick-and-mortar retail business model”, with thousands of outlets in high-tax countries around the world.

Really, Starbucks differed from your average coffee shop only in its tax arrangements. It minimised its liabilities by making large, deductible intragroup payments to Dutch, Swiss, and US affiliates – for example, it made royalty payments for its brand to a subsidiary in Amsterdam, and sourced its coffee beans through a Swiss subsidiary. In the 14 years since 1998, when it established itself in the UK, Starbucks made sales of more than £3 billion, but paid just £8.6 million in company tax.

What the coffee-chain example shows, says Kleinbard, is that, “...if Starbucks can organise itself as a successful stateless income generator, any multinational company can.”

He writes, “...the Starbucks story demonstrates the fundamental opacity of international tax planning, in which neither investors in a public company nor the tax authorities in any particular jurisdiction have a clear picture of what the company is up to.”

This situation is made all the more frustrating by the fact that even in countries that are not secrecy jurisdictions, multinationals get cover via the privacy provisions of tax laws.

To illustrate this point, consider what Australia’s assistant Treasurer, David Bradbury, said when, some months ago, The Global Mail asked him about the scope of tax dodging.

“The scale is very difficult to determine, because of a lack of transparency around what is actually paid by multinational corporations both here in Australia and abroad.

“I sit here as the assistant Treasurer, having no visibility over what tax is being paid by companies.”

Bradbury has since overseen the passage of legislation requiring the Australian Taxation Office to report total income, taxable income and income tax payable in Australia for corporate tax entities with total incomes of $100m or more.

(It should be noted that Tony Abbott’s Opposition did not support the move. This is odd, given that the Liberal-National coalition’s putative core constituency is small business, and small businesses also suffer when big corporations dodge tax, because it gives them an unfair price advantage.)

The current government has also taken a number of other small steps to tighten its general anti-avoidance provisions and transfer pricing laws.

But as recently as this week, in releasing a “scoping paper” he commissioned from the Treasury, Bradbury conceded neither he nor the department had much idea about what was going on.

As he said: “... the paper highlights that data limitations make it difficult to accurately assess the extent to which Australia's corporate tax base is currently being impacted by base erosion and profit shifting.”

Mark Zimsak calls the Australian response “pathetic” and says expert advice to the TJN suggests Australia loses several billions of dollars in revenue each year.

The Australia Institute cites tax-office figures showing that in 2010-11, companies in Australia claimed $5,959 million in royalty expenses overseas.

It also points to official Balance of Payments data showing some $14,734 million in service debits (imported services) that, in the words of the Australia Institute’s Dave Richardson, “appear to cover the types of avoidance schemes we know of in Australia”.

But, as ever in this area, it’s impossible to know what portion of these deductions is legitimate.

So, what’s to be done?

Well, in theory, it’s simple. Impose a level of transparency such that these companies pay their taxes in the countries where they earn their income.

In practice, though, it’s complicated, because there is only so much individual countries can do.

There are some hopeful signs. For instance, at the just-concluded meeting of the G20, finance ministers threw their support behind an “Action Plan to Address Base Erosion and Profit Shifting”, proposed by the OECD.

The details are necessarily complex, but the 15-point plan proposes to substantially rework the existing international rules on transfer pricing – the major means by which multinationals shift profits to low-tax jurisdictions and costs to high-tax jurisdictions. It also proposes to rejig the regime for tax treaties between countries, to impose new standards for data collection and mandatory disclosure by companies – all within two or three years.

An ambitious timetable, but it has to be; what we have here is a fundamental threat to the notion of national sovereignty.

It’s a war alright – between governments, whose duty is the welfare of all the people within their borders, and corporations whose duty is only to their owners, wherever they may live.

Today, stateless corporations, not stateless people, are the real threat to “border security” in the world.

- By John Richardson at 27 Jul 2013 - 3:13pm

- John Richardson's blog

- Login or register to post comments

the mistletoe mob ....

In every era, there are certain people and institutions that are held in the highest public regard as they embody the prevailing values of society. Not that long ago, Albert Einstein was a major public figure and was widely revered. Can you name a scientist that commands a similar presence today?

Today, some of the most celebrated individuals and institutions are ensconced within the financial industry; in banks, hedge funds, and private equity firms. Which is odd because none of these firms or individuals actually make anything, which society might point to as additive to our living standards. Instead, these financial magicians harvest value from the rest of society that has to work hard to produce real things of real value.

While the work they do is quite sophisticated and takes a lot of skill, very few of these firms direct capital to new efforts, new products, and new innovations. Instead they either trade in the secondary markets for equities, bonds, derivatives, and the like, which perform the ‘service’ of moving paper from one location to another while generating ‘profits.’ Or, in the case of banks, they create money out of thin air and lend it out – at interest of course.

Banking was conceived in iniquity and was born in sin. The bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again. However, take away from them the power to create money, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create money.

Because these institutions and individuals accumulate vast sums of money for their less-than-back-breaking efforts, they are well respected if not idolized by most. Many of the most successful paper-accumulators are household names. They get invited to the best parties, are lured by major networks to appear on their shows, speak at the biggest conferences, and their views and words find an easy path to the ears of millions.

But this is more than just an idle set of observations for the curious. It’s actually a critically important phenomenon to be aware of. For the current configuration of financially powerful entities has, at the tail end of a decades-long debt-based money experiment, achieved an astonishing concentration of power, money, and influence.

We raise this topic because our work centers on changing the conversation towards the things that really matter while there is still time to engineer a better outcome, and that requires illuminating the status quo and having a conversation about whether it needs to be modified. Unfortunately, those at the center of the status quo are not at all interested in having any such conversation, because all of their accumulated power depends on maintaining things as they are.

Money is power.

And history has shown that power is never ceded spontaneously or willingly.

The Network That Runs the World

A couple of years ago, I came across a study that has stuck with me ever since and I want to share it with you. It’s really important if we want to understand the likelihood of a graceful transition for our current society into a future of prosperity.

Unlike prior studies seeking to quantify the degree of concentration of wealth and influence, this study simply pored through all of the available public data to build an empirical map of the network of power. Its findings are quite startling and deserve a bit of pondering:

Revealed – the capitalist network that runs the world

Oct 2011

AS PROTESTS against financial power sweep the world this week, science may have confirmed the protesters’ worst fears. An analysis of the relationships between 43,000 transnational corporations (TNCs) has identified a relatively small group of companies, mainly banks, withdisproportionate power over the global economy.

(…)

Previous studies have found that a few TNCs own large chunks of the world’s economy, but they included only a limited number of companies and omitted indirect ownerships, so could not say how this affected the global economy – whether it made it more or less stable, for instance.

The Zurich team can. From Orbis 2007, a database listing 37 million companies and investors worldwide, they pulled out all 43,060 TNCs and the share ownerships linking them. Then they constructed a model of which companies controlled others through shareholding networks, coupled with each company’s operating revenues, to map the structure of economic power.

The work, to be published in PLoS One, revealed a core of 1318 companies with interlocking ownerships (see image). Each of the 1318 had ties to two or more other companies, and on average they were connected to 20.

What’s more, although they represented 20 per cent of global operating revenues, the 1318 appeared to collectively own through their shares the majority of the world’s large blue chip and manufacturing firms – the “real” economy - representing a further 60 per cent of global revenues.

When the team further untangled the web of ownership, it found much of it tracked back to a “super-entity” of 147 even more tightly knit companies - all of their ownership was held by other members of the super-entity - that controlled 40 per cent of the total wealth in the network. ”In effect, less than 1 per cent of the companies were able to control 40 per cent of the entire network,” says Glattfelder. Most were financial institutions. The top 20 included Barclays Bank, JPMorgan Chase & Co, and The Goldman Sachs Group.

Just 147 companies control over 40% of the wealth of the entire network of companies. It should be pointed out that such a network does not have any borders and operates on a global basis, meaning that regional analyses – such as how Germany compares with the U.S. – might be less relevant than typically portrayed.

After all, if decisions being made by a tightly knit group of companies are being made to benefit a network that has no borders, then actions by the German or U.S. governments are only a part of the story. And perhaps a minor one, compared to those made the entities that actually control the real wealth of each nation.

It wasn’t that many decades ago that a list of the top companies with the most wealth and influence would have been dominated by companies that produced real, tangible products – that is, those that created wealth by adding value to goods by transforming resources into products. Companies like GE, GM, IBM, Exxon, and other industrial giants would have been the wealthiest, because, well, they create actual wealth.

Today the top fifty companies in the ‘super-entity’ list of 147 from the above study is concerning. Out of the fifty, 17 are banks, 31 are an assortment of investment, insurance, and financial services companies, and only 2 are non-financial companies (Walmart and China Petrochemical)

The top 50 of the 147 superconnected companies

1. Barclays plc

2. Capital Group Companies Inc (Investment Management)

3. FMR Corporation (Financial Services)

4. AXA (Investments & Life Insurance)

5. State Street Corporation (Investment Management)

6. JP Morgan Chase & Co (Bank)

7. Legal & General Group plc (Investments & Life Insurance)

8. Vanguard Group Inc (Investment Management)

9. UBS AG (Bank)

10. Merrill Lynch & Co Inc (Bank)

11. Wellington Management Co LLP (Investment Management)

12. Deutsche Bank AG (Bank)

13. Franklin Resources Inc (Investment Management)

14. Credit Suisse Group (Bank)

15. Walton Enterprises LLC

16. Bank of New York Mellon Corp (Bank)

17. Natixis (Investment Management)

18. Goldman Sachs Group Inc (Bank)

19. T Rowe Price Group Inc (Investment Management)

20. Legg Mason Inc (Investment Management)

21. Morgan Stanley (Bank)

22. Mitsubishi UFJ Financial Group Inc (Bank)

23. Northern Trust Corporation (Investment Management)

24. Société Générale (Bank)

25. Bank of America Corporation (Bank)

26. Lloyds TSB Group plc (Bank)

27. Invesco plc (Investment mgmt)

28. Allianz SE

29. TIAA (Investments & Insurance)

30. Old Mutual Public Limited Company (Investments & Insurance)

31. Aviva plc (Insurance)

32. Schroders plc (Investment Management)

33. Dodge & Cox (Investment Management)

34. Lehman Brothers Holdings Inc* (Bank)

35. Sun Life Financial Inc (Investments & Insurance)

36. Standard Life plc (Investments & Insurance)

37. CNCE

38. Nomura Holdings Inc (Investments and Financial Services)

39. The Depository Trust Company (Securities Depository)

40. Massachusetts Mutual Life Insurance

41. ING Groep NV (Bank, Investments & Insurance)

42. Brandes Investment Partners LP (Financial Services)

43. Unicredito Italiano SPA (Bank)

44. Deposit Insurance Corporation of Japan (Owns a lot of banks’ shares in Japan)

45. Vereniging Aegon (Investments & Insurance)

46. BNP Paribas (Bank)

47. Affiliated Managers Group Inc (Owns stakes in 27 money management firms)

48. Resona Holdings Inc (Banking Group in Japan)

49. Capital Group International Inc (Investments and Financial Services)

50. China Petrochemical Group Company

(Source)

How is it that companies that produce nothing and only move digital representations of money from point to point now control far more wealth than the companies that actually produce the things that makes money useful at all?

Well, that’s just how the system works. And this is something that nobody in power wants to talk about.

While we may decide that such as system is just, or unjust, or evil, or good, such judgments are merely the emotionally laden descriptors we might assign to a system that – by its very design – accumulates wealth from the many to the few.

This is why compound money systems have been tried and tried again, yet have never proved sustainable. Even ancient religious texts described them as requiring a Jubilee every 7 periods of 7, or 49 years. The Jubilee, of course, was a reset mechanism that wiped out the inevitable concentration of wealth so that things could start all over again with a fresh slate.

An imbalance between rich and poor is the oldest and most fatal ailment of all republics.

~ Plutarch

So it really should not be any surprise that banks, in particular – with their extraordinary power to lend money out of thin air (that’s what ‘fractional reserve’ allows) and their unlimited-duration corporate lives –are able over time to accumulate, accumulate some more, and finally end up owning everything.

While we’re not quite there yet, we are well on the way.

A few are beginning to notice the seeming unfairness of it all, such as the author of this recent article in The New Yorker:

The Problem with Record Bank Profits

July 16, 2013

What do these large dollar numbers have in common: $6.5 billion, $5.5 billion, $4.2 billion, and $1.9 billion? They represent the latest quarterly net profits made by too-big-to-fail banks—in order, JPMorgan Chase, Wells Fargo, Citigroup, and Goldman Sachs, the last of which reported its second-quarter figures before the market opened on Tuesday.

Five years after being bailed out by the federal government, the U.S. banking system hasn’t merely recovered from the financial crisis that brought it to the brink of collapse. It is generating record profits—the sorts of figures usually associated with oil giants like ExxonMobil and Royal Dutch Shell. During the past twelve months, for example, JPMorgan, the country’s biggest bank, has earned $24.4 billion in net income.

Let’s begin with trading. In the aftermath of 2008, there was much talk of banks getting back to basics, which meant concentrating on lending to businesses and households, and jettisoning many of their investment bankers, whose generously remunerated antics had helped to bring on the financial crisis. (…) In the latest quarter, Citigroup’s investment-banking arm generated more than sixty per cent of the bank’s net profits, and JPMorgan’s investment bank generated more than forty per cent of the firm’s net profits.

What exactly did JPM do to ‘earn’ more than $24 billion over the past 12 months? Did they build millions of appliances? Install thousands of critical power systems? Build and install high-definition CT scanners?

In fact they did none of these things, which are just three out of hundreds of accomplishments of GE, which reported a 12-month net profit of just $17 billion while employing over 300,000 workers.

What JPM did was: trade on the markets, lend to speculators, and use its inside advantage to skim what it could off of the Fed’s monthly $85 billion of free money. Not that there’s anything illegal with that, but perhaps we should really be asking ourselves if this truly serves our society to anoint financial players with the privilege of walking off with the vast majority of our total national and global income.

Unsustainable Systems Ultimately End

The alarming growing wealth gap in developed nations is a predictable indicator of the obvious inequities involved in this system. Those not in the top 1% are finding themselves as modern-day feudal subjects – bound by debt or lack of property – to a global corporatocracy (corporations being the new aristocrats).

But the stability of this parasitical system begins to weaken quickly when the lifeblood it depends on begins to dry up. And that’s when things can begin to go south in a hurry: a crack-up of the financial system, civil unrest, government breakdown – that kind of scary strife.

In Part II: The Indicators of Instability to Watch For, we discuss the 3 most important danger indicators to monitor. These are the areas where the cracks will first appear, and will give those watching closely advance warning to adopt extremely defensive financial, physical, and emotional positions.

The vast concentration of wealth into so few hands is creating systemic instability, and if it continues long enough, it will prove to be a fatal ailment of not just any one particular republic, but all of them.

Click here to read Part II of this report (free executive summary; enrollment required for full access)

Bankers Own the World

gimme shelter ....

Australia is cleaning up some of its own tax-avoiders, but for those with money to launder – especially from Papua New Guinea – it’s a nice place to wash up.

Australia is getting better at protecting its own revenue base from tax dodgers, but remains far too complacent about accepting investment from those who have dodged the taxes of other countries, according to a new report.

The 2013 update of the Financial Secrecy Index, compiled every two years by the international Tax Justice Network (TJN), finds that Australia still hosts “significant quantities of illicit funds from other jurisdictions”, notably from Papua New Guinea.

The secrecy index scores countries according to the openness of their financial systems as well as the amounts of dubious money flowing through them.

The “secrecy score” is compiled by assessing each country against 15 indicators, and the results are represented on a 100-point scale, on which a higher score represents greater secrecy, and a lower score greater transparency.

“Australia has been assessed with 47 secrecy points out of a potential 100, which places it in the lower mid-range of the secrecy scale,” the Australia section says.

Of 82 jurisdictions assessed by the group, Australia came in about half-way down, at number 44.

It remains a “tiny player” in the global scheme of things, says the report, because it accounts for less than 1 per cent of the global market for offshore financial services. Nonetheless, as we have reported before, wealthy Australians and Australian multinational companies are enthusiastic users of tax havens overseas. A survey earlier this year found the majority of Australia’s top 100 companies had subsidiaries in tax havens – in some cases, scores of them, as you can see in this interactive graphic.

“Australia has taken significant steps to address tax evasion and tax avoidance, especially as it relates to revenue loss from Australia,” the TJN report, released November 7, says.

The most notable of those steps, it says, was Project Wickenby, “the multi-agency taskforce … focused on tax evasion activities by Australians and Australian companies through secrecy jurisdictions. Indeed, it is seen as a model for other countries to follow in curbing tax evasion and tax avoidance.”

Not only had Project Wickenby raised over $1 billion in tax liabilities and collected over $563 million over five years to June 2011, the report notes, it had seen the flow of funds from Australia to various secrecy jurisdictions fall dramatically: by 80 per cent to Liechtenstein, 50 per cent to Vanuatu, and 22 per cent to Switzerland.

“Overall fund flows from Australia to 13 secrecy jurisdictions decreased by 22 per cent between the 2007- 2008 and 2010-2011 financial years, from $55 billion to $43 billion,” says the report.

Nonetheless, Australia continues to lose huge revenues to tax dodging; the report cited one estimate that in the period from 2005 to 2007, €1.1 billion was lost through profit shifting on trade with the European Union and USD1.5 billion through profit shifting on trade with the US.

The report noted, with approval, the changes to Australia’s general anti-avoidance rule made last year, by the Labor government, and also the passage of legislation that allowed the Tax Office to make public the tax liabilities of companies with revenues of more than $100 million, which it called “a small step towards greater tax transparency by transnational companies”.

So Australia is apparently getting better at protecting its own revenue base from tax avoiders.

But the report was critical of Australia’s performance when it came to co-operating with other countries trying to take on tax avoiders and evaders.

It stressed that PNG was a particular victim of “Australia’s role as a host for illicit finance”, and highlighted the accusation by the head of PNG’s anti-corruption body, Task Force Sweep, Sam Koim, that Australia has acted like the “Cayman Islands in relation to laundering and housing the proceeds of corruption from Papua New Guinea”.

In 2012, Mr Koim told officials of Australia’s major investigator of money laundering, the Australian Transaction Reports and Analysis Centre (AUSTRAC), that the Australian financial system was being used to systematically launder tens of millions and possibly hundreds of millions of kina.

Mr Koim complained, and the Tax Justice Network report reiterates, that Australian authorities have done very little to assist in providing intelligence about suspicious investments, particularly in real estate in North Queensland.

“[This is] an issue that has become increasingly pertinent as PNG investments in Australia have recently reached over $1 billion,” the report says.

“One reason for the failures [to make progress against widespread corruption in PNG] appears to be weaknesses in Australia’s anti-money laundering laws.

“In 2007 the Federal Government released draft legislation to extend anti-money laundering provisions to real estate agents in relation to the buying and selling of property, dealers in precious metals and stones, lawyers, accountants, notaries and company service providers.

“Yet this legislation was never implemented.”

Among the 15 criteria used by the network to compile its “secrecy index”, Australia was found inadequate in six and seriously wanting in another four.

These four most serious failures are that: Australia does not maintain company ownership details in official records; it does not require that company accounts be made available on the public record; it does not require country-by-country financial reporting by all companies; and it does not participate fully in Automatic Information Exchange.

And the man who prepared the Australian section of the report, Mark Zirnsak, director of the Justice & International Mission for the Uniting Church, fears the new Abbott government lacks commitment to the cause of tightening up on tax avoidance.

He cites the November 5 announcement that the new government intends to drastically water down so-called “thin capitalisation” rules that apply to companies operating here.

The previous government moved to reduce and cap the size of tax deductions available to big companies that use disproportionate amounts of debt to fund their Australian projects.

“Now it appears that instead of a blanket limit on the amount of interest and debt you can claim repayments on, they’re going to go for an approach of investigating each case,” says Zirnsak.

“I think that’s likely to be ineffective. It will be highly resource intensive to try to identify any examples of tax avoidance and to do anything about them.

“It is a worrying sign about how serious this government is about cracking down on corporate tax dodging within Australia, and it also sends a bad signal as to their will to investigate and crack down on companies that may be involved in tax evasion in developing countries in particular.

“I’m concerned that the political will to investigate tax dodging by Australian companies overseas is very low,” says Zirnsak.

Still, by comparison with many countries, Australia doesn’t look so bad.

Of the 82 jurisdictions assessed by the Tax Justice Network, the most egregious contributor to global tax avoidance is – no real surprise here – Switzerland.

It ranks top of the list, not because it has the most secretive financial regime – that dubious honour goes to Samoa – but because of a combination of great secrecy and great capital flows.

Some of the other jurisdictions in the top 10 are more surprising.

Luxembourg, which the network describes as “the dark horse of the offshore secrecy world”, comes in second.

“Offering a toxic cocktail of secrecy, tax loopholes and lax financial regulation, it is serviced by a huge offshore financial services industry and has recently been working with Switzerland to derail emerging European transparency initiatives,” the TJN says.

Hong Kong, the Cayman Islands, Singapore, the United States, Lebanon, Germany, Jersey and Japan round out the top 10.

The TJN finds some small improvement in the openness of some of the European countries since the publication of its last report, but not much, and also points to an eastward movement of the tax-avoidance centre of gravity – which it says has come about largely as a result of the greater wealth now concentrated in Asia.

“Some positive trends are evident,” says the TJN.

“With public tolerance for offshore financial secrecy having fallen sharply in many countries since our last index in 2011, we see potential for real political change: for example, citizens are demanding full disclosure in public registries of the beneficial owners that lie behind offshore shell companies, trusts … foundations and so on.”

However, despite increasing lip service paid to addressing the issue in western countries, particularly in the UK, it says, “little has been done so far to rein in the menagerie of offshore trusts, foundations, shell companies, loopholes and subterfuges that make up the global secrecy system.

“Rolling back the secrecy that shrouds up to $32 trillion in offshore financial assets remains one of the great challenges of the 21st century.”

Under The Umbrella: Tax Haven Cocktails